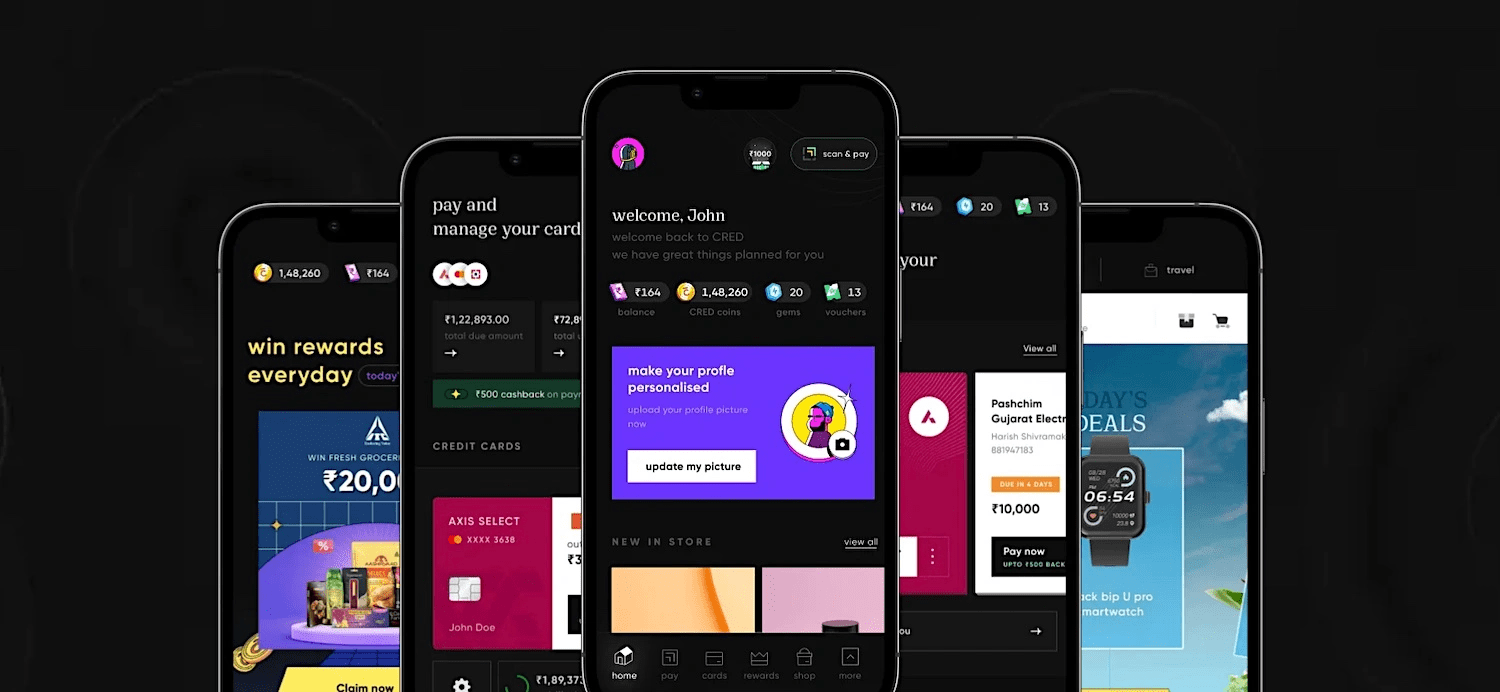

CRED is expanding its offerings, including a buy now, pay later service and a tap to pay feature, in order to increase engagement and monetization on the platform.

Cred flash, the Bengaluru-based startup’s foray into the buy now, pay later category, will allow customers to make seamless payments on the app and across over 500 partner merchants such as Swiggy, Zepto, and Urban Company and clear the bill for free within 30 days. Customers will be able to make bill payments, recharges, and other expenses with a single swipe and without having to wait for an OTP authentication code, according to the startup, which is valued at more than $6 billion. The service, powered by RBI-registered NBFC Parfait Finance and Investments Pvt Limited, will initially be available to a small number of customers, according to the startup.