In a recent statement, the RBI Governor revealed that the Indian economy has shown a remarkable recovery and currently stands among the fastest-growing large economies in the world. This news has been received with great enthusiasm and optimism.

Supporting Data:

11.8% Increase in Deposits (10% YoY)

The surge in deposits can be attributed to several factors, including the withdrawal of ₹2000 notes, the loss of indexation benefits for Debt Mutual Funds, and an increase in interest rates. These measures have significantly contributed to the substantial increase in deposits, thereby enhancing liquidity in the economy. Private banks have been at the forefront of driving this growth.

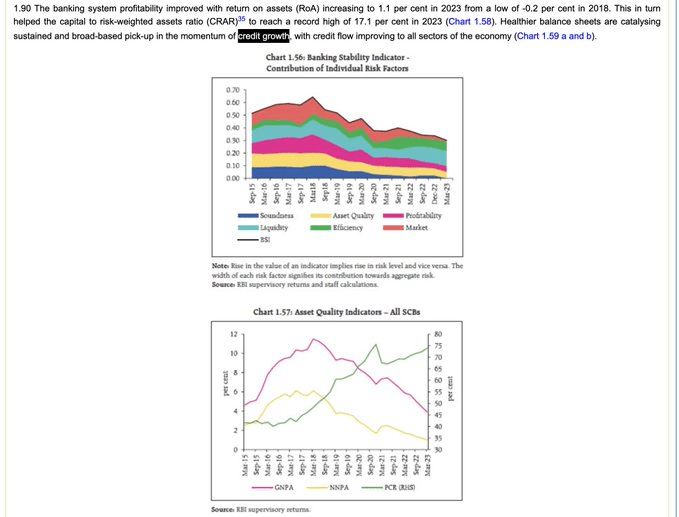

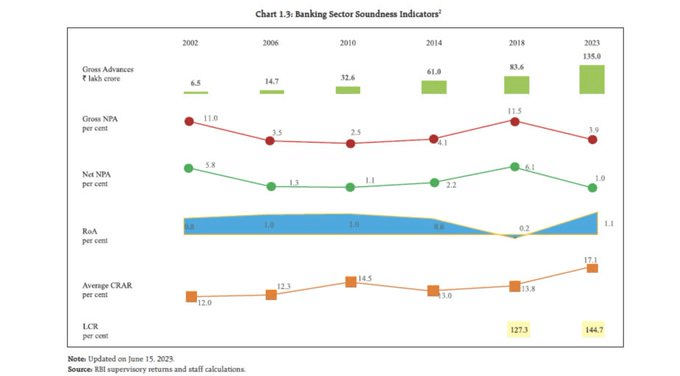

15.4% Credit Growth

Notably, the credit growth in the country has reached an impressive 15.4%. Particularly, personal loans, encompassing housing loans, credit card loans, and car loans, have experienced a staggering growth rate of 22.2% year on year. This impressive rise in credit growth demonstrates the resilience of the Indian economy, which has managed to withstand global economic turmoil.

Significant Decrease in Bad Loans

The decline indicates the banking sector is healthier and more robust now. It sharply contrasts with China’s banking sector, which struggled to manage bad loans.

The data presented by the RBI Governor showcases remarkable progress in the Indian economy. Despite challenges, there’s an increase in deposits and credit growth, along with a decrease in bad loans. This shows the financial system’s resilience and stability in the country. The positive outlook opens doors for further growth and development in the Indian economy. It encourages investors and businesses to explore new opportunities.

Here’s the link to the official page: https://www.rbi.org.in/Scripts/PublicationReportDetails.aspx?UrlPage=&ID=1243

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)