India’s digital payment system, Unified Payments Interface (UPI), which is primarily used for money transfers between users, will now enable cash withdrawals without needing an ATM card/PIN.

A man named Ravi Sutanjani, who worked at elite startups Zomato and OYO, recently demonstrated the working of the UPI ATM at the ongoing Global Fintech Fest in Mumbai.

A post shared by Indian Startup News (@indianstartupnews)

The UPI ATM was launched by Hitachi Payment Services in partnership with the National Payments Corporation of India on September 5, during the Global Fintech Fest in Mumbai, to revolutionise the way people withdraw cash from ATMs.

With this, Any customer of participating banks can walk to a white-label ATM to withdraw cash effortlessly by using any UPI application, thereby eliminating the conventional method of using physical cards and streamlining the transaction process. White-label ATMs are those that are owned and operated by non-bank companies.

How does it work?

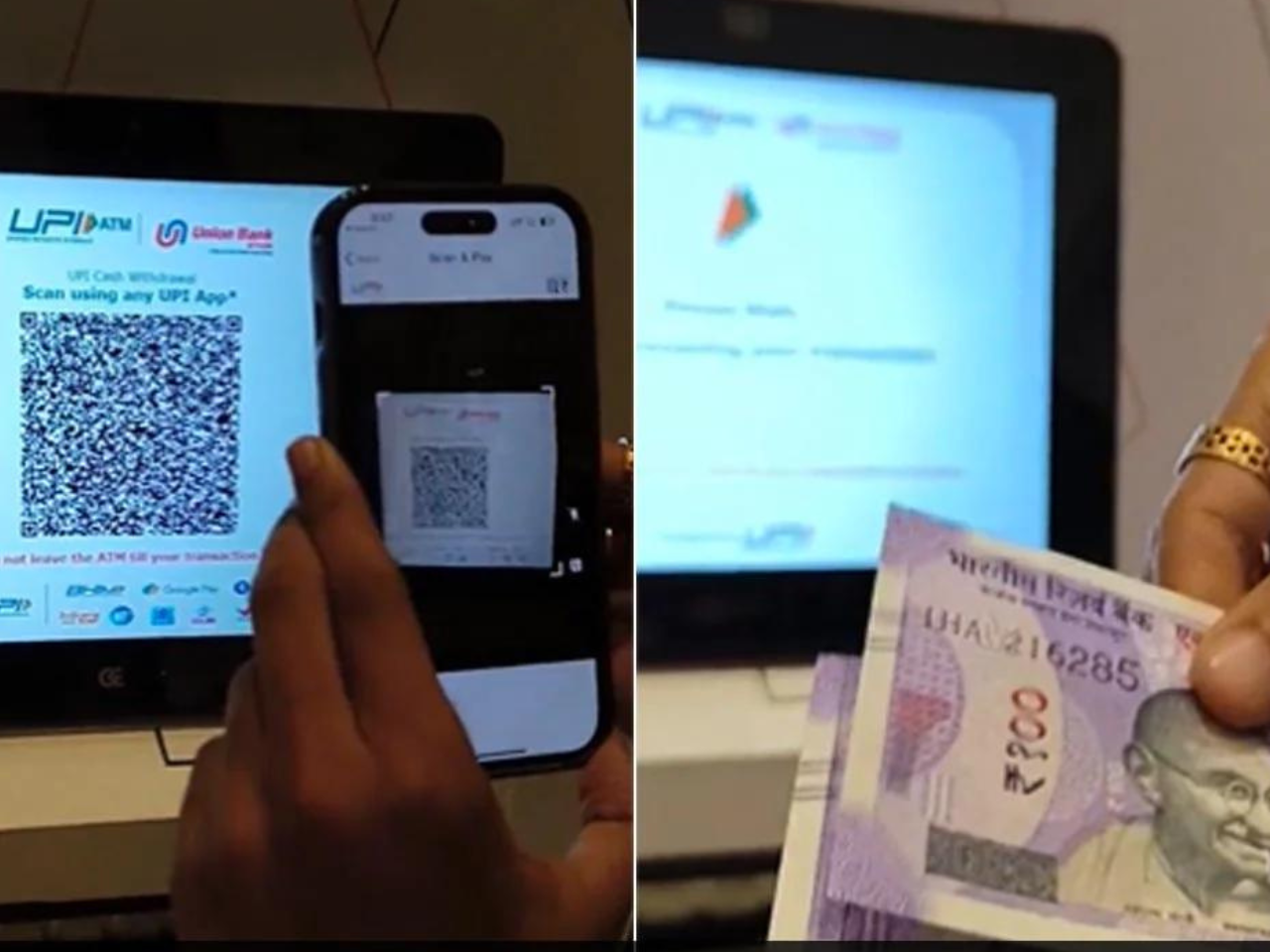

Withdrawing cash from a UPI ATM is quite simple. The customer needs to select the ‘UPI cash withdrawal’ option on the ATM and then choose the withdrawal amount. After this, a single-use dynamic QR code appears on the ATM screen.

Customers can use any preferred UPI app to withdraw cash by scanning the QR code and entering their UPI PIN within the app. Once the transaction is successful, the ATM validates it and dispenses the cash.

It’s worth noting that the withdrawal limit for a UPI ATM is Rs 10,000 per transaction, which is included in the existing daily UPI limit.

The video, posted by Ravi, has caught the attention of many notable personalities, including billionaire Anand Mahindra and Piyush Goyal.

“This UPI ATM was apparently unveiled at the Global Fintech Fest 2023 in Mumbai on September 5. The speed at which India is digitising financial services & making them consumer-centric as opposed to corporate-centric (Alarm bell for credit card companies?) is simply dazzling. I just have to make SURE I don’t misplace my cellphone!” Billionaire Anand Mahindra posted on X.

This UPI ATM was apparently unveiled at the Global Fintech Fest 2023 in Mumbai on September 5. The speed at which India is digitising financial services & making them consumer-centric as opposed to corporate-centric (Alarm bell for credit card companies?) is simply dazzling.… pic.twitter.com/krBXhbc9Qh

— anand mahindra (@anandmahindra) September 7, 2023

Minister of Commerce & Industry Piyush Goyal also shared Ravi’s video and wrote, “UPI ATM: The future of fintech is here! 💪🇮🇳”

UPI ATM: The future of fintech is here! 💪🇮🇳 pic.twitter.com/el9ioH3PNP

— Piyush Goyal (@PiyushGoyal) September 7, 2023

Needless to say, UPI is already achieving new milestones. Recently, for the first time, UPI crossed 10 billion transactions with a value of Rs 15.18 lakh crore in August 2023.

Also Read:

SBI Life Insurance enters MetaVerse, launches LifeVerse Studio

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

Here’s what you should know about India’s first UPI ATM

India’s digital payment system, Unified Payments Interface (UPI), which is primarily used for money transfers between users, will now enable cash withdrawals without needing an ATM card/PIN.

A man named Ravi Sutanjani, who worked at elite startups Zomato and OYO, recently demonstrated the working of the UPI ATM at the ongoing Global Fintech Fest in Mumbai.

A post shared by Indian Startup News (@indianstartupnews)

The UPI ATM was launched by Hitachi Payment Services in partnership with the National Payments Corporation of India on September 5, during the Global Fintech Fest in Mumbai, to revolutionise the way people withdraw cash from ATMs.

With this, Any customer of participating banks can walk to a white-label ATM to withdraw cash effortlessly by using any UPI application, thereby eliminating the conventional method of using physical cards and streamlining the transaction process. White-label ATMs are those that are owned and operated by non-bank companies.

How does it work?

Withdrawing cash from a UPI ATM is quite simple. The customer needs to select the ‘UPI cash withdrawal’ option on the ATM and then choose the withdrawal amount. After this, a single-use dynamic QR code appears on the ATM screen.

Customers can use any preferred UPI app to withdraw cash by scanning the QR code and entering their UPI PIN within the app. Once the transaction is successful, the ATM validates it and dispenses the cash.

It’s worth noting that the withdrawal limit for a UPI ATM is Rs 10,000 per transaction, which is included in the existing daily UPI limit.

The video, posted by Ravi, has caught the attention of many notable personalities, including billionaire Anand Mahindra and Piyush Goyal.

“This UPI ATM was apparently unveiled at the Global Fintech Fest 2023 in Mumbai on September 5. The speed at which India is digitising financial services & making them consumer-centric as opposed to corporate-centric (Alarm bell for credit card companies?) is simply dazzling. I just have to make SURE I don’t misplace my cellphone!” Billionaire Anand Mahindra posted on X.

This UPI ATM was apparently unveiled at the Global Fintech Fest 2023 in Mumbai on September 5. The speed at which India is digitising financial services & making them consumer-centric as opposed to corporate-centric (Alarm bell for credit card companies?) is simply dazzling.… pic.twitter.com/krBXhbc9Qh

— anand mahindra (@anandmahindra) September 7, 2023

Minister of Commerce & Industry Piyush Goyal also shared Ravi’s video and wrote, “UPI ATM: The future of fintech is here! 💪🇮🇳”

UPI ATM: The future of fintech is here! 💪🇮🇳 pic.twitter.com/el9ioH3PNP

— Piyush Goyal (@PiyushGoyal) September 7, 2023

Needless to say, UPI is already achieving new milestones. Recently, for the first time, UPI crossed 10 billion transactions with a value of Rs 15.18 lakh crore in August 2023.

Also Read:

SBI Life Insurance enters MetaVerse, launches LifeVerse Studio

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

Website Upgradation is going on for any glitch kindly connect at office@startupnews.fyi

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)