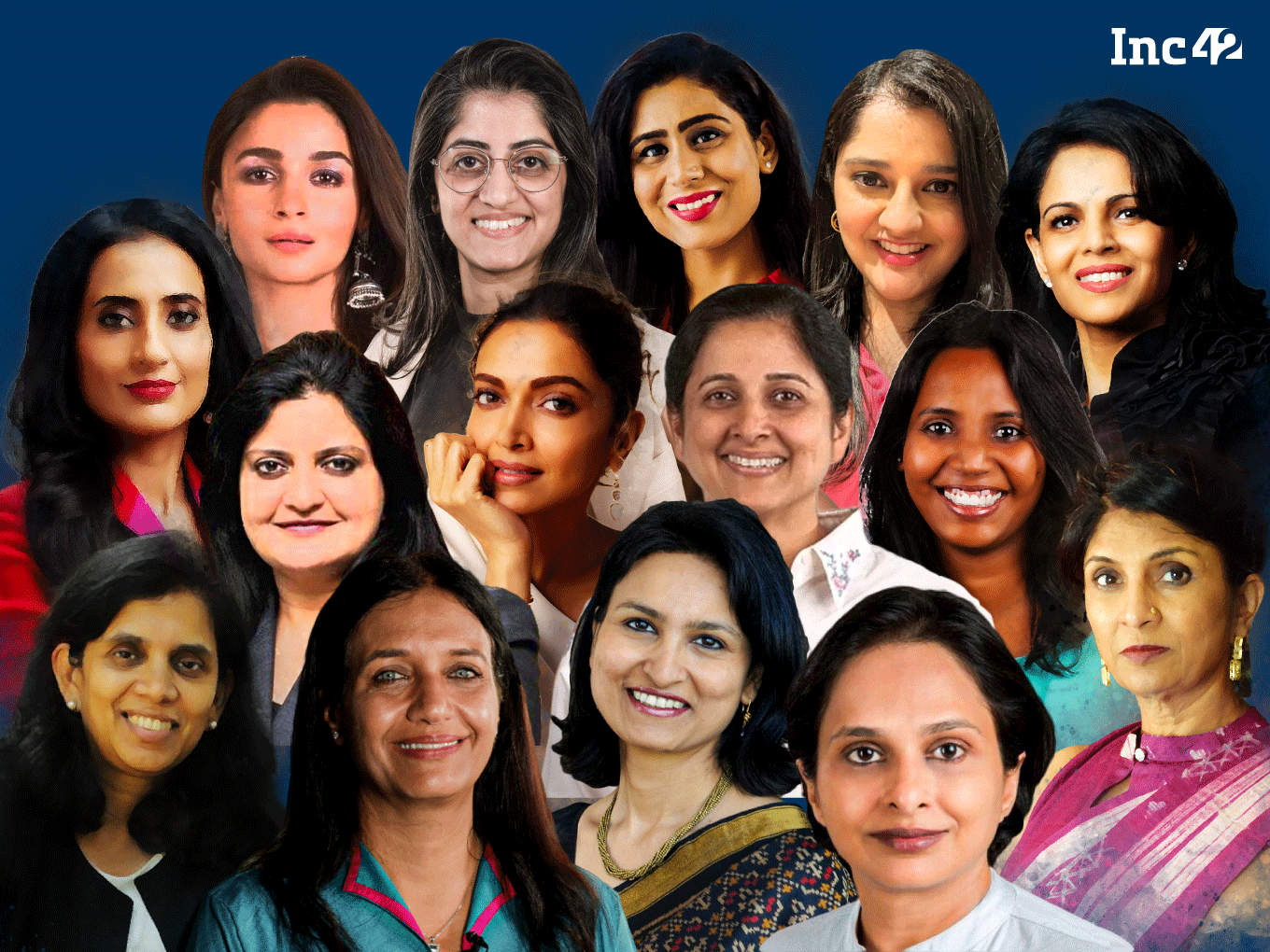

The investment landscape in the country is going through a shift never seen before, with more and more women founders and investors winning themselves a bigger share in the high-octane arena of the Indian startup space.

Be it Swati Nangalia Mehra of Sixth Sense Ventures, who directly ventured into the world of investing, or the founders-turned-investors Ghazal Alagh and Vineeta Singh, many of these trailblazing women have made their mark in the homegrown startup ecosystem. This is notwithstanding other veterans such as Kiran Mazumdar Shaw and Rekha Menon who have already set examples for many in the past.

Many of these women investors bring years of experience to the table and have today emerged as role models for the country’s youth. However, things were not the same a few years ago, the founder of She Capital Anisha Singh told Inc42.

“It was hard explaining to people that women are successful as entrepreneurs. Now that we have given mega returns to our investors, they’re excited… and understand that women are great business persons,” she added.

As sharp as a knife, these new-age women investors have their eyes on the stars and feet on the ground, and they are charging through with great perseverance. With numerous successful exits, Indian women investors are creating templates that will be followed by many in the years to come.

However, more importantly, women founders and investors possess something really important when it comes to building an enterprise and the world of investing.

“They will call a spade a spade and tell you things exactly as they are and not how they can be,” opines the cofounder and CFO of B2B building material marketplace OfBusiness Ruchi Kalra on what makes women great investors.

We, at Inc42, have collated some of the names that are making waves in the startup investment world. These are the names of the women that aim to build an equitable world of tomorrow and are leaving no stone unturned in their quest.

If you are a women investor or want to nominate a women investor in the startup ecosystem, nominate us at editor@inc42.com. This is a running list (and not a definitive one), we would love to add more women changing the investing landscape in the Indian startup ecosystem.

Here Are The 38 Women Investors Spearheading The Startup Investment Game In India

1. Aarti Gupta

Aarti Gupta is the chief investment officer (CIO) of VC firm DBR Ventures. She heads the family office of DM Gupta and is the national head of the FICCI FLO Startup Cell.

In 2022 alone, she participated in investment deals for edtech startup SpeakIn and health tech startup Medyseva.

Earlier, she was a senior chairperson of the FICCI FLO Kanpur Chapter. She holds a PhD from IIT Kanpur and completed her postgraduation in economics from Northwestern University.

Aarti started her investment journey five years ago in 2017. So far, she has invested in four tech-driven startups operating in sectors such as health tech, edtech, foodtech and waste management.

Aarti believes in shoring up startup founders by helping them build their ventures and raise funds. Additionally, she is passionate about spreading financial literacy among professionals and homemakers.

2. Anisha Singh

Anisha Singh is the founder of women-focused VC firm She Capital. She founded the VC firm in 2020 to stimulate more women founders to enter India’s startup ecosystem. Some of the portfolio companies of the VC firm are Samosa Singh, Spark Studio, Elev8 Sportz, and Nova Nova.

Earlier, she founded ecommerce platform MyDala and also headed B2B startup Kinis Software as its CEO. She has also worked as a manager with Centra Software.

She is mostly seen talking about women’s empowerment and supporting women-focussed businesses and startups.

3. Alia Bhatt

Bollywood superstar Alia Bhatt has also donned the hat of an investor and has quite an interesting portfolio. One of her prominent investments was in beauty ecommerce marketplace Nykaa. Her investment grew more than 10X within months to INR 54 Cr when Nykaa got listed on the Indian bourses.

Bhatt’s portfolio also includes Mumbai-based personal styling platform Style Cracker and Kanpur-based biomaterial startup Phool.

Besides investing in other startups, Alia Bhatt has also set up her startup, Ed-a-Mamma, which operates in the kidswear category.

4. Anjali Bansal

Founder and chairperson of Avaana Capital Anjali Bansal has been actively investing in Indian startups. In 2022, Avaana funded four Indian startups — BambooBox, Gold Setu, and Groyyo, according to the Inc42 funding report.

In addition to the aforementioned startups, Anjali has invested in various startups – Delhivery, Urban Company, Darwinbox, and Nykaa, to name a few.

Currently, Bansal is a member of the ONDC steering committee. She is also on the board of various Indian companies such as Tata Power, Nestle India, and Piramal Enterprises. She has also worked with TPG Growth, Spencer Stuart, McKinsey, and Dena Bank.

5. Ankita Vashistha

Ankita Vashistha is the founder of Saha Fund and StrongHer Ventures, which backs female-led early-stage startups operating in the fintech, health tech, consumer tech, and Web 3.0 segments.

She is currently associated with multiple names such as MySpaces, Tholons Capital, NASSCOM, Aureos Capital, and Abraaj Group. In her more than 10 years of professional journey, she has worked with tech ventures, private equity and VCs across the UK, the US, and Asia.

She is currently an active investor in Indian Angel Network. Her startup portfolio comprises startups such as Licious, Uniphore, Fitternity, LoveLocal, Zumata, and Insta Health.

She got her master’s degree from the Cranfield School of Management, Stanford University, and is an alumna of Ramaiah Institute of Technology.

6. Archana Jahagirdar

Archana Jahagirdar is the founder and managing partner of Rukam Capital, which invests in early-stage consumer products and services companies.

Earlier, she headed companies like Textron, Angelworks and Espace Corporate and worked as a journalist with media organisations such as Business Standard, The Times of India, Zee News, Outlook, and India Today.

In the last few years, Archana has made more than 10 investments in startups like Yoho, Sleepy Owl Coffee, Anveya, Pilgrim, The Indus Valley, and GoDESi, among others. She completed her masters in English literature from St Stephen’s College.

7. Archana Priyadarshini

Archana Priyadarshini is a founder of Forward Slash Capital, which backs pre-seed to pre-Series A stage tech startups. In 2022, she invested in four startups – Broomees, CogniSaaS, Ekank Technologies, and Threado.

Over the years, she has participated in more than 25 startup deals, which include Metastable Materials, Exprto Live, and VAMA, to name a few.

At the moment, she is working as a general partner at PointOne Capital. She has also worked with companies such as Wells Fargo, Bootcamp Fitness Studio, IBM and CGEY. She has done her B.Tech in chemical engineering from IIT Kanpur.

8. Bala C Deshpande

Bala C Deshpande is the founder partner of Megadelta Capital, which is an India-focussed mid-market growth fund. It typically invests $15 Mn to 25 Mn of growth equity in startups across sectors such as consumer, healthcare, and enterprise tech.

Megadelta Capital’s portfolio includes startups such as ecommerce unicorn Firstcry and health tech startup GOQII, among others.

Deshpande has nearly two decades of experience in investment advisory. She started her investing career with ICICI Venture in 2001. Later, she joined global VC firm NEA to set up their India platform where she headed the practice for ten years and helped NEA US in investing and backing startups in the mid-market space.

9. Bharati Jacob

Bharati Jacob is the founder and managing partner of Seedfund, which invests in startups operating in diverse industries. She holds more than 24 years of experience in venture investing, marketing, and financial services.

Earlier, she worked with venture capital firm Infinity Venture Fund, investment bank Lazard, and aviation company Northwest Airlines.

An XLRI graduate, Jacob completed her MBA in marketing from the Wharton School, University of Pennsylvania.

10. Bhawna Bhatnagar

Bhawna Bhatnagar is the cofounder of We Founder Circle (WFC), which invests in pre-seed to pre-series A-stage startups.

So far, she has invested in edtech OLL and F&B direct-to-consumer (D2C) startup Bored Beverages. Besides, she has also participated in six startup deals, including ParkMate, ParkMate, Quizy, and Commaful.

Prior to founding WFC, she worked with leading companies such as ByteDance, Cheetah Mobile and India Today.

After completing her bachelor’s in biochemistry from Delhi University in 2009, she went to the Indian Institute of Mass Communication and then earned her master’s degree in East Asian studies from Delhi University in 2014.

11. Debjani Ghosh

Debjani Ghosh is currently the president of NASSCOM, an industry body representing the IT-BPM space. In her career of nearly three decades, she has worked with Intel Corporation and Yes Bank.

She has also been on Cisco’s India Advisory Board and served as an advisor to the FICCI S&T/Innovation Committee.

An MBA from S.P. Jain Institute of Management and Research, Debjani completed her graduation in political science from Osmania University.

12. Deepika Padukone

With five startups in her portfolio, Bollywood actor Deepika Padukone has recently worn the investor’s hat. She began her entrepreneurial journey by founding 82°E in 2021.

82°E, which is led by Padukone and Jigar Shah, got $7.5 Mn funding from DSG Consumer Partners and IDEO Ventures, along with multiple ultra-HNIs and Padukone’s family office, Ka Enterprises.

Ka Enterprises mainly backs consumer and consumer-tech companies across the globe. Its portfolio companies include Epigamia, Furlenco, Blu Smart, Bellatrix, Playshifu, Atomberg, Front Row, Mokobara, Supertails, and Nua.

13. Ghazal Alagh

Mamaearth’s cofounder Ghazal Alagh is an active angel investor. In 2022, she backed 14 startups, including Humpy Farms, unScript AI, and Wishlink. Her startup portfolio also comprises companies like BlissClub, HumpyFarm and Uvi Health.

Before founding Mamaearth, she set up a fitness platform dietexpert.in, which shuttered its operations in 2013. She has a BCA degree from Panjab University and holds certifications in visual arts from New York Academy.

14. Ishani Chanana

Ishani Channa, partner investments at Sarcha Advisors, plays a pivotal role in managing family office investments and shaping capital allocation strategies across a diverse spectrum of assets, encompassing equity, debt, and alternative investment opportunities, with a significant focus on startups.

With investments in over 50 startups, including notable names like BluSmart, Josh Talks, STAGE, TrulyMadly, Prescinto, and The New Shop, and active participation in 20+ follow-on rounds, Ishani has been instrumental in nurturing entrepreneurial talent and fostering innovation.

In addition to her role at Sarcha Advisors, Chanana is an angel investor and has stakes in startups like JumpingMinds, BatX Energies, Yatrikart, Newmi, and Jobsgaar.

Prior to her current role, Ishani spent nearly four years at a hedge fund within Edelweiss Financial Services, where she honed her skills in buy-side research. Her work involved in-depth analysis of Indian-listed companies across diverse sectors, making valuable contributions to investment decisions within the fund.

Chanana holds a master’s degree in finance from Warwick Business School. Her investment track record includes successful exits and the ability to attract substantial investments from renowned investors to her portfolio companies, underscoring the prudence of her investment choices.

15. Kanika Mayar

Kanika Mayar is a partner of Vertex Ventures, which infuses money in seed to Series B-stage startups operating in Southeast Asia and India. Vertex’s portfolio companies include Grab, Patsnap, 17Live, Nium, FirstCry, Licious, AsianParent, Validus, and Warung Pintar, among others.

So far, Kanika has participated in four startup deals – Chatty Bao, Proactive For Her, Onato and Karkhana.io. She has also worked with leading companies such as IFC, TechnoServe, Goldman Sachs, and Ernst & Young.

A graduate of economics from the prestigious Lady Shree Ram College, Kanika completed her MBA from IIM Ahmedabad.

If you are a women investor or want to nominate a women investor in the startup ecosystem, nominate us at editor@inc42.com. This is a running list (and not a definitive one), and we would love to add more women changing the investing landscape in the Indian startup ecosystem.

16. Namita Thapar

Namita Thapar is the executive director of India Business for Emcure, a pharmaceutical company. Thapar rose to fame after she joined the TV Show ‘Shark Tank India’ as one of the sharks.

So far, Thapar has participated in 11 startup deals, including Medulance, Ubreathe, Snitch, JhaJi Store, and TagZ Foods, among others.

She recently invested in ePharmacy when the startup bagged an investment of INR 2 Cr from multiple investors on Shark Tank India.

A chartered accountant from The Institute of Chartered Accountants of India, Namita holds an MBA degree from the Fuqua School of Business.

17. Nandini Mansinghka

Nandini Mansinghka is the co-promoter and CEO at Mumbai Angels Network. She is also a founder investor at Digibooster, a content marketplace. Over the years, she has participated in more than 55 startup deals.

Founded in 2006, Mumbai Angels Network invests in early-stage startups in India. The network backs a slew of startups such as Adsparx, Adonmo, and BabyChakra, among others.

After her graduation (BCom) from the University of Calcutta, she completed her CFA from the Institute of Chartered Financial Analysts of India.

18. Padmaja Ruparel

Padmaja Ruparel is one of the cofounders of the Indian Angel Network. She is also recognised as a key player in the Indian entrepreneurial ecosystem.

So far, she has participated in over 16 startup deals, which include names like Phool, Nivesh, Sirona Hygiene, goStops, and Dhruva Space, among others.

Last year, Indian Angel Network launched the IAN Alpha Fund, a SEBI-registered category II venture capital fund, worth INR 1,000 Cr.

So far, Indian Angel Network has invested in over 180 startups. Some of its portfolio companies are Zypp Electric, Crest, Huddle, Elctrifuel, Indium Finance, and Sirona Hyginene, among others.

Before starting her journey in the Indian startup ecosystem, Ruparel worked as the head of corporate communications at the UK-based Xansa.

19. Paula Mariwala

Paula Mariwala has been an early-stage investor for the past 15 years, and is a founding partner of Mumbai-based Aureolis Ventures, and the founder of Stanford Angels & Entrepreneurs India.

A Stanford alumna, Paula invests in early-stage startups and has been a key investor in Tapchief, Tread, Browntape, Thinklabs, RedBus, and Carwale, among others. In terms of sectors, she has been actively investing in segments like technology, sustainability, social impact, women empowerment, and education.

Paula is a member of the governing council of the Foundation for Innovation and Technology Transfer, IIT Delhi. She is also on the board of the Center for Human Rights and International Justice at Stanford University.

20. Pearl Agarwal

Pearl Agarwal is a prolific angel investor, with investments in 16 startups across sectors such as web3, fintech, edtech, gaming, and SaaS. Some of her notable investments include InFeedo, BluSmart Mobility, GroMo, Trell, and Redwing Labs.

Pearl is also the founder and MD of Delhi-based VC firm Eximius Ventures, which has its investments in startups such as Eka.Care, Jar, iTribe, Fego, Zorro, KalaGato, Oyela, Flux, Stan, Fleek, and Skydo.

Before becoming a full-time investor, Pearl worked at Merril Lynch. Pearl has also worked in the private equity sector with names like UTIMCO and Global Infrastructure Partners.

She is also the cofounder of DotReview, a platform where first-time investors can learn about startup funding.

21. Pooja Mehta

Pooja Mehta is the chief investment officer (CIO) at JITO Angel Network (JAN), a platform which connects angel investors with startups. She has expertise in evaluating startups, managing angel investment deals, and administering investment operations.

In the last two years, she has participated in three startup deals – KloudMate, Nexus Power, and NewsReach India.

Under her leadership, the JAN network has grown to over 350 members, with an investment of INR 100 Cr in various startups. Pooja is also the CIO at the JITO Incubation & Innovation Foundation.

A seasoned management professional with an MBA degree in finance, Pooja’s skillset ranges from business development, market research, and management to building business strategies and financial analysis.

22. Raakhe Kapoor Tandon

Raakhe Kapoor Tandon runs a family office – The Three Sisters: Institutional Office – with two of her sisters, Radha and Roshini Rana Kapoor. Raakhe, Radha and Roshini are the daughters of Rana Kapoor, the founder and MD of Yes Bank.

Under the family office, Raakhe founded ART Capital (India), an investment vehicle. The Three Sisters also has its investments in Delhi-based Awfis Space Solution, a real estate tech startup.

A Wharton alumna, Raakhe has founded two more ventures under ART Capital – ART Housing Finance (India) and Rural Agri Ventures India.

While ART Housing Finance provides long-term mortgage finance to retail customers, Rural Agri Ventures is an incubation/project development firm focussed on agritech startups.

23. Rema Subramanian

Rema Subramanian is the co-founder and managing partner at Ankur Capital Fund, which backs early-stage startups in the agritech, fintech, health tech, and edtech segments.

She is currently working as an advisor consultant at DY Works. Earlier, she has worked with various Indian companies such as Dasra, ADTS, Element K India, Zee Interactive Learning, Ion Exchange, Datamatics and JK (Raymonds).

So far, Rema has participated in more than four startup investment deals. These names include SportVot, Josh Talks, MyCaptain, and Banyan Environmental Innovations.

A cost accountant from ICFAI, Rema has worked across education and IT/ITES, taking young companies from scratch to midsize ventures.

24. Ritu Verma

Ritu Verma, the cofounder of Ankur Capital, has backed several startups over the years. Some of the companies in her portfolio include names like CropIn, ERC, HealthSutra, Big Haat, Niramai, Tessol, Suma Agro, and Karma Healthcare.

In 2022, Verma took part in more than 13 startup investment deals, including D-Nome, IBISA, Vegrow, Wasabi, and Offgrid Energy Labs, among others.

At present, she is acting as a board observer in various Indian companies such as BigHaat India, String Bio, AgricxLab and Niramai. She is also on the board of Tessol, Health Sutra and CropIn.

Earlier, she worked with Truven, Philips and Unilever. She has a PhD in physics from the University of Pennsylvania and an MBA from INSEAD.

25. Ruchi Kalra

Ruchi Kalra helms the financial affairs at one of the few profitable new-age tech startups in the country. The CFO of B2B building material marketplace OfBusiness also helped found the startup back in 2016 and has not looked back since then.

An alumna of the prestigious Indian Institute of Technology Delhi, Kalra studied chemical engineering and then went on to work at Evalueserve for a couple of years. Afterwards, Kalra enrolled at the Indian School of Business in Hyderabad and completed her MBA.

Immediately after that, Kalra landed a job at McKinsey & Company and was entrusted with overseeing the insurance and retail banking sector. After nine years working at the consulting firm, Kalra took the plunge into the world of entrepreneurship and helped found OfBusiness.

Not stopping there, she has helped scale the business to new heights while she has also continued investing in multiple other businesses as an angel investor. She has so far invested in as many as 10 startups, as an angel, including seafood marketplace Captain Fresh, tyre marketplace TyrePlex, women-led lifestyle brand FableStreet, and B2B pharmacy marketplace Saveo, among others.

26. Seema Chaturvedi

Seema Chaturvedi, the Founder and Managing Partner of Achieving Women Equity (AWE) Funds, boasts an impressive 25-year track record in capital markets and financial management. Her primary mission is to drive gender equity in entrepreneurship.

A staunch advocate for entrepreneurship with a specific focus on women’s empowerment, Chaturvedi aims to empower 30 Mn women in India by 2030 through AWE Funds.

She also chairs TiE Global’s prominent initiative, the Project All India Roadshow for Women’s Economic Empowerment through Entrepreneurship (AIRSWEEE), securing funding from the US Department of State for six consecutive rounds.

Earlier this year, AWE Funds announced the first close of its maiden fund in India – the Achieving Women Entrepreneurs Early Growth Fund I – at $15 Mn. While promoting gender equity and climate action as a strategy, the fund aims to invest in scalable innovations in sectors such as climate tech, agritech, health tech, edtech and fintech.

27. Shagun Tiwary

Shagun Tiwary is a senior principal at Verlinvest, a Belgium-based investment firm. She is equipped with 12 years of work experience and has invested in companies across consumer and healthcare services such as Dr Lal PathLabs, Indira IVF, Epigamia, and Veeba.

Prior to joining Verlinvest, she worked at TA Associates and Nomura in Mumbai, where she focussed on growth equity investment and capital market transactions. She holds a master’s degree in economics from the Delhi School of Economics, University of Delhi.

Verlinvest is largely involved in late stage venture capital funding and mid-market private equity. Typically, the firm invests between $20 Mn and $200 Mn in startups, depending on the stage they are in.

28. Shanti Mohan

Shanti Mohan is the founder of LetsVenture, a Bengaluru-based investor network that allows angels and HNIs to invest in startups. She has also founded trica, a platform that allows people to invest in startups and private equity.

In the last few years, she participated in more than 10 startup deals, which include Minko, Simply Services, Bimaplan, and Aulerth.

With LetsVenture, Shanti has invested in startups such as Absolute Foods, Agnikul, BharatX, CityMall, Dukaan, Trell, Yulu, Blusmart, and The ePlane Company, among others. Her personal portfolio comprises Siply, Minko, and Bimaplan.

Shanti is an active angel investor and part of the SEBI advisory AIF committee. She is also active with the RBI Council on startup funding. Further, Shanti is part of the startup committees of several states in India.

29. Shrishti Sahu

The founder of Hustle Hard Ventures, Shrishti Sahu, has been actively supporting Indian startups and has so far backed 30 startups, including Plum, Kutumb, Rupifi, Chingari, 10Club, Leap Club, Eeki Foods, GrowthSchool, Accacia, Descrypt, and Gold Setu, among others.

Sahu shared that she writes off cheques between INR 3 Lakh and INR 25 Lakh for homegrown startups.

Currently, she is a managing partner and angel investor at Swadharma Source Ventures. She has also worked with multiple companies like Emoha Eldercare, Facebook, Lumis Partners, Aqaya Source Foundation, and Aqaya. She completed her graduation from the University of Warwick.

30. Shruthi Cauvery Iyer

Caha Capital founder Shruthi Iyer is an active angel investor, who is overseeing two early-stage startups’ expansion strategies. She administers Wharton Alumni Angels (South Asia) and HBS Alumni Angels.

Earlier, she worked with international companies such as Agate Medical Investment LP, PT Perintius, International Finance Corporation (IFC), and Eastern Energy Resources. She is one of the cofounders of the ecommerce startup Blend8.

She did her MBA from the Wharton School and completed her B.Tech from Visveswaraya Technological University, Karnataka.

31. Sowmya Suryanarayanan

Sowmya heads the impact and ESG functions at Aavishkaar Capital – an impact fund manager that invests in impact enterprises across India, South and South East Asia and East Africa. She is responsible for delivering significant impact, gender and ESG value across Aavishkaar’s various impact funds and portfolio companies.

At Aavishkaar, Sowmya has helped invest in sectors such as agritech, financial inclusion, and essential services. Some of the portfolio companies of Aavishkaar Capital include Nalanda Learning Systems, GoBolt, Milk Mantra, and Seven Ocean, among others.

32. Surabhi Washishth

Surabhi Washishth, the founding partner of Paradigm Shift Capital, has been actively supporting the Indian startup ecosystem.

So far, she has investments in 20 startups, including Ixana, Zeda, Landeed, Praan, 10XAR, Samudai and Arcana Network. In her personal capacity, she writes cheques between $250K and $300K for startups.

At present, she is acting as a ‘Global Shaper’ with the World Economic Forum. She has also worked with multiple companies such as WeWork India, Headout, Target, AOL, and ING Life, among others. She has a B.Com degree from Christ University, Bengaluru.

33. Swapna Gupta

A prolific investor, Swapna Gupta is currently a partner at Avaana Capital, a climate-focused VC firm. Before joining Avaana Capital, Swapna spent more than seven years at Qualcomm Ventures, where she led India investments.

She is an investor and board observer in multiple Indian startups, including Locus, Shadowfax, Ninjacart, Zuddl, FabHotels, MoveInSync, Reverie, Stellapps, and attune, among others.

Swapna also launched Qualcomm Women Entrepreneurs India Network (Qwein), a networking, learning, and mentoring programme for deeptech, and early-stage female entrepreneurs in India.

Swapna has recently been recognised by GCV among the Top 50 emerging leaders in the corporate venture community. Surprisingly, she is the only Indian on the list. She is also part of the prestigious Global Kauffman fellows programme.

34. Swati Nangalia Mehra

Swati Mehra’s tryst with investments began long ago. One of her first jobs was to oversee investment research in the consumer space. The job came in handy when she decided to take the plunge into the world of investing.

In 2014, she helped cofound Sixth Sense Ventures, the country’s first domestic and consumer-focussed venture fund. Since then, the firm has invested in a host of new and emerging D2C brands that have created a niche for themselves.

Nangalia Mehra has helmed the venture fund, which has invested in a slew of emerging brands, including homegrown beer brand Bira91, men’s grooming and personal care brand Bombay Shaving Company, and gaming and entertainment platform Smaaash. She also has stakes in CarterX, Pariksha, and ProcMart.

35. Tarana Lalwani

Tarana Lalwani is a founding partner of InnoVen Triple Blue Capital, which has backed multiple startups such as Zetwerk, Chaayos, Ather, slice, and Bounce.

As an angel investor, Lalwani bets on startups working in the consumer, consumertech, health tech, fintech, and SaaS sectors. She also holds expertise in pre-seed to Series D funding rounds via equity and debt instruments.

Presently, she is an advisor at Aureolis Ventures and a senior director at InnoVen Capital India. Earlier, she worked with companies like Anand Rathi Securities, Kae Capital, SeedFund, Edvance Learning, Webaroo, Radian Group, and Morgan Stanley.

She is also on the advisory board of Oscar Foundation and CII. Not only this, Tarana is currently part of the venture capital and private equity committee of IMAI (Internet and Mobile Association of India).

She holds an MBA degree from Columbia Business School and a bachelor’s degree from La Salle University.

36. Vani Kola

Vani Kola is the founder and managing director of the early-stage VC firm Kalaari Capital. She has led over 30 investments at Kalaari. Some of the prominent names include Dream11, Myntra, Cure.fit, and Snapdeal.

Vani is currently on the board of CXXO. She has also worked with Certus Software and RightWorks. She likes mentoring first-time entrepreneurs and ushering them into becoming seasoned business leaders. So far, she has participated in over 63 startup deals. Some of these names include Climbes, Bombay Play, Zocket, StanPlus and Zluri, among others.

After graduating from Osmania University, she completed her master’s degree from Arizona State University.

37. Varsha Tagare

Varsha Tagare is the managing director at Qualcomm Ventures where she manages a $150 Mn fund dedicated to India and cross-border digital enterprise investments.

Prior to joining Qualcomm Ventures, Tagare served as an investment director at Intel Capital, responsible for global equity investments in mobile technology.

At Qualcomm Ventures, she has led and managed investments in Capillary Technologies, Ideaforge, MapMyIndia, among others.

38. Vineeta Singh

Widely popular for being featured on Shark Tank India, Vineeta Singh is the CEO and cofounder of beauty and personal care brand SUGAR Cosmetics. Singh is an alumna of the prestigious Indian Institute of Technology, Madras and the Indian Institute of Management, Ahmedabad.

Singh is a serial entrepreneur and the founder of FAB BAG, a beauty and grooming subscription startup. Since appearing on Shark Tank India, Singh has shot to fame and has invested in a slew of Indian startups featured on the show.

As an angel investor, Vineeta Singh has participated in multiple fundraisers. Some of her bets include Padcare Labs, JhaJi Store, Snitch, and Josh Talks, among others.

Note: Please note that the order is arbitrary. The information has been collected from available public resources and websites.

If you are a women investor or want to nominate a women investor in the startup ecosystem, nominate us at editor@inc42.com. This is a running list (and not a definitive one), and we would love to add more women changing the investing landscape in the Indian startup ecosystem.

[With inputs from Hemant Kashyap ]

Last updated on September 19, 2023 | The list has been updated to include three more women investors.

The post title=”Meet The 38 Women Torchbearers Of India’s Startup Investment Space” href=”https://inc42.com/features/meet-the-30-women-torchbearers-of-indias-startup-investment-space/”>Meet The 38 Women Torchbearers Of India’s Startup Investment Space appeared first on Inc42 Media.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)