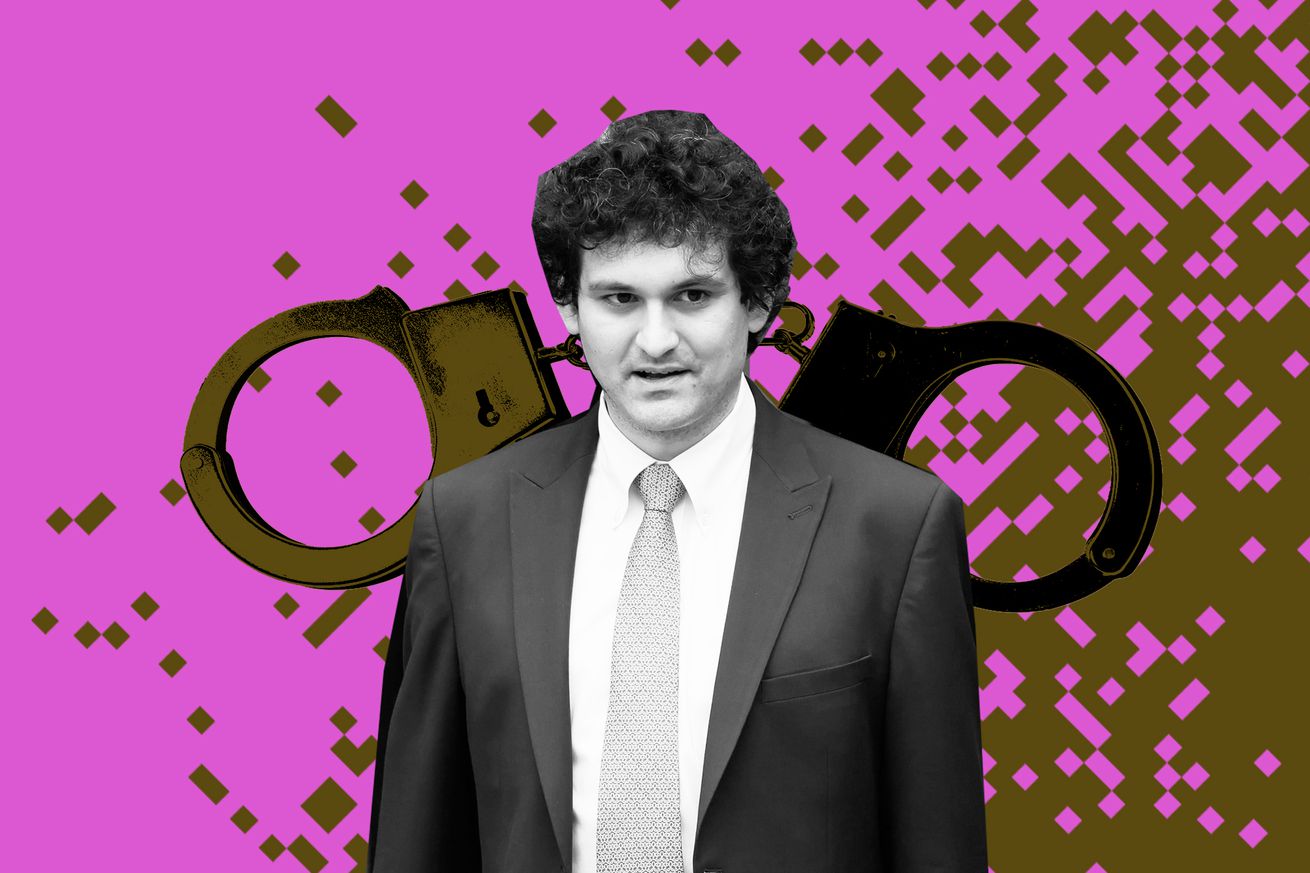

Photo Illustration by Cath Virginia / The Verge

Former cryptocurrency kingpin Sam Bankman-Fried has been found guilty of fraud. A New York jury delivered the verdict on November 2nd, concluding a trial that has seen Bankman-Fried defend himself against claims that he criminally mismanaged his crypto exchange FTX and trading firm Alameda Research.

After more than a month in trial, the jury took four and a half hours to decide Bankman-Fried’s fate, declaring him guilty on all seven charges, including wire fraud, conspiracy to commit wire fraud, and conspiracy to commit money laundering. He is set to be sentenced by Judge Lewis Kaplan on March 28th of next year and faces decades in prison.

Bankman-Fried started FTX in 2019, and its valuation rose stratospherically during a post-pandemic crypto boom. But prosecutors charged that the operation was a fraud “from the start.” While he promoted the exchange to investors and the public as safe and secure, Bankman-Fried’s former colleagues testified that it falsified numbers and granted secret, special privileges to Alameda — including a $65 billion line of credit and a flag that let Alameda’s balance dip into the negative as it illicitly borrowed FTX customer funds.

The FTX empire collapsed after a November 2022 Coindesk article — published precisely one year before the jury’s decision — revealed the secret blurring of funds and Binance CEO Changpeng “CZ” Zhao announced he would pull out of the exchange. Bankman-Fried resigned and FTX filed for bankruptcy, but he was soon hit with civil and criminal charges of fraud and money laundering.

Bankman-Fried spent the months ahead of his trial antagonizing prosecutors and the court. Originally placed under house arrest, he was sent to jail in August for violations of his bail conditions, including using a VPN to watch a football game and leaking the diary entries of his ex-girlfriend — former Alameda Research CEO Caroline Ellison, who pleaded guilty to federal charges and testified against him in trial — to The New York Times.

His case has further tarnished the reputation of the already embattled crypto industry, thanks to Bankman-Fried’s status as a high-profile representative of the industry. Several other major companies are the subject of civil or criminal charges in the US and abroad, including a few that suffered collapses as sudden as FTX’s.

In court, Bankman-Fried’s defense argued that he had honestly failed at operating a high-risk business. He denied directly supervising the damning code updates that allowed Alameda to spend FTX funds and said he had not participated in trading or questioned employees about billions of missing dollars. His testimony was contradicted by Ellison, his former roommates Adam Yedidia and Gary Wang (the cofounder of FTX), and family friend Nishad Singh; all had worked under Bankman-Fried and later cooperated with prosecutors. Wang, Singh, and Ellison are awaiting sentencing.

Correction 10:30PM ET: Deliberation of the jury took four and a half hours, not less than four. We regret the error.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)