At the end of 2022, there were telltale signs of distress in the Indian startup ecosystem. But not much attention was paid to the eight Indian startups that shut down in 2022 as it was seen as sanity returning to the market after the funding boom of the previous year.

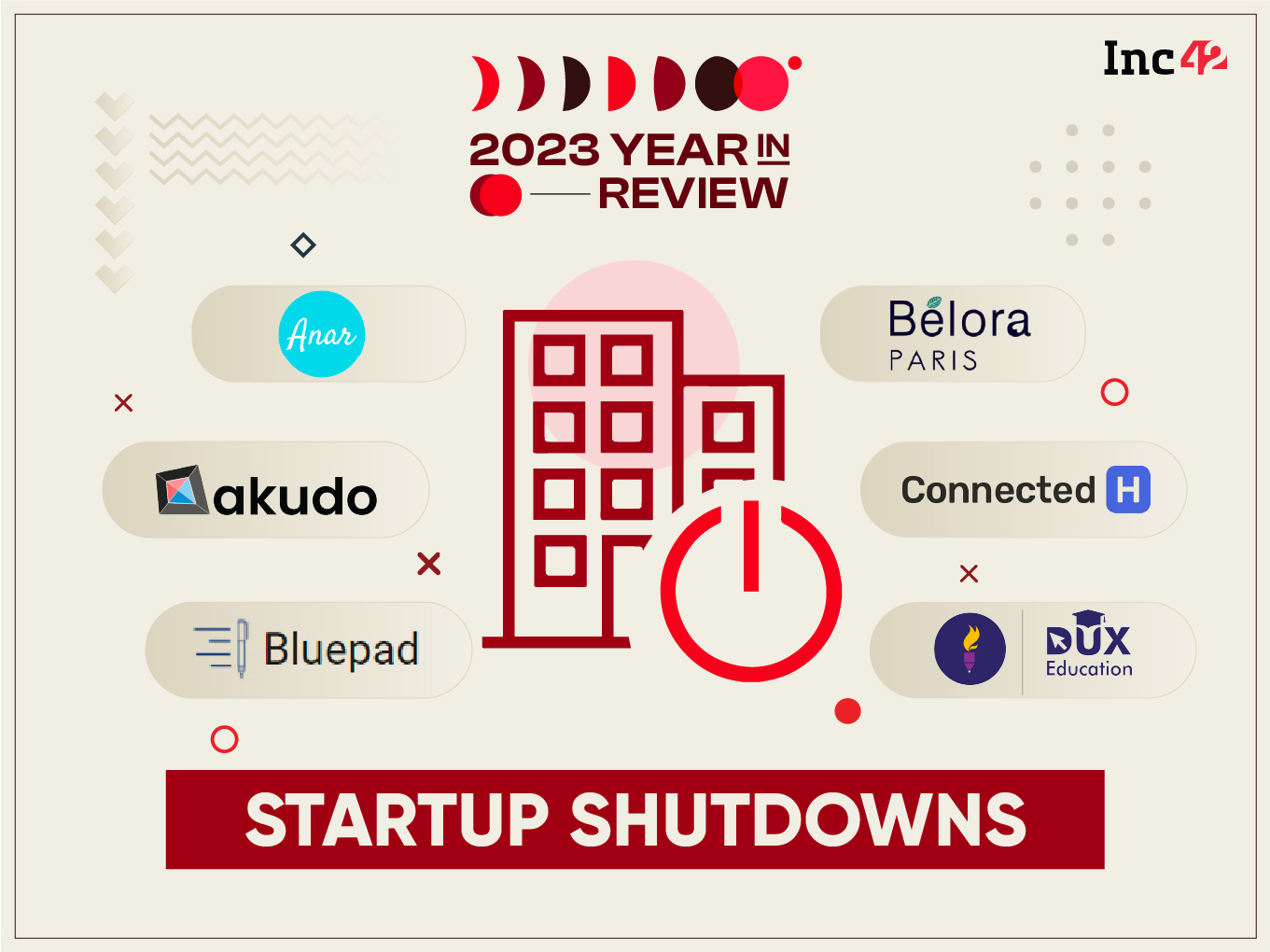

However, as 2023 progressed, the impact of the slowdown hit home as a wave of shutdowns hit the Indian startup arena.

At the outset, it was smaller players such as edtech platform DUX Education and crypto platform WeTrade that wound up operations this year. However, the fire soon spiralled out of control and took down big-ticket funding baggers such as crypto platform Pillow and edtech startup FrontRow.

So what happened?

“The wave of shutdowns among Indian startups is largely a repercussion of the funding frenzy of 2021 and 2022. During this period, a surge in capital led to the emergence of unsustainable business models. Even viable models were distorted by the ‘growth at all costs’ mentality, fueled by excessive funding. This approach often neglected the path to profitability and is now faltering under the weight of higher capital costs and attractive, lower-risk investment alternatives in the market,” Anirudh Damani, managing partner at Artha Venture Fund, told Inc42.

If investors were apprehensive in 2022, they completely began re-evaluating their investment strategies in 2023. Funding taps suddenly dried up as global interest rate hikes made it tough and unattractive for investors to place their bets on new ventures. This created an extremely challenging environment for homegrown startups that operated on razor-thin margins and, in many cases, were over-reliant on external funding.

“A number of these shutdowns can be attributed to the consequences of higher interest rates by the Federal Reserve. This tightened liquidity in the system and changed investor expectations from high growth to high operating cash flows. This also affected M&A as well as future fundraises as investors became more discerning about their investments,” said Siddarth Pai, founding partner at 3one4 Capital and co-chair of the regulatory affairs committee of the Indian Venture and Alternate Capital Association (IVCA).

Chiming in, D2C footwear brand Fausto’s founder Sumit Agarwal attributed the shutdown trend to startups pushing the paddle, on the back of VC money, in terms of scaling up with products that lacked product market fit (PMF).

To make matters worse, government regulations also hit some of the sectors hard. The Centre’s heavy taxation approach (30% tax on profits and a 1% TDS (tax deducted at source) levy) towards crypto space and 28% GST on the real money gaming ecosystem came in like a wrecking ball and left a trail of bloodbath in its wake.

While Pai expects the trend of startup shutdowns to continue in 2024 as well, he also believes that the next year will see the emergence of startups with strong financial metrics.

While much seems to be on the horizon in 2024, the year 2023 will no doubt be remembered for shutdowns. As the ongoing year nears its end, we, at Inc42, have collated a list of Indian startups that bid adieu to the ecosystem in 2023.

Note: The list has been compiled in alphabetical order.

Here’s The List Of 15 Startups That Shut Down In 2023

Low Retention Forced Elevation-Backed Anar To Shut Shop

Founded in 2020 by Nishank Jain and Sanjay Bhat, Anar was a LinkedIn of sorts for small medium enterprises. It helped small enterprises network across the board, from manufacturers to retailers, connect and interact online with one another.

In November 2023, the startup’s cofounder and chief executive officer (CEO) Jain announced that it would cease its operations and return the remaining capital to the investors.

The announcement came just two years after Anar raised a $6.2 Mn seed funding round co-led by Elevation Capital and Accel India in September 2021. It was backed by marquee cofounders and angel investors such as Pratilipi’s Ranjeet Pratap Singh, ShareChat’s Farid Ahsan, Meesho cofounders Vidit Aatrey and Sanjeev Barnwal, among others.

In a LinkedIn post, Jain attributed the decision to shut the platform to low retention rate, not creating enough value, and the failure to solve enough for sellers.

While Anar has bit the dust, cofounder Jain is mulling exploring a new venture in the AI space to solve super-large problems that will fundamentally define how society operates.

Belora Cosmetics Wound Up Ops Due To Capital Crunch

In September 2022, Belora Cosmetics was eyeing a full-scale public expansion with an ARR of INR 500 Cr in the next three to four years. By October 2023, reports began to surface that the cosmetics brand was nearing a ‘dead end’ as funding taps ran dry with no capital in sight.

A month later, neither its website was functional nor were its Instagram and Facebook pages.

As per a report, the startup failed to elicit any interest from existing investors, including Peak XV’s Surge. Belora Cosmetics was also said to have explored talks with multiple players in the space for a potential acquisition but the talks also fell through.

Founded in 2019 by Ainara Kaur and Akaljyot Kaur, Belora used to sell vegan and toxin-free makeup and skincare products such as lipsticks, moisturisers, eyeshadows, among others.

The startup last raised an undisclosed amount of seed funding from marquee names such as accelerator initiative Peak XV Surge, DSG Ventures, and a few other angel investors.

Funding Woes Led To Content Startup Bluepad’s Demise

A brainchild of Sanjyot Bhosale, Devakrishna Asokar and Kishore Garimella, Bluepad was founded in 2020 and aggregated content for Indian users in vernacular languages. Users could read and post written content, including blogs, poems, stories and experiences, in regional languages and form communities.

Bluepad shut shop in April 2023 after it failed to raise a follow-on round. The startup had raised INR 1.8 Cr in its pre-seed round, led by Titan Capital and AngelList’s Syndicate, in 2021.

In a LinkedIn post, cofounder Bhosale attributed the lack of a reliable monetisation channel in the long term and no ‘strong urgent need’ for the product among the users as the reason behind the decision to shut shop.

After shutting operations, the three cofounders parted ways and moved on to different projects. While Bhosale is now a product manager at Koo, Garimella is the founder of WorkBrow. Meanwhile, Asokar has joined Articuno Coding as the chief executive officer.

Kalaari-Backed ConnectedH Folded Up Due To Unaddressable Market Realities

Another casualty of the funding winter in 2023 was Kalaari Capital-backed healthtech startup ConnectedH.

The startup shut shop in August 2023 and returned the remaining capital to the investors. ConnectedH attributed the shutdown to ‘certain market realities’ that could not be addressed. As a consequence, the startup laid off its entire workforce.

Founded in 2018 by Subham Gupta, Rahul Kumar, and Suresh Singh, ConnectedH was a full-stack B2B healthtech startup that offered CRM solutions, online report management tools and other services for diagnostic labs.

Over the course of its lifetime, the startup catered to more than 5 Lakh patients, aggregating a database of 10 Mn health data points during the process.

Backed by marquee names such as Kalaari Capital, Incubate Fund India and angel investors such as CRED’s Kunal Shah, Roman Saini of Unacademy, ShareChat’s Farid Ahsan, ConnectedH had raised $2.5 Mn in total funding, $2.3 Mn of which was raised in a seed round in 2021 alone.

The startup’s cofounder Singh, in a LinkedIn post, said he would iron out the idea of a new venture over the course of the next couple of months.

As per Gupta’s LinkedIn bio, he has already taken over as the CEO of AI platform I’mBesideYou.

Funding Winter Forced Malpani Ventures-Backed DUX Education To Shut Shop

Edtech startup DUX Education was one of the first Indian startups to shut down in 2023. DUX Education failed to raise funds, prompting the founders to cease operations in April 2023.

Founded at the peak of Covid-19 pandemic in 2020 by Rohit Jain, Udit Chaturvedi and Manika Tiwari, the edtech startup offered school curriculum-based online classes for K-12 students.

The Bengaluru-based startup raised INR 2 Cr over the course of its lifetime from angel investment firm Malpani Ventures, and other investors.

Since shutting the startup, Chaturvedi has joined athleisure brand Techno Sportswear as chief financial officer (CFO) while Tiwari is now the chief strategy officer at edtech startup LXL Ideas.

28% GST Forced RMG Startup Fantok To Temporarily Suspend Ops

Real money gaming startup Fantok decided to temporarily suspend operations after the GST Council decided to levy a 28% Goods and Services Tax (GST) on online gaming platforms.

Citing the ‘shifting regulatory environment’ for real money gaming in India, the startup said that the new GST regime led to complicated legal challenges which compelled it to suspend operations.

The startup also attributed the decision to challenges related to high tax deducted at source (TDS), issues related to payment gateways, and the substantial cost of customer conversion.

Fantok plans to use the breather to explore a pivot that is in line with India’s evolving regulatory landscape and its bid to deliver meaningful experiences to end users.

A brainchild of Ronak Ahuja, Prakhar Saxena and Ashok Vishwakarma, the Gurugram-based Fantok was founded in 2022 and operated a social gaming platform for real money binary prediction games hosted by social media creators.

Funding Winter Sent Fipola Down The Liquidation Route

One of the first casualties of the ongoing funding winter in 2023, D2C meat delivery startup Fipola shut shop in February as it failed to raise capital from investors.

The startup’s founder and managing director Sushil Kanugolu told a news portal that Fipola failed to raise a follow-on round owing to unfavourable market conditions amid the funding winter.

Last heard, the startup was looking for ways to liquidate assets to pay off operational dues.

Founded in 2016, Fipola delivered meat to customers via its app and website. It also operated restaurants under the brand names Fipola Exclusive Cafe and Grill House by Fipola, which have also become non-operational.

Fipola last raised a Series A funding round of $3 Mn in March 2022 which saw participation from CK Ranganathan’s Cavinkare. The startup was even looking to raise another $40 Mn by 2023-end. It even onboarded actor Nayanthara as its brand ambassador in mid-2022.

At the end of February, Fipola had 65 stores under its belt spanning multiple cities in South India and had plans to expand to 250 stores by the end of 2023.

Not Enough Traction, Heavy Cash Burn Led To Friyey Shutting Shop

Pune-based coworking space provider Friyey’s cofounders made an appearance on the second season of the popular show Shark Tank India but the startup met an abrupt end just months later.

Founded in 2019 by Yogesh Thore, Friyey was a coworking startup that had a unique business model – converting places such as restaurants, pubs, and clubs into coworking spaces during morning hours, when the footfall is lower.

The startup attributed the shutdown to paucity of funds, with founder Thore adding that raising capital for idea-based startups was more difficult than for product-based businesses in India. On top of that, the Covid-19 pandemic appeared to have further hammered the startup’s business model.

Noting that the startup failed to create enough traction, Thore said expenses were much higher than the top line. Eventually, Friyey folded operations in July 2023.

Friyey last secured an undisclosed amount of seed funding from angel investor Tarun Bhalla in 2020. By the time it shut down, the startup boasted of more than 500 restaurant partners and more than 24,000 remote workers operating out of its spaces.

Despite Raising $17 Mn, Lightspeed-Backed FrontRow Folded On Account Of Low Traction

One of the biggest Indian startups to bite the dust in 2023 was extracurricular activity startup FrontRow.

The startup’s struggles came as a surprise as it had raised a big-ticket Series A round of $14 Mn in September 2021. However, it found itself struggling to stay afloat within a year and laid off 75% of its employees in October 2022.

As 2023 unfolded, the funding winter took a toll and the startup set course for path correction and profitability. But it was too late by then. FrontRow first culled most of its workforce and then decided to shut operations by mid-June and return the remaining capital to investors.

The startup folded on account of the deadly concoction of the funding winter, adverse market conditions, the failure to gain traction and retention, and absence of a real product market fit (PMF).

In the words of cofounder Ishaan Preet Singh, the startup’s annualised revenue plateaued after the initial ‘burst’, while marketing cost ballooned to more than 100% of revenue and course completion stayed below average. He also conceded that the startup overestimated the Indian online extracurricular activities market.

There were also issues such as delayed pilots, and lack of a strong product and profitable unit economics.

FrontRow raised $17 Mn during the course of its lifetime and was backed by big-ticket investors such as Eight Roads Ventures, GSV, Lightspeed, Elevation Capital and marquee angel investors such as CRED’s Kunal Shah, Unacademy’s Gaurav Munjal and ShareChat’s Farid Ahsan, among others.

Accel-Backed OSlash Returned Capital To Investors After Failure To Find Traction

The year 2023 also saw Bengaluru and San Francisco-based SaaS platform OSlash shut operations, almost one-and-a-half years after it raised a hefty post-seed funding round of $5 Mn at a valuation of $50 Mn.

OSlash shut shop at the end of November 2023 and returned the remaining capital to its investors. It cited failure to find traction and commercial success as the reason behind the decision to shut operations.

Founded in 2020 by Ankit Pansari and Shoaib Khan, OSlash was a SaaS startup that offered plug-and-play artificial intelligence (AI)-based copilots for teams and individuals to improve productivity at the workplace. It essentially enabled employees to access information across an organisation using everyday keywords, helping teams collaborate seamlessly.

The Accel-backed startup raised more than $7.5 Mn over the course of its lifetime and found investors in names such as Better Capital, CRED’s Kunal Shah, YouTube senior executive Christian Oestlien, Notion COO Akshay Kothari, among others.

Pillow Folded Due To Tough Business Environment, Adverse Crypto Regulatory Regime

Crypto investment platform Pillow was the biggest startup, in terms of funding raised, to shut operations in 2023. It attributed the decision to wind up to ‘difficult regulatory headwinds’ and tough business environment that made it ‘impossible’ to sustain its operations.

The startup wrapped up operations in July-end and claimed to have returned nearly 80% of the total capital raised to investors.

The big blow came just nine months after Pillow raised a massive $18 Mn in funding from Accel, Quona Capital, Elevation Capital, Jump Capital, among others, in 2022. In total, it bagged $21 Mn over the course of its lifetime.

Founded in 2021 by Arindam Roy, Rajath KM, and Kartik Mishra, Pillow allowed users to invest in US dollar-backed stablecoins and other cryptocurrencies such as Bitcoin and Ethereum via its app.

While the crypto industry appeared to be investor favourites in 2021, government regulations and imposition of heavy tax regime on the industry pummelled the entire ecosystem. The strong criticism of cryptocurrencies and calls to ban them by the top officials of the Reserve Bank of India (RBI) further dampened the sentiment. To add to this, the collapse of giants such as FTX only made matters worse for India’s crypto industry.

Tax Woes Forced Quizy To Shut Operations

Founded in 2021 by Amit Kumar and Sachin Yadav, Quizy was a real money gaming platform that offered gamified educational learning experience for users. The platform hosted experts that would write content for academic writings such as assignments, essays, book reports, book reviews, among others.

The startup shut shop in August 2023 due to considerations around regulatory headwinds, especially the increase in GST.

“Recent GST changes have thrown significant challenges our way. The removal of the TDS exemption limit and the adding flat 30% TDS on all winnings, regardless of the amount, hit us hard. This sudden change substantially impacted player earnings and motivation, leading to a decline in user engagement and loyalty,” Quizy cofounder Sachin Yadav said then.

Before shutting down, the startup burned through $317K of investor capital. Quizy was backed by names such as 100X.VC, We Founder Circle, Capital A.

Since then, both Kumar and Yadav have moved on and currently serve as the assistant vice-president at lendingtech platform BASIC Home Loan.

Tiki Closed Down Due To Funding Drought, Market Challenges

Short video platform Tiki shut in June citing the ‘recent challenges faced by the tech industry’.

The shut down came at the top of the raging funding winter as investors tightened their purse strings while startups looked for investors to tide over the capital drought. The industry was also plagued by lower retention and competition from global social media giants.

Announcing the shutdown, Tiki said it would delete all user data from its servers in India and Singapore and recommended its users download any videos important to them.

Incubated by Peak XV Surge, the startup raised $3.63 Mn in funding over its lifetime.

Peak XV-Backed Vah Vah! Shut Shop Due To Declining Revenue, Weak Unit Economics

Vah Vah!, A brainchild of former India head of Zynga Shailesh Chaganlal Daxini and two ex-Zynga employees – Akash Senapaty and Muthukaleeshwaran Subbiah, was a vocational training startup that offered certificate courses in makeup artistry, hair styling and grooming.

Founded in 2020 and incubated by Peak XV Surge, the startup silently shut operations in July 2023 and fired its entire workforce of 150 employees. The ensuing fracas also saw police intervention.

In a deep dive done by Inc42 into the startup’s fall, several erstwhile employees claimed that the startup was plagued by declining revenue, ballooning loss, weak unit economics, lack of traction, lack of business model, and inability to raise funds.

Over the course of its lifetime, Vah Vah! secured $2 Mn in funding.

Meanwhile, Daxini and Subbiah have already begun work on their new venture – a Thrasio-style gaming platform Brightpoint. They have reportedly secured funds to the tune of $5 Mn to $6 Mn from Peak XV, Nexus, among others for Brightpoint.

Regulatory Headwinds Led To Crypto Platform WeTrade’s Demise

Another crypto startup that bit the dust in 2023 was Bengaluru-based crypto platform WeTrade. Hit by the funding winter, regulatory headwinds and uncertainty in the crypto market, WeTrade shut shop in January 2023.

“WeTrade started in 2022 with a vision to make trading in cryptocurrency easy and rewarding. However, with the crypto winter deepening and the ambience turning increasingly hostile, we have decided to pause our services,” the startup said back then.

The startup was also said to have fired all its employees as a result of the shut down.

Founded in 2022 by Prashant Kumar, WeTrade was a crypto trading platform that charged zero trading fees and allowed customers to begin crypto investing with a minimum amount of INR 100. It also offered fixed interest products on their stable cryptocurrency investments.

The startup raised more than INR 15 Cr from external investors during its lifespan.

Since shutting down WeTrade, Kumar has moved on to work on his new fintech venture Kredit.Pe where he serves as the founder and CEO.

The post title=”Plagued By Funding Winter & Bad Economics, Here Are 15 Indian Startups That Shut Down In 2023″ href=”https://inc42.com/features/plagued-by-funding-winter-bad-economics-here-are-15-indian-startups-that-shutdown-in-2023/”>Plagued By Funding Winter & Bad Economics, Here Are 15 Indian Startups That Shut Down In 2023 appeared first on Inc42 Media.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)