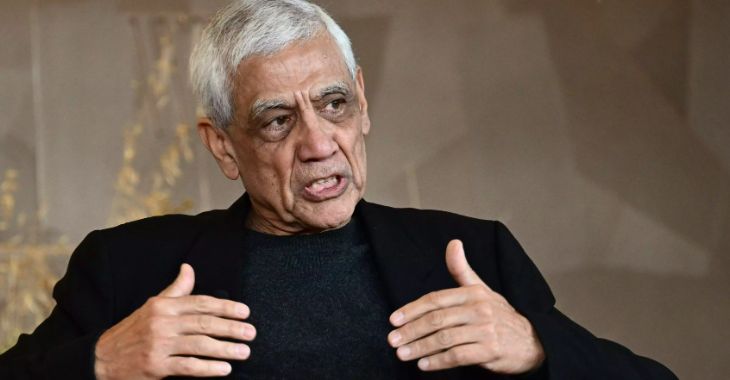

Vinod Khosla, a billionaire investor and early backer of OpenAI, has expressed his belief that artificial intelligence (AI) will bring about fundamental changes to the global economy. In a recent statement on X, Khosla outlined his view that AI’s impact will be deflationary over the next twenty-five years.

Khosla’s perspective diverges from the prevailing economic trends, which have seen persistent inflationary pressures despite a decrease in price growth from multi-decade highs. In a deflationary scenario, prices decline, leading to reduced profitability for businesses and potentially stagnant or shrinking economic growth.

However, Khosla predicts that AI’s influence will render traditional metrics of economic health less relevant. He suggests that while capital may become scarce in the short term, there will be an abundance of goods and services. This shift, according to Khosla, raises questions about the appropriateness of current economic measures and indicators.

Khosla’s venture-capital firm made a significant investment of $50 million in OpenAI in 2019, marking the largest investment in the company’s fifteen-year history. The 68-year-old investor has been vocal about both the opportunities and risks associated with AI.

At Fortune’s Brainstorm AI conference on December 12, Khosla emphasized that AI is not the world’s greatest threat, countering concerns about sentient AI posing existential risks. Instead, he highlighted China as a far greater concern.

Khosla’s views align with those of Elon Musk, who has also projected dramatic economic effects from AI. Musk, during the unveiling of Tesla’s AI robot last year, predicted that a future with capable AI robots could lead to quasi-infinite economic possibilities, eliminating poverty and providing abundance in products and services. He described this as a fundamental transformation of civilization.

Despite requests for comment from Business Insider, representatives for Khosla have not responded at the time of writing.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)