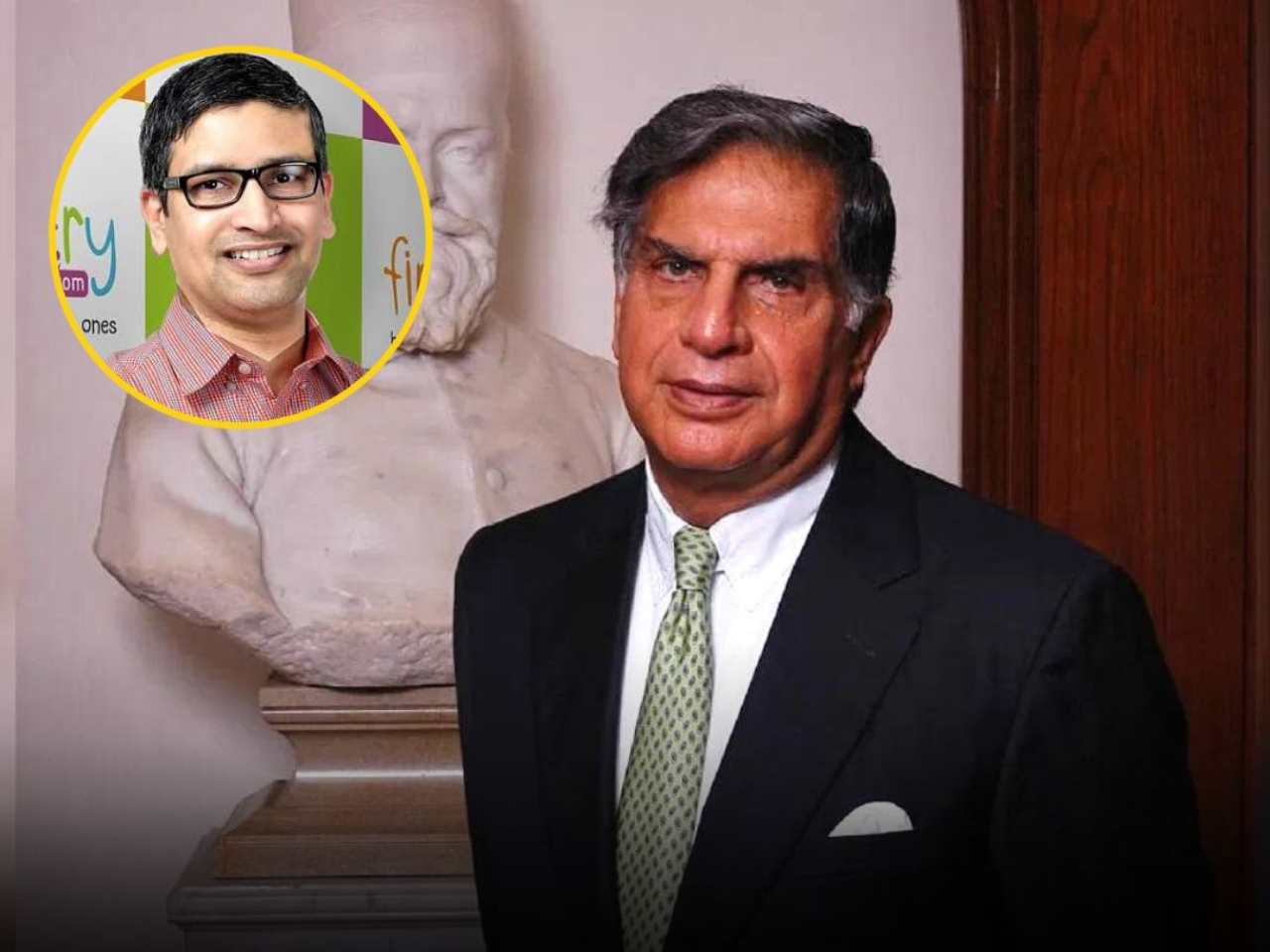

Former Tata Group Chairman Ratan Tata, who turned 86 on Thursday, is set to sell his entire stake of 77,900 shares in the upcoming IPO of FirstCry, an e-commerce platform for kids’ products.

Ratan Tata invested Rs 66 lakh in 2016, representing a 0.02% stake in the company. Alongside Tata, major shareholders such as Mahindra & Mahindra (M&M), SoftBank, and other investors are also participating in the Offer for Sale (OFS), collectively offloading 5.44 crore shares.

Details of the IPO

FirstCry’s parent company, Brainbees Solutions, is preparing for an IPO that includes issuing new equity shares worth Rs 1,816 crore and an OFS. The IPO might also feature a private placement of shares worth Rs 363.20 crore. The company has not yet announced the IPO’s opening and closing dates or the price band.

IPO proceeds utilization

According to DRHP, The company would use the IPO proceeds for setting up new retail stores and warehouses, international expansion, particularly in Saudi Arabia, and investing in subsidiary FirstCry Trading.

Additionally, The funds would also be utilized to support sales, marketing, technology, data science, and strategic acquisitions.

Who are the other selling shareholders?

Apart from Tata and M&M, significant sellers in the OFS include SoftBank’s SVF Frog (Cayman) with 20.3 million shares, PI Opportunities Fund-1, TPG Growth V SF Markets Pte., NewQuest Asia Investments, and several others. FirstCry co-founder Supam Maheshwari is also offloading shares.

The IPO is managed by Kotak, Morgan Stanley, Bofa Securities, JM Financial, and Avendus, with Link Intime India Private Limited as the registrar. FirstCry, known for its range of baby, kids, and mother-care products, operates both online and through physical stores.

The company offers a range of products, including apparel, toys, and accessories for babies, kids, and mothers, both online and through physical stores.

Join our new WhatsApp Channel for the latest startup news updates

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)