SUMMARY

Acquired by Snapdeal in 2015, Unicommerce is an ecommerce SaaS startup that enables sellers to manage their inventory across all online marketplaces

AceVector (formerly Snapdeal) is the largest shareholder in Unicommerce with a 38.18% stake, while SoftBank owns a 29.23% stake

Unicommerce’s net profit stood at INR 6.3 Cr in H1 FY24. In FY23, the startup’s net profit grew 8% to INR 6.4 Cr from INR 6 Cr in the previous fiscal year

Snapdeal-backed SaaS startup Unicommerce last week joined the rapidly growing list of startups that have filed their draft red herring prospectus (DRHP) with market regulator SEBI. The startup will sell up to 2.98 Cr shares during its initial public offering (IPO).

The SoftBank-backed startup’s IPO will only have an offer for sale, with no fresh issuance of shares. Unicommerce will also not engage in a pre-IPO placement.

Acquired by Snapdeal in 2015, Unicommerce is an ecommerce SaaS startup that enables sellers to manage their inventory across all online marketplaces. It offers integrations with all major ecommerce platforms active in India.

Unicommerce became the fifth startup to file DRHP within two weeks. Now, let’s take a look at the startup’s shareholding pattern.

Who Sits On Unicommerce’s Cap Table?

AceVector Ltd (formerly Snapdeal) is the largest shareholder in Unicommerce with a 38.18% stake. Snapdeal founders, Kunal Bahl and Rohit Kumar Bansal own a 9.95% stake in Unicommerce via their VC firm, B2 Capital Partners.

SoftBank is next on the list, with a 29.23% stake in the ecommerce SaaS player. The Japanese investing giant holds the equity stake via its UK-based entity, SB Investments Holdings (UK) Limited. Anchorage Capital is the fourth largest stakeholder in Unicommerce, as the US-based investor sits with a 7.77% stake.

Sutherland Global Services’ founder Dilip Vellodi is the largest individual stakeholder in the ecommerce SaaS platform, with a 3.45% stake. Vellodi invested in Unicommerce less than ten days before the startup filed the draft papers. Ace investor Madhuri Kela, the wife of veteran investor Madhusudan Kela, is another significant individual shareholder in Unicommerce with a 1.66% stake.

The DRHP showed that Kela, Vellodi, Anchorage Capital, and CitiusTech cofounders Rizwan Koita and Jagdish Moorjani invested in the company on December 22, 2023.

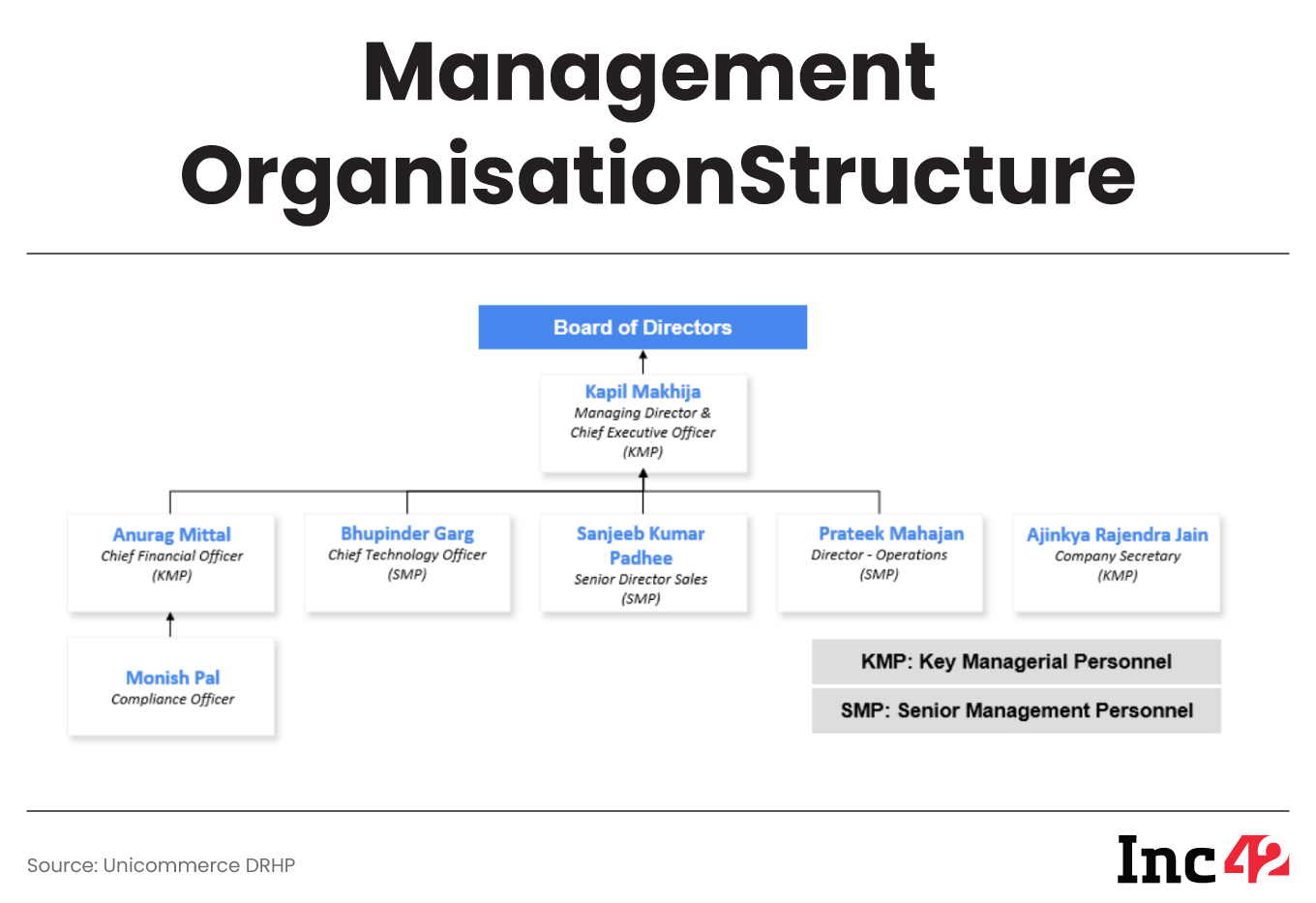

People In Charge At Unicommerce

The board of directors at Unicommerce consists of Snapdeal cofounders Bahl and Bansal, along with several industry veterans. The board is chaired by Manoj Kumar Kohli, who also sits on the board of companies like Ola Electric, WeWork India, and Bira91, among others.

Kapil Makhija is the MD and CEO at Unicommerce, having been appointed to his position in 2017. Makhija, an IIT Delhi and IIM Bangalore alumnus, previously worked with Oracle India, A.T. Kearney, and Qwest Software Services.

Anurag Mittal is the CFO at the ecommerce SaaS startup. He joined the organisation in 2022 before being elevated to his current position in December 2022. An IIM Jammu alumnus and a trained chartered accountant (CA), Mittal previously worked with companies like Paytm, Nokia Siemens, Body Cupid, and Snapdeal.

Bhupinder Garg is Unicommerce’s CTO, appointed in October 2017. An IIT Roorkee alumnus, Garg previously worked with Snapdeal, Amazon Development Centre (India), and D. E. Shaw India Software.

The ecommerce SaaS startup is the third SoftBank-funded company that has filed DRHP in the past two weeks, following Ola Electric and FirstCry. In all, five startups, including MobiKwik and Awfis, have filed draft IPO papers with SEBI in the recent past.

Unicommerce’s net profit stood at INR 6.3 Cr in H1 FY24. In FY23, the startup’s net profit grew 8% to INR 6.4 Cr from INR 6 Cr in the previous fiscal year. The ecommerce SaaS startup’s operating revenue stood at INR 51 Cr in H1 FY24. In FY23, the startup’s operating revenue rose 52% to INR 90 Cr from INR 59 Cr in FY22.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)