SUMMARY

We expect Meesho to be the key gainer with more than 48% downloads in Indian ecommerce and gain incremental market share: Bernstein

The brokerage also expects Zomato to continue gaining higher incremental gross merchandise value (GMV) as compared to Swiggy

Bernstein also analysed its top picks across quick commerce, OTT, and fashion ecommerce. All the analysis were based on app downloads and engagement trends comparing consumer behaviour and competitive dynamics

As the ecommerce sector continues to see strong growth in the Tier II and III cities of India, Meesho is gaining market share and is the fastest-growing ecommerce platform in the country, according to brokerage Bernstein.

In a recent research note, Bernstein said the ecommerce industry leader Flipkart’s user base grew 21% year-on-year (YoY) in December 2023. Meanwhile, Amazon lagged behind at 13% user growth, primarily due to relative premium offerings as compared to peers.

Meesho saw a 32% YoY rise in its user base and has about 120 Mn average monthly average users (MAUs), the brokerage said.

“The company differentiates by providing access to unbranded products at low prices to SMEs… We expect Meesho to be the key gainer with more than 48% downloads in Indian ecommerce and gain incremental market share,” added Bernstein.

lockquote>

The brokerage’s analysis was based on app downloads and engagement trends comparing consumer behaviour and competitive dynamics.

Bernstein also analysed its top picks across food delivery, quick commerce, OTT, and fashion ecommerce.

“Zomato remains top of the charts in food delivery, gaining share in MAUs,” said the brokerage, adding that the company’s deeper penetration in smaller cities as compared to its peers has been a key growth driver in MAUs.

lockquote>

Zomato’s active user base continues to grow faster than Swiggy, said Bernstein, and it expects that the foodtech major would continue to gain higher incremental gross merchandise value (GMV) as compared to Swiggy.

Zomato also has an over 60% share in new downloads as compared to Swiggy’s 40%, it noted.

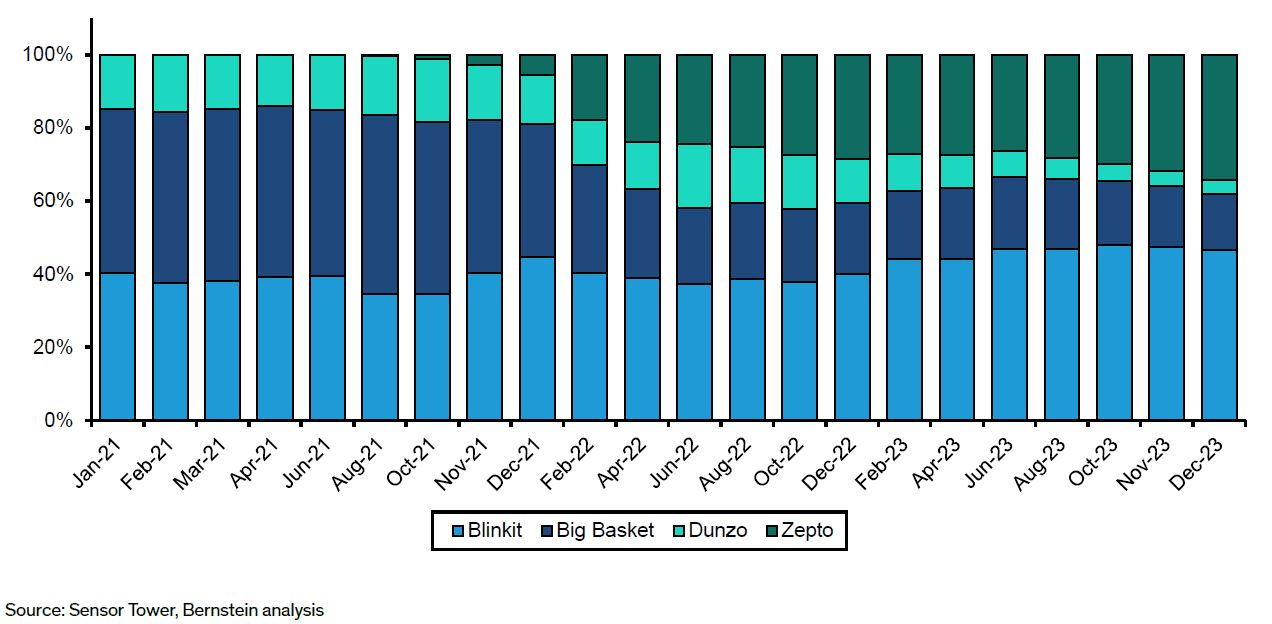

Besides, on the quick commerce front, Zomato’s Blinkit business is a market leader with an early 40% share, Swiggy’s Instamart at 37-39%, and Zepto at about 20% share from a GMV perspective.

The brokerage also pointed out that as per the current ecommerce market share based on MAUs, Big Basket is losing its share to Blinkit and Instamart.

Amongst egrocery players, Blinkit continues to grow the fastest driven by maturity in market, wide catalogue among the quick commerce peers, reach of more than 470 dark stores, and strong execution.

Though Zepto began its operations in April 2021, it lags behind Blinkit in terms of SKUs and reach (over 200 dark stores), the brokerage said.

On the other hand, Bernstein said Dunzo’s muted growth is primarily due to a shortage of access to capital and mixed focus on quick commerce and hyperlocal parcel delivery.

In the fashion ecommerce vertical, the brokerage considers Nykaa as a small player given its 6% share in the segment. Meanwhile, Myntra remains in pole position with a 66% share followed by Reliance’s Ajio with about a 30% share, it noted

lockquote>

Bernstein has a ‘market perform’ rating on Nykaa and a price target of INR 179, which implies an upside of INR 11% to the stock’s last close on Thursday (January 25).

On the other hand, the brokerage has an ‘outperform’ rating on Zomato and a target of INR 154, implying a 13.2% upside.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)