SUMMARY

Longer gestation periods associated with OEM investments, increasing competition, and heavy capital requirements are some of the reasons why many investors want to stay away from funding EV manufacturers

EV manufacturing is a long journey, which is why they now want to focus on allied sectors like batteries, EV infrastructure development, and other segments

According to data compiled by Inc42, the Indian EV sector has raised over $780 Mn so far this year as against $758 Mn in 2022

From marquee startup investors like Peak XV Partners (formerly Sequoia Capital) and Lightspeed to sector-focussed VCs such as AdvantEdge and Speciale Invest, there is hardly any VC or angel investor who does not want to bet on the country’s burgeoning EV story.

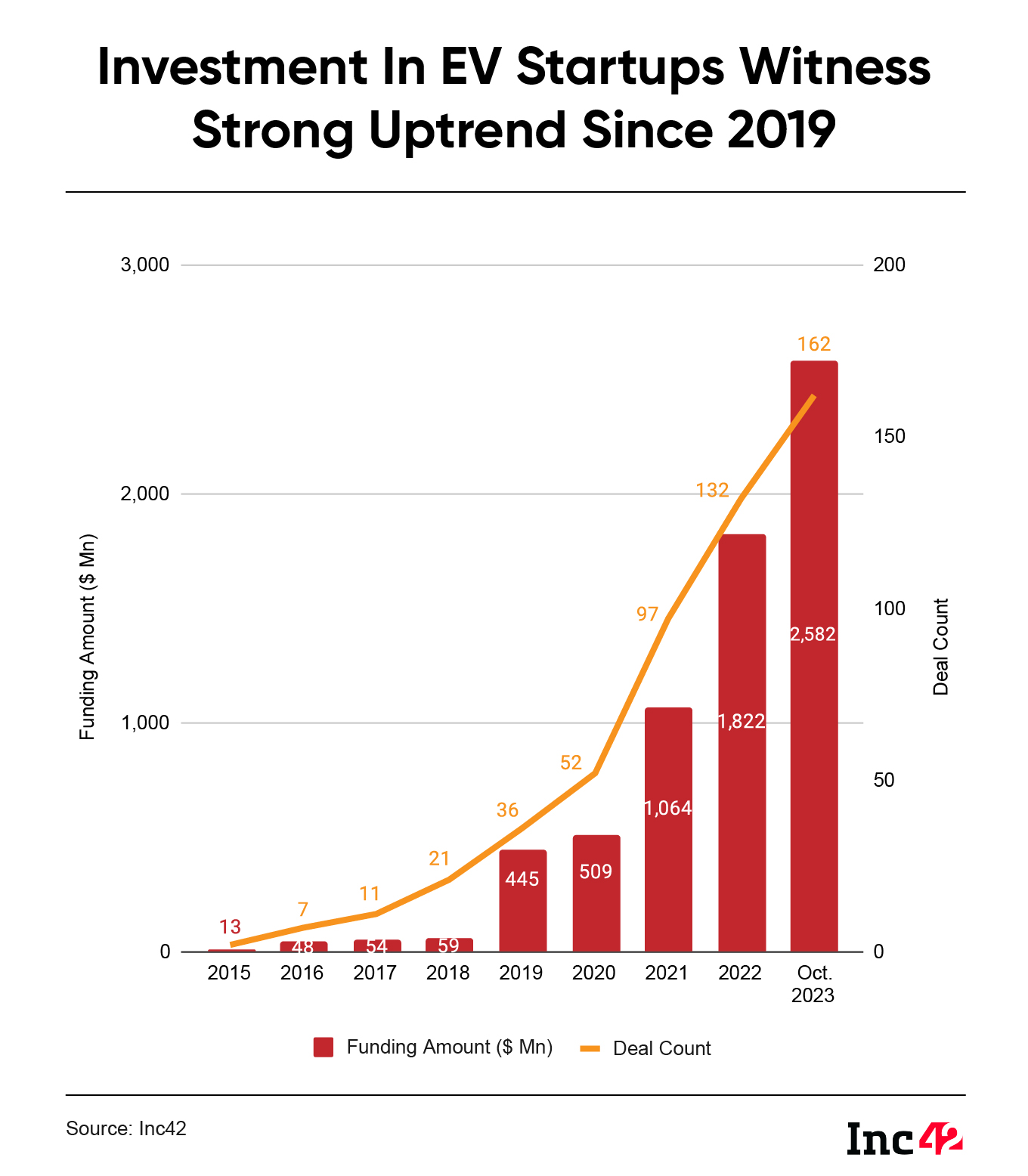

In fact, as against a total of 35 funding deals last year, the Indian EV ecosystem has already lapped up 32 deals so far this year, amid the ongoing funding winter. Further, according to data compiled by Inc42, the Indian EV sector has raised over $780 Mn so far this year as against $758 Mn in 2022.

The aforementioned funding numbers and deal counts may look quite promising, along with the fact that Indian EV startups have raised a total of $2.6 Bn since 2015, with OEMs leading the show so far.

However, a closer look at the current funding activities in the sector reveals that EV OEMs, once the lure of the Indian funding carnival, no longer look lucrative to investors. According to Inc42, over 41% of deals in the industry have been lapped up by non-OEMs so far this year.

lockquote>

Speaking with Inc42, a few investors revealed that the longer gestation period associated with OEM investments, increasing competition, and heavy capital requirements are some of the reasons why many investors want to stay away from funding EV manufacturers. However, amid this, investor focus is shifting towards industry sub-segments like EV financing, charging and infra, and battery technology.

“Both two-wheelers and three-wheelers have seen a proliferation of newer OEMs while in four-wheelers the incumbents have taken a large lead. Given the long timeframe to hit the market, extended working capital cycles and heavy competition, we are not bullish on entering an OEM as a venture investor at this point,” Romit Mehta, an investor at Lightspeed India said.

lockquote>

Echoing similar sentiments, the managing partner of Speciale Invest, Vishesh Rajaram, told Inc42 that if OEMs have to start businesses today, they either need headstarts that Ather Energy or Ultraviolette had (given the founders’ years of experience in the mobility sector) or a huge capital investment like Ola.

“If none is in place, it will be a tough battle for OEMs to catch up with the market. Hence, vehicle manufacturers that are starting afresh may not get much investor attention,” Rajaram said.

Notably, Speciale Invest has investments in electric motorcycle manufacturer Ultraviolette, Li-ion battery recyclers Metastable Materials, electric flying taxi startup ePlane Company, and battery tech startup e-TRNL Energy.

Rajaram added that Speciale Invest will continue to remain laser-focussed on the entire electric mobility value chain.

Is The EV Funding Pattern Shifting?

According to industry experts, EV manufacturing is a long journey and investors understand this, and as a result, they now want to focus on allied sectors like batteries, EV infrastructure development, and other segments.

In addition, the country has already received the initial push in terms of EV adoption, and in a bid to keep this momentum going, the allied sectors will now require a significant backing from investors.

Lightspeed’s Mehta looks at EV opportunities from two angles – the first is the initial adoption and the second is the proliferation.

“Today, the pace of EV adoption is picking up, and we believe it is a great time for founders to make charging more accessible, innovate components and data stack for lifecycle management, and build a brand for financing,” he said.

lockquote>

Sharing his thoughts on emerging EV sub-segments and investors’ growing inclination towards them, Sandiip Bhammer, the founder and co-managing partner at Green Frontier Capital said that the same stems from the high potential for innovation and scalability in these allied areas.

“These emerging areas hold the key to solving the fundamental challenges in the ecosystem… Going forward, investments in electric mobility are likely to be aggressive, especially in the emerging technologies that will enhance range, reduce costs, and improve overall user experience,” Bhammer said.

lockquote>

According to Bhammer, investments in the development of efficient battery technology and businesses that support the EV ecosystem, like lending, SaaS-based business, and others, are well poised for growth.

Meanwhile, Mehta of Lightspeed believes that in terms of second-generation opportunities, which is proliferation, there is an emerging play in full-stack battery solutions, systems-level charging optimisation across the network, second-hand marketplaces, and distributed storage, among others.

Notably, the charging and battery technology segment has recently seen startups like Exponent Energy and EMO Energy come up with quicker solutions to EV charging.

Similarly, Bengaluru-based Vidyut was founded in 2021 to help commercial EVs with financing and vehicle lifecycle management solutions.

This year, the former India CEO of CARS24, Kunal Mundra, launched a full-stack EV asset management and leasing startup, Electrifi Mobility.

A Sneak Peek In 2023 So Far

It is pertinent to note that even after multiple safety issues and major policy changes in the EV ecosystem over the last one year, the funding in this space has only increased.

As per Inc42, the total amount of funding in EV startups since 2015 stood over $1.8 Bn in 2022 and more than $2.6 Bn so far in 2023.

Even after safety challenges and other issues that shrouded the Indian EV industry last year, several investors had told Inc42 that the initial problems would only be short-lived and that long-term opportunities in the sector set the stage for doubling investments.

Meanwhile, Green Frontier Capital’s Bhammer said that despite the funding winter, climate investments have grown, and currently, there are a lot of investors who are looking at the EV sector in India and its growth, which has been well-documented in terms of the growing number of EVs, and charging and swapping stations.

“We are finding a lot of foreign investors in the VC space. All have, in some form, taken an exposure to the industry… The fact is that the EV exposure is very much part of everyone’s portfolio whether it’s in financing, whether it’s a platform, whether it’s an OEM, and I feel that there is a lot more to come,” Bhammer added.

lockquote>

The founder of Green Frontier Capital has a point here, given that a lot is happening in this burgeoning space. Recently, Paytm founder and CEO Vijay Shekhar Sharma launched his maiden fund, VSS Investment Fund, with EV as one of the sectors in focus.

It is pertinent to note that while OEM giants like Ola Electric and Ather Energy raised more than $490 Mn until mid-November 2023, there were multiple other fundings across EV sub-segments.

For instance, EV financing startup Revfin bagged a debt funding of $5 Mn. Similarly, EV cab service provider Evera bagged $7 Mn as part of its Pre-Series A funding round, and lithium-ion (Li-ion) battery recycling startup Metastable Materials raised an undisclosed Seed round from Sequoia Capital’s Surge, Speciale Invest, and others.

Besides, some big investments in the non-OEM segments included EV battery startup Log9 Material’s $40 Mn Series B funding, EV charging startup CHARGE+ZONE’s $54 Mn Series A1 funding, and Magenta Mobility’s $22 Mn Series A1 round.

lockquote>

So far this year, India’s total EV registrations stand at 13.29 Lakh units compared to 10.24 Lakh in 2022, as per Vahan data.

As of now, the sheer rise in the number of EVs and investors’ willingness to give a much-needed investment boost to EV sub-sectors are some of the many tailwinds that the Indian EV industry is well-positioned to leverage going ahead.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)