SUMMARY

Drone startup ideaForge emerged as the biggest loser this week, with its shares slumping 6.6% on the BSE

Zomato, PB Fintech, Delhivery, RateGain, EaseMyTrip, Fino Payments Bank, Mamaearth, and CarTrade Technologies gained in a range of 0.09%-4% this week

Sensex and Nifty50 declined a little over 1% each during the week to 70,700.67 and 21,352.6, respectively, amid the weakness in banking stocks

Most of the Indian new-age tech stocks fell this week, in line with a significant slump in the broader equity markets due to the weakness in the banking sector.

Drone startup ideaForge emerged as the biggest loser this week, with its shares slumping 6.6% on the BSE.

Besides, 10 out of the 19 stocks under Inc42’s coverage fell between 0.7% and 5.7% during the week. Nykaa, Paytm, IndiaMART, DroneAcharya, and Nazara Technologies were among the other losers this week.

However, Zomato, PB Fintech, Delhivery, RateGain, EaseMyTrip, Fino Payments Bank, Mamaearth, and CarTrade Technologies gained in a range of 0.09%-4% this week, with CarTrade emerging as the biggest gainer.

After an extended trading session last week, there were only three trading sessions this week as Monday (January 22) and Friday (January 26) were market holidays on the occasion of the consecration ceremony of the Ram temple in Ayodhya and the Republic Day celebrations, respectively.

Among the benchmark indices, Sensex and Nifty50 declined a little over 1% each during the week to 70,700.67 and 21,352.6, respectively.

Commenting on the market’s performance this week, Siddhartha Khemka, head of retail research at Motilal Oswal, said that weak results of Tech Mahindra, Axis Bank, and HDFC bank continued to weigh on the stocks of IT and private banks.

“FIIs have been mostly sellers in the month of January, having sold more than 30K Cr so far. Going ahead, the market is likely to consolidate further ahead of the US Fed interest rate decision on Wednesday where Fed is expected to maintain the status quo and give some hint with regards to rate cut timeline,” Khemka said.

lockquote>

However, with many heavyweights releasing their Q3 earnings next week, stock-specific action is expected to continue despite market consolidation. Among the new-age tech stocks, RateGain, Delhivery, PB Fintech, and Fino Payments Bank are scheduled to report their quarterly earnings next week.

Santosh Meena, head of research at Swastika Investmart, said that the Union Budget, earnings, and US Fed policy will keep the market on its toes next week.

“The upcoming week is poised to be pivotal, marked by a series of significant events, with the Budget taking the centre stage. However, the finance minister’s indication of a modest, vote-on-account budget suggests a lack of extravagant announcements,” said Meena.

lockquote>

Now, let’s take a look at the performance of the new-age tech stocks this week.

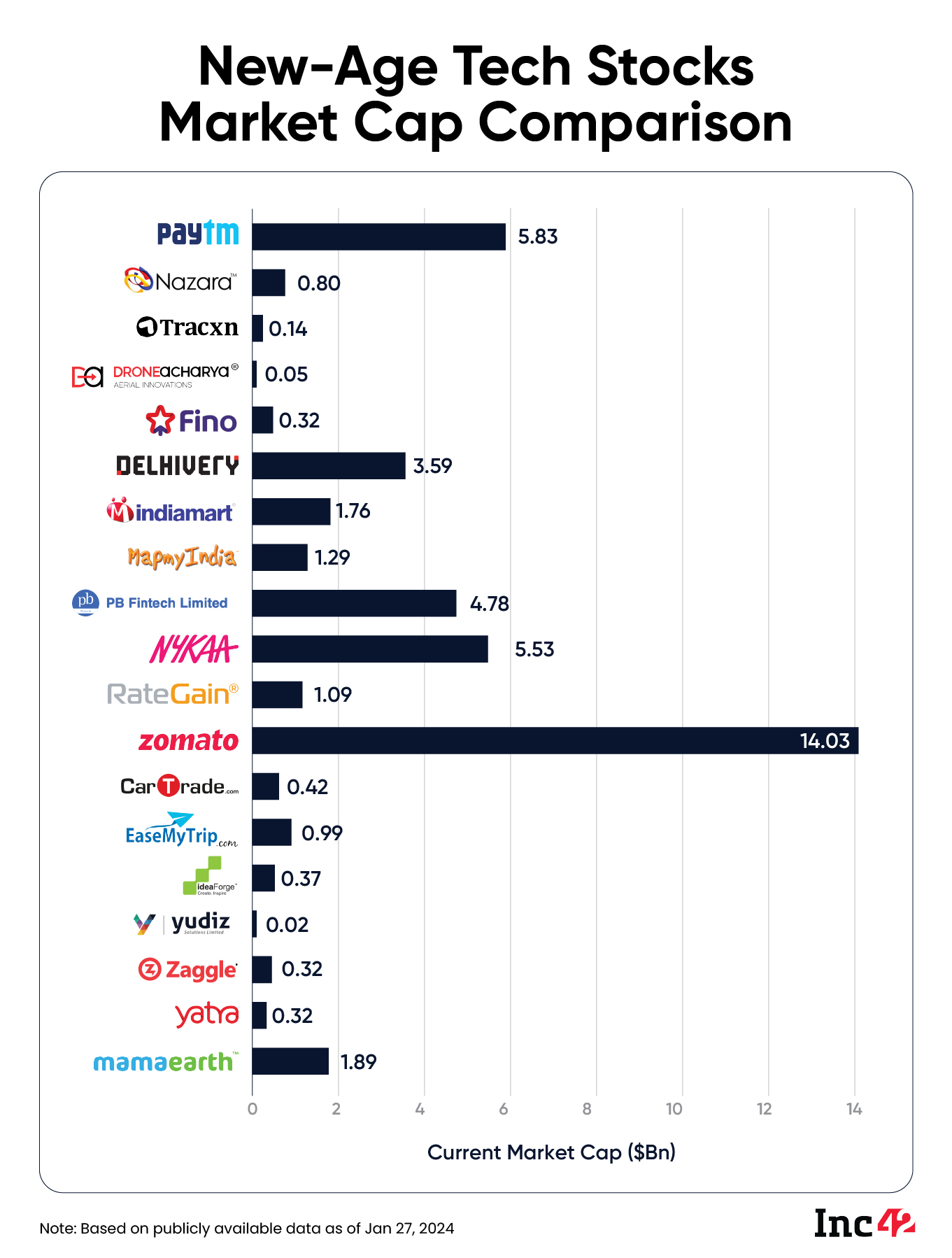

The total market capitalisation of the 19 new-age tech stocks under Inc42’s coverage stood at $41.69 at the end of this week as against $42.67 Bn last week.

SoftBank Continues To Pare Stake In Paytm

After Paytm reported its Q3 FY24 earnings last week, the Japanese investment giant said in an exchange filing this week that it sold another 2% stake in the fintech major in a series of disposals between December 19, 2023 and January 20, 2024.

SoftBank offloaded 1.27 Cr shares of Paytm, worth INR 950 Cr ($114 Mn), during this period.

As per the BSE data, at the end of the quarter ending December 2023, SoftBank’s SVF India Holdings (Cayman) Limited held 4.10 Cr shares in Paytm or a 6.46% stake.

After SoftBank’s announcement on Tuesday (January 23), BNP Paribas Arbitrage and Societe Generale together offloaded 52.78 Lakh shares in Paytm via block deals worth INR 397.9 Cr on January 25.

Various funds of Marshall Wace Investment Strategies bought most of these offloaded shares via block deals.

After surging over 13% last week, Paytm fell 2.72% on the BSE this week. The stock ended the last trading session at INR 762.9 on the BSE.

lockquote>

Paytm’s net loss narrowed over 43% year-on-year (YoY) to INR 222 Cr in Q3 FY24.

Commenting on Paytm’s stock performance, Amol Athawale, vice president of technical research at Kotak Securities, said that the INR 800 level would act as a crucial resistance for the stock.

“On the downside, if its shares slip below INR 735, we can expect the stock to correct till INR 700-INR 690,” said Athawale.

Zomato Forays Into Payments Ecosystem

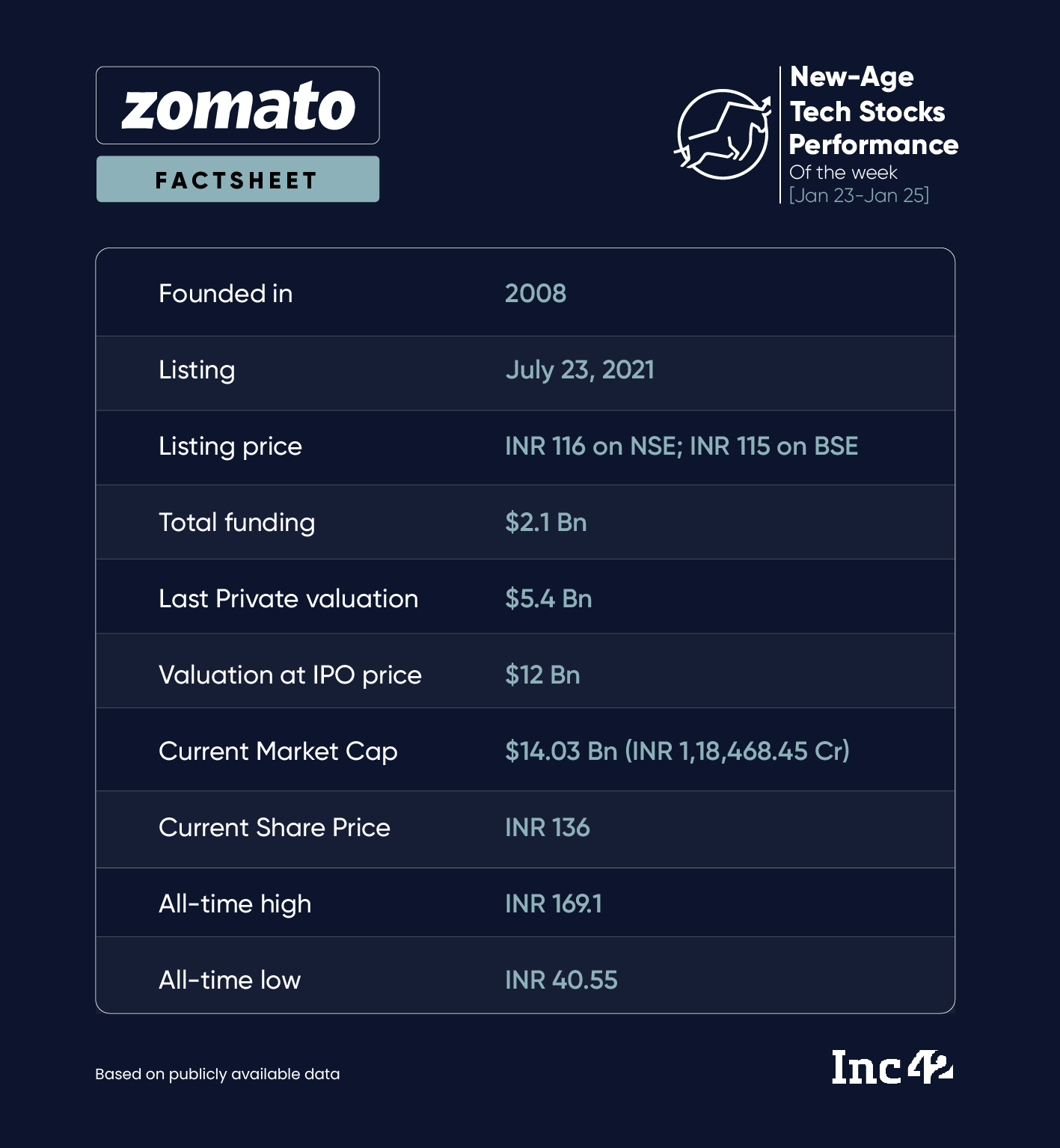

Share of Zomato managed to gain this week despite volatility in the broader market. The stock rose 2.18% to end the week at INR 136 on the BSE.

In The News For:

- In another major development for the foodtech giant, the Reserve Bank of India (RBI) has granted a certificate of authorisation dated January 24, 2024 to Zomato Payments Private Limited to operate as an online payment aggregator.

- Amid the Indian market witnessing large selling by FIIs, Societe Generale offloaded 86.5 Lakh shares in Zomato for INR 117.82 Cr in a block deal on Thursday (January 25). Marshall Wace Investment Strategies bought the offloaded shares via block deals.

After gaining over 100% last year on the back of improving bottom line, shares of Zomato are trading almost 10% higher year to date in 2024.

In a research report this week, brokerage Bernstein said that the company would continue to gain higher incremental gross merchandise value (GMV) as compared to Swiggy.

Kotak Securities’ Athawale said that Zomato is currently making a bullish formation on the charts.

“After a short-term correction, the stock is moving sideways but the consolidation is positive,” he said, adding that INR 125-INR 128 is the immediate support area for the stock. Beyond this, it can move up to INR 147-INR 150.

lockquote>

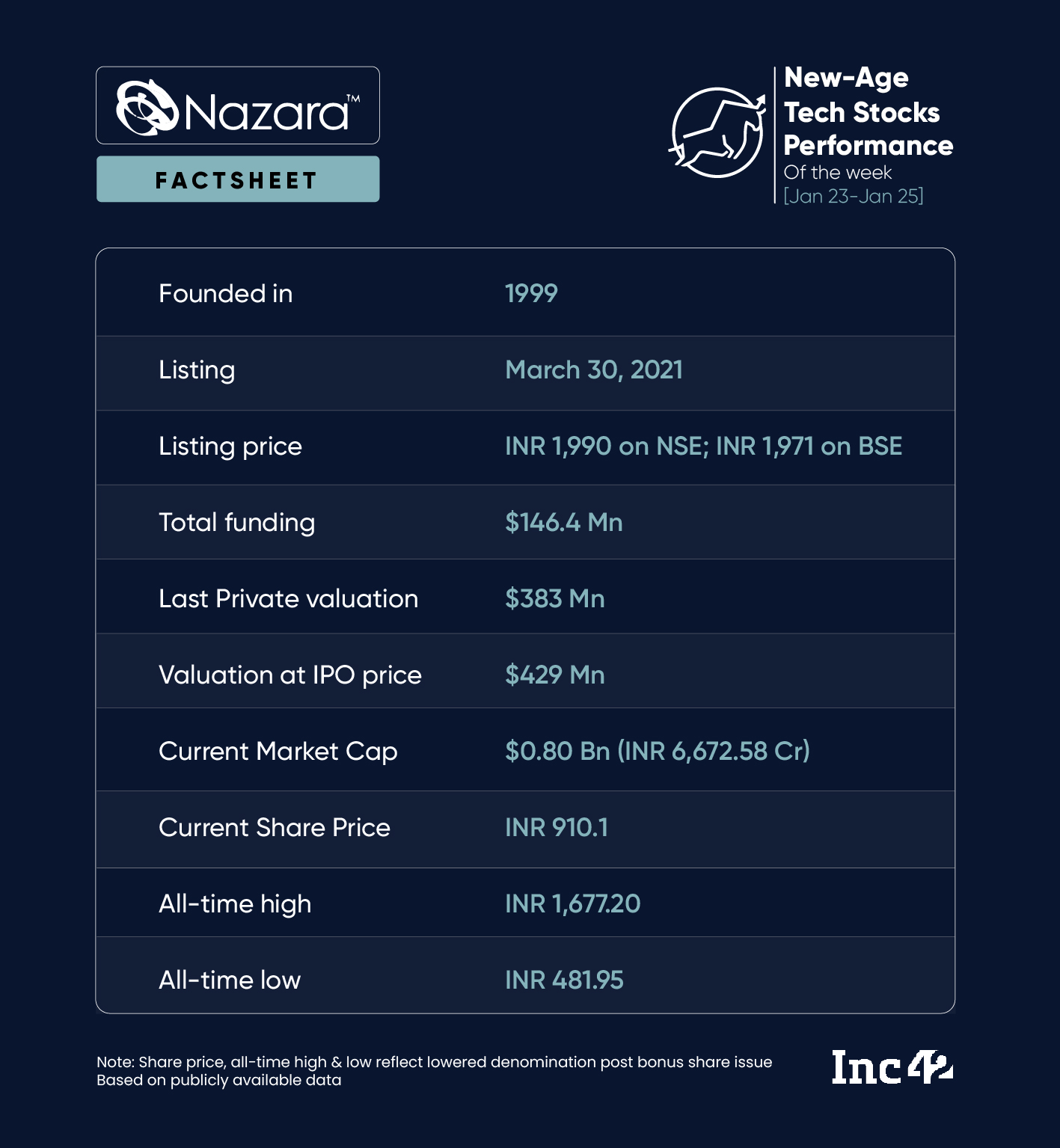

Nazara’s Acquisition Spree Continues

After announcing a fundraise of INR 250 Cr last week, Nazara’s esports subsidiary NODWIN Gaming announced acquiring a 100% stake in Comic Con India for INR 55 Cr ($6 Mn) in a cash and stock deal this week.

Shares of Nazara remained volatile during the week but gained in two trading sessions. Overall, its shares fell 1.31% on the BSE this week, ending the last trading session at INR 910.1.

It is pertinent to note that Nazara has been focusing on acquisitions after raising funding from Zerodha’s cofounders and SBI Mutual Fund last year. Last week, Nazara also announced acquisition of a 10.77% stake in Kofluence Tech Private Limited.

The company’s shares have been on a bull run since the beginning of the year but slumped a bit in the last few trading sessions and were trading sideways.

Commenting on the stock performance, Kotak Securities’ Athawale said it is holding a higher bottom formation, which indicates that an uptrend is likely.

lockquote>

“For the short term, INR 850-INR 860 would be the immediate support zone for the stock. On the higher side, the shares might touch INR 920 and even INR 1,000-INR 1,020,” Athawale added.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)