SUMMARY

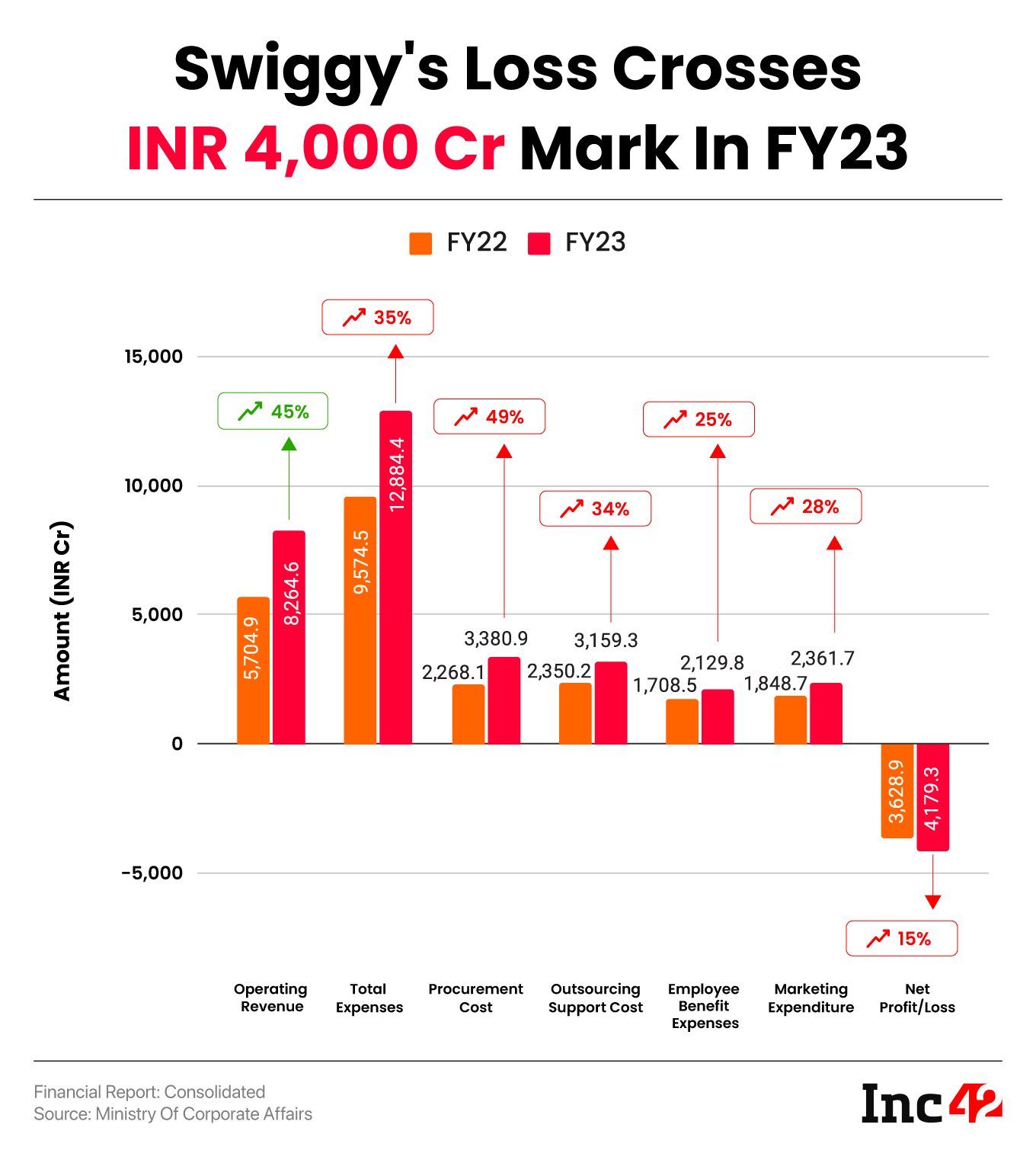

Swiggy’s operating revenue jumped over 40% to INR 8,264.4 Cr in FY23 from INR 5,704.9 Cr in FY22

The foodtech giant’s net loss crossed the INR 4,000 Cr mark in the financial year ended March 31, 2023

The financials come at a time when decacorn is looking to cut down its losses and show improvement in its operating financial metrics ahead of its $1 Bn IPO

Bengaluru-based food delivery giant Swiggy’s net loss crossed the INR 4,000 Cr mark in the financial year ended March 31, 2023. The Invesco-backed decacorn incurred a net loss of INR 4,179.3 Cr in the financial year 2022-23 (FY23), an increase of 15% from INR 3,628.9 Cr in the previous financial year.

Swiggy’s operating revenue jumped over 40% to INR 8,264.4 Cr during the year under review from INR 5,704.9 Cr in FY22 as it scaled up its quick commerce vertical during the year.

Founded in 2014 by Sriharsha Majety, Nandan Reddy, Phani Kishan Addepalli, Rahul Jaimini (left the company in 2020), Swiggy primarily started as a food delivery startup. Later, during the pandemic, it launched its quick commerce vertical – Swiggy Instamart. It also offers services like Swiggy Genie and Minis store.

Swiggy earns revenue by providing online platform services to partner merchants (including restaurant merchants, grocery merchants and delivery partners), advertisement services, sale of food and traded goods, subscriptions, and other platform services.

The startup generated revenue of INR 3,221.4 Cr by selling FMCG products via Swiggy Instamart in FY23, an increase of 39.7% from INR 2,035.6 Cr in the previous fiscal year.

It also earned INR 4,413.9 Cr from sale of services, an increase of 28% from INR 3,444.4 Cr in FY22. However, Swiggy didn’t provide a breakdown of this revenue.

Where Did Swiggy Spend?

The foodtech giant’s expenditure jumped over 35% to INR 12,884.4 Cr in FY23 from INR 9,574.5 Cr in the previous fiscal year.

- Procurement Cost: It includes the cost of buying FMCG products for Swiggy Instamart. In FY23, the startup’s procurement cost surged 49% to INR 3,380.9 Cr from INR 2,268.1 Cr in the previous fiscal year.

- Outsourcing Support Cost: The startup’s outsourcing support cost rose 34% to INR 3,159.3 Cr in FY23 from INR 2,350.2 Cr in the previous fiscal year. The outsourcing support cost could include employees who are on third-party payrolls, such as delivery executives and employees working at dark stores.

- Marketing Expenditure: Swiggy spent INR 2,361.7 Cr on advertising during the year under review, a rise of 28% from INR 1,848.7 Cr in FY22. In other words, Swiggy earned INR 3.4 from every rupee spent on advertising.

- Employee Benefit Expenditure: Employee costs increased 25% to INR 2,129.8 Cr in FY23 from INR 1,848.7 Cr in FY22.

The startup also spent INR 139.5 Cr in losses on order cancellations in FY23, a decline of 11% from INR 156.4 Cr in the previous fiscal year.

The financial statements come days after Inc42 reported that Swiggy is looking to layoff around 400 employees. The foodtech giant is looking to go for its initial public offering (IPO) later this year. The layoffs were attributed to its efforts to show improvement in its financial numbers before filing the draft papers. Swiggy is eyeing raising $1 Bn (INR 8,300 Cr) via IPO.

Last year, the startup claimed to have achieved profitability in its food delivery business as of March 2023. CEO Majety said that the foodtech giant was one of the few global food delivery platforms to achieve profitability, though no numbers were revealed by the company.

Last week, Swiggy expanded its food delivery services to Agatti island city of Lakshadweep, the union territory that rose to fame after Prime Minister Narendra Modi’s visit earlier this month.

Recently, Swiggy has also seen a number of high-profile exits. Key people, including Karthik Gurumurthy (senior vice president and head of Swiggy Instamart), Dale Vaz (CTO), Anuj Rathi (SVP, central revenue and growth ), Ashish Lingamneni (VP, marketing) and Dineout cofounder Vivek Kapoor, were among those who left the company.

Valued at over $10 Bn, the startup has raised over $3 Bn in funding and counts marquee backers such as SoftBank, Invesco, Prosus Ventures, DST Global, among others. It competes with Zomato, which has reported two consecutive profitable quarters in FY24.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)