SUMMARY

Following the Reserve Bank of India’s crackdown on Paytm Payments Bank, the shares of Paytm’s parent entity, One97 Communications, crashed over 36% this week

Shares of Delhivery, which reported its maiden profitable quarter in Q3 FY24 on Friday after market hours, emerged as the biggest winner this week

In the broader market, Sensex rose 1.96% to end the week at 72,085.63 and Nifty50 gained 2.3% to 21,853.8

Indian new-age tech stocks saw a mixed performance this week, which largely saw stock-specific actions as the broader domestic equity market remained volatile due to multiple macroeconomic factors, including the interim Budget.

Following the Reserve Bank of India’s (RBI’s) crackdown on Paytm Payments Bank, the shares of Paytm’s parent entity, One97 Communications, crashed over 36% this week.

Besides, of the 18 other new-age tech stocks under Inc42’s coverage, nine, including Tracxn Technologies, Mamaearth, Nazara Technologies, ideaForge, and Fino Payments Bank, fell this week in a range of 0.3% to over 9% on the BSE.

Tracxn and Fino reported their Q3 FY24 earnings this week. While Fino’s consolidated profit after tax (PAT) jumped 19% year-on-year (YoY) to INR 22.8 Cr, Tracxn reported a PAT of INR 2.2 Cr, a 64% decline YoY, including the exceptional gain in the year-ago quarter.

On the other hand, nine new-age tech stocks gained during the week in a range of 1% to a little over 18%, with Delhivery emerging as the biggest winner.

PB Fintech, RateGain, Zomato, Nykaa, and IndiaMART were among the other gainers during this week.

In the broader market, Sensex rose 1.96% to end the week at 72,085.63 and Nifty50 gained 2.3% to 21,853.8.

Commenting on the performance, Vinod Nair, head of research at Geojit Financial Services, said that even a “conservative” interim Budget couldn’t slow down the market amidst the pre-election rally.

“The drastic fall in the fiscal deficit target is leading to a reduction in bond yields, which will lead to lowering of corporate borrowing costs, increasing incentives to step up investment,” Nair said. “Furthermore, the FOMC has tempered expectations that the central bank will soon slash interest rates and that inflation in the US is continuing to cool.”

lockquote>

The US Fed kept benchmark interest rates unchanged at 5.25%- 5.50% for the fourth straight meeting this week.

Siddhartha Khemka, head of retail research at Motilal Oswal, said that after the US Fed’s decision and interim Budget, all eyes will be on the RBI’s policy meeting next week.

“We expect the central bank to maintain its status quo. Overall, we expect the market to remain in positive territory as sentiments remain high amid commendable delivery on Budget,” Khemka added.

lockquote>

Now, let’s deep dive into the performance of some of the new-age tech stocks this week.

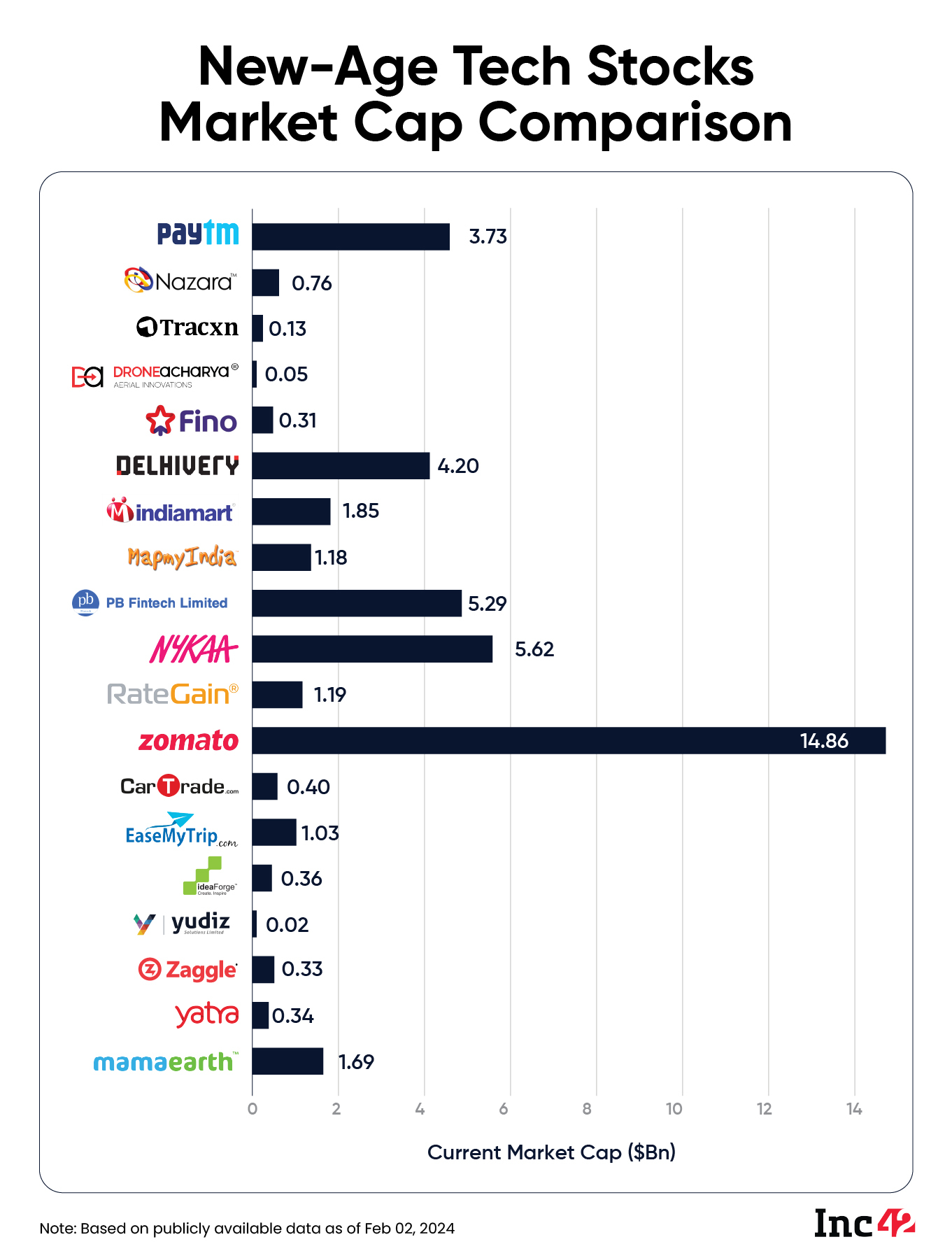

The total market capitalisation of the 19 new-age tech stocks under Inc42’s coverage stood at $43.34 Bn at the end of this week.

Paytm In Fresh Trouble

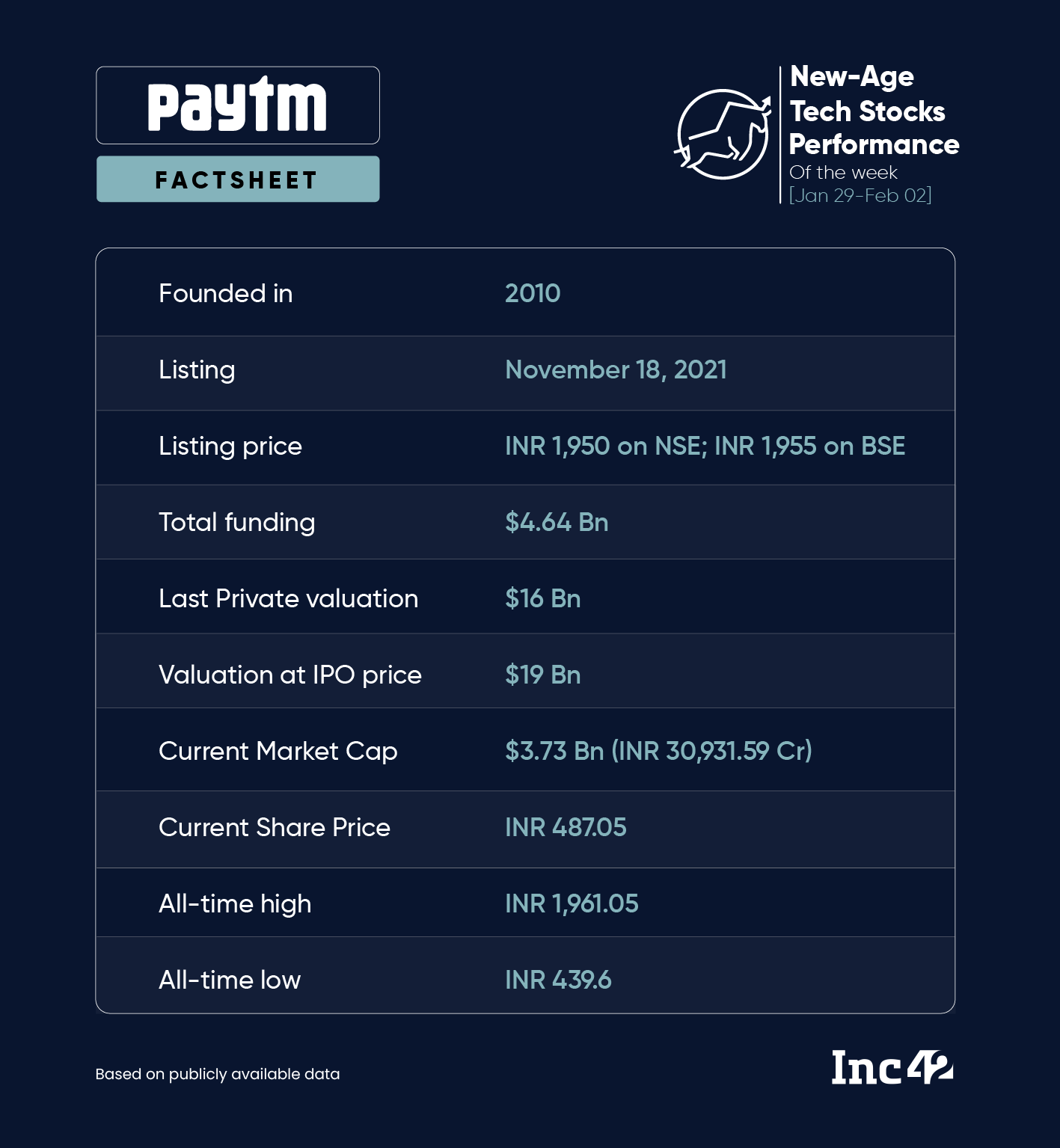

Shares of Paytm touched the lower circuit by crashing 20% in two consecutive sessions during the week after the RBI barred Paytm Payments Bank from taking any deposits or credit transactions or top-ups in any of its customer accounts.

The central bank also stopped Paytm Payments Bank from providing any other banking services, such as UPI facility and fund transfers after February 29, 2024

Shares of Paytm nosedived to a level last seen in December 2022, ending the week at INR 487.05 on the BSE.

Paytm has issued the following statements on the matter:

- Paytm Payments Bank said it’s taking immediate steps to comply with the RBI’s directions, including working with the regulator to address the central bank’s concerns.

- A day after the RBI’s order, Paytm’s top management tried to assuage the fear of investors and highlighted the steps the fintech giant would be taking over the next few weeks.

- Founder and CEO Vijay Shekhar Sharma assured its users that the Paytm app will continue to work beyond February 29.

- Madhur Deora, president and group CFO at Paytm has issued a statement clarifying that Paytm and Paytm Payments Bank are not one entity. “Paytm, as a payments company works with various banks (not just its associate), on various other products… The next phase of the company’s journey is to continue to expand its payments and financial services businesses, only in partnership with other banks,” Deora said.

It is pertinent to note that One97 Communications, holds a 49% stake in Payment Payments Bank. Multiple brokerages have cut their ratings and price targets (PTs) on shares of Paytm following RBI’s restrictions.

Jefferies cut its rating to ‘underperform’ and PT to INR 500. The brokerage expects an additional 20% hit on Paytm’s EBITDA, led by the impact on lending business from rising reputational concerns.

“We believe the recent events will drag the company’s growth and elongate profitability timelines,” Jefferies said.

lockquote>

Motilal Oswal also downgraded Paytm to a ‘neutral’ rating and cut its PT on the stock to INR 575, expressing concerns over its business outlook.

Brokerage Macquarie also said that given the severe restrictions imposed on Paytm Payments Bank, Paytm’s ability to retain customers in its ecosystem would be impacted.

lockquote>

Amid a crash in its stock, Morgan Stanley Asia (Singapore) Pte. – Odi lapped up 50 Lakh Paytm shares on Friday (February 2) in a bulk deal worth INR 243.6 Cr.

Delhivery Turns Net Profitable

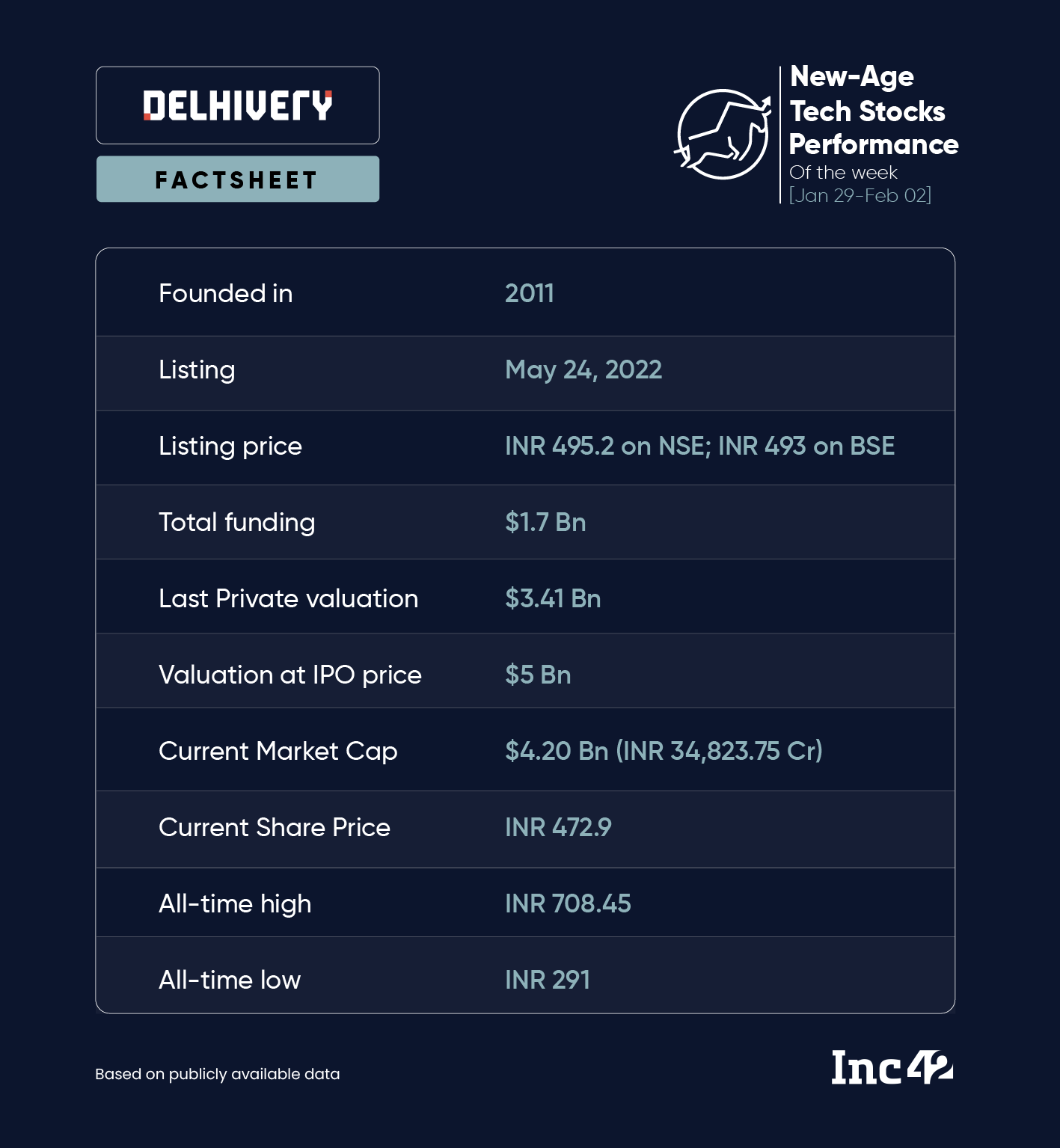

Logistics unicorn Delhivery turned profitable in the December quarter. It posted a consolidated profit after tax (PAT) of INR 11.7 Cr in Q3 FY24 against a net loss of INR 195.6 Cr in the year-ago period.

The company’s operating revenue also grew over 20% YoY to INR 2,194.5 Cr in the reported quarter.

Ahead of the company’s earnings announcement, Delhivery shares gained over 18% during the week. The stock made sharp gains in two consecutive sessions on Tuesday and Wednesday. The company released its Q3 numbers after market hours on Friday.

lockquote>

Delhivery also turned out to be the biggest gainer this week. Its shares closed the week at INR 472.9 on the BSE – a level last seen in October-end 2022.

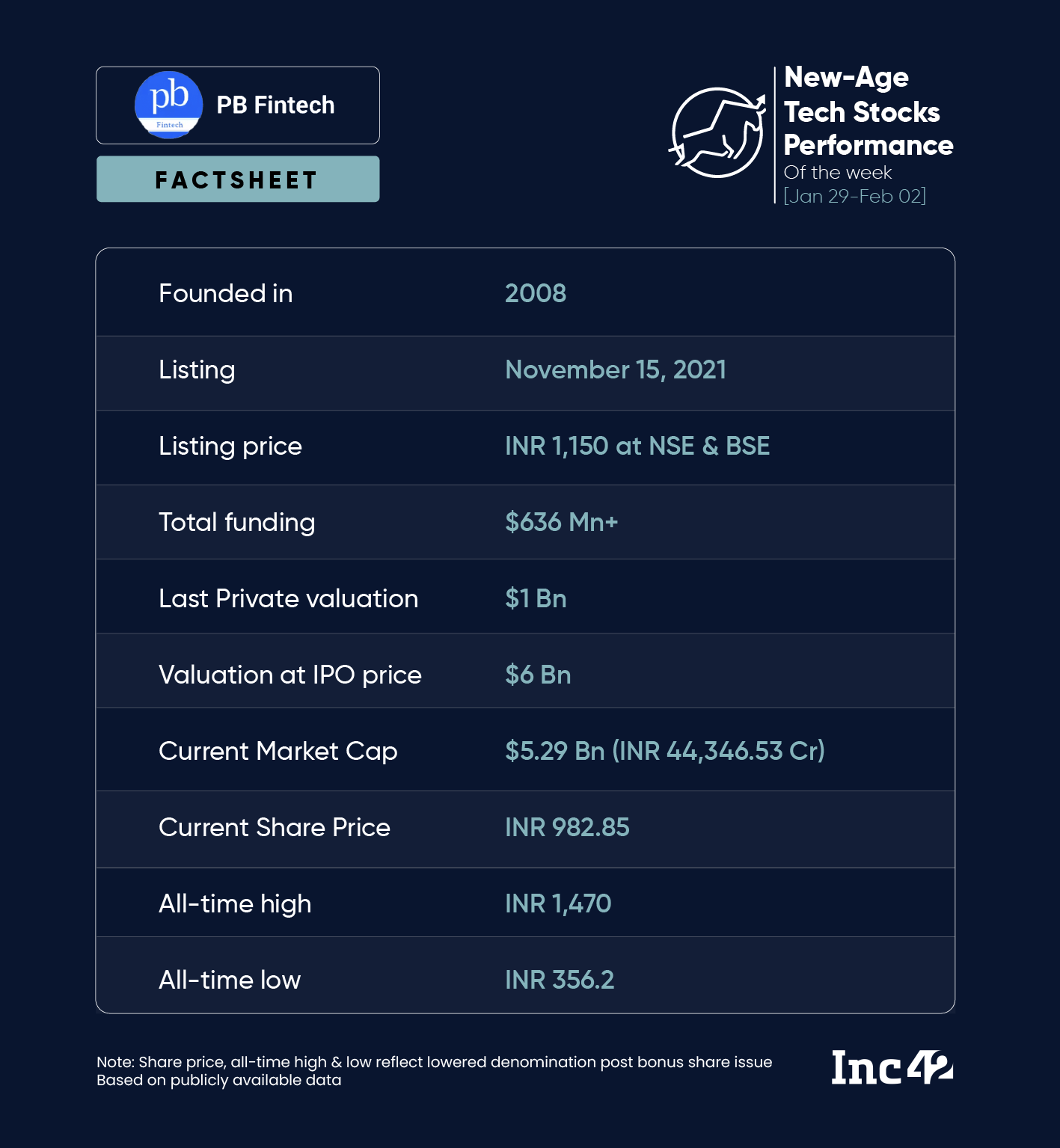

PB Fintech Posts Maiden Profitable Quarter

Shares of PB Fintech surged 10% the day after it reported its first net profitable quarter in Q3 FY24. The company reported a PAT of INR 37.2 Cr in the December quarter and a 43% YoY jump in operating revenue to INR 871 Cr.

Helped by the positive earnings results, PB Fintech’s shares gained 10.7% overall during the week, ending the last trading session at INR 982.85 on the BSE.

Brokerage JM Financial is optimistic on the company’s insurance vertical Policybazaar following steady growth in the segment in Q3 FY24 despite a tepid insurance industry growth.

“With renewals expected to gain in revenue mix, PB Fintech is likely to see rising incremental contribution from core insurance business while Paisabazaar’s incremental contribution journey is expected to be relatively gradual,” the brokerage noted.

lockquote>

It has a PT of INR 1,010 on the stock, which implies an upside of about 3% to the stock’s last close.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)