Software company MicroStrategy kicked off the year buying even more Bitcoin (BTC), the firm has announced.

In January, MicroStrategy bought 850 BTC at a price of $37.5 million, Saylor wrote on X (previously Twitter) on Tuesday. The company confirmed the latest buy in its 2023 fourth quarter earnings presentation.

The company now owns 190,000 BTC. That’s $8.2 billion in digital coins at today’s prices.

The Tyson, Virginia-based firm, which sells data-analyzing software, announced in December that it bought 14,620 BTC for approximately $616 million at the end of the year.

MicroStrategy first bought BTC back in August 2020. Saylor said that the idea was to give shareholders a better return when the company was sitting on so much cash.

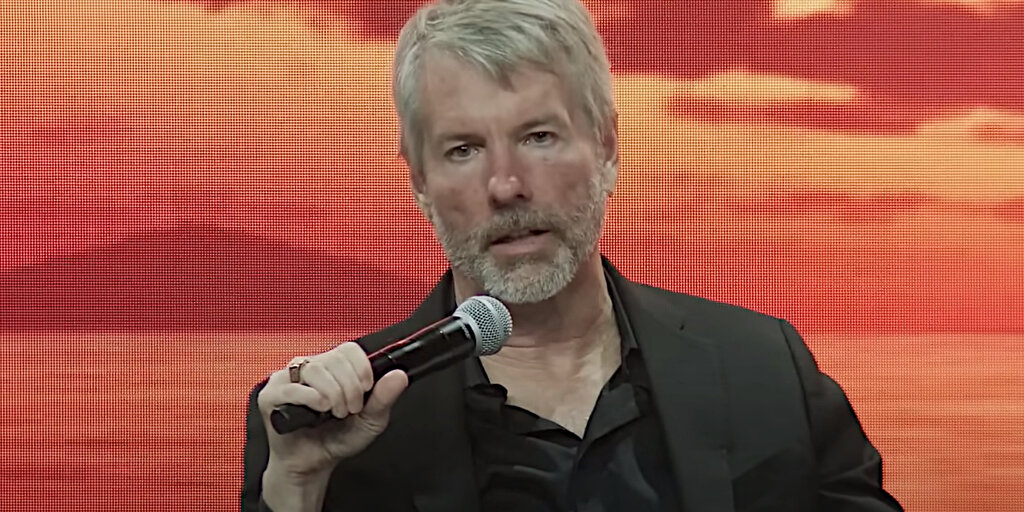

BTC is the safest long-term investment and an inflation hedge, Saylor said at the time. Since then, he has talked about the biggest cryptocurrency by market cap being “digital gold” and a “bank in cyberspace.”

The company’s stock with its BTC strategy is up by 240% since it started buying cryptocurrency.

Saylor also talks about the price of BTC going up—especially after the halving event. In April, BTC’s network will undergo a change which will see miners, who keep the network running and produce BTC, have their rewards cut in half.

In simple terms, this means that the cryptocurrency will become scarcer than it already is, and therefore people will pay more for it, according to some experts.

Saylor has said repeatedly to news media that the halving will cause the price of BTC to go up. And he might be right: following the last three halving events in BTC’s history, the digital coin’s price has gone up.

MicroStrategy is by far the largest public holder of BTC.

Edited by Ryan Ozawa.

Stay on top of crypto news, get daily updates in your inbox.

Source link

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)