SUMMARY

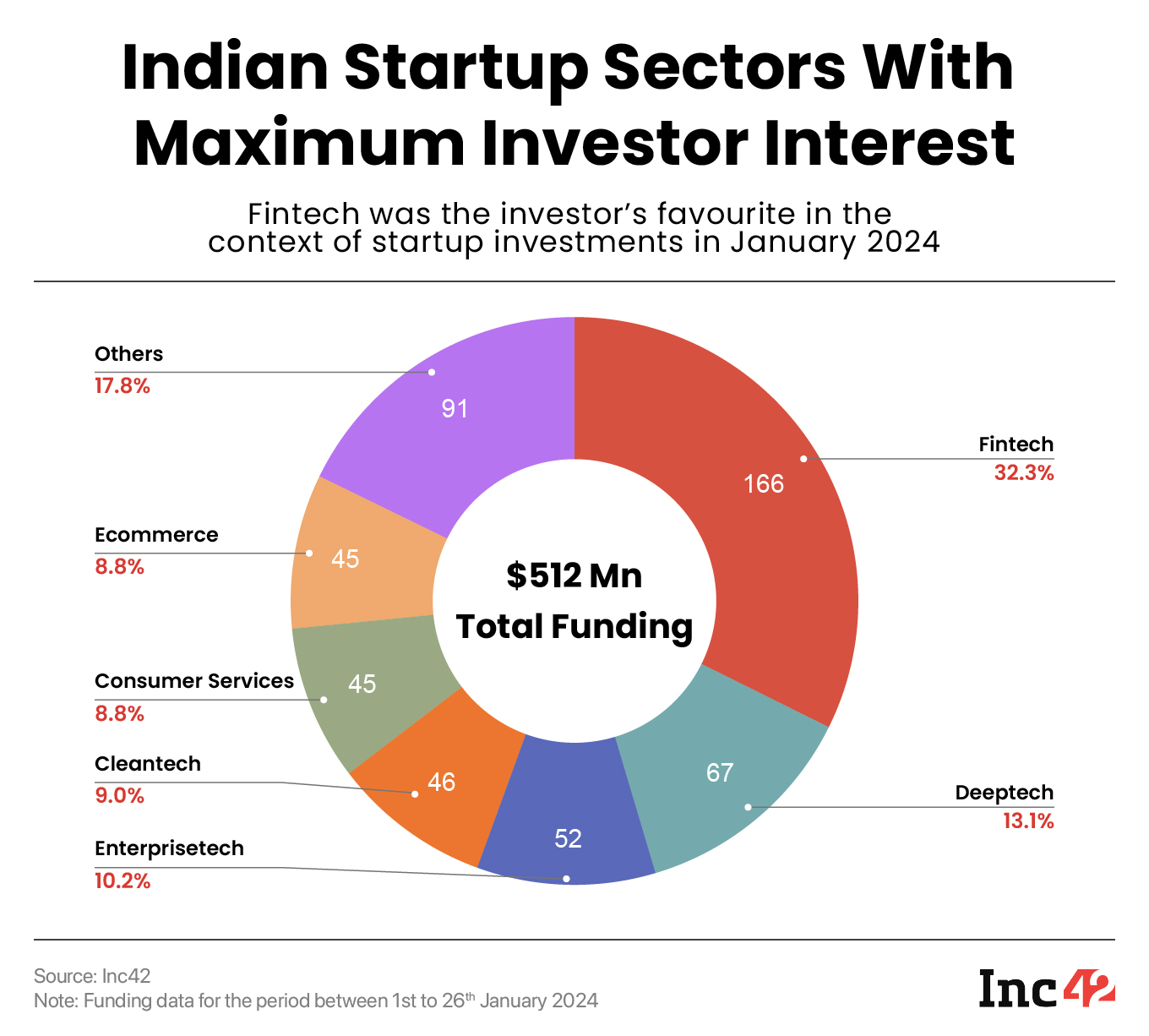

The total funding secured by Indian startups in the first month of the year tanked to its five-year-low of $512 Mn

At $166 Mn, Indian fintech startups commanded a third of the total funds allocated in the first month of 2024

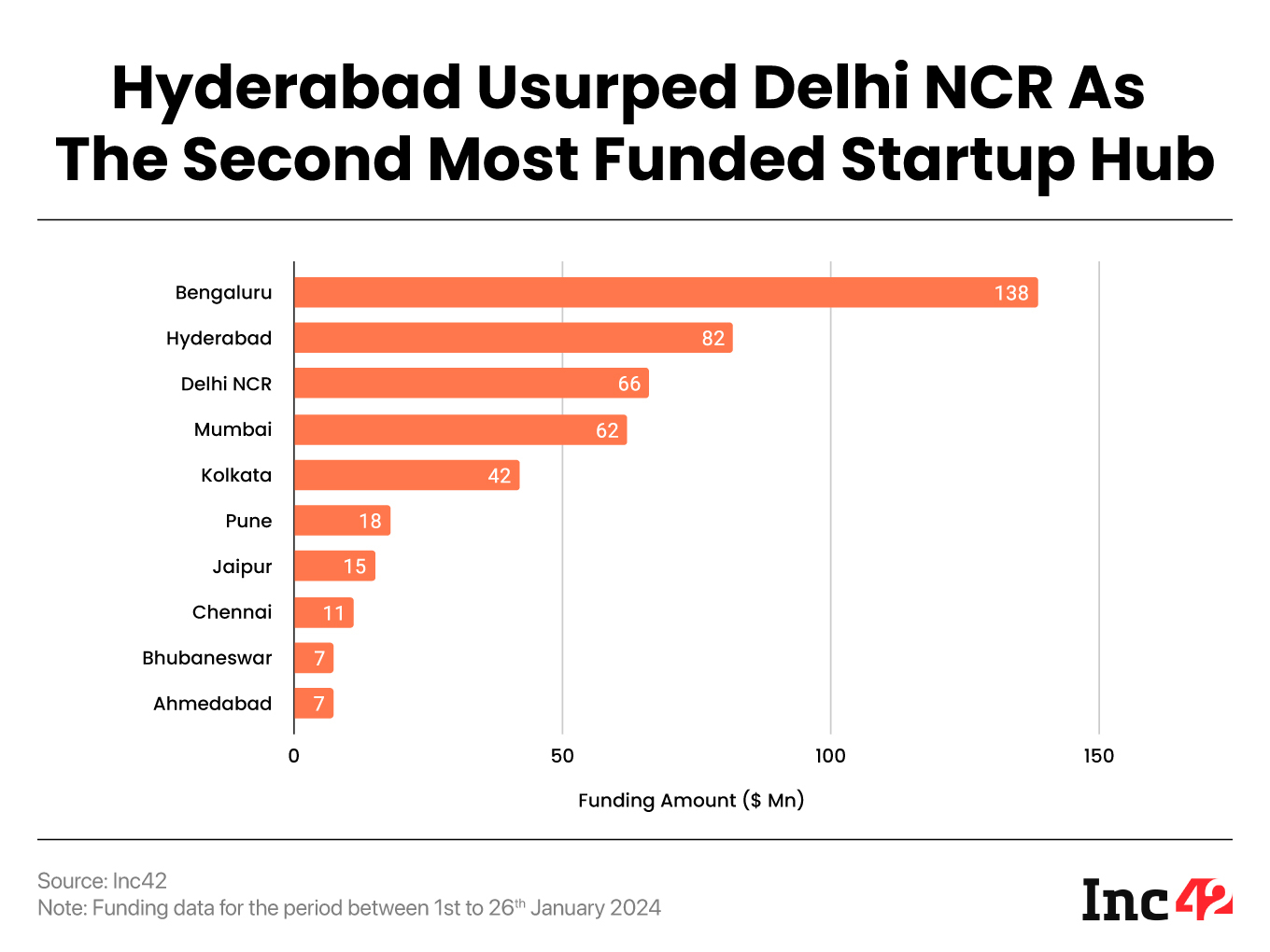

In terms of top startup hubs, Hyderabad took over Delhi NCR’s second spot by securing a total funding of $82 Mn, primarily on the back of Vivifi India’s $75 Mn

Despite the optimism shared by startup founders at the onset of 2024, the funding winter not only persisted in January but turned harsher.

The total funding secured by Indian startups in the first month of the year tanked to its five-year-low of $512 Mn, registering a 47% year-on-year (YoY) decline. The number of deals, too, dwarfed to 68 from 81 deals tapped a year ago.

Additionally, the number of mega deals signed in January declined from January 2023’s one to none this year. Moreover, the funding secured during the month was only about 11% of the $4.5 Bn secured by Indian startups in 196 deals in January 2022.

A massive dip can also be seen if the number is compared with the funding secured in the preceding month. Startup funding exceeded $1 Bn in December 2023 with a deal count of 76.

Fintech Startups Continues To Dominate The Funding-Verse

Continuing their winning streak, fintech startups dominated the funding charts. Securing $166 Mn, Indian fintech startups commanded a third of the total funding raised in the first month of 2024. The sector also saw the highest number of funding deals.

A little under half of this came from the $75 Mn secured by growth stage Hyderabad-based NBFC Vivifi India and Jaipur-based Namdev Finvest, too, secured $15 Mn as part of its Series B funding round.

Despite a fall in overall startup funding, the world’s third-largest startup ecosystem ended up minting its 113th unicorn, Krutrim.

Ola founder Bhavish Aggarwal’s third startup Krutrim bagged $50 Mn at a valuation of $1 Bn. With the funding, the startup became India’s first AI unicorn. Further, funding secured by Krutim also boosted the funding for the deeptech sector, making it the second most-funded sector in the month with $67 Mn.

January’s third-largest funding was secured by QSR startup Wow! Momo with Malaysian Sovereign Fund Khazanah and OAKS Asset Management infusing $42 Mn.

Sector-wise, ecommerce’s downward spiral continued in the month with startups only netting a total funding of $45 Mn across 12 deals. Last year, Indian ecommerce startups raised $2.6 Bn, down 32% from $3.8 Bn raised in 2022.

In terms of top startup hubs, Hyderabad took over Delhi NCR’s second spot by securing a total funding of $82 Mn, primarily on the back of Vivifi India’s $75 Mn. Delhi NCR-based startups could raise $66 Mn in the month. Meanwhile, Bengaluru continued to savour the top spot, with the likes of Krutrim pulling the most weight.

In line with the drastic decline in funding secured, funding for both seed and late stage startups suffered, too. However, late stage startups were the worst hit, with funding declining 76% YoY to $176 Mn from January 2023’s $611 Mn. Seed stage funding, too, declined to $38 Mn, down 64% from last year’s $104 Mn.

Interestingly, funding for growth stage startups improved, up 35% YoY to $225 Mn from last year’s $159 Mn.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)