SUMMARY

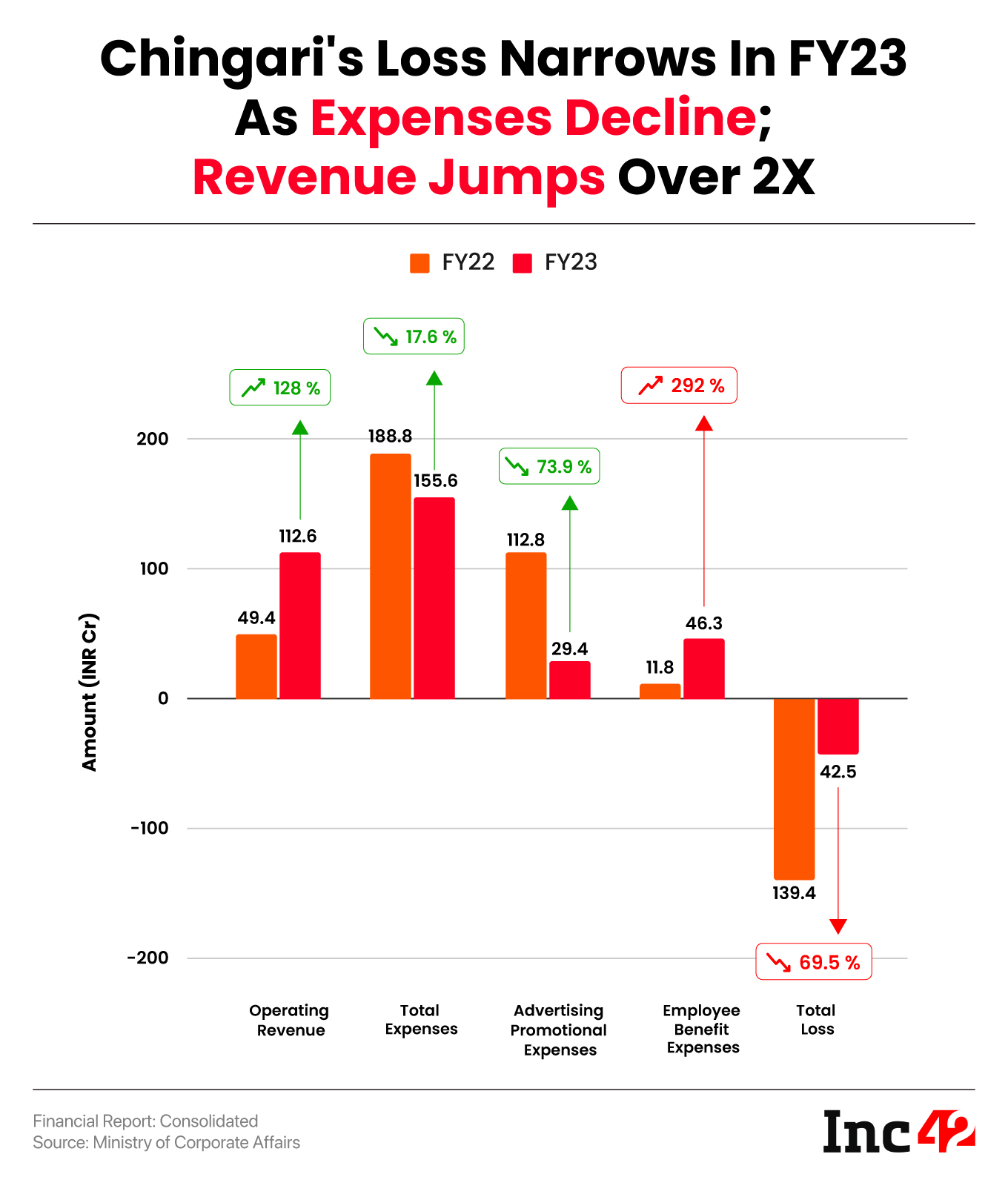

Chingari’s operating revenue more than doubled to INR 112.6 Cr in the reported fiscal year from INR 49.4 Cr in FY22

The startup’s FY23 filing with the Registrar of Companies (ROC) showed that a majority of its operating revenue came from sales of services outside India

Chingari, which undertook two rounds of layoffs in 2023, managed to slash its total expenses by 17.6% YoY to INR 155.6 Cr in FY23, largely helped by a sharp decline in ad costs

Short-video sharing platform Chingari’s net loss narrowed 69.5% to INR 42.5 Cr in the financial year 2022-23 (FY23) from INR 139.4 Cr in the prior fiscal, helped by its growing top line and cut in advertising costs.

Operating revenue more than doubled to INR 112.6 Cr in the reported fiscal year from INR 49.4 Cr in FY22.

Founded in 2018 by Sumit Ghosh, Aditya Kothari, Biswatma Nayak, and Deepak Salvi, Chingari is an on-chain social app which enables users to upload videos, interact with friends, and share and browse content. It also operates crypto token GARI.

Chingari gained prominence after the Indian government banned TikTok and such other Chinese apps in 2020.

Though this hype led to a significant fund flow into Chingari and its peer startups, the failure to find a clear monetisation plan resulted in a funding crunch for the short-video apps. Last year, Inc42 reported about Chingari’s pivot to 18+ content with paid live one-on-one calls between creators and users in a bid to increase its revenue.

However, as the startup pivoted in April, its impact on its top and bottom lines is likely to be visible in its FY24 numbers.

We must also note that in May 2023, Chingari cofounder Kothari announced that he had quit the startup.

The startup’s FY23 financials, filed with the Registrar of Companies (ROC), showed that a majority of its operating revenue came from sale of services outside India. Its income from operations in export/SEZ stood at almost INR 111 Cr, while income from operation in the domestic market stood at INR 1.6 Cr in the reported fiscal.

Including interest income and other non-operating income, Chingari’s total revenue stood at INR 113.2 Cr in FY23, growing almost 129% year-on-year (YoY).

Zooming Into Expenses

Chingari managed to cut its total expenses by 17.6% to INR 155.6 Cr in the reported period from INR 188.8 Cr in FY22, largely helped by a sharp decline in advertising promotional expenses.

Ad Expense: The startup spent INR 29.4 Cr in the bucket as against INR 112.8 Cr spent towards it in FY22.

Employee Cost: Chingari’s employee benefit expenses jumped almost 300% to INR 46.3 Cr in FY23 from INR 11.8 Cr in the prior fiscal.

In that, INR 44.5 Cr was spent towards salaries and wages.

However, we must note that the startup laid off at least 70% of its total workforce in two rounds of business restructuring in June and August 2023.

Legal Professional Charges: The startup’s expenditure in this bucket fell over 8% YoY to INR 8.2 Cr in FY23.

Subscriptions Membership Fees: Spending in this bucket jumped 47.4% YoY to INR 7.5 Cr in the reported fiscal year.

In August 2023, Chingari also claimed to have turned operationally profitable.

“We are finally profitable and will do business with our monthly revenues from now on. Not burning VC cash anymore or need to raise to sustain the business. We still have a few million USD left in the bank, which we have kept aside for the rainy days,” cofounder and CEO Ghosh then claimed.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)