SUMMARY

Happi Planet will utilise the funding to expand its offline footprint, as well as online presence

The startup plans to increase its availability on online platforms and expand offline presence to more than 250 stores by 2024-end

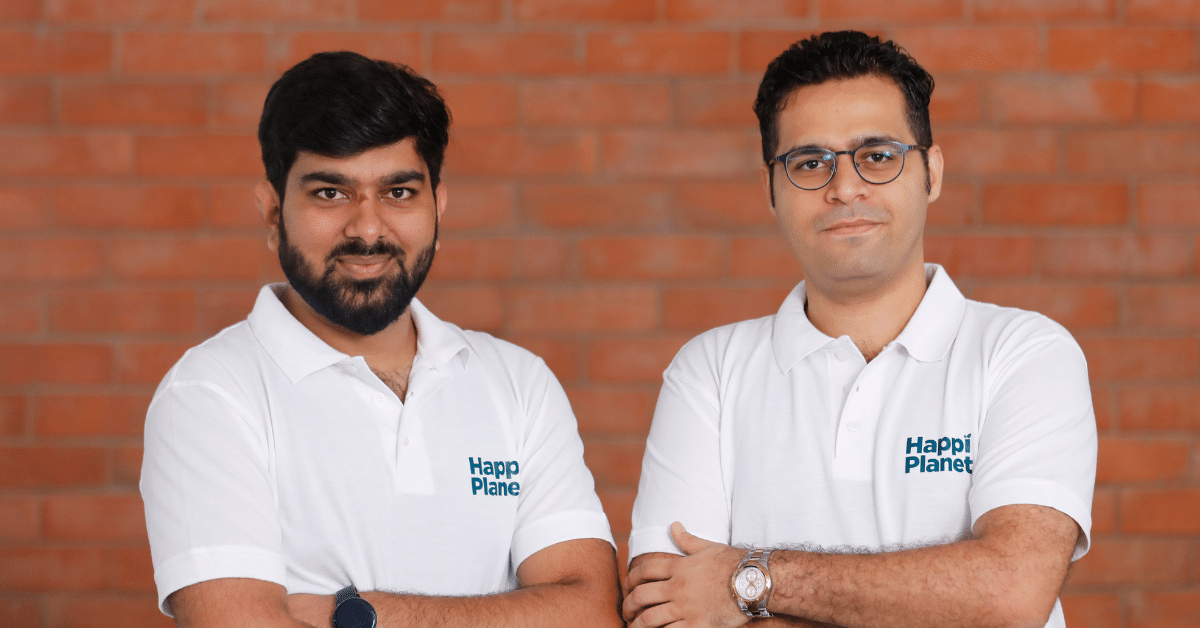

Founded in 2022 by former P&G employees Mayank Gupta and Nimeet Dhokai, Happi Planet sells plant-based and non-toxic home care products

D2C homecare startup Happi Planet has raised INR 8.47 Cr (about $1 Mn) in a strategic funding round from Fireside Ventures.

The startup will utilise the funding to expand its offline footprint as well as online presence. The capital will also be used to ramp up consumer education to further accelerate growth.

In a statement, the startup said it plans to expand its physical reach to more than 250 stores by the end of 2024 and is eyeing a 10X growth in top line over the next 12 months.

Founded in 2022 by former Procter & Gamble employees Mayank Gupta and Nimeet Dhokai, Happi Planet manufactures and sells plant-based and non-toxic home care products, beauty and personal care items, among others.

The startup sells its offerings through online marketplaces such as Amazon, Big Basket & D Mart Ready, as well as Reliance Signature offline stores. It last secured a funding of INR 1.25 Cr from VC firm 100X.VC in March 2023.

Commenting on the funding, cofounders Gupta and Dhokai said in the statement, “We are delighted to have Fireside Ventures join us on our mission to disrupt the home cleaners’ market & create a household brand name in the next 5 years.”

Meanwhile, Ankur Khaitan, principal at Fireside Ventures, said, “… consumers are becoming increasingly aware of harmful chemicals in their daily use products and seeking less nasties. Happi Planet with their innovative formulation of natural ingredients, high efficacy and conducive price point makes them unique to win in this large opportunity,”

Happi Planet competes with the likes of Beco, The Better Home, and Koparo Clean in the sustainable health and personal care space.

The funding marks Fireside Ventures’ latest investment in the consumer space. The early-stage VC firm closed its third fund, the Fireside Fund III, at $225 Mn (INR 1,830 Cr) in October 2022.

According to a report, India’s sustainable home hygiene products market is anticipated to grow into a size of $74.05 Mn by financial year 2026-2027 (FY27), growing at a CAGR of 32.90% between FY22 and FY27.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)