SUMMARY

Magenta Mobility is in talks to transfer some of its charging assets toJio-bp but has dismissed all the reports that it is selling off its public charging infrastructure business

As per a media report, Jio-bp would acquire 100 charging stations from Magenta

In April last year, Magenta raised $22 Mn in its Series A1 funding round from UK-based oil major bp and Morgan Stanley India Infrastructure

Mumbai-based electric mobility startup Magenta Mobility has dismissed all the reports that it is selling off its public charging infrastructure business to Jio-bp, saying that talks are on to transfer some of its charging assets to the petroleum major but no such acquisition has taken place yet.

“We would like to address the recent reports regarding the takeover of Magenta’s charging business by Jio-bp. We would like to clarify that while there are ongoing strategic discussions regarding the transfer of a few charging assets from Magenta to Jio-bp, there is no acquisition of Magenta’s charging business itself,” Magenta told Inc42 in a statement.

A report by CapTable on Wednesday (February 14) said that Magenta has sold off its public charging infrastructure business to Jio-bp. This deal was reportedly agreed upon a year ago, and now would see Jio-bp acquire 100 charging stations from Magenta.

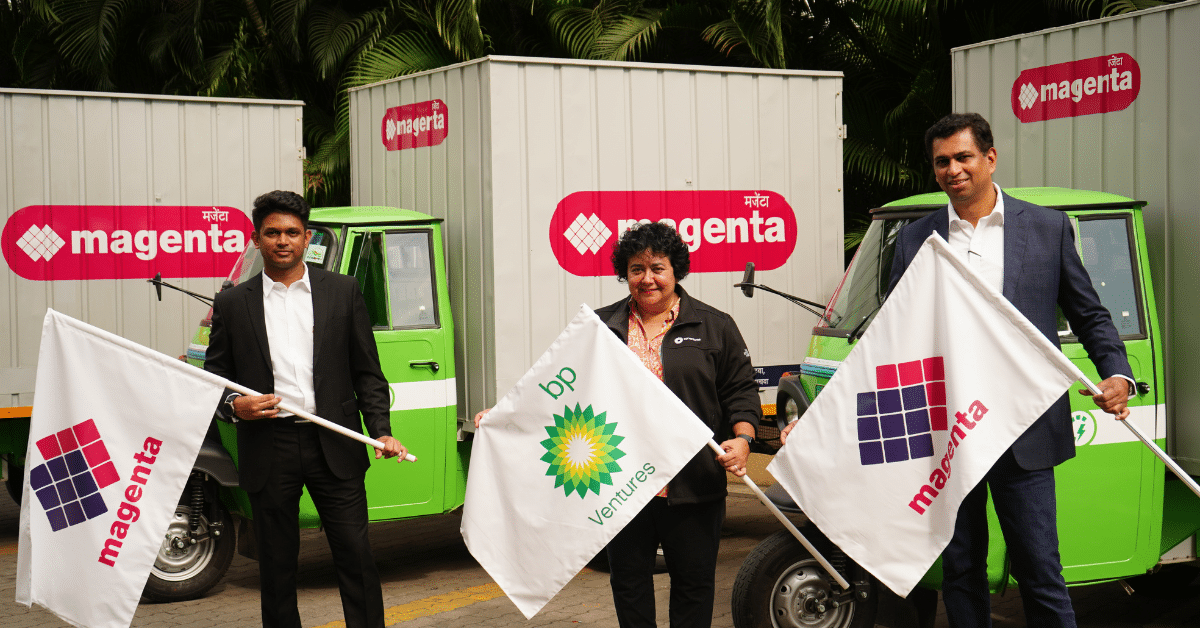

Jio-bp is a joint venture between Reliance Industries Ltd and UK-based oil major bp, which is an investor in Magenta.

While the startup said that it would provide further details on that matter after outcomes of joint discussions, Inc42 got to know that Magenta has 69 operational charging depots across India, which the startup continues to operate. However, it is planning to sell the assets of a few charging stations across highways and a few other places, which makes less business sense to the EV company.

bp hasn’t responded to Inc42’s query on the matter till the time of publishing the article.

Founded in 2018 as a charging solution provider for EVs by Maxson Lewis, Magenta gradually shifted its focus on providing vehicle fleets for the logistics and last-mile delivery needs of various ecommerce companies. Operating more than 1,550 electric three-wheelers in the L5 category for last-mile delivery, the startup was planning to expand to more than 3,000 vehicles by FY24 end.

In April last year, Magenta had raised $22 Mn (about INR 180.6 Cr) in its Series A1 funding round from bp and Morgan Stanley India Infrastructure. Cumulatively, the startup has raised $35 Mn so far.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)