After announcing key details regarding its hotly anticipated STRK token airdrop this morning, Ethereum software firm Starkware found itself on the back foot after crypto users raised ethical questions about how quickly after the launch the network’s investors and contributors will be able to sell off massive STRK positions.

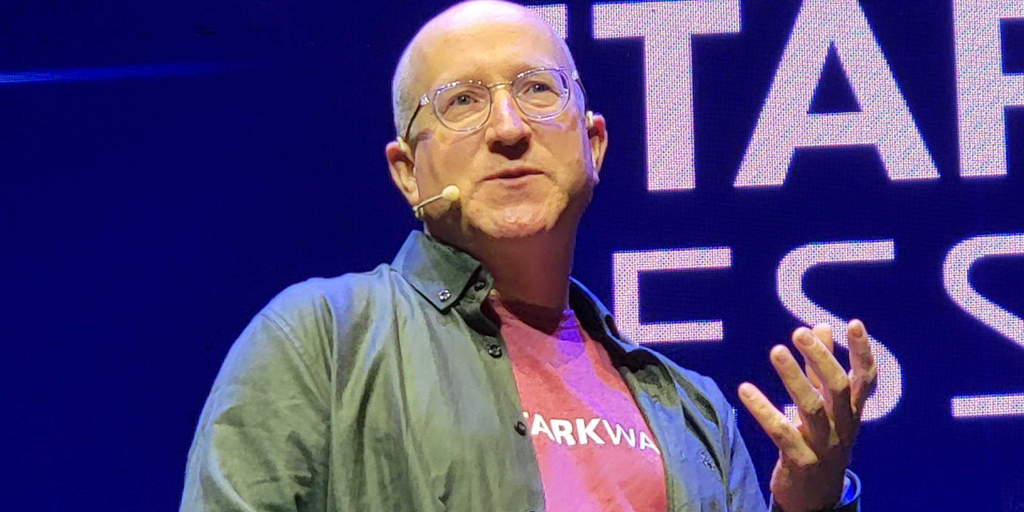

But in an exclusive interview with Decrypt, Starkware’s CEO pushed back against detractors, doubled down on the Starknet airdrop roadmap, and explained why he believes it will pose no harm to the token’s community.

On April 15, less than two months after STRK’s upcoming launch on February 20, over 1.3 billion STRK tokens allocated to investors and early Starknet contributors—13.1% of the total STRK token supply—will unlock for transfer and sale. That sum is already estimated to be worth over $2.15 billion, judging by pre-market trading prices.

Typically, airdrop allocations reserved for a project’s team and investors are locked for a lengthier period of at least a year, for several reasons. Doing so can help ensure a team’s long-term commitment to a project, prevent early volatility in a token’s price should internal parties sell off huge swathes of tokens, and shield the company behind an airdrop from securities-related litigation.

Crypto users quickly took note of the Starknet airdrop’s deviation from standard practice, with some criticizing its speedy offloading of tradable tokens to insiders as “predatory” and “borderline criminal.”

lockquote class=”twitter-tweet mx-auto”>

is this real lmaooooo (????)

the allocation was actually pretty good for real devs, early eth stakers; so on ignoring farmers

but doing this completely changes things

2 month cliff for investors https://t.co/UE1sG7BSFs

— Loopify 🧙♂️ (@Loopifyyy) February 14, 2024

lockquote>

Eli Ben-Sasson, Starkware’s co-founder and CEO, concedes that the structure of the Starknet airdrop is not typical. But he considers that deviation from norms representative of Starkware’s strengths, not its weaknesses.

“The unlocking for the team and early investors… is one aspect in which we may be non-standard,” Ben-Sasson told Decrypt. “But we build different and we view things a little bit differently.”

lockquote class=”twitter-tweet mx-auto”>

LOL What the fuck is this graph????

Another blatant case of teams making tokenomics as contrived and scammy as possible

This is the kind of thing the SEC needs to look at, not suing random exchanges pic.twitter.com/01I7RwKhGv

— Wazz (@WazzCrypto) February 14, 2024

lockquote>

As Ben-Sasson sees it, lengthier token locks for investors and contributors are designed to increase trust in the team behind a project launching an airdrop. But that industry norm is one of several barometers that can indicate a project’s trustworthiness, he says. And he believes Starkware has already proven its trustworthiness to users.

“Let’s address the elephant in the room,” Ben-Sasson said. “What people are really concerned about is whether anyone at Starkware, or in the Starknet ecosystem, will still be working on Starknet and advancing it passionately three months out, or one year out.”

“Let me make this very public announcement, as Starkware’s CEO,” he continued. “As far as the eye can see, the only thing on the radar of Starkware’s 150 employees—and its expanding team—will be advancing Starknet.”

To emphasize the point, Ben-Sasson referenced his personal commitment to the company.

“I left a very lucrative position as a professor in academia to do this, and I’m not going back,” he said.

Ben-Sasson previously taught as a professor at the Israel Institute of Technology in Haifa, from 2010 to 2018.

As to concerns that investors may begin dumping STRK tokens as soon as they’re able to in April, impacting STRK’s price and theoretically leaving dedicated community members in the lurch, Ben-Sasson stressed that prolonging the token lock period would not prevent such a scenario.

lockquote class=”twitter-tweet mx-auto”>

we hear all of your feedback about our round 1.

dont worry, we hear all of it.

— od1n fr33 ✨✨🐺 (@odin_free) February 14, 2024

lockquote>

“This concern could also happen one year out,” he said.

Ultimately, the former academic says, Starkware elected to make STRK’s token lock period for investors and contributors significantly shorter than other airdrops because those individuals deserve to be rewarded for their contributions. The CEO feels that there is no risk that he or his team might take improper advantage of the airdrop’s structure.

“It really wouldn’t be the right thing to unnecessarily delay them,” Ben-Sasson said, “when we have full conviction in our long-term commitment to advancing Starknet.”

Edited by Andrew Hayward

Stay on top of crypto news, get daily updates in your inbox.

Source link

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)