SUMMARY

Startup funding in Delhi NCR declined to $2.7 Bn from $5.5 Bn in 2022 and hovered near 2016 levels

In 2023, Delhi NCR saw six mega deals, including ecommerce unicorn Lenskart’s $600 Mn two mega deals

Within the Delhi NCR region, investor interest was found predominantly focussed on six sectors in 2023 — ecommerce, fintech, enterprise tech, consumer services, edtech, and logistics

Startup funding in the Delhi NCR region, the second-highest funded startup hub, fell to a seven-year low of $2.7 Bn in 2023.

According to Inc42’s latest “Indian Tech Startup Funding Report 2023”, startup funding in Delhi NCR declined 51% year-on-year (YoY) to $2.7 Bn from $5.5 Bn in 2022.

Notably, total funds raised by Delhi NCR-based startups in 2016 stood at $2 Bn. The number of deals, too, plummeted to almost half to 243 versus 401 deals in 2022.

The decline was in line with the overall downturn in funding within the Indian startup ecosystem in 2023. While Indian startups raised slightly over $10 Bn in the preceding year, funding levels plunged to a seven-year low, sustaining close to the levels observed in 2017.

In 2023, Delhi NCR saw six mega deals, including ecommerce unicorn Lenskart’s $600 Mn two mega deals. Additionally, InsuranceDekho raised $246.5 Mn across three rounds, with one being the major $150 Mn mega deal round.

Other mega deals included DMI Finance ($400 Mn), GreyOrange ($135 Mn) and Stashfin ($100 Mn).

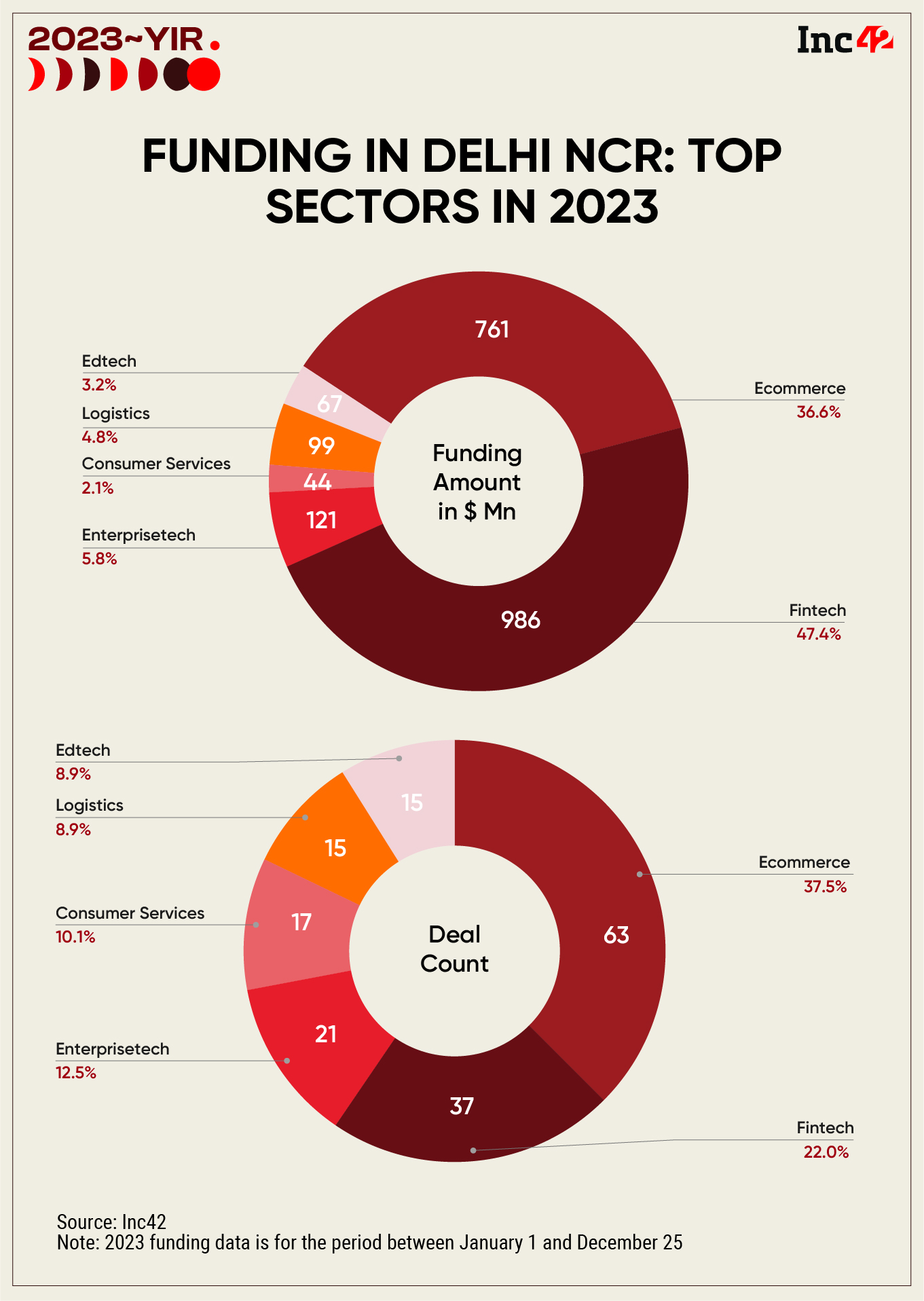

Six Top Funded Sectors In Delhi NCR

Within the Delhi NCR region, investor interest was found predominantly focussed on six sectors in 2023 — ecommerce, fintech, enterprise tech, consumer services, edtech, and logistics.

The ecommerce sector secured the highest number of deals (63), raising $761 Mn in 2023. Excluding Lenskart as an outlier deal, the Delhi NCR startups raised funding with an average ticket size of $3 Mn. The sector saw five deals with at least $10 Mn raised, including Blue Tokai Coffee ($30 Mn), Bakingo ($16 Mn), The Ayurveda Company ($12 Mn), NatHabit ($10.2 Mn), and SmartDukaan ($10 Mn).

Next, fintech startups lapped up 37 deals and raised $986 Mn in 2023, highest among all the sectors in the Delhi NCR region. Apart from mega deals, the top fund gainers in the sector were Credgenics ($50 Mn), Renewbuy ($40 Mn), Aye Finance ($37.3 Mn), Indifi ($35 Mn) and Aviom ($30 Mn).

These were followed by enterprise tech and healthtech startups raising $122 Mn across 21 deals and $84 Mn across 19 deals, respectively.

Among other sectors, consumer services startups lapped up 17 deals to raise $44 Mn funding throughout the year. Besides, edtech and logistics startups secured 15 deals each and raised $67 Mn and $ 99 Mn, respectively.

Further, between 2014 and 2023, Delhi NCR startups secured 1,241+ deals. Apart from the mainstream sectors, the region has seen the emergence of some other key sectors on the investors’ radar.

One such sector is cleantech, which has grown over the years from just one deal in 2014 to securing 12 deals in 2023. Also, deeptech is another sector wherein the number of deals just doubled from four in 2022 to eight in 2023.

Will Delhi’s Startup Policy Boost The Startup Ecosystem In The Region?

Consistently taking proactive measures to bolster the startup ecosystem, the Delhi government, through its industries department, finalised a draft of its startup policy in October 2023. The primary objective is to foster and support 15,000 startups by the year 2030. The comprehensive policy includes provisions such as collateral-free loans, expert guidance, and targeted assistance for college students.

Looking ahead to 2030, the Delhi Startup Policy aims to position the city as a global innovation hub, making it the preferred location for startups.

As part of these efforts, the government is actively working on a proposal for the Dilli Bazar portal, a digital platform intended to connect with customers on both national and global scales.

In 2022, Chief Minister Arvind Kejriwal unveiled the Delhi Startup Policy, outlining a series of initiatives geared towards streamlining entrepreneurship in the nation’s capital to establish Delhi as the premier startup hub in India.

However, Delhi NCR grapples with formidable challenges, including escalating land and infrastructure costs, widening income inequality, compromised air quality, land and water pollution, and a dearth of natural resources. To emerge as the top startup hub in the country, the Delhi government also needs to address these challenges.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)