SUMMARY

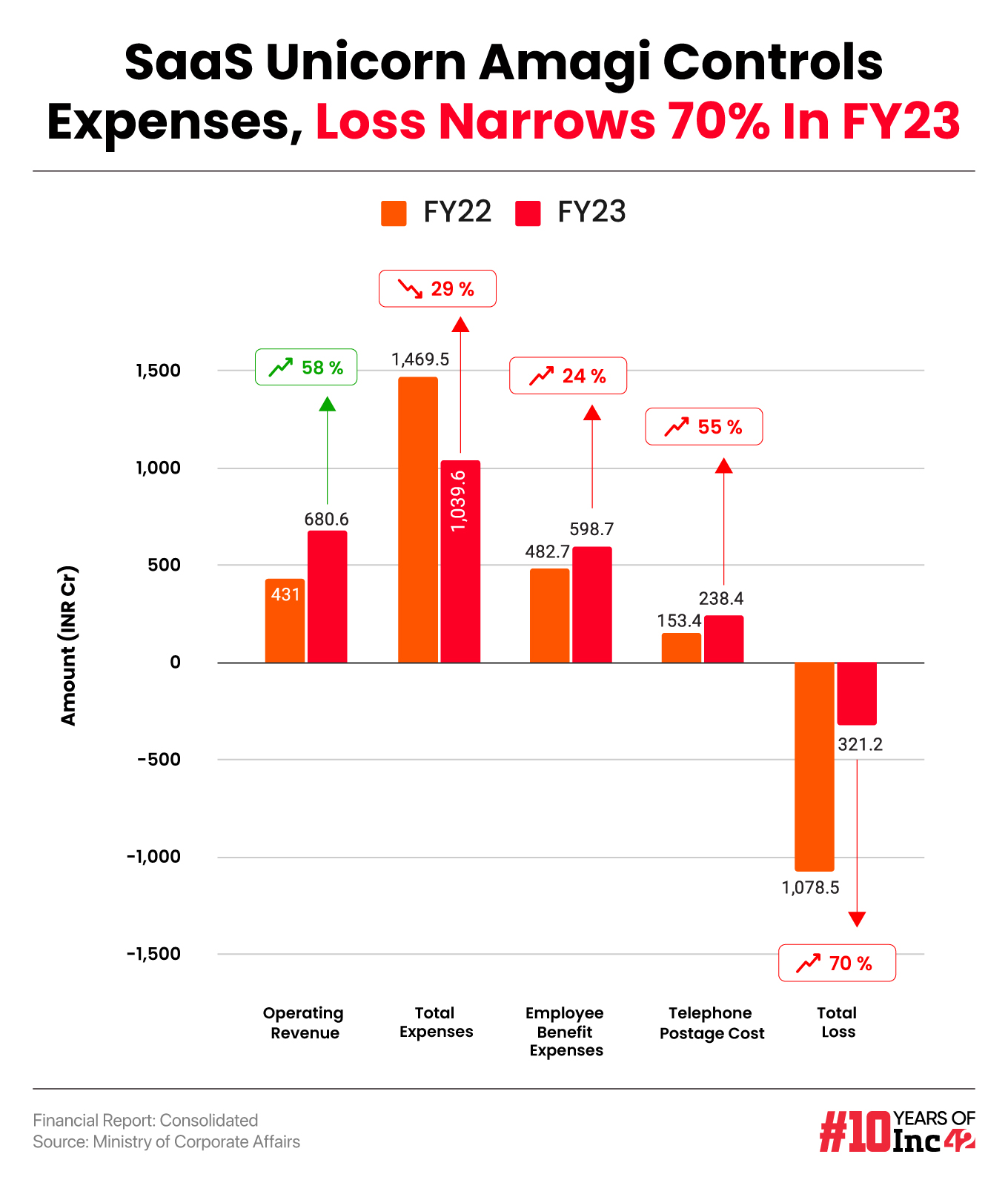

Operating revenue grew 58% to INR 680.6 Cr in the reported fiscal year from INR 431 Cr in FY22

The unicorn’s total income including other income grew 67% to INR 724.7 Cr in FY23 from INR 433.9 Cr in FY22

Amagi managed to cut its total expenses by 29% to INR 1039.6 Cr in the reported period from INR 1469.5 Cr in FY22

Media-focussed SaaS unicorn Amagi’s loss narrowed 70% year-on-year (YoY) to INR 321.2 Cr in FY23 from INR 1078.5 Cr in the previous fiscal year, fuelled by its growing revenue and cut in expenses.

Operating revenue grew 58% to INR 680.6 Cr in the reported fiscal year from INR 431 Cr in FY22.

Founded in 2008 by Subramanian, Srinivasan KA and Srividhya Srinivasan, Amagi offers a full stack cloud suite for clients to create, distribute and monetise content globally. It also offers broadcast and targeted advertising solutions for broadcast and streaming TV platforms.

The unicorn’s total income including other income grew 67% to INR 724.7 Cr in FY23 from INR 433.9 Cr in FY22.

Zooming Into Expenses

Amagi managed to cut its total expenses by 29% to INR 1039.6 Cr in the reported period from INR 1469.5 Cr in FY22.

Employee Cost: Amagi’s employee benefit expenses jumped 24% to INR 598.7 Cr in FY23 from INR 482.7 Cr in the prior fiscal.

In that, INR 349.6 Cr was spent towards salaries and wages.

However, Amagi brought down its other expenses significantly which include telephone postage cost, legal professional charges, subscription membership fees, rent and advertising promotional expenses. Its other expenses declined 57% to INR 427.2 Cr in FY23 from INR 1003.1 Cr in FY22.

Telephone Postage Cost: The startup’s expenditure in this bucket increased 55% YoY to INR 238.4 Cr in FY23.

Significantly, the startup’s miscellaneous expenses, for which it did not give any breakdown, fell from INR 763.6 Cr in FY22 from INR 25.4 Cr in FY23.

Amagi raised $79 Mn in funding from private equity (PE) firm General Atlantic. It counts Accel, Avataar Venture as its investors.

Last year, Amagi announced plans to acquire UK-based Tellyo’s business for an undisclosed amount. It further said that the deal will bolster its offerings across live sports and news broadcast segments.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)