There’s no exact science to reading markets. But that hasn’t made technical analysis any less popular among crypto traders looking for the next obscure indicator that will lead their portfolio to glory.

Technical analysis has, technically, been around for centuries. Its roots can be traced back all the way to the 17th century during the Dutch Golden Age, when traders started studying prices to predict future market behavior. But it’s more accurate to say that what most Twitter anons and crypto market analysts think of as “technical analysis” originated in the early 20th century. That’s thanks to Charles H. Dow, the founder of the Dow Jones Industrial Average and co-founder of The Wall Street Journal.

While the foundational elements of technical analysis hold up, analysts have had to adjust the way they’re applied and interpreted in the often volatile and always-on cryptocurrency market.

What follows is a mix of classic technical analysis terms and ones that have been introduced over the past decade as chart watchers have figured out what to watch for in crypto markets.

Bearish

A bearish outlook suggests that an investor expects a market, stock, or asset to decrease in value. Being bearish reflects pessimism about the future performance of an asset or the market.

Bearish investors may sell off assets to avoid losses, short-sell stocks betting on their decline, or employ strategies that capitalize on a downward market trend.

Bitcoin NVT Ratio

The Bitcoin Network Value to Transactions Ratio is used to assess whether Bitcoin, specifically, is overvalued or undervalued based on its transaction volume.

It’s analogous to the PE (Price to Earnings) ratio used in stock market analysis, but tailored for digital currencies. The NVT Ratio is calculated by dividing the market capitalization (or network value) or Bitcoin by the daily dollar volume transmitted through the blockchain.

Bollinger Bands

A technical analysis tool defined by a set of lines plotted two standard deviations (positively and negatively) away from a simple moving average (SMA) of a security’s price (see: Exponential Moving Average below). They’re named after American certified financial accountant John Bollinger.

Breakout

A breakout in financial markets refers to a price movement through an identified level of resistance or support, which is usually followed by heavy volume and increased volatility. Breakouts can occur in any direction, but they are more significant when they happen in the direction of the prevailing trend.

Bullish

A bullish outlook indicates that an investor believes that a market, stock, or asset will rise in value. Being bullish reflects optimism about the future performance of an asset or the market as a whole.

Bullish investors may buy assets in anticipation of price increases, hold onto assets expecting them to appreciate, or engage in strategies that profit from an upward market trend, such as going long on stocks or digital assets.

Candlestick Chart

A type of financial chart used to describe price movements of a security, derivative, or currency, which displays the high, low, opening, and closing prices for a specific period.

Green bars indicate days where the closing price was higher than the opening price, while red bars represent days where the closing price was lower than the opening price. The lines extending from the bars, or wicks, show the range between the day’s low and high prices. Day traders in crypto and traditional markets will often adjust the time period for candlestick charts to shorter increments, ranging from hours to as short as one minute.

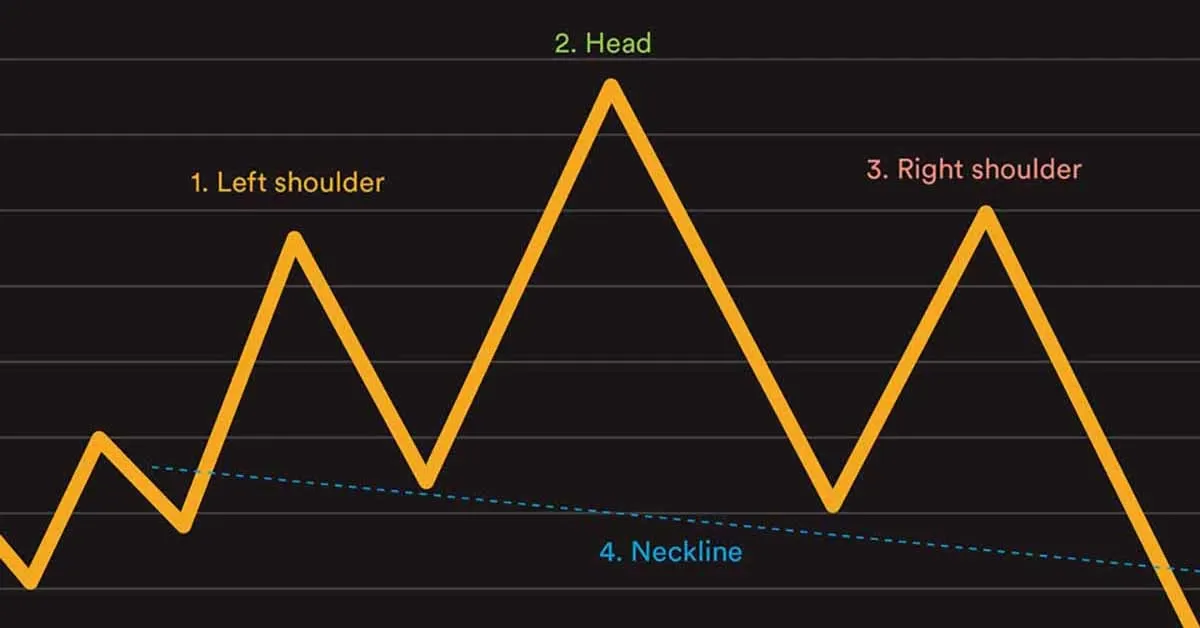

Chart Patterns

Distinctive patterns formed by the movement of security or digital asset prices on a chart. They are the foundation of technical analysis. Some common ones include Head and Shoulders and Inverse Head and Shoulders.

Day Trading

The practice of buying and selling a security within a single trading day. Particularly popular in crypto due to market volatility.

Doji

A candlestick pattern that indicates indecision among traders, represented by a candlestick with a small body and equal or nearly equal shadows. Often seen in crypto markets as a sign of potential reversal or continuation.

Elliot Wave Theory

A method of technical analysis that looks for recurrent long-term price patterns associated with ongoing changes in investor sentiment and psychology. Often applied to crypto markets for predicting price movements.

It was developed by Ralph Nelson Elliott in the 1930s, based on the observation that financial markets move in repetitive cycles, which he believed were the result of investor responses to outside influences, or predominant psychology of the masses at the time.

Exponential Moving Average (EMA)

Similar to a simple moving average, but gives more weight to the most recent prices, making it more responsive to new information.

A Simple Moving Average (SMA) is a basic technical analysis tool used to smooth out price data by creating a constantly updated average price. The SMA is calculated by adding up the closing prices of an asset over a specific number of time periods (such as days, weeks, or months) and then dividing this total by the number of time periods.

The calculation of an EMA involves several steps, with the initial step being the calculation of the SMA for the initial EMA value.

Fear and Greed Index

The Fear and Greed Index is a tool used to gauge the sentiments of investors in the financial markets, particularly in the cryptocurrency market, although it can also apply to stocks and other assets. This index interprets emotions and sentiments from different sources and consolidates them into a single number on a scale, typically ranging from 0 to 100.

A low score indicates “Fear,” suggesting that investors are worried or pessimistic about the market’s future, which could mean that assets are undervalued as people are selling off their investments. A high score represents “Greed,” implying that investors are getting overly confident or greedy, potentially leading to overvalued market conditions due to excessive buying.

Fibonacci Retracement

A tool used to identify potential support and resistance levels based on a series of numbers derived from the Fibonacci sequence. Often used in crypto trading for pinpointing reversal levels.

Gap

A break between prices on a chart that occurs when the price of a stock makes a sharp move up or down with no trading occurring in between. Not as common in 24/7 crypto markets, but still observed during significant news or events.

Head and Shoulders

A chart pattern that predicts a bullish-to-bearish trend reversal and is one of the most reliable trend reversal patterns.

Inverse Head and Shoulders

The opposite of the Head and Shoulders pattern, it signals a reversal of a downtrend.

MACD (Moving Average Convergence Divergence)

A trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

Market Cap

The total market value of a cryptocurrency’s circulating supply. It’s calculated by multiplying the current price of a coin by its circulating supply. A key metric in crypto for assessing the overall size and importance of a coin.

Moving Average (MA)

A technical indicator that shows the average price of a security over a specified time period, smoothing out price data to identify the direction of the trend.

Oscillator

Any technical analysis indicator that varies over time within a band, above and below a centerline, or between a set of indicator bands.

Relative Strength Index (RSI)

A momentum oscillator that measures the speed and change of price movements, typically used to identify overbought or oversold conditions.

Resistance Level

A price level where a trend can pause or reverse due to a concentration of selling interest.

Satoshi (SAT)

The smallest unit of Bitcoin, equivalent to 100 millionth of a Bitcoin. Used to express smaller transactions and valuations in the crypto market.

Stochastic Oscillator

A momentum indicator comparing a particular closing price of a security to a range of its prices over a certain period of time.

Support Level

A price level where a downtrend can be expected to pause due to a concentration of demand or buying interest.

Swing Trading

Swing trading is a type of trading strategy aimed at capturing short- to medium-term gains in a stock (or any financial instrument) over a period of a few days to several weeks. Swing traders primarily use technical analysis due to the short-term nature of the trades, although they may also use fundamental analysis or a combination of both to make their trading decisions.

Tokenomics

Tokenomics, a portmanteau of “token” and “economics,” refers to the economic principles and characteristics that govern the issuance, distribution, and management of a cryptocurrency or digital token within its ecosystem. It includes the rules and incentives designed to ensure the stability, utility, and growth of a token. Understanding tokenomics is crucial for investors, developers, and users to evaluate the potential value and sustainability of a cryptocurrency project.

Some common elements of tokenomics include supply, distribution, utility, governance, and incentives.

Trend

The general direction in which the price of an asset is moving— upward, downward, or sideways.

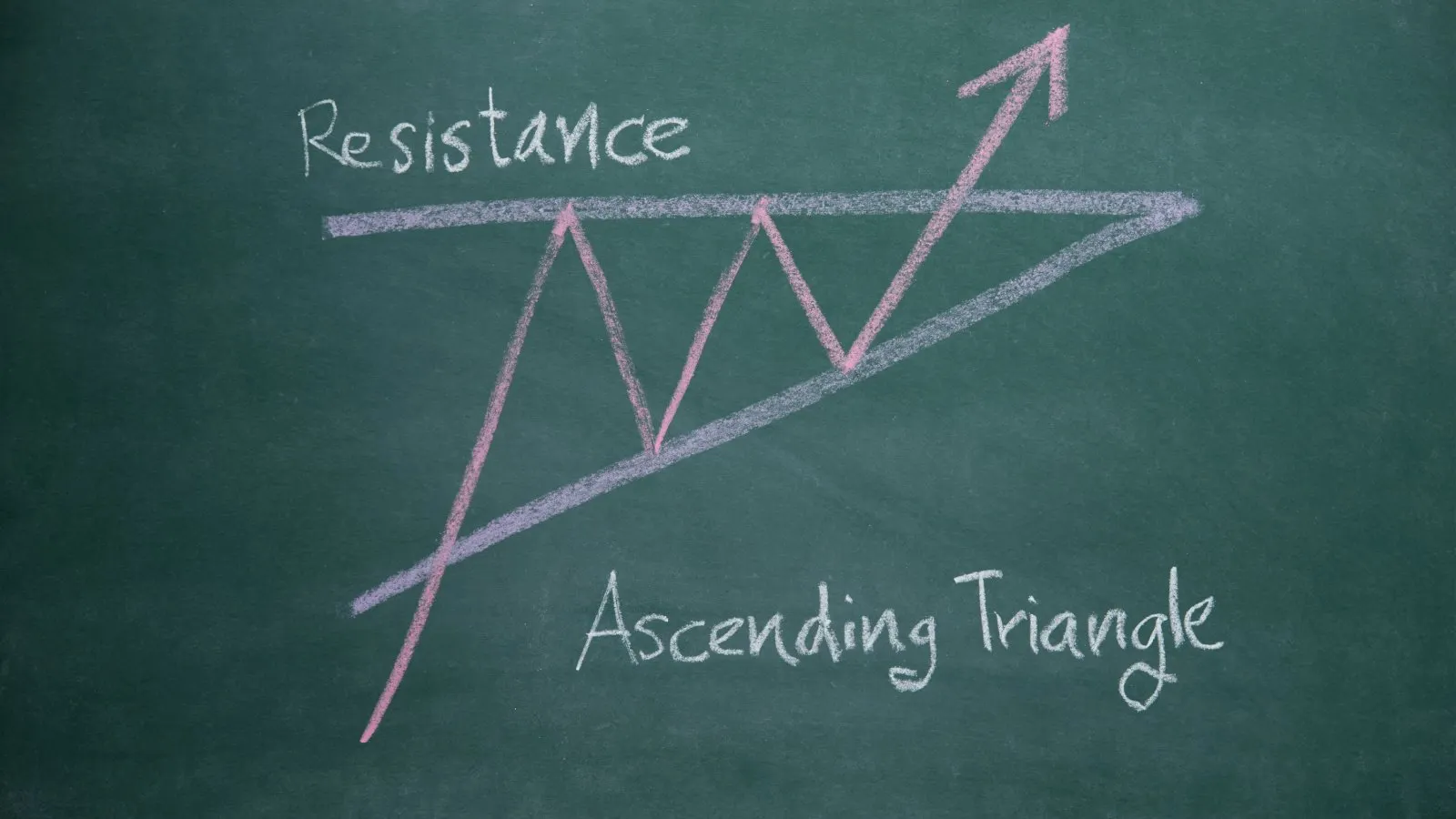

Triangles

Triangles can be ascending, descending, or symmetrical. Ascending triangles have a flat upper trend line and a rising lower trend line, suggesting continuation in an uptrend.

Descending triangles have a flat lower trend line and a descending upper trend line, suggesting continuation in a downtrend. Symmetrical triangles have converging trend lines and suggest a continuation but require confirmation of the direction.

Volume

The number of shares, contracts traded or coins traded in a security or market during a given period, used to measure the strength of a price move. Often considered in crypto markets to analyze trading activity levels.

Volume Analysis

The examination of the number of shares or contracts of a security that have been traded in a given period to assess the strength of a price move. Particularly important in crypto to gauge market interest and potential trend reversals.

Editor’s note: This article was written with the assistance of AI. Edited and fact-checked by Stacy Elliott.

Stay on top of crypto news, get daily updates in your inbox.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)