SUMMARY

Signzy acquired fraud risk management solutions provider Difenz in a cash and equity deal, valuing the latter at $5 Mn

Signzy said it will now be able to provide AI-led Know Your Customer (KYC) compliance solutions to financial institutions

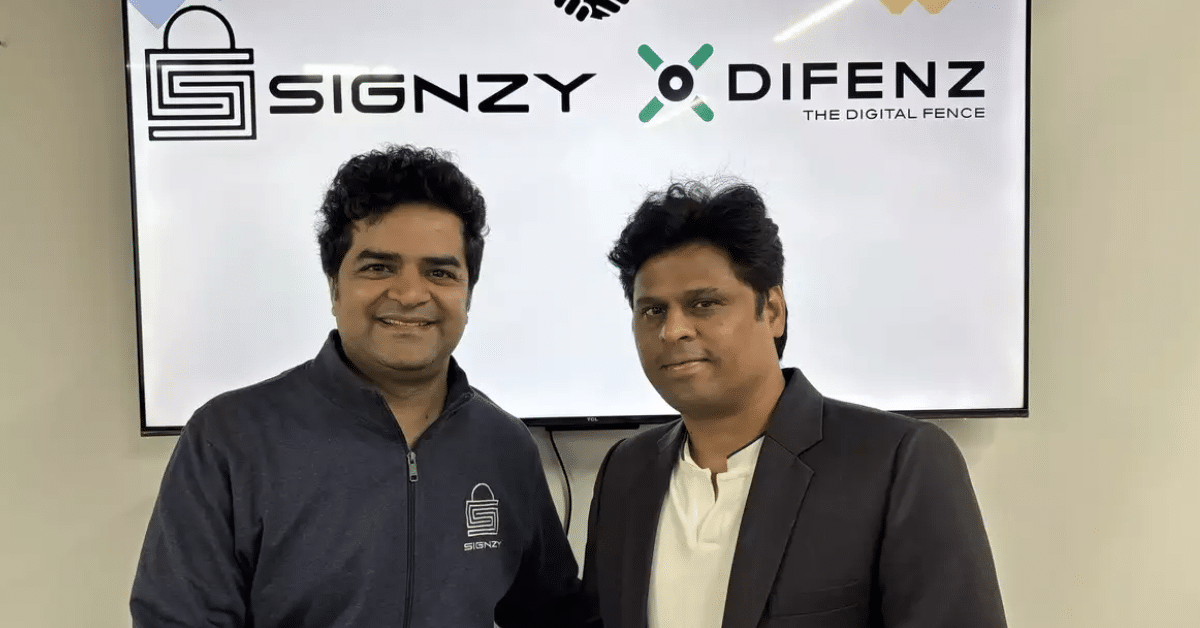

Difenz cofounders Sivaram Jayaraman and Madhu Srinivas have joined Signzy at partners following the acquisition

Fintech SaaS startup Signzy has acquired fraud risk management (FRM) solutions provider Difenz in a cash and equity deal, which valued the latter at $5 Mn.

In a statement, Signzy said the acquisition would allow it to strengthen its AI play. The startup will now be able to provide AI-led Know Your Customer (KYC) compliance solutions to financial institutions.

Further, the acquisition would help Signzy provide its clients offerings like advanced anti-money laundering (AML) screening and transaction monitoring.

Founded in 2020 by University of Madras alumni Sivaram Jayaraman and Madhu Srinivas, Difenz offers a full-stack financial risk management (FRM) platform for transaction monitoring, which can be integrated with any type of payment like cards, POS, payment gateways, core banking systems and wallets.

Following the acquisition, the cofounders of Difenz have been appointed as partners at Signzy. The acquisition also provided an exit to early stage venture capital (VC) firm 8i ventures. The VC firm had invested around INR 4.5 Cr in Difenz’ seed funding round back in 2021.

Commenting on the acquisition, Signzy CEO and cofounder Ankit Ratan said, “Difenz’s product is plug and play, we experienced it first hand when one of our common customers was able to go live within just 2 weeks on their transaction monitoring tool…We couldn’t have wished for a better team to lead this offering.”

Founded by Ratan, Ankur Pandey, and Arpit Ratan in 2015, Signzy provides digital onboarding solutions to banks and NBFCs via its no-code platform. The startup claims to work with over 240 financial institutions and counts the likes of State Bank of India, Axis Bank, and IndusInd Bank among its customers.

Signzy last raised INR 210 Cr ($26 Mn) in a Series B round led by Gaja Capital. Overall, it has raised more than $37 Mn till date and counts the likes of Vertex Ventures and Arkam Ventures among its backers.

“….This partnership aims to enhance clientele experience by facilitating end-to-end customer journey management, enabling clients to concentrate on their core business activities,” Srinivas said on the acquisition.

The development comes at a time when the number of mergers and acquisitions in the Indian startup ecosystem slumped to 123 deals in 2023 from over 200 in the previous year due to the ongoing funding winter. However, as many as 55% of the investors surveyed by Inc42 believe that 2024 will be a good time to mark exits.

Earlier this year, Kunal Shah’s CRED acquired Kuvera, while troubled fintech giant Paytm acquired Bitsila. DMI Group also acquired troubled fintech startup ZestMoney.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)