SUMMARY

While the new policy doesn’t allow 100% FDI flow via automatic route for all the subsegments, industry leaders think it’s an important first step towards the liberalisation of the Indian space sector

Easier access to capital will also allow new and existing Indian space tech companies to scale up

It is pertinent to note that the government earlier also allowed 100% FDI for the establishment and operations of satellites but it was subject to the government’s approval

The Indian government has fulfilled a long-standing demand of spacetech startups by liberalising the FDI regime for the sector, allowing up to 100% FDI via the automatic route for certain sub-segments in the space sector.

The move is part of the government’s push to make India a leading player in the segment by enabling the growth of private players.

While the Centre opened up the space industry to private players in 2020 and subsequently established the Indian National Space Promotion and Authorization Centre (IN-SPACe), as a nodal agency, to support emerging startups in the sector, the lack of a clear FDI policy for the space sector was a major bottleneck.

It is pertinent to note that the government allowed 100% FDI for the establishment and operations of satellites in 2020. Still, it was subject to the sectoral guidelines of the Department of Space or the Indian Space Research Organisation (ISRO).

Spacetech being a capital-intensive sector, particularly in the upstream market, has always depended on foreign capital. However, the startups had to apply to the government to receive any foreign financial aid so far. This approval process took somewhere around six months to a year, industry leaders told Inc42.

The Cabinet’s decision to approve the amendment to the FDI policy for the space sector will not only reduce such waiting time but also improve the ease of doing business for young spacetech startups in the country.

lockquote>

Industry Welcomes A ‘Cautious’ Opening

The Indian spacetech sector had been seeking a robust FDI policy for more than a year now. It was also one of the most prominent demands of industry leaders ahead of the interim budget 2024.

While the new policy doesn’t allow 100% FDI flow via automatic route for all the subsegments, industry leaders think it’s an important first step towards the liberalisation of the Indian space sector.

Speaking on the matter, Pixxel founder and CEO Awais Ahmed, said that the 49% cap on FDI for launch vehicles reflects a cautious yet optimistic opening of the sector.

“Given the strategic importance of launch capabilities and the rapidly growing global demand for launch services, this cap ensures that domestic entities retain control and decision-making power while still benefiting from foreign expertise, technology transfer, and investment,” he said.

lockquote>

Ahmed called the caps a “balanced approach”, aimed at fostering a competitive and vibrant space industry in India.

He believes that by allowing 74% FDI for satellite manufacturing under the automatic route, the Centre has acknowledged the capital-intensive nature of satellite development.

Notably, the government has also acknowledged the benefits of global partnerships in enhancing technological capabilities, reducing costs, and accelerating space technologies’ commercialisation into a domain crucial for both commercial and strategic purposes, Ahmed added.

Meanwhile, Akash Yalagach, CTO at KaleidEO, the upstream arm of SatSure, believes that the caps were divided based on the criticality of the industries.

lockquote>

For instance, sub-systems form small building blocks for any space system, hence 100% FDI will allow such companies to grow seamlessly with access to foreign capital, he noted.

“Space industry is capital intensive. FDI will allow foreign capital to be invested in the growing private space ecosystem of India with less hurdles. This will propel the Indian private space industry to reach greater heights,” Yalagach added.

How Does The New Policy Fuel Spacetech Growth

The Department of Space, in its statement on February 21, 2024, said that the increased private sector participation in the space sector would help generate employment, enable modern technology absorption, and make it self-reliant.

The development is also expected to integrate Indian companies into global value chains, said the Union ministry, adding that this would help companies set up their manufacturing facilities within the country, encouraging ‘Make In India’ and ‘Atmanirbhar Bharat’ initiatives of the government.

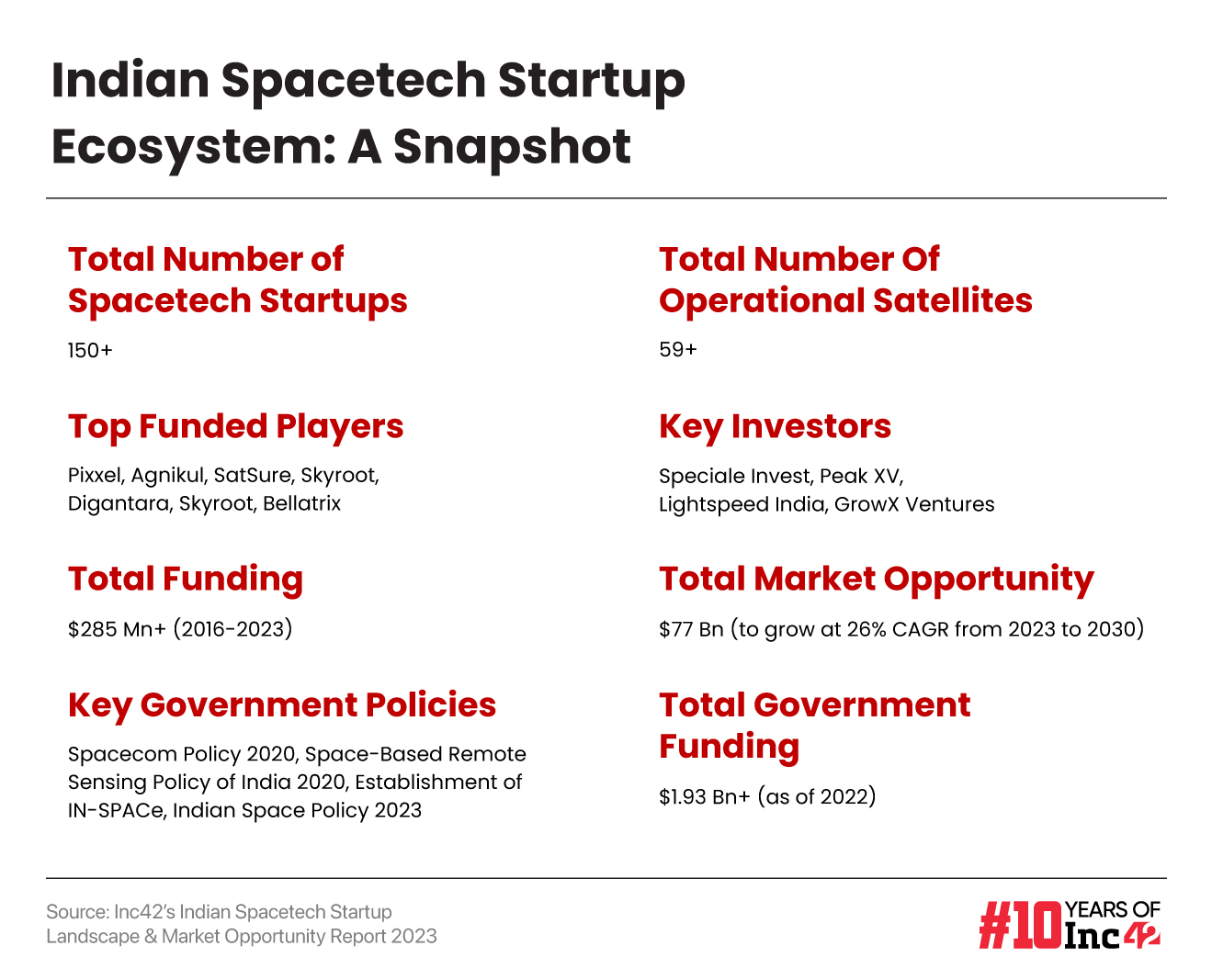

As per Inc42’s report, a majority of the spacetech investment of more than $285 Mn in India has gone to the upstream market so far – a segment which broadly includes transportation, exploration, deep space observations, design and development of space components, subsystems, and ground and space stations.

The space sector now expects an overall increase in capital infusion.

For instance, Pixxel’s Ahmed said that this policy shift would catalyse technology transfer from international entities, enhancing India’s technological base and operational capabilities in space exploration, satellite manufacturing, and other critical areas.

lockquote>

By enabling easier access to capital, new and existing Indian space tech companies can scale up, drive research and development, and enhance their competitiveness on a global level, he added.

Echoing a similar sentiment, Pranit Mehta, VP of business development at GalaxEye Space, said, “We should now be expecting various international entities, all the way from corporates to venture capitalists to private equity firms, paying a lot more attention to the Indian space ecosystem. Therefore, an increasing trend in capital infusion into existing corporates and startups and also more startups getting registered in the time to come.”

We must note that the Indian spacetech market is expected to grow at a 26% CAGR between 2023 and 2030, reaching $77 Bn.

India is now well-equipped with talent and infrastructure backed by enabling policies to seize the opportunity of a growing global space industry, which is estimated to generate over $1 Tn in revenue in 2040, believes Dr Pawan Goenka, the chairman of IN-SPACe.

lockquote>

In a statement, he explained that the last decade has witnessed a massive growth in investment activity in the space sector globally as investors are convinced of the sector’s long-term commercial potential. In just three years, from 2021 to 2023, $37.1 Bn has been raised by the space sector globally, and a significant portion of this capital is going to space startups.

“The easing of FDI will enable Indian space start-ups working on capital-intensive space products to now access this global pool of capital to expand manufacturing and production capacity,” Goenka added.

[Edited By Shishir Parasher]

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)