SUMMARY

Reversing the sharp downfall of the last three weeks, shares of Paytm emerged as the biggest gainer. The stock rallied 19.4% during the week

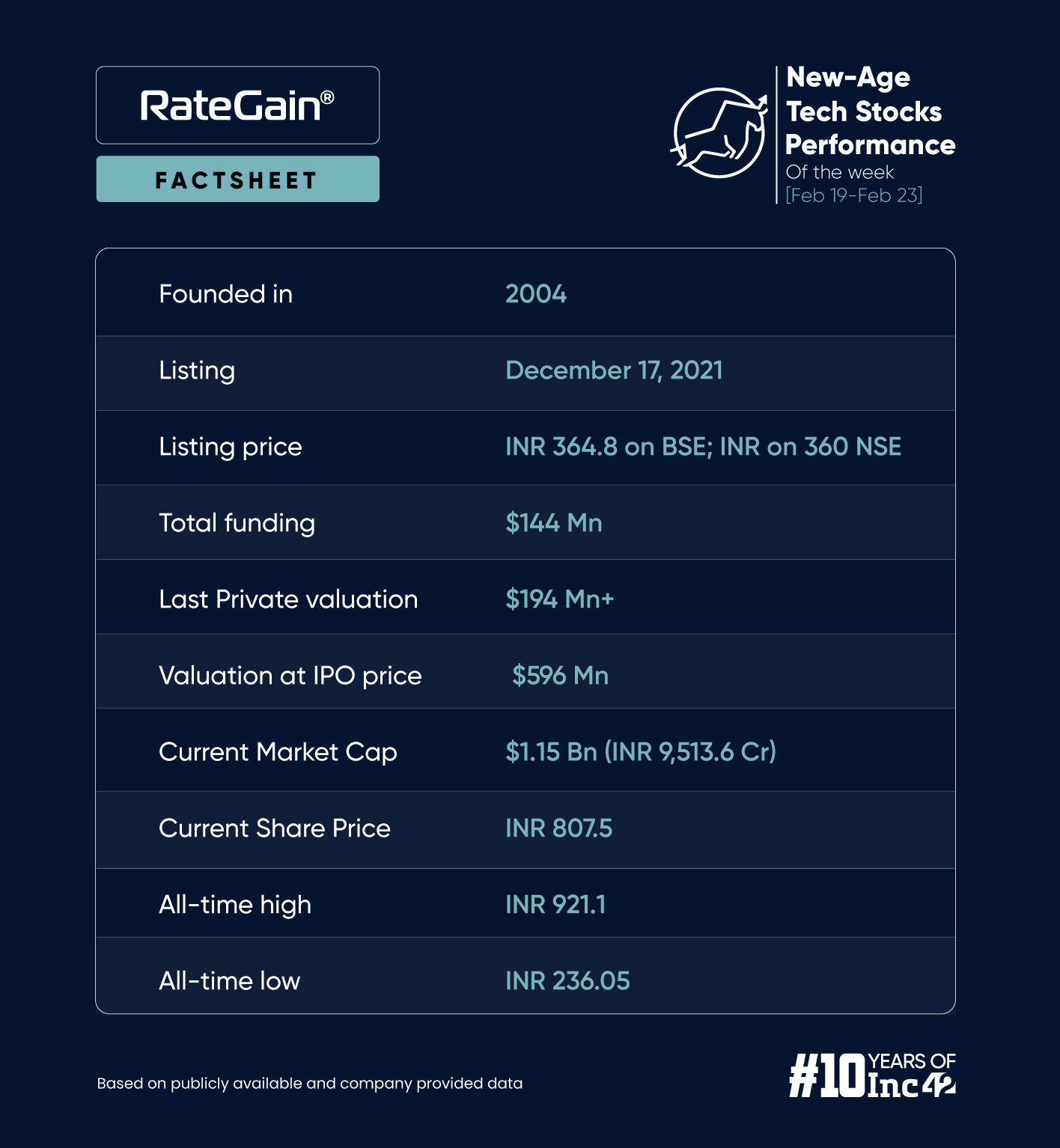

Eight out of the 19 new-age tech stocks under Inc42’s coverage fell in a range of 0.08% to almost 8% this week, with RateGain being the biggest loser with a decline of 7.7%

In the broader market, Sensex rallied 0.99% to end the week at 73,142.8 while Nifty50 jumped 0.8% to 22,212.7

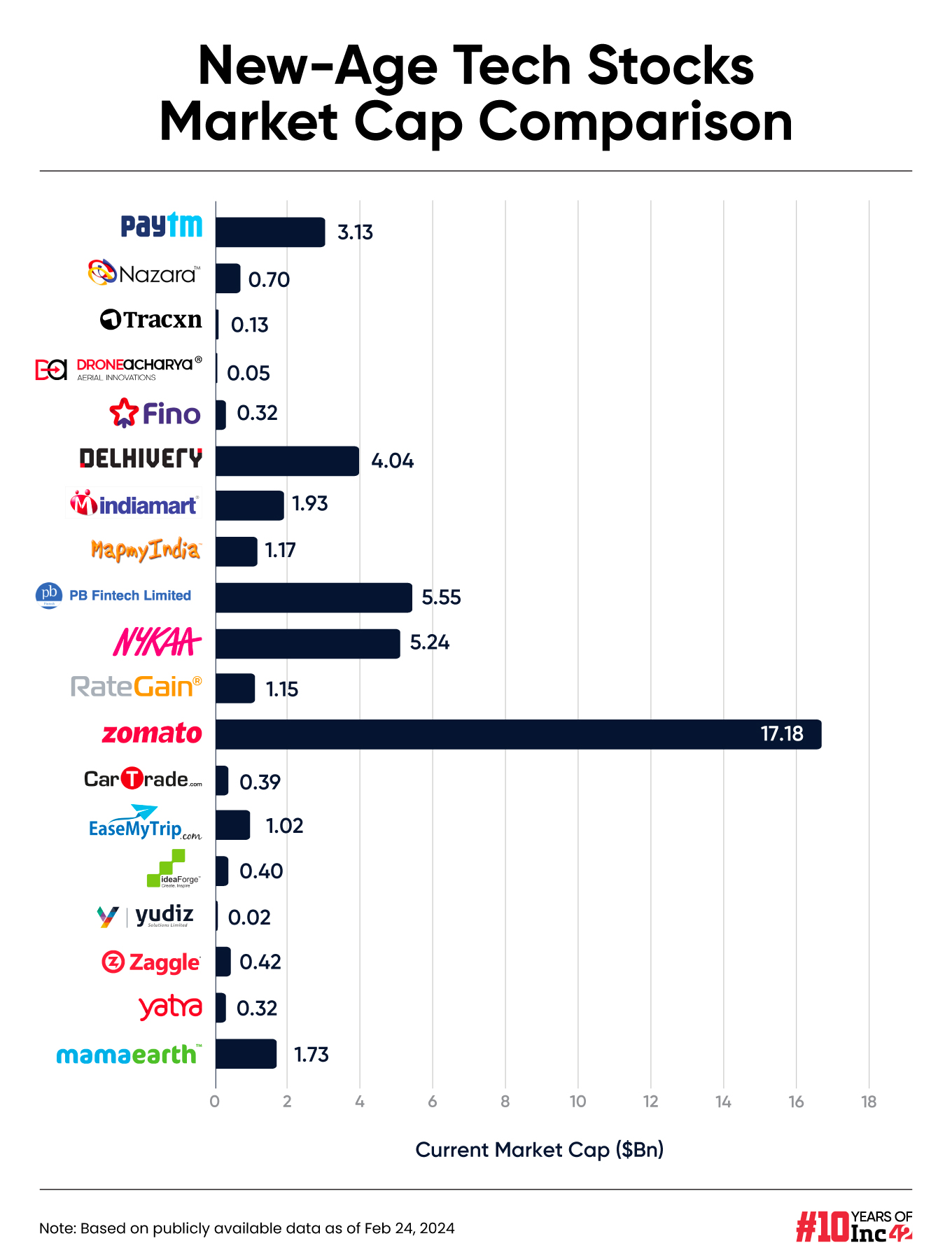

Indian new-age tech stocks saw another week of mixed performance but sharp gains of over 10% in some of the counters took the combined market cap of these stocks to almost $45 Bn at the close of the trading on Friday (February 23).

Paytm managed to reverse the downward trend of the past three weeks and emerge as the biggest gainer this week. The Vijay Shekhar Sharma-led company’s shares surged 19.4% during the week. It was followed by fintech SaaS startup Zaggle, which rallied 13%.

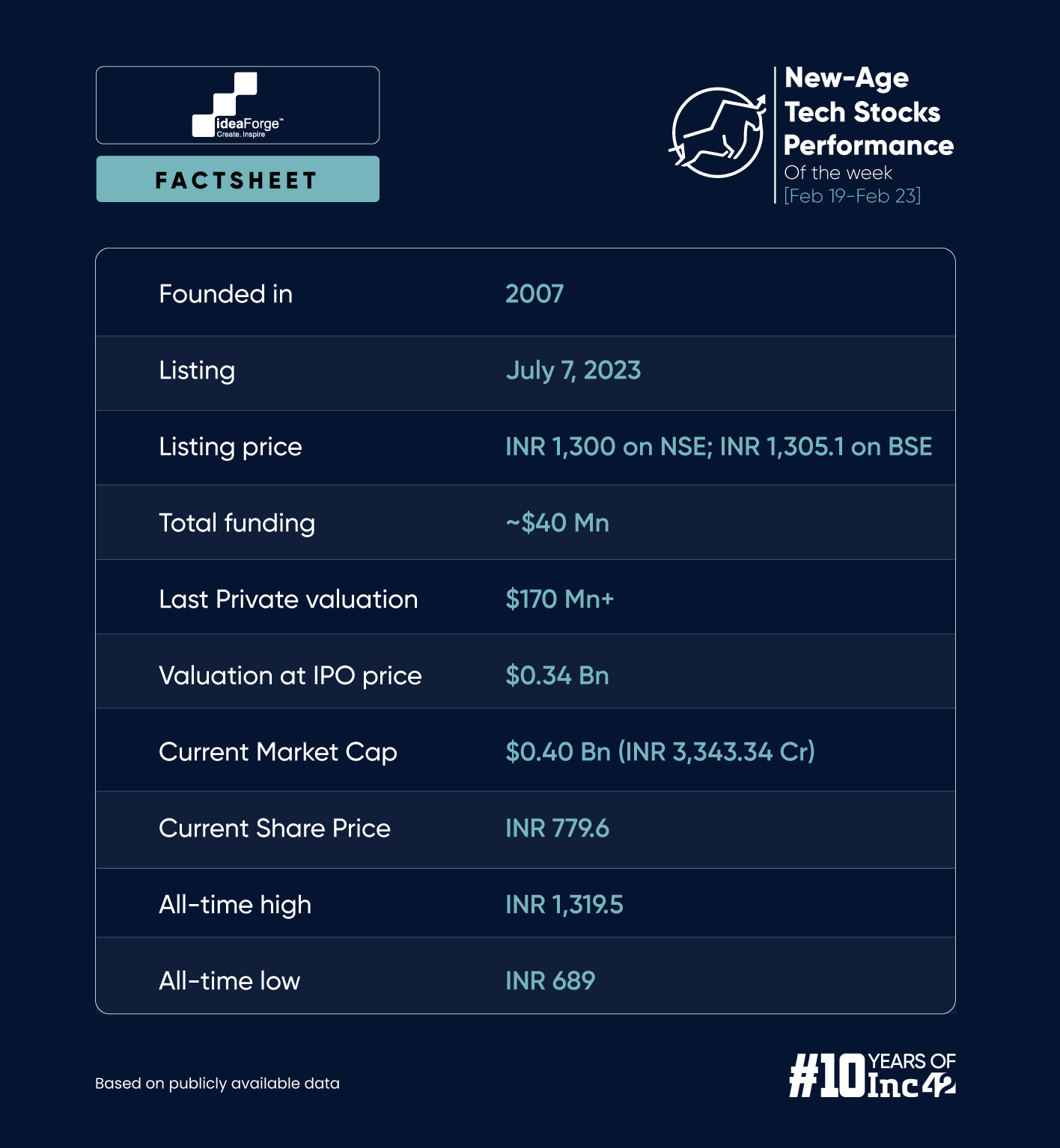

Drone manufacturing startup ideaForge also witnessed a massive 11.4% jump during the week, followed by another fintech major, PB Fintech (up 10.1%).

Besides, five others, including Nykaa, Zomato, and DroneAcharya, gained in a range of 0.6% to 5% on the BSE this week. Meanwhile, Delhivery gained marginally and Yatra’s shares ended the week at the same price as last week.

Overall, eight out of the 19 new-age tech stocks under Inc42’s coverage fell in a range of 0.08% to almost 8% this week. RateGain was the biggest loser, declining 7.7%. It was followed by Nazara, which fell 6.2% on the BSE.

lockquote>

In the broader domestic equity market, it was a sectorally mixed week. However, Sensex rallied 0.99% to end the week at 73,142.8 while Nifty50 jumped 0.8% to 22,212.7. Both the indices also touched new all-time highs during the intraday trading on Friday but gave up the gains on the back of domestic and global macroeconomic developments.

Siddhartha Khemka, head of retail research at Motilal Oswal, said that mixed flash estimates of Purchasing Managers’ Index (PMI) for February for both India and the US, along with the hawkish tone of the RBI in its MPC meeting, dented investor sentiments.

He said the market rally might take a pause next week ahead of various global economic data releases. However, the overall trend remains positive.

On the other hand, Prashanth Tapse, senior VP (research) at Mehta Equities, said that with the corporate earnings season coming to the end, traders are awaiting new catalysts. However, pre-election momentum remains in the market.

lockquote>

“But concerns over rising crude oil prices, surging US bond yields, and stretched valuations linger on the market and are likely to prompt continued selling by FIIs,” Tapse added.

Now, let’s take an in-depth look at the performance of some of the new-age tech stocks this week.

The total market capitalisation of the 19 new-age tech stocks under Inc42’s coverage stood at $44.9 Bn at the end of this week as against $43.2 Bn last week.

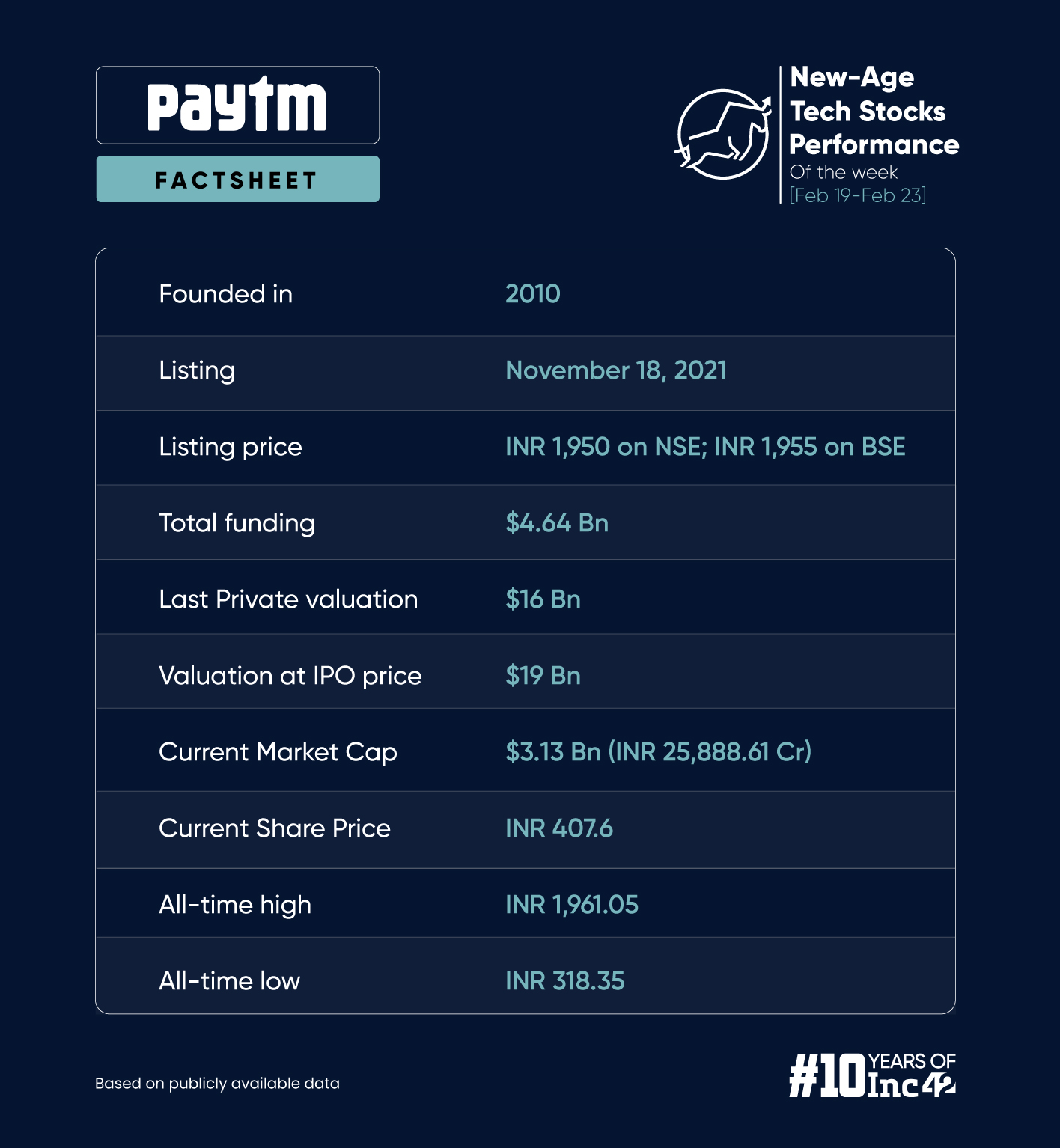

Paytm’s Sharp Recovery

Shares of fintech major Paytm gained in three consecutive trading sessions this week and also touched the upper circuit of 5% at INR 407.6 on the BSE during Friday’s trading session.

Paytm rallied 19.4% this week to reverse its losing streak, which began after the RBI clamped down on Paytm Payments Bank.

The company’s shares gained this week after the RBI, on February 16, extended the deadline for some of the business restrictions on its payments bank to March 15 from February 29 earlier. The central bank’s frequently asked questions (FAQs) on the issue also provided more clarity to stakeholders, turning investor sentiment a little positive.

Besides, Paytm’s decision to shift the nodal account of Paytm Payments Bank to Axis Bank also added to the optimism.

It is pertinent to note that on January 31, the RBI issued a notification barring Paytm Payments Bank from taking any deposits or credit transactions, or top-ups in any of its customer accounts. Shares of Paytm crashed almost 50% following this. The RBI also asked the payments bank to stop providing any banking services, including UPI facility and fund transfers.

Earlier, brokerage Bernstein warned of a lasting impact of the regulatory action on Paytm’s business.

However, in its latest research note this week, the brokerage said, “However, we believe the regulatory actions are restricted to the PPBL (Paytm Payments Bank Limited) entity, and we expect the company to successfully execute the operational changes required to remove the dependency on PPBL with limited long-term impact to their overall business.”

Meanwhile, Jefferies has suspended its rating and price target (PT) on Paytm until the news flow settles down. The brokerage also sees a 28% YoY decline in the company’s FY25 revenue, pushing it into cash burns.

Earlier this week, the RBI asked the National Payments Corporation of India (NPCI) to examine Paytm’s request to become a third-party application provider for UPI payments.

Speaking on Paytm shares, Ganesh Dongre, senior manager, technical research, at Anand Rathi, said that the stock seems to have still not touched its bottom point and it’s better to remain in a wait-and-watch phase.

lockquote>

The resistance for the stock is at around INR 490, he said. Dongre said he would suggest buying the stock only if its price goes beyond this level.

RateGain Emerges As The Biggest Loser

After emerging as the top gainer last week, shares of traveltech SaaS startup RateGain nosedived 7.7% this week. Its shares ended Friday’s close at INR 807.5 on the BSE.

The startup’s shares declined despite the Expedia Group recognising it as an Elite Connectivity Partner for 2024.

Besides, RateGain also announced the launch of its unified rate insights platform navigator that would help commercial teams eliminate extra effort, bringing everything on one screen that would help revenue management, marketing, and distribution act faster on insights.

RateGain has made significant gains over the last two months. Helped by these gains, the company’s market capitalisation crossed the $1 Bn mark in the last week of December.

RateGain shares have gained 10.5% so far in 2024.

ideaForge To Enter The US Market

Shares of drone startup ideaForge soared 7% on Friday to end the week at INR 779.6 on the BSE after its CEO Ankit Mehta said that the company is set to enter the US market.

While the stock was already witnessing an upward momentum throughout the week, the news about the entry in the US market added to the rally. Overall, ideaForge shares gained 11.4% during the week.

However, the shares continue to trade significantly below their listing price of INR 1,305.1 on the BSE.

Anand Rathi’s Dongre said that the stock is still in a “falling channel”. While the stock has witnessed small rebounds after each quarter, the gains haven’t sustained, he observed.

lockquote>

“We need a proper closing of this counter above INR 820 to advise investors to go long on it,” Dongre added.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)