SUMMARY

The total number of two-wheeler EVs registered in February stood at 81,963 units as against 81,928 units in January

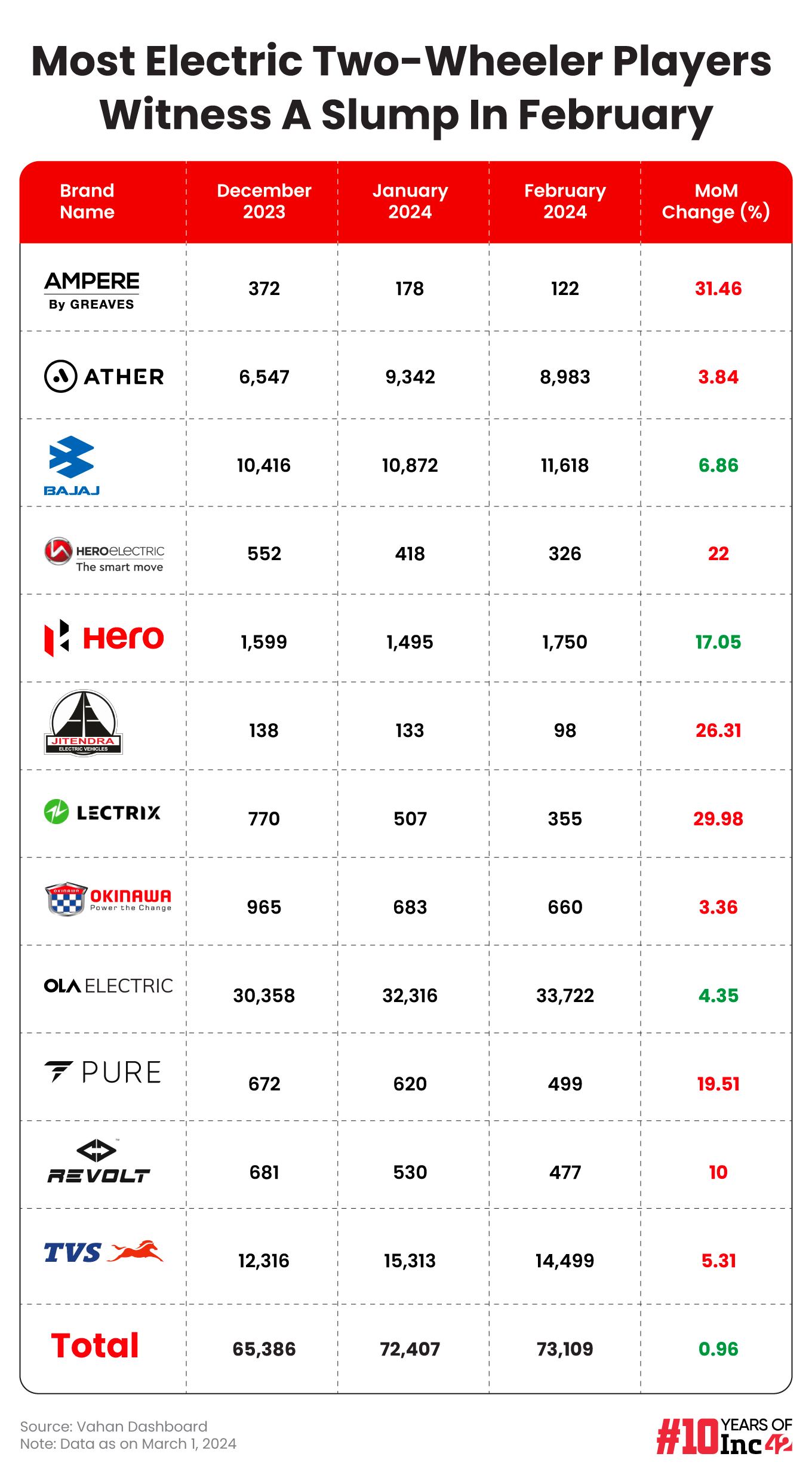

Ather Energy and TVS Motor saw a decline in their vehicle registrations last month, while Ola Electric and Bajaj Auto registered muted MoM growth

Hero MotoCorp’s registrations didn’t cross the 2,000 mark in February, but the company saw one of the highest MoM increases at 17%

Electric two-wheeler registrations remained almost flat month-on-month in February, largely due to the seasonality factor.

As per Vahan data on March 1, two-wheeler EV majors, including Ather Energy and TVS Motor, saw a decline in their vehicle registrations last month, while Ola Electric and Bajaj Auto registered muted growth month-on-month (MoM).

Overall, the total number of two-wheeler EVs registered in February stood at 81,963 units as against 81,928 units in January. This number stood at 66,094 units in February 2023.

Bhavish Aggarwal-led Ola Electric continued to top the charts in terms of vehicle registrations. The electric two-wheeler major saw registrations of 33,722 units in February, up 4% from 32,316 units in the month before.

The IPO-bound EV player has also announced the launch of a new electric scooter model, S1X 4kWh, to further its portfolio and maintain its lead in the market. Priced at INR 1.1 Lakh, deliveries of the new escooter are expected to start from April.

On the other hand, TVS Motor maintained the second position in terms of escooter registrations. However, its vehicle registrations declined over 5% MoM to 14,499 units in February.

The legacy automobile player had witnessed a sharp jump of over 23% in its vehicle registrations in January, thereby crossing the 15,000 units mark. Prior to that, helped by the festive season boost, TVS Motor’s registrations surpassed the 19,000-units mark in November last year.

Maintaining its third position among the electric two-wheeler players, Bajaj Auto’s total escooter registrations grew over 6% to 11,618 units in February from 10,872 units the month before.

It is pertinent to note that legacy automobile players have been seeing strong growth in their electric two-wheeler registrations for the last few months. For context, Bajaj Auto’s escooter registrations grew over 10X in February 2024 from around 1,219 units a year ago.

Bajaj Auto overtook Ather Energy to grab the third position in terms of escooter registrations towards the end of 2023. Amid rising competition, Ather has been struggling to catch up with other players in terms of escooter sales for quite some time now.

Ather’s EV registrations declined almost 4% to 8,983 units last month from 9,342 units in January.

The Bengaluru-based EV startup is launching new models to increase its registrations and market share. While deliveries of its new 450X escooters are expected to begin from March, Ather recently announced the launch of Ather Rizta in April.

Amid its ongoing struggles, Hero MotoCorp is emerging as another competitor for Ather. While Hero MotoCorp’s registrations didn’t cross the 2,000 mark in February, the company saw one of the highest MoM increases at 17%.

On the other hand, a number of two-wheeler EV players still seem to be reeling under the impact of the FAME-II subsidy issues. The registrations of the likes of Okinawa Autotech, Hero Electric, Jitendra, and PURE EV, among others, continued to nosedive.

It is pertinent to note that Hyderabad-based PURE EV also raised $8 Mn recently in a funding round led by Bennett Coleman and Company Limited and Hindustan Times Media Ventures to scale up its two-wheeler playbook.

However, as several leading players of 2022 struggle to scale today, most market experts believe that only eight to ten electric two-wheeler players with in-house innovations will survive.

Meanwhile, the overall registrations of EVs across categories stood at 1.4 Lakh units in February as against 1.45 Lakh units in January. This MoM fall was in line with the decline in petrol and diesel vehicles.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)