SUMMARY

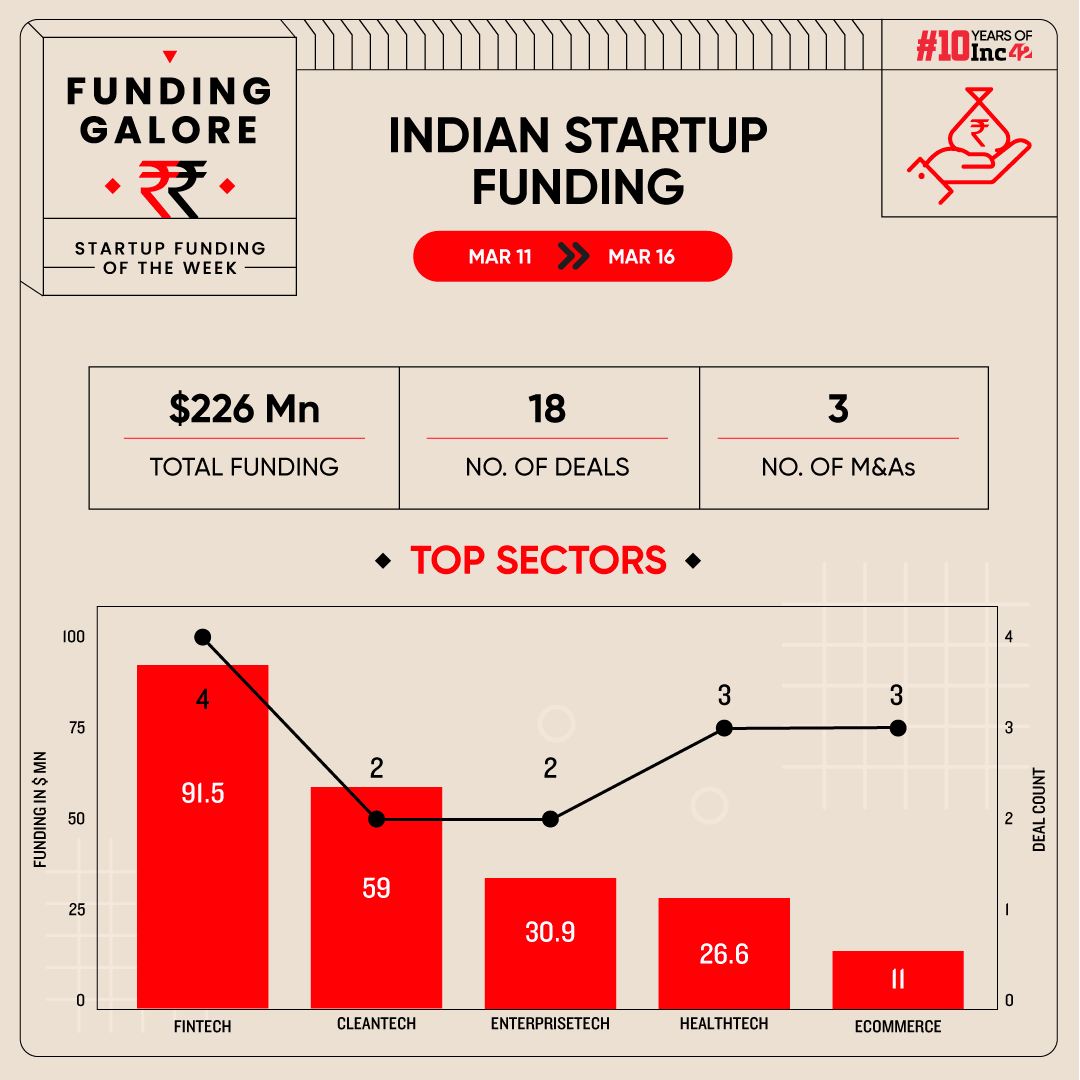

Indian startups cumulatively raised $226.2 Mn across 18 deals

Securing a $80 Mn funding, Perfios became the second startup to attain unicorn status in 2024

Fintech sector pulled in maximum number of cheques, propelling startups to raise a total of $91.5 Mn

Startup funding activity gained ground in the second week of March after a slight dip. Between March 11 and 16, startups cumulatively raised funding of $226.2 Mn across 18 deals, a 50% increase from $150.1 Mn across 17 deals in the previous week.

The week also saw India minting its 114th Unicorn as fintech SaaS startup Perfios raked in $80 Mn cheque from Teachers’ Venture Growth at a valuation of over $1 Bn.

Funding Galore: Indian Startup Funding Of The Week [Mar 11 – Mar 16]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 13 Mar 2024 | Perfios | Fintech | Fintech SaaS | B2B | $80 Mn | – | Teachers’ Venture Growth (TVG) | Teachers’ Venture Growth (TVG) |

| 13 Mar 2024 | Lohum | Cleantech | Electric Vehicle | B2B | $54 Mn | Series B | Singularity Growth, Baring Private Equity, Cactus Venture Partners, Venture East | – |

| 12 Mar 2024 | Nanonets | Enterprisetech | Horizontal SaaS | B2B | $29 Mn | Series B | Accel, Elevation Capital, YCombinator and others. | Accel |

| 13 Mar 2024 | Cureskin | Healthtech | Fitness & Wellness | B2C | $20 Mn | Series B | HealthQuad, JSW Ventures, Khosla Ventures, and Sharrp Ventures | HealthQuad |

| 11 Mar 2024 | BlueStone | Ecommerce | D2C | B2C | $9 Mn | Debt | Trifecta Capital | |

| 14 Mar 2024 | FREED | Fintech | Lendinghtech | B2C | $7.5 Mn | Series A | Sorin Investments, Multiply Ventures, Piper Serica, others | Sorin Investments and Multiply Ventures |

| 14 Mar 2024 | KITES | Consumer Services | Hyperlocal Services | B2C | $5.4 Mn | Series A | Manipal Education and Medical Group | Manipal Education and Medical Group |

| 13 Mar 2024 | Sugar.fit | Healthtech | Fitness & Wellness | B2C | $5 Mn | B Capital | B Capital | |

| 11 Mar 2024 | Kimbal | Cleantech | Energy Tech | B2B | $5 Mn | – | Niveshaay, Ayush Mittal, Sandeep Kapadia, others. | Niveshaay |

| 14 Mar 2024 | TapFin | Fintech | Lendinghtech | B2B | $4 Mn | Seed | Elevar Equity | Elevar Equity |

| 11 Mar 2024 | OppDoor | Ecommerce | B2B Ecommerce | B2B | $2 Mn | – | Three State Ventures | Three State Ventures |

| 15 Mar 2024 | GobbleCube | Enterprisetech | Horizontal SaaS | B2B | $1.9 Mn | Seed | Kae Capital, CRV, among others | Kae Capital |

| 15 Mar 2024 | Fluid Analytics | Healthtech | Medtech | B2B | $1.6 Mn | Pre-Series A | Pravega Ventures | Pravega Ventures |

| 12 Mar 2024 | Fiona Diamonds | Ecommerce | D2C | B2C | $723k | Seed | Venture Catalysts, AC Ventures, Anikarth Ventures, Shantanu Deshpande, Eco Brilliance, Suraj Nalan. | Venture Catalysts |

| 12 Mar 2024 | Attron Automotive | Deeptech | Hardware & IoT | B2B | $573k | Seed | Anicut Capital, Venture Catalysts, Pontaq VC, Yashovardhan Shah | Anicut Capital, Venture Catalysts |

| 11 Mar 2024 | Authpay | Fintech | Payments | B2C | $450k | – | SCOPE VC | SCOPE VC |

| 14 Mar 2024 | Pumpumpum | Travel Tech | Transport Tech | B2C | $241k | – | Inflection Point Ventures | Inflection Point Ventures |

| 13 Mar 2024 | Indicold | Logistics | Storage Services | B2B | Pre-Series A | Fundalogical Ventures | ||

| Source: Inc42 *Part of a larger round Note: Only disclosed funding rounds have been included |

||||||||

Key Startup Funding Highlights Of The Week

- Perfios’ $80 Mn fundraise was the largest round of the week.

- Supported by Perfios’ funding, the fintech sector emerged as the most funded sector, propelling startups to raise a total of $91.5 Mn. The sector also received the highest number of 4 deals.

- Seed funding regained its pace with startups securing $5.9 Mn, a 655% jump from last week’s $904k.

- Venture Catalysts emerged as the most active investor this week, investing in Fiona Diamonds and Attron Automotive.

Mergers and Acquisitions This Week

Other Major Developments

- The Competition Commission of India (CCI) has given its nod to the merger of fintech unicorn slice with North East Small Finance Bank.

- Bengaluru-based on-demand driver aggregator DriveU told Inc42 that is seeks a funding of around $10 Mn in its Series B round.

- Omnichannel jewellery startup BlueStone is eyeing to acquire a $9 Mn debt from VC firm Trifecta Capital. To raise the capital, the startup’s board passed a resolution to allot ‘Series X1 Debentures’ to Trifecta Venture Debt Fund-III last month.

- A91 Partners is in the final stage to raise its largest ever fund to date at $700-750 Mn. The investment firm is eyeing the fund launch in a few months.

- Dealing with unsustainable business models, two fashion startups Virgio and Fashinza have initiated a process to return most of the proceeds they had raised from marquee investors like Prosus Ventures and Accel.

- VC firm Peak XV Partners announced its plans to launch an evergreen perpetual fund called Peak XV Anchor Fund to enable the firm’s leadership to invest in future funds as well as partner with other fund managers.

- Stock broking startup Zerodha is in preliminary discussions with multiple investors to secure a $100 Mn investment for its asset management company (AMC), Zerodha Fund House. However, Zerodha Fund House, in a statement, told Inc42 that it is currently not engaged in any conversations to raise external funding.

- 8i Ventures floated a seed funding programme, Origami, to support early-stage founders. Select startups will be offered an initial funding ranging between $250K and $2 Mn.

- Small Industries Development Bank of India (SIDBI) secured $24.5 Mn from UN’s Green Climate Fund (GCF) for its $120 Mn climate focussed fund Avaana Sustainability Fund (ASF).

- Prath Ventures has raised $14.5 Mn from SIDBI Funds of Funds, several other angel investors and family offices, marking the second close of its INR 225 Cr fund.

- Eyeing global expansion, gaming major Nazara has set aside $100 Mn for mergers and acquisitions over the next two years.

- Alternative credit platform BlackSoil NBFC raised an equity of $12 Mn (INR 100 Cr) from its existing Indian investors and family offices through a rights issue.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)