In the tumultuous period of 2019-2020, social media was ablaze with allegations against BYJU’S, accusing the edtech giant of employing ‘predatory’ tactics and misselling. Reports surfaced, suggesting that BYJU’S utilised dubious methods while marketing consumer loans of its partners, cleverly disguised within its educational courses and bundled with Chinese tablets.

The company faced further scrutiny for silencing critics on social media by invoking ‘copyright’ violations, which resulted in the removal of numerous posts and videos from platforms like Twitter, LinkedIn, and YouTube.

Dr. Aniruddha Malpani, an angel investor and physician with a substantial following, found himself at the centre of the controversy, as his critical stance against BYJU’S led to the removal of his content and suspension from various social media platforms. It’s worth noting that BYJU’S was also one of the leading advertisers on these platforms.

Fast forward to June 2023, and the narrative takes an unexpected turn and it’s been a year where the company has only found itself among the headlines for the wrong reasons.

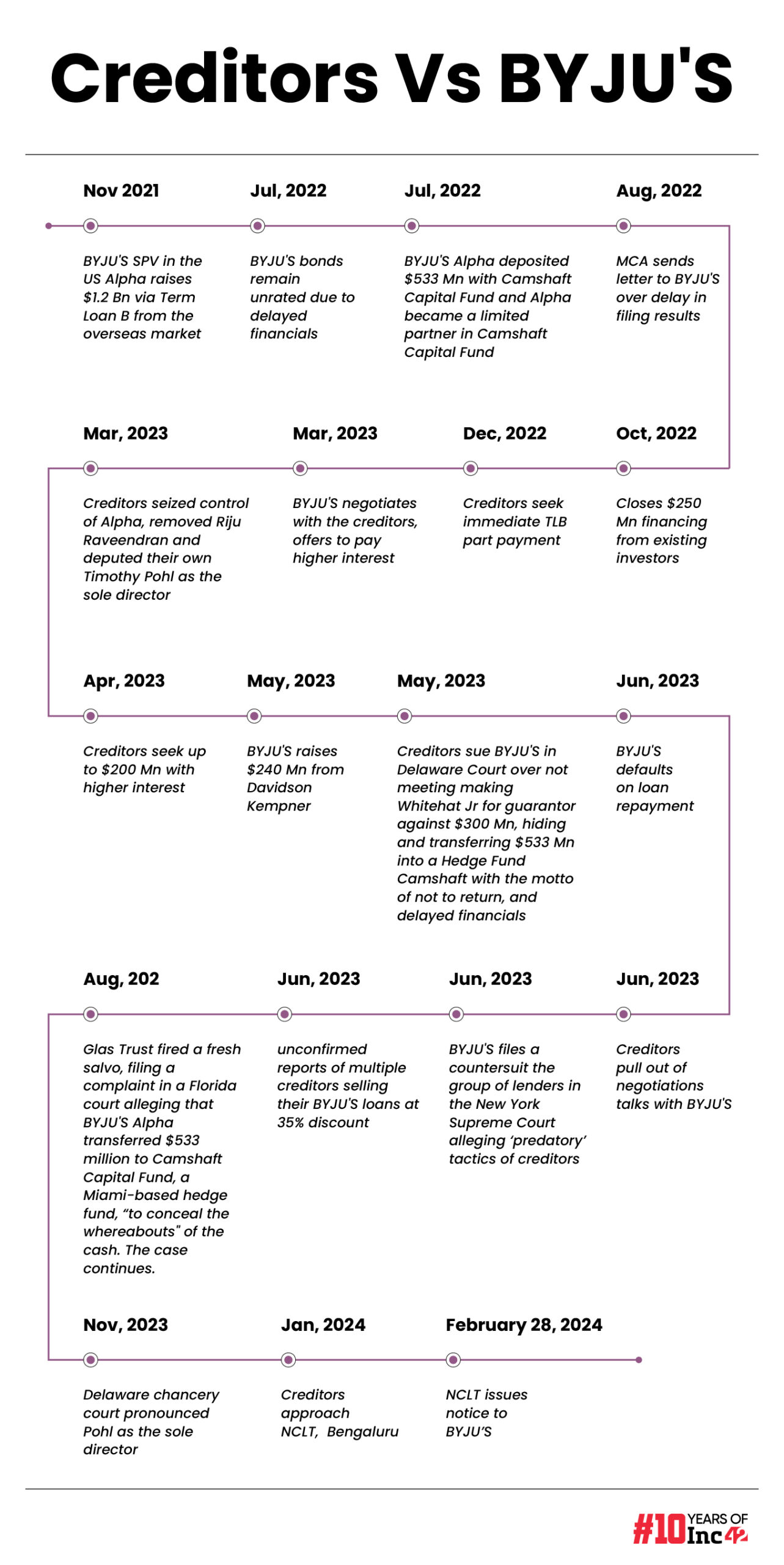

First up is a fight against lenders who accused the company of improperly using funds and breaking loan covenants. BYJU’S retaliates by filing a counter lawsuit against its creditors in a New York Court, accusing them of adopting ‘predatory’ practices. Simultaneously, the creditors initiate proceedings at the National Company Law Tribunal (NCLT) in Bengaluru, seeking to commence the insolvency process against BYJU’S to recoup their investments.

However, the challenges don’t end there. There’s also a fight with investors on the cards.

The company, once valued at $22 Bn, now faces a staggering 99% devaluation, plummeting to $225 Mn. Even friendly investors, once allies, turn adversaries, citing corporate governance mishandling and exiting the board. Legal troubles pile up, with the investors, Enforcement Directorate (ED) issuing a show cause notice for Foreign Exchange Management Act violations, and the Board of Control for Cricket in India (BCCI) filing an insolvency petition against BYJU’S for defaulting on INR 158 Cr after unilaterally terminating the Team India jersey contract.

BYJU’S is fighting over a dozen cases amounting to over $1.5 Bn. The question is will the right issue of over $200 Mn, which it can’t use until the High Court says so, be enough to meet the needs even in the short term?

lockquote>

As the company grapples with these challenges, including cofounder and group CEO Byju Raveendran resorting to mortgaging his home to pay employees’ salaries with February salaries of some of the employees still due, the question looms: Can BYJU’S navigate through this complex legal terrain and emerge unscathed?

Investors Fighting To Oust The Founder

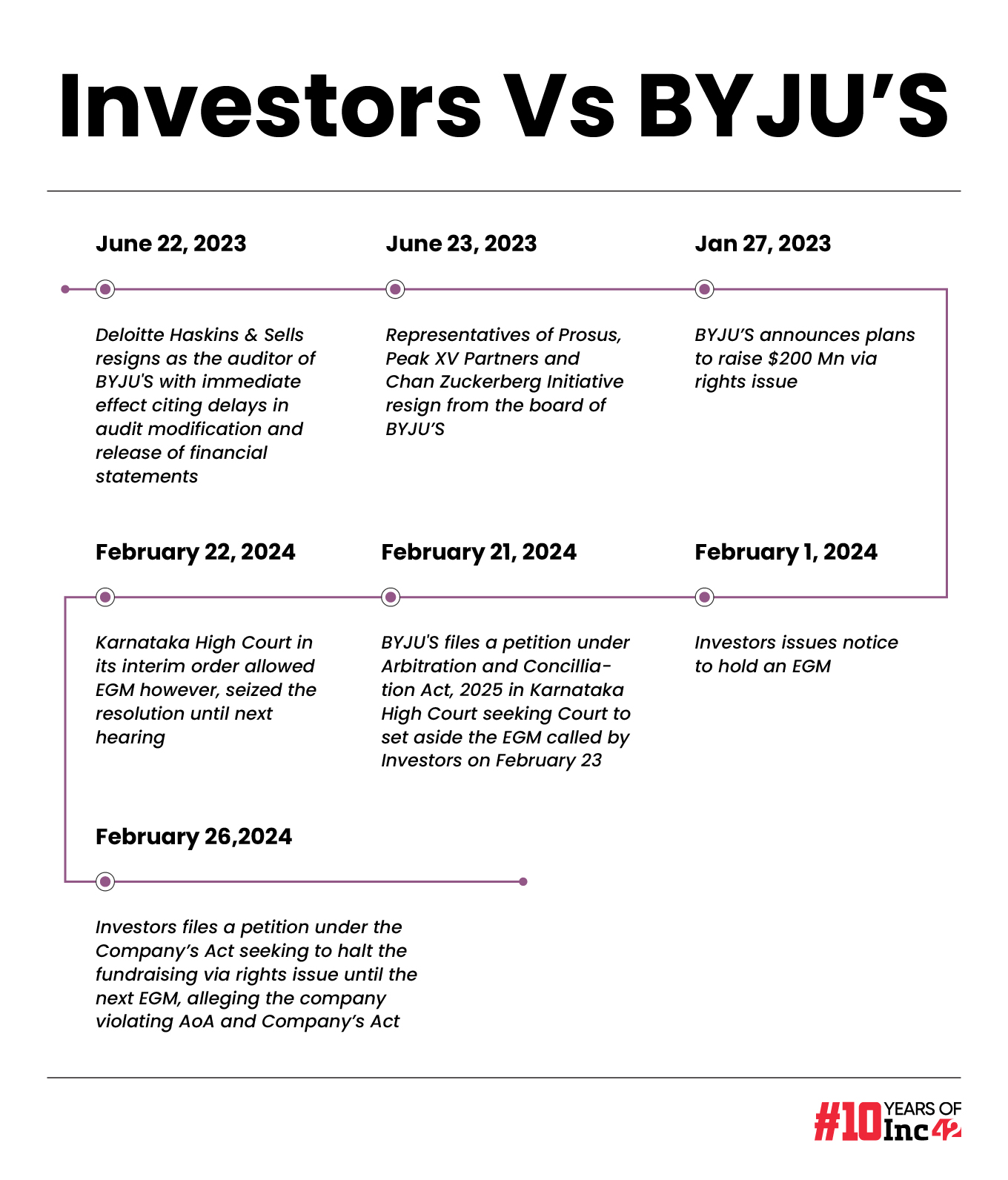

The unofficial war between BYJU’S promoters — Byju, brother and director Riju Ravindran, and cofounder Divya Gokulnath got official after the the representatives of Prosus, Peak XV Partners and Chan Zuckerberg Initiative resigned from the board in June 2023.

Since then, despite constituting a board advisory committee (BAC) to provide strategic advice to the CEO on matters related to the governance structure, the gap between the investors and the promoters has only worsened.

To the extent that investors on February 23, 2023 called for an EGM and passed a resolution seeking the resignation of Byju Raveendran as the CEO. This was after BYJU’S announcement to raise $200 Mn through rights issue at $25 Mn valuation.

lockquote>

However, anticipating this to happen, BYJU’S had filed the petition under Section 9 of The Arbitration and Conciliation Act, 1996, arguing that certain investors, including General Atlantic, Chan Zuckerberg Initiative, MIH EdTech Investments, Own Ventures, Peak XV Partners, SCI Investments, SCHF PV Mauritius, Sands Capital Global Innovation Fund, Sofina and T. Rowe Price Associates, had violated the Articles of Association (AoA), the Shareholders’ Agreement (SHA), and the Companies Act, 2013 by calling for an EGM.

High Court, while Green signalled the EGM, put the EGM resolution on hold until the next hearing.

Speaking to Inc42, one of the advocates representing BYJU’S in the Karnataka High Court said that there are multiple grounds to assert that the EGM called by the investors on February 23 was not legal.

For instance, the notice was served to the promoters as mandated under the Companies Act. Secondly, as per the Article of Association (AoA) and the shareholding agreement, promoters need to be present during the EGM.

Three days after the EGM, investors went to the NCLT, Bengaluru, seeking resolution under the Companies Act. In their petition, investors alleged:

- The rights issue in excess of the Authorised Share capital of the Company is not allowable under the Companies Act

- There are various irregularities against the Company and the matter is also under investigation before the Enforcement Directorate(ED)

- Fundraising plans via rights issue without increasing the company’s authorised shares capital violates Section 62 of the Companies Act

- The Company had committed to giving the information/documents within a period of the next five business days, however the same was not given

- No financial audit has been done for the financial year 2022-23; earlier also such audits were substantially delayed

- The company did not share information regarding financial irregularities, the ongoing ED investigation, IBC proceedings and other litigations, a direct violation of Article of Association Article 121 and 197

The Investors demanded an interim order seeking:

- To maintain the operation and effect of the rights issue

- Let EGM be held and resolutions passed to be accepted

- Clarify the purpose and of the rights issue and how the funds will be utilised

At the last hearing on the validity of the EGM on March 13, 2024, the Karnataka High Court extended the stay on the implementation of the resolutions passed by the investors till March 28.

It must be noted that during the EGM last month, the company’s investors passed a total of seven resolutions, including those calling for a change in the board structure of the embattled edtech giant and removal of founder and CEO Byju Raveendran, cofounder Divya Gokulnath and director Riju Ravindran from their respective management roles.

BCCI Insolvency Case Against BYJU’S

“We’ve all grown up watching cricket, cherishing our association with the Men in Blue with immense pride. Partnering with the BCCI for the Indian Team Jersey was a dream come true,” BYJU’S Group CEO Raveendran said soon after the collaboration with the BCCI.

Nobody could deny that this was a major coup.

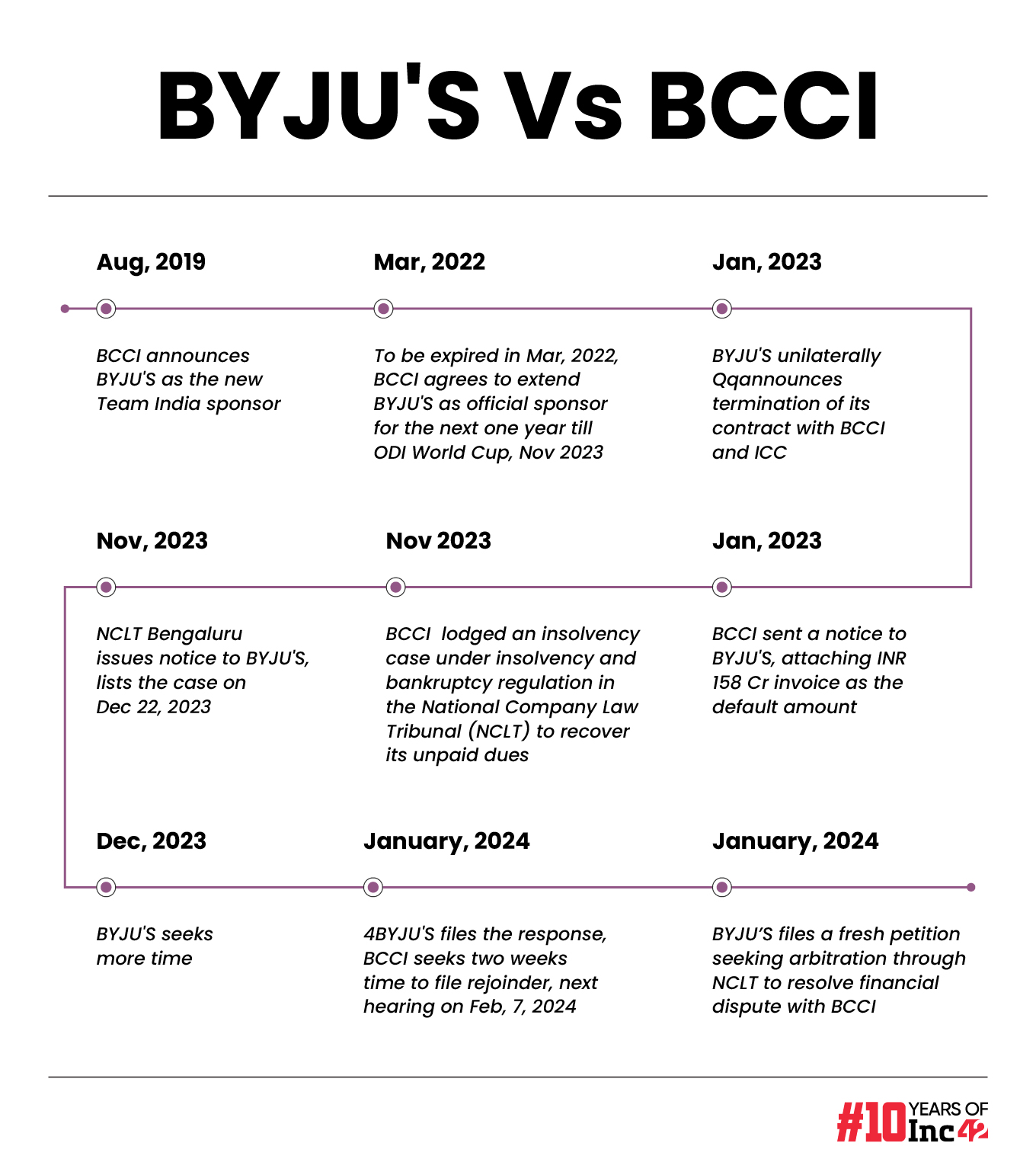

BYJU’S, in August 2019, achieved the status of the official partner of Team India for the next three years, concluding in March 2022. As part of this agreement, the company’s logo adorned the shirts of Indian players across all formats for both men and women’s teams.

The edtech giant had committed to paying around INR 4.61 Cr per match for certain matches and around INR 1.51 Cr per match for others.

In March 2022, BYJU’S also requested an extension of the contract till November 2023 and reached a deal with BCCI at INR 457 Cr ($55 Mn).

Beyond cricket, the company secured a contract with FIFA for the football World Cup in Qatar in 2022 at $40 Mn and signed the renowned football player Lionel Messi in 2022 as a brand ambassador for its foundation arm, despite laying off over 2,500 employees for cost-cutting reasons.

Troubles for BYJU’S began surfacing in November 2022, leading to the abrupt termination of its contract with BCCI in January 2023.

Post-termination, BCCI sent an email to BYJU’S, requesting the remaining payment of INR 158 Cr. However, even after 10 months, BYJU’S failed to comply. Consequently, BCCI filed an insolvency petition against the company under Section 9 of the Insolvency & Bankruptcy Code 2016.

Current Status: BYJU’S has responded to the notice issued by NCLT, Bengaluru, while BCCI requested two more weeks to file a rejoinder on January 17, 2024. The case is scheduled for a hearing on February 7, 2024.

Prashant Shivadass, Partner, Shivadass & Shivadass Law Chambers, told Inc42, “BCCI should have gone for the arbitration first. That’s the established way, if a contract of such nature goes wrong.”

In a fresh application, BYJU’S has sought arbitration through NCLT to resolve the financial dispute with BCCI, and the NCLT is likely to pronounce the order by next week.

BYJU’S argued that the BCCI did not render any service post the culmination of the contract between the two parties. Thus, the BCCI’s claims of pending dues to the tune of INR 158 Cr from BYJU’S cannot be considered as an operational credit, as per sources close to the company.

The Curious Case Of The $1.2 Bn Term Loan B

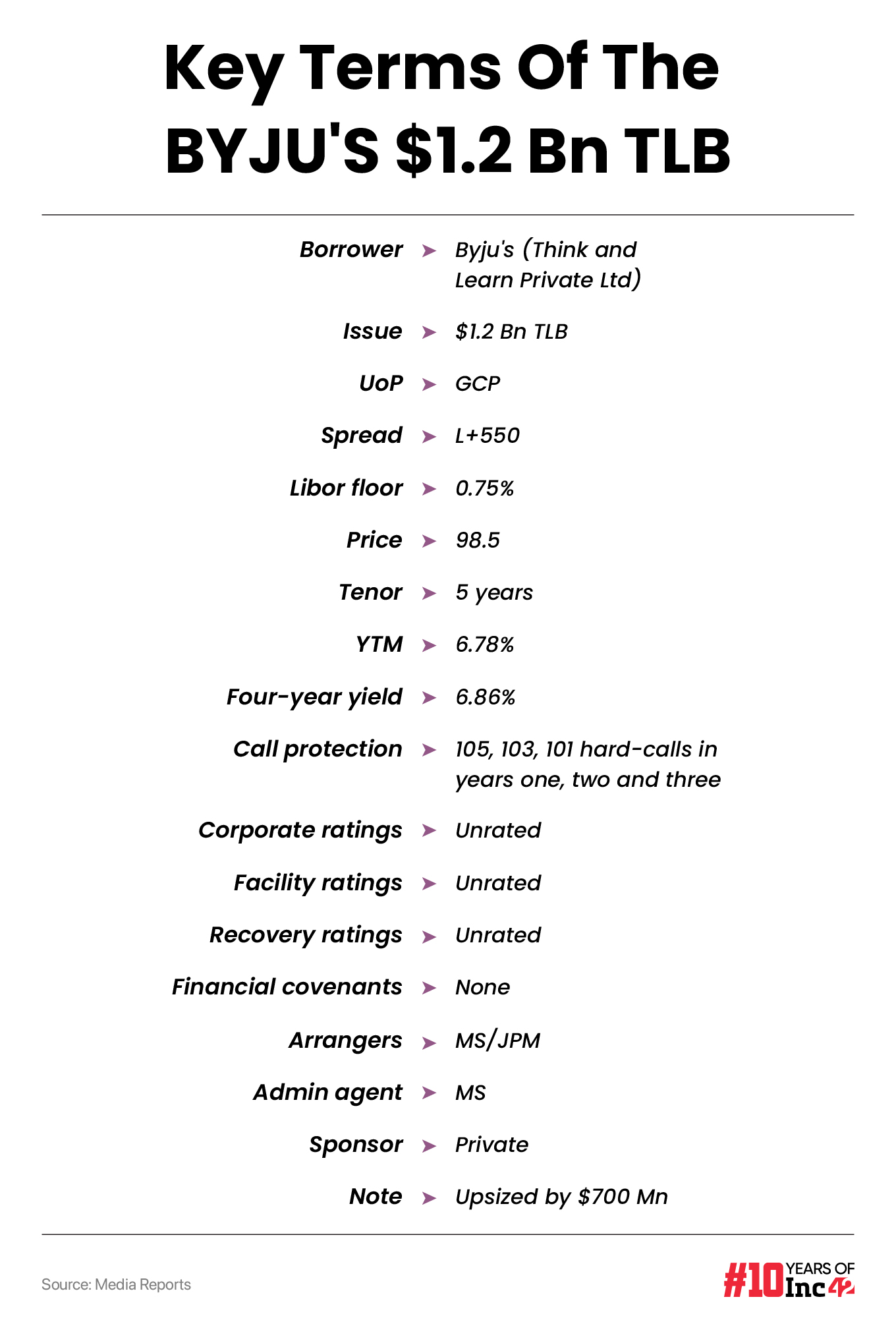

How often it happens to you that you go to a supermarket to buy things worth INR 5,000 but you end up buying INR 10,000. In the case of BYJU’S, the loan shopping in the US meant, it went looking for a $500 Mn loan but instead the deal was upsized by $700 Mn.

In 2021, BYJU’S secured a $1.2 Bn loan to support its business growth needs till 2026. Investment bankers such as Morgan Stanley and J P Morgan drove this deal which had certain terms or covenants: the loan had a fixed interest rate (L+550, with a minimum interest rate of 0.75% Libor), and it was issued at a discounted price of 98.5.

BYJU’s parent company, Think & Learn, was supposed to get a credit rating from at least two of S&P Global Ratings, Moody’s, or Fitch within nine months, failing which the interest rate on the loan will increase to L+600.

Due to the delayed financials, BYJU’S could not secure a credit rating either from Moody’s or from S&P, which set off a chain of events that compelled lenders to move courts.

The loan was supposed to be used for various general company needs, mainly for business growth in North America and potential strategic opportunities.

After BYJU’S failed to secure a rating, the loans by original creditors are believed to have been sold to others at 20-35% discounts.

In May, 2023, Glas Trust acting as an administrative agent on the behalf of 37 creditors sued BYJU’S Alpha, BYJU’S SPV in the US, its director Riju Raveendran, brother of Byju Ravindran in the Delaware Chancery Court for not meeting the two technical requirements as per the Term sheet.

BYJU’S could not get RBI’s approval for Whitehat Jr as guarantor nor was it able to share audit reports in a timely manner, as a result of which, the unrated loan price in the market had gone down by 35%.

Creditors had meanwhile also removed Riju Ravindran from BYJU’S Alpha, Inc. and had made Timothy Pohl, the representative appointed by the lenders, as the sole director.

This was approved by the Delaware Court. “WhiteHat’s failure to accede as a guarantor constituted an event of default, entitling Glas to send a default notice. It follows that Glas’s and Pohl’s actions were valid unless one of the defendants’ defence succeeds,” judge Zurn ruled.

In response, BYJU’S skipped the $50 Mn as part of loan repayment in June, 2023 and filed a countersuit in New York Court.

BYJU’S in its countersuit, made a few points:

- The default claims of the creditors are ‘bogus’

- The company is ready is raise the loan rate as per the term sheet

- The creditors are using predatory tactics to make BYJU’S go bankrupt

In September 2023, Glas Trust escalated the situation by filing a fresh complaint in a Florida court alleging that BYJU’S Alpha transferred $533 Mn to Camshaft Capital Fund, a Miami-based hedge fund, with the intention of hiding the cash’s whereabouts. This case is ongoing.

When asked that Camshaft return the money to creditors, David Massey, a lawyer representing Camshaft wrote in a letter dated 4 December stating BYJU’S Alpha is a former limited partner of Camshaft Capital Fund, LP, and was never a limited partner of any other Camshaft entity.

“As such, BYJU’S Alpha’s demand for books and records is rejected because BYJU’S Alpha has no statutory right or standing to demand books and records from Camshaft Capital Fund, LP (or any other Camshaft entity identified in your letter). Nor does BYJU’S Alpha have any rights under the Limited Partnership Agreement between BYJU’S Alpha and Camshaft Capital Fund, LP, as a former limited partner with a zero-balance capital account,” the letter reads.

lockquote>

While the New York court and Florida court’s hearings are still pending, the creditors have now approached the NCLT Bengaluru to speed up the solvency process. The case was registered on February 22, 2024 and the NCLT has issued notice to BYJU’S. The next hearing is on April 3, 2024.

While a US bankruptcy court ordered the arrest of a hedge fund manager on March 14, 2024, for allegedly helping BYJU’S hide $533 Mn, the edtech major shot back a day later. The company accused TLB lenders of being opportunistic and building fake narratives in the media to tarnish its image. BYJU’S also claimed that the judge quashed the lenders’ request seeking the deposit of the $533 Mn with the court.

ED’s Notice For INR 9,000 Cr FEMA Violations

On April 27 and 28, 2023, the Directorate of Enforcement (ED) conducted searches and seizure action at Byju Raveendran’s residence and two of the company premises in Bengaluru under the provisions of Foreign Exchange Management Act (FEMA).

The ED seized various incriminating documents and digital data. In a statement, the apex agency stated that the company received foreign direct investment to the tune of INR 28,000 Cr during the period from 2011 to 2023.

Further, the company also remitted INR 9,754 Cr to various foreign jurisdictions during the same period in the name of overseas direct investment. The company booked around INR 944 Cr in the name of advertisement and marketing expenses including the amount remitted to foreign jurisdiction.

The agency also claimed that before the search and seizure conduct, several summons were issued to CEO Raveendran, however, he is said to have remained evasive and never appeared during the investigation.

After an initial investigation, in November 2023, ED issued show cause notices to BYJU’S and its CEO alleging violations of FEMA, 1999, amounting to INR 9,362.35 Cr.

The company was accused of significant foreign remittances and investments abroad, allegedly breaching FEMA, 1999, resulting in a loss of revenue for the Indian government. ED had also recorded statements from CFO and Raveendran among other leaders of the company.

And, it concluded that BYJU’S and Raveendran violated FEMA provisions by not submitting documents for imports against advance remittances, not realising proceeds from exports made abroad, delaying filing documents for FDI, not filing documents for remittances made abroad, and not allocating shares against FDI received.

After the show cause, BYJU’S also issued a statement and said that the queries in the notice are mainly technical.

The technical issues mentioned in the notice revolve around the delay in filing Annual Performance Reports (APRs) related to compliant Overseas Direct Investment (ODI) of approximately INR 8,000 Cr, resulting from a delayed statutory audit for the fiscal year 2022.

Current Status: The ED has not filed the chargesheet yet. Meanwhile, since the show cause notice, BYJU’S has filed the financials for FY22 and has yet to release them for FY23. As reported exclusively by Inc42, the edtech giant is expected to report total revenue of around INR 6,500 Cr for FY23, 23% higher than FY22.

An ED source informed Inc42 that the ED is looking into the details. Prima facie, there seems to be discrepancies while matching the account statements and the revenue declared. However, an official statement will be released only after it arrives at the conclusion.

Savitri Srirangam Vs BYJU’S

In January 2024, Savitri Srirangam had filed a petition under Section 11(6) of the Arbitration and Conciliation Act, 1996 (hereinafter, ‘1996 Act’) citing a lease deed dated November 24, 2021.

As per the lease deed between Srirangam and BYJU’S, a property spread in 840 sq yards belonging to the former was leased out to BYJU’S for a period of five years and was set to expire on November 23, 2026. The lease had a lock in period till July 23, 2023.

Srirangam had sent an email dated April 6, 2023 asking BYJU’S to vacate the premises after the lock-in period that is by July 24, 2023.

Thereafter, on July 27, 2023, another reminder was sent. However, BYJU’S declined to vacate the premise stating that it had not defaulted on any contractual obligations and that the matter ought to be referred to arbitration.

Matter will now be heard on April 1, 2024.

Fab Hotels vs Think And Learn Pvt Ltd

BYJU’S has even defaulted on its travel subscription agreement.

In November, 2023, Fab Hotels had filed a petition under the Arbitration Act in Delhi High Court seeking to appoint an arbitrator to adjudicate disputes arising between Fab Hotels and BYJU’S. Fab Hotels had earlier sent a legal notice to BYJU’S on July 20, 2023 to make payment for the sum of INR 21.74 Lakhs and interest thereupon.

However, BYJU’S didn’t respond to the legal notice.

Hearing the case on January 9, 2023, the Delhi High Court referred the case under the aegis of Samadhan, Delhi High Court Mediation and Conciliation Centre. The Court ordered the parties to appear before the Centre. If the dispute is not resolved through mediation, the case will be handed over to the Delhi International Arbitration Centre of the Delhi High Court.

Karnataka State Employees Union Vs BYJU’S

The timeline traces back to October 2022 when the Karnataka State IT/ITeS Employees Union (KITU) lodged an industrial dispute against the BYJU’S management, accusing them of pressuring employees into resigning.

According to KITU general secretary Sooraj Nidiyanga, BYJU’S allegedly used intimidation and coercion tactics to compel its employees to resign.

KITU has formally raised the industrial dispute with the Deputy Labour Commissioner, Bengaluru Division-2, seeking the reinstatement of the dismissed employees along with their back wages, continuous service, and associated benefits. The union has issued a call for solidarity among all IT/ITeS employees to support their cause.

In September 2023, The KITU filed a petition under the Industrial Disputes Act in a Bengaluru District Court.

Surfer Technologies Vs BYJU’S

Not just Fab Hotels, BCCI, BYJU’S defaulted on a slew of vendors too. Surfer Technologies, a company that helps companies by generating leads for them, claimed to have not received INR 2.3 Cr due from BYJU’S.

On January 9, 2024, Surfer Technologies filed an insolvency plea with NCLT praying to order BYJU’S return the INR 2.3 Cr, as admitted by BYJU’S.

Teleperformance Vs BYJU’S

BYJU’S has allegedly also not paid INR 3 Cr to another vendor France-based Teleperformance and terminated the contract unilaterally. Teleperformace was working closely with BYJU’S India for various customer service functions and sales operations. According to reports, it also helped the edtech major to onboard new students for courses.

The French company also filed an insolvency petition on November 4, 2023 and was registered on January 25, 2024.

Can BYJU’S Survive The Legal Battle?

What started as delayed financial audits went on to become a big issue in terms of corporate governance and plenty of concern around what will happen to the company which was once the poster child of Indian tech startups.

The question is can BYJU’S investors really shy away from all the wrongdoings that occurred at BYJU’S? Can the entire blame be put on CEO Byju Raveendran and the higher management?

It must be noted that investors on the company board exited only when the ship hit the rocks, and as some sources have indicated to us, this was largely to avoid liabilities that come with having invested money in a company which is suspected to be hiding facts and figures.

Investors on the board were supposed to alarm the founders in time if the business was going off track, but instead they let the company go haywire and secure loans without a concrete plan. Many of them continued to invest again and again despite lack of disclosures on the companies part, which has now turned into litigation.

Another investor in the company told us that Raveendran did not share most of the issues with the board. There was hardly any transparency. As per the article of association and SHA, the company was bound to share the details pertaining to ED raids, MCA notices and delay in financials, for instance.

Besides this, they have raised other red flags such as defaulting on loan covenants and investing $534 Mn in a hedge fund where the company is the beneficiary. “We were told things like it would happen soon or that issues, if any, will be sorted out. The management promised financials will be out soon or that they are being delayed because of ongoing acquisitions. There were a number of excuses.”

Corporate governance, a critical aspect for any company, was clearly compromised in BYJU’s aggressive expansion phase.

The emphasis on hyper-scaling, extensive advertising, and multiple acquisitions without a robust governance framework has directly led to the current predicament. The lack of oversight and checks on the company’s trajectory has led to financial mismanagement and legal entanglements. Here, investors cannot wash their hands off their responsibilities either, despite claiming that the company was dishonest in its disclosures.

The many legal skirmishes threaten to end the journey and promise of BYJU’S. The response to these legal battles and the leadership’s ability to navigate the complex terrain will shape its future. The ED show cause notice and the fight with government authorities adds another layer of complexity.

Even as cofounder and CEO Raveendran has claimed to have resorted to personal sacrifices to meet payroll obligations, the fate of BYJU’S hangs on its legal disputes and not its business or innovation.

[Edited By Nikhil Subramaniam]

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)