SUMMARY

Indian startups cumulatively raised $204.84 Mn across 14 deals

Pocket FM raked in $103 Mn, marking the only mega deal this week

Ecommerce attracted the maximum number of cheques this week with startups in the space securing $54.1 Mn via three deals

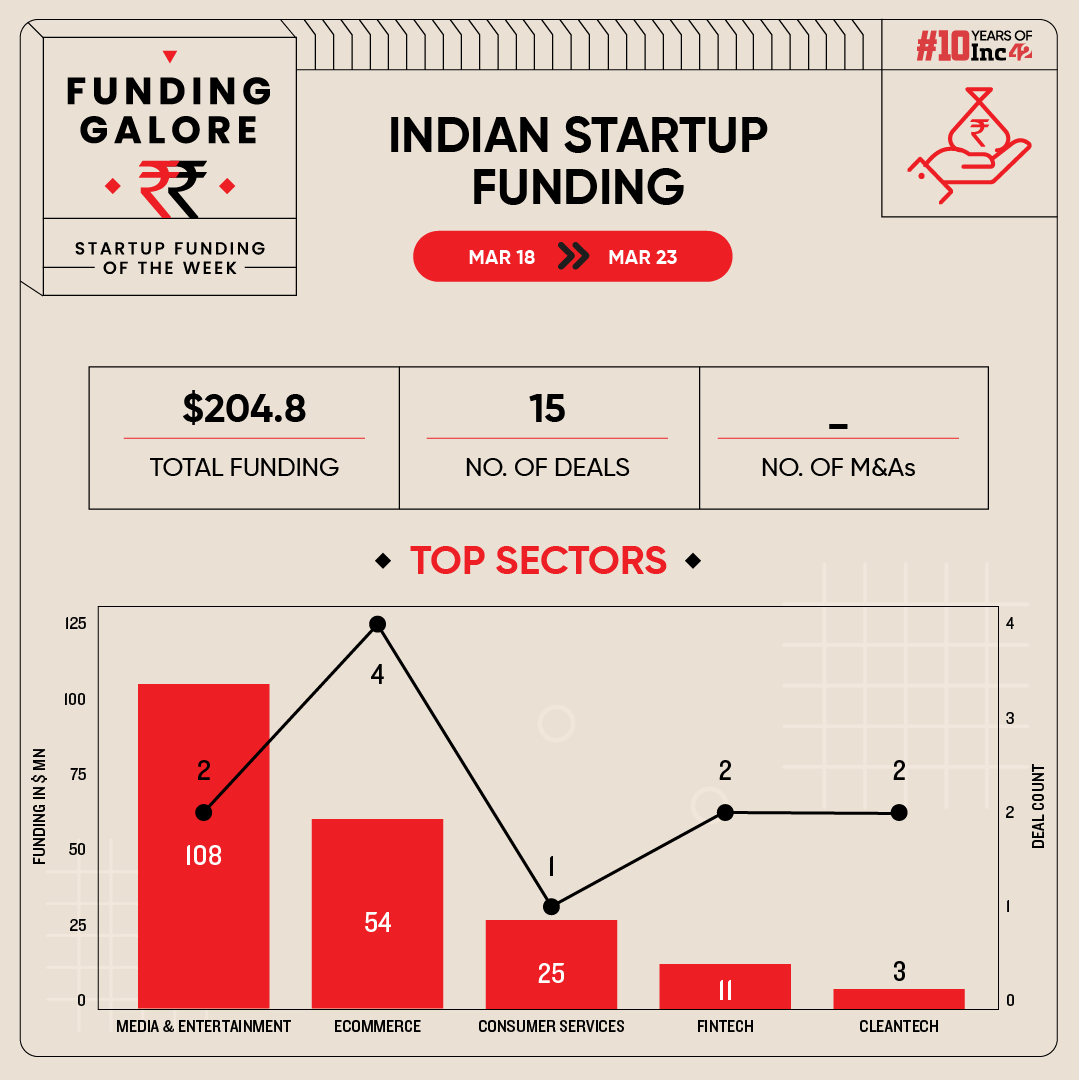

Investment activity across the Indian startup ecosystem saw a marginal dip in the third week of March after an uptick. Between March 18 and 23, startups cumulatively raised funding of $204.84 Mn across 14 deals, a 10% drop from $226.2 Mn across 18 deals in the preceding week.

The week also saw audio entertainment platform Pocket FM raising $103 Mn in its Series D funding round from Lightspeed and Stepstone Group. Besides, the company is also in talks with Abu Dhabi Investment Authority (ADIA) for a fresh fundraise which will likely value it at around $1.2 Bn.

Funding Galore Indian Startup Funding Of The Week [Mar 18- Mar 23]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 20 Mar 2024 | Pocket FM | Media & Entertainment | OTT | B2C | $103 Mn | Series D | Lightspeed, Stepstone Group | Lightspeed |

| 20 Mar 2024 | Ultrahuman | Ecommerce | D2C | B2C | $35Mn | Series B | Blume Ventures, Steadview Capital, Nexus Venture Partners, Alpha Wave Incubation and Deepinder Goyal | – |

| 18 Mar 2024 | Curefoods | Consumer Services | Hyperlocal Delivery | B2C | $25 Mn | – | Three State Ventures | Three State Ventures |

| 18 Mar 2024 | Jumbotail | Ecommerce | B2B Ecommerce | B2B | $18.3 Mn | Series C3 | Artal Asia, Heron Rock, Sabre Investment, Arkam Ventures, Jarvis Reserve Fund, Reaction Global and VII Ventures | Artal Asia |

| 20 Mar 2024 | Optimo Loan | Fintech | Lending Tech | B2B | $10 Mn | Seed | Blume, Omnivore, Prashant Pitti. | Blume, Omnivore |

| 20 Mar 2024 | Liquidnitro Games | Media & Entertainment | Gaming | B2C | $5.25 Mn | Seed | Nexus Venture Partners and others | Nexus Venture Partners |

| 19 Mar 2024 | Sprih | Cleantech | Climate Tech | B2B | $3 Mn | Seed | Leo Capital, others | Leo Capital |

| 18 Mar 2024 | HCIN Networks | Enterprisetech | Enterprise Services | B2B | $1.5 Mn | Equity | Swastika Investmart, Ankit Mittal, Vijay Khetan, Ageless Capital, MSB E-Trade Securities, others | Swastika Investmart |

| 18 Mar 2024 | Beatoven ai | Enterprisetech | Horizontal SaaS | B2B | $1.3 Mn | pre-Series A | Capital 2B, IvyCap Ventures, Upsparks Capital, Rukam Capital, others | Capital 2B |

| 19 Mar 2024 | Vobble | Edtech | Skill Development | B2C | $1 Mn | Seed | Lumikai, Blume Founders Fund, others | Lumikai |

| 19 Mar 2024 | Relso | Ecommerce | D2C | B2C | $840k | Pre-Seed | Ventures Catalysts, Inflection Point Ventures, Ramakant Sharma, Shantanu Deshpande, Saurabh Jain | Ventures Catalysts and Inflection Point Ventures |

| 22 Mar 2024 | Yenmo | Fintech | Investment Tech | B2C | $500k | – | Y Combinator | Y Combinator |

| 18 Mar 2024 | BNZ Green | Cleantech | Climate Tech | B2B | $100k | Pre-Seed | Climate Detox, others | Climate Detox |

| 20 Mar 2024 | Rock Paper Rum | Alcoholic beverage | Alcoholic beverage | B2C | $59k | – | Vineeta Singh | Vineeta Singh |

| 21 Mar 2024 | Droom | Ecommerce | Automobile Marketplace | B2C | – | – | Badshah | Badshah |

| Source: Inc42 *Part of a larger round Note: Only disclosed funding rounds have been included |

||||||||

Key Startup Funding Highlights Of The Week

– Pocket FM logged the largest-ticket transaction this week.

– Media and entertainment became the most funded sector this week, catapulted by Pocket FM’s $103 Mn funding. To be sure, the space saw a cumulative investment of $108.25 Mn across two deals.

– Ecommerce saw a maximum number of funding deals this week, with startups operating in the space bagging $54.14 Mn via four deals.

– Early stage startups raised $19.25 Mn this week largely driven by seed funding rounds. This is a 326% increase from last week’s $5.9 Mn.

– Nexus Venture Partners emerged as the most active investor this week, writing cheques for Liquidnitro Games and Ultrahuman.

IPO Updates

– The initial public offering (IPO) of SaaS cybersecurity startup TAC Infosec, also known as TAC Security, will kick off on March 27. The startup is looking to raise $3.5 Mn from its public debut.

– Fintech SaaS company Trust Fintech Limited’s IPO is set to open on March 26. The company plans to net INR 63.45 Cr from the public offering.

Other Major Developments

– US-based venture capital (VC) firm Alphatron Capital (formerly SMK Ventures) closed its maiden fund at $30 Mn. The fund will majorly invest on startups across SaaS, fintech, healthtech, AI/ML, digital content and D2C sectors.

– Fintech-focused VC Cedar Capital has marked the first close of its $30 Mn FinTech Venture Capital fund. It aims to back around 15 early stage startups in the fintech space.

– VC firm B Capital has announced the close of its ‘Opportunities Fund II’ at $750 Mn. The fund received commitments from both existing and new investors, including private and public pension funds and family offices, among others.

– Edtech startup Toprankers has acquired the judiciary arm of Lucknow-based Coach Up IAS. However, the startup did not disclose the financial terms of the deal.

– Investment fund Malabar Investments is seeking a stake in SUGAR Cosmetics via secondary deal worth $9 Mn- $12 Mn.

– The Good Glamm Group is in final stages of discussion to close a $70 Mn funding round as it gears up to go public next year, sources told Inc42.

– After a 13-year stint, Nexus Venture Partners’ Managing Director Sameer Brij Verma has stepped down to float his own investment fund majorly focussed on early stage startups.

– Delhi NCR-based used car marketplace, Spinny, is expanding its ESOP pool by granting an additional 24 Mn options.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)