SUMMARY

GoldPe will cease to exist precisely one year after its inception on April 1, 2023

Cofounded by Shah and Yaagni Raolji, GoldPe allowed users to invest in digital gold and leverage its prize-linked savings (PLS) offering for windfall gains

Another major trigger behind Shah’s decision to pull the plug on his startup was linked to his fear of the country’s complicated regulatory regime

Ahmedabad-based fintech startup GoldPe will cease to exist precisely one year after its inception on April 1, 2023. Speaking with Inc42, the cofounder of the investment tech startup Parth Shah said that the decision has been taken in the absence of revenues, a flawed business model, and cash flow issues.

Cofounded by Shah and Yaagni Raolji, GoldPe allowed users to invest in digital gold and leverage its prize-linked savings (PLS) offering for windfall gains. It had a total user base of 2.25 Lakh individuals.

Despite the growing traction, the startup failed to secure the additional funding necessary to keep going, Shah said. He added that at the time of its incorporation, the startup had INR 71 Lakh, which the cofounders secured from 100X.VC and a group of angel investors for their first startup, SPAC, in 2022.

With the previously acquired funding drying out, the duo were actively seeking to secure fresh funding from investors to sustain GoldPe, but to no avail.

Shah said that while GoldPe’s PLS concept impressed many investors, the startup could not do much in terms of raising funds as it could only generate INR 1.5 Lakh in revenue in one year, as per Shah.

GoldPe earned a 3% commission selling digital gold in partnership with integrated gold player Augmont. It then utilised a third of this revenue to fund weekly draws in which users could win up to INR 10 Lakh upon buying digital gold worth INR 100 and above.

“The model, which was focussed solely on rewarding users, could not generate enough revenues. While consumer lending could have solved this issue, it just wasn’t the direction we wanted to take. We are incredibly grateful to our users for being a part of our journey. We are working diligently to ensure a smooth transition for our users,” Shah told Inc42.

The startup had plans to expand into saving assets other than digital gold after it had achieved a user base of 5 Lakh. These assets would have included fixed deposits (FDs) and recurring deposits (RDs).

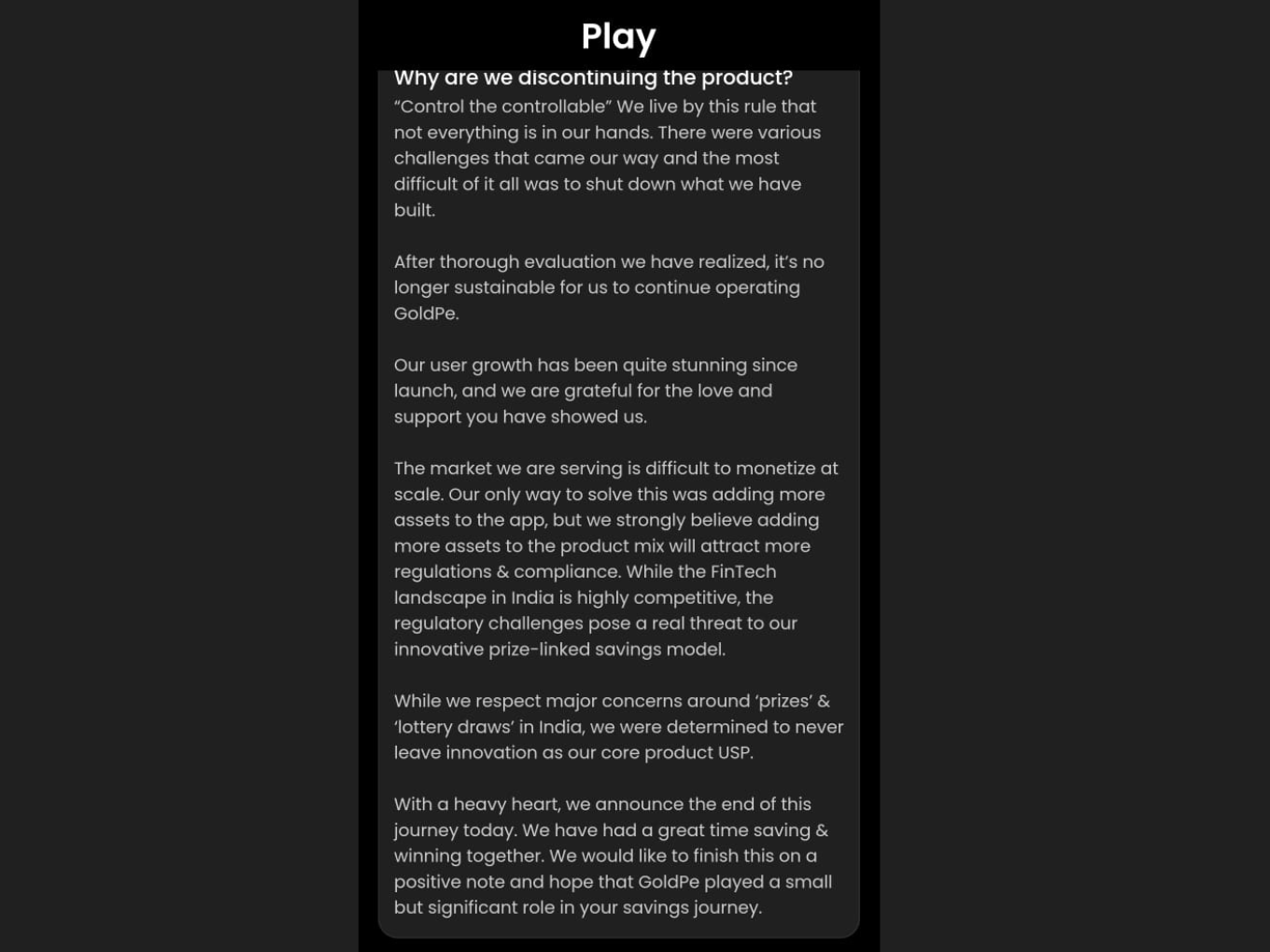

Meanwhile, the GoldPe app reads, “The market we are serving is difficult to monetise at scale. Our only way to solve this was by adding more assets to the app, but we strongly believe adding more assets to the product mix will attract more regulations and compliance. While the fintech landscape in India is highly competitive, the regulatory challenges pose a real threat to our innovative prize-linked savings models.”

Another major trigger behind Shah’s decision to pull the plug on his startup was linked to his fear of the country’s complicated regulatory regime.

He said that while there aren’t any regulatory challenges today, any decision to extend the scope of gambling laws by bringing PLS models under their ambit could have dire consequences for startups like GoldPe.

Despite his fears, Shah believes his PLS model, which was the core USP of GoldPe, could still serve as a great instrument for user acquisition and retention. To that extent, the GoldPe cofounders now plan to sell their PLS tech stack, potentially helping them repay their investors.

“We are also looking to give access to our reward system to other companies, which are currently focussed on user acquisitions, engagement, and retention. Lastly, we are extremely grateful to our investors for their trust and support shown throughout our journey,” Shah said.

It is pertinent to note that in the PLS space, GoldPe’s only competitor was Fello, which has a user base of over 500K. Set up in 2021, Fello raised $4 Mn in a fresh funding round led by US-based Courtside Ventures last year. Fello also sees users invest in digital gold to participate in weekly lucky draws.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)