SUMMARY

Licensed under the name Nu Investors Technologies Pvt Ltd for stock broking services, Lemonn is the second independent company under PeepalCo, after CoinSwitch

Lemonn is offering zero brokerage fee for three months and curated industry-based stock offerings, and aims to simplify stock investing for Indians

While the platform offers only stock investment currently, it aims to add products such as mutual funds, futures and options, IPO investments going forward

Founders of cryptocurrency exchange CoinSwitch – Ashish Singhal, Vimal Sagar Tiwari and Govind Soni – have launched stock investment platform Lemonn under the umbrella brand PeepalCo.

Licensed under the name Nu Investors Technologies Pvt Ltd for stock broking services, Lemonn is the second independent company under PeepalCo, after CoinSwitch.

Lemonn is offering zero brokerage fee for three months and curated industry-based stock offerings, and aims to simplify stock investing for Indians.

Last month, Inc42 reported that CoinSwitch founders were aiming to launch an investment platform in the next quarter.

Speaking on the launch announcement, PeepalCo cofounder and group CEO Ashish Singhal said, “Millions of Indians find stock markets complicated even today. Despite the post-pandemic growth, only about 6% of Indians invest in stock markets. We aim to bridge this gap by making stock investing engaging, informative, and effortless.”

It is pertinent to note that CoinSwitch unveiled the umbrella brand PeepalCo in December last year to house all its business verticals.

How Lemonn Plans To Gain Market Share In The Investment Tech Market

Lemonn, which would take on established brands like Groww and Zerodha, currently offers only stock investment. PeepalCo aims to incorporate other products, such as mutual funds, futures and options, IPO investments, on the platform going ahead.

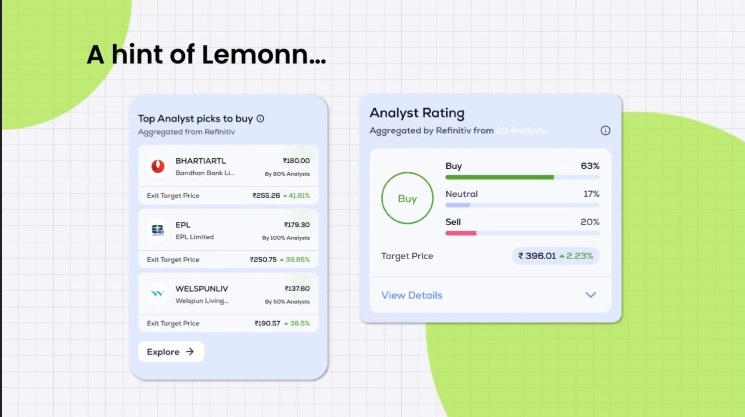

Lemonn is currently offering the following features:

- Zero brokerage fee for three months and zero fees for account opening

- Curated industry-based stock offering

- A detailed glossary explaining all financial and market-related terms

Lemonn does not have an advisory licence currently and hence will not offer stock suggestions, Singhal said.

About 100 employees are currently working on the platform, housed as a separate business division with its own managing and operations teams. Devam Sardana is the business head of Lemonn and is leading the team.

lockquote>

“Devam has actively worked towards the launch of Lemonn right from day one from when it was just an idea on paper to a reality now,” said Singhal.

On Lemonn’s revenue model, Sardana said all options, including subscription and brokerage commission, will be considered.

CoinSwitch has over 20 Mn users. While the company may advertise Lemonn on the CoinSwitch app, there will not be any data transfer and auto-KYC for the crypto exchange’s users, said Singhal.

The existing users will have to download the Lemonn app and follow the entire KYC process separately, he added.

CoinSwitch is backed by a slew of reputed investment firms, including Andreessen Horowitz, Tiger Global, Sequoia Capital, Ribbit Capital, Paradigm and Coinbase Ventures. The company has raised more than $300 Mn since its inception. It was valued at $1.9 Bn+ in its last funding round in 2021.

Since Lemonn has been using the same funding, Singhal clarified that CoinSwitch investors will continue to hold similar stakes in the stock investing platform.

With the launch of the stock broking platform, PeepalCo is eyeing to capture market share in India’s burgeoning investment tech market. Valued at over $9.2 Bn in 2022, the investment tech market is estimated to reach a size of over $74 Bn by 2030 at a 30% CAGR.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)