India’s farming sector has served as the bedrock of the economy since independence. Even today, it sustains the livelihoods of about two-thirds of the population. Not just this, the Indian agriculture industry accounts for 19% of the country’s GDP, highlighting its enduring significance.

As of 2022, the Indian agriculture market was valued at $435.9 Bn and is expected to reach $580.82 Bn by 2028, growing at a CAGR of 4.9% during this period.

This growth is also a testament to the fact that the country is not only enhancing its position domestically but also in the global food trade, as evidenced by India’s push for millet exports at the G20 Leaders’ Declaration in New Delhi.

Despite the positives, the Indian agri space finds itself shrouded in an array of challenges, which range from farmer-level struggles to supply chain bottlenecks.

In the absence of avenues that could help farmers fetch fair prices for their produce, small farmers are forced to take loans to continue farming. These loans are often taken at high-interest rates to buy farm equipment and other farm inputs.

Other than this, traditional ways of farming, diminishing soil fertility and small or fragmented land holdings further compound the hardships faced by farmers, limiting their avenues for prosperity.

To combat these, India’s new-age agritech startups are aiming to bring about a transformative shift. Despite the sector’s historical resistance to modern practices, agritech startups are making strides in addressing the aforementioned key issues with the help of innovative solutions that resonate with farmers.

According to the World Economic Forum, agritech activity in India has seen a dramatic surge in recent years, with the startup count rising from 43 in 2013 to more than 1,000 in 2020. This changing paradigm is further fuelled by increasing internet penetration in rural India.

Armed with the latest technologies such as AI, ML and IoT, agritech startups are poised to play a crucial role in reshaping India’s agricultural future, according to industry experts.

But this transformation has its own set of challenges. For starters, agritech penetration stood at about 1% in 2020, according to an Ernst & Young report. While recent data is unavailable, the rise in technology use during the pandemic likely fuelled its growth, suggesting an upward trend.

“Agritech involves season-on-season experimentation, so the pace will not match what we are used to in other sectors. For there to be a technology breakthrough and then adoption, you’re looking at a decade to two-decade cycle,” said an agritech expert during the ‘Harvesting Tomorrow Summit 2023’, an annual agritech conference organised by ThinkAg.

lockquote>

ThinkAg Harvesting Tomorrow Summit 2023 was held on 11 and 12 October 2023 and it hosted around 60+ industry experts as speakers. The speakers cited a number of factors challenging the adoption of agritech in India including small landholdings, a trust deficit between farmers and technology providers, diversity in agro-climatic zones and business practices, and most importantly long cycle times for experimentation and adoption.

Founded in 2018, ThinkAg is a not-for-profit AgFoodtech platform that aims to bolster the growth of India’s agritech sector by building multi-stakeholder networks, nurturing partnerships and enabling knowledge sharing.

Through such initiatives, ThinkAg brings together diverse ecosystem stakeholders such as agritech innovators, corporates, investors, incubators, financial institutions and multilateral and development organisations – to catalyse innovation, investment and adoption of agritech solutions in India.

Sectors Propelling Agritech’s Success In India

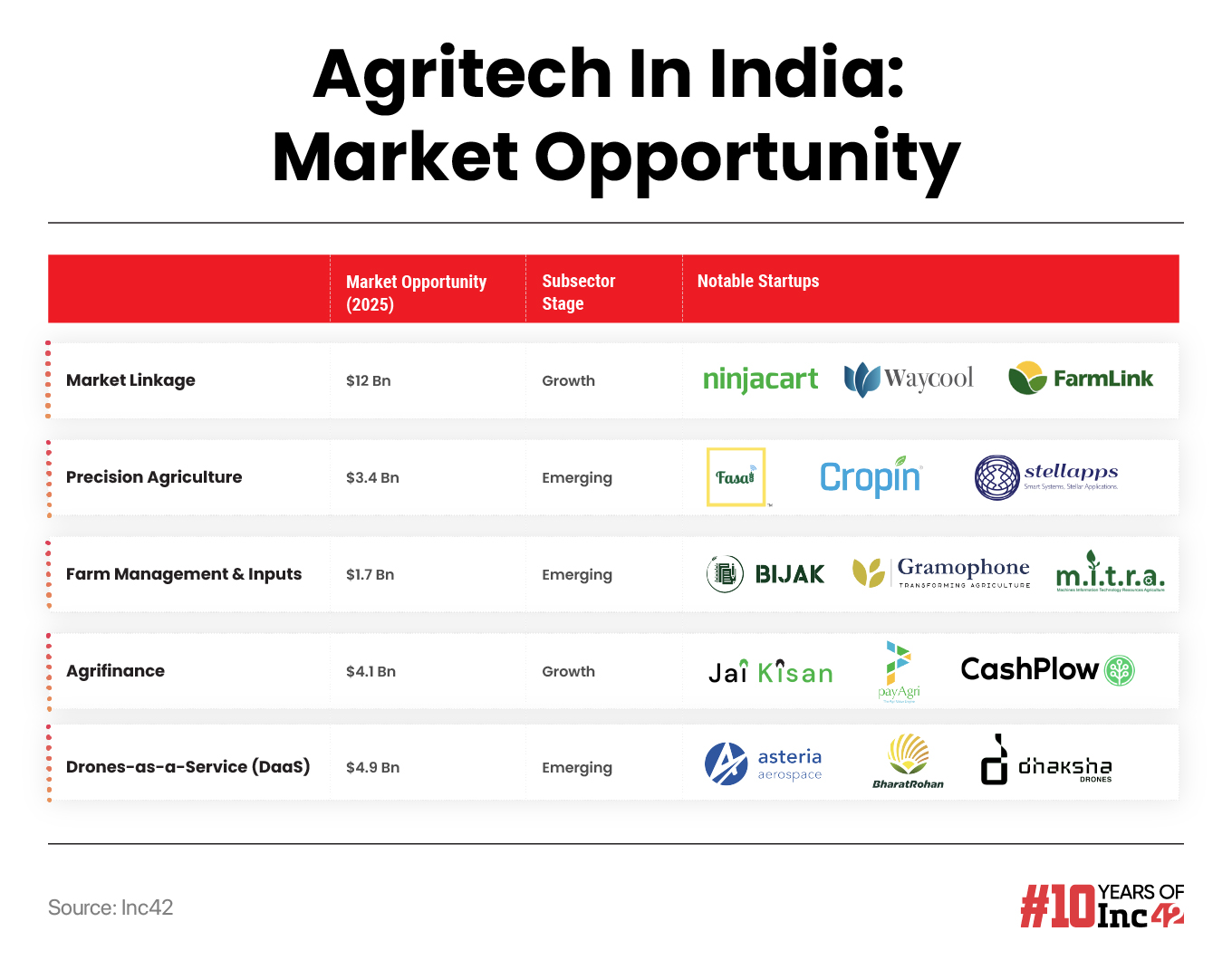

Despite numerous challenges, the agritech sector shows promise, as illustrated by the success stories of soonicorns such as DeHaat in Patna (focussed on farm inputs) and market linkage platforms like Ninjacart in Bengaluru and Waycool in Chennai.

Additionally, a multitude of lending tech platforms, with a focus on agriculture, are striving to provide accessible formal credit to farmers in India.

This trend shows that Indian entrepreneurs recognise agritech as an emerging sector.

The graph above reveals the thriving opportunities within the rural ecosystem for lending, and startups are actively capitalising on these prospects.

Beyond lending tech, drone technology has emerged as another burgeoning space, propelled by government initiatives. Ranging from fertiliser spraying to crop mapping and soil analysis, drones are finding diverse applications in farming.

In response to this, the Indian government liberalised drone operations under the Drones Rules 2021, providing relief to the unmanned aerial vehicle (UAV) ecosystem. Initiatives such as digital airspace mapping for drones and announcements like Drone Shakti in 2022 and Kisan drones across 100 locations have been lauded as positive steps by experts.

Consequently, the number of drone or UAV startups in India surged 34.4% from 157 startups in August 2021 to 221 drone startups in February 2022, with indications of continued growth in the sector.

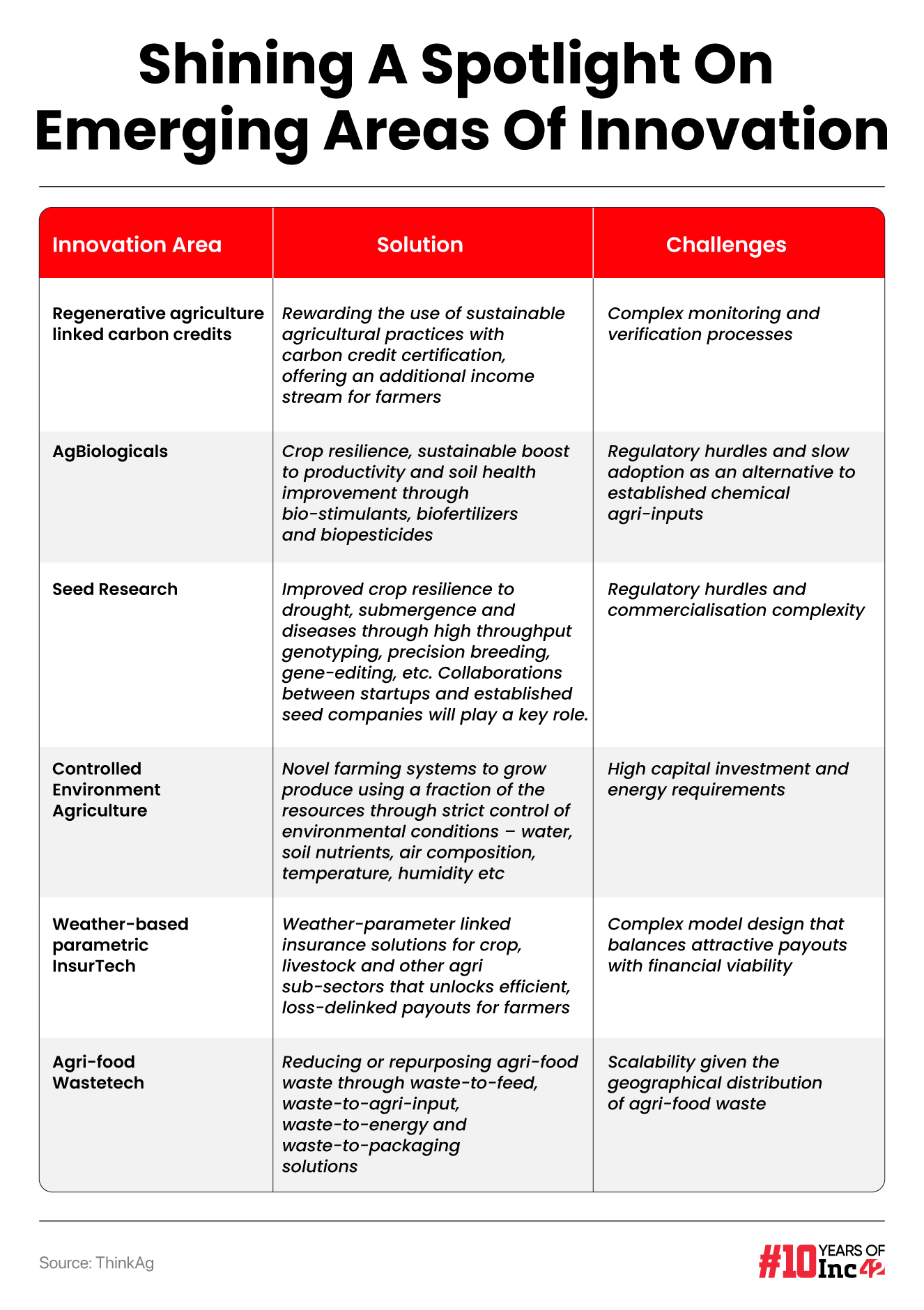

Talking to Inc42, Sannidhi Srinivasan, lead, knowledge and strategy at ThinkAg shared, “Given the inextricable mutual impact of climate and agriculture, we will see a range of climate-resilience linked innovations emerging in the agritech sector. These will span across both — mitigation solutions such as regenerative agricultural practices including use of AgBiological inputs, as well as innovations enabling adaptation to a changing climate such as weather-based parametric insurance and Controlled Environment Agriculture (CEA).”

The Decade Of Agritech?

Undeniably, India’s agritech space has undergone a significant change in the last few years, and a considerable portion of this development can be attributed to the increasing interest of investors in this domain.

“In India’s sizable, complex and climate-vulnerable agri-food landscape, opportunities abound for Agritech solutions to create value, spanning digitisation-led value chain disruption, data-enabled financing and insurance and science-based innovations for novel production inputs and techniques, to name a few,” said Ritu Verma, cofounder of ThinkAg and cofounder and managing partner at Ankur Capital.

lockquote>

She added that the current capital scare climate, though a challenge, can refocus companies on the fundamentals of value creation and drive bold moves that payoff when the markets recover.

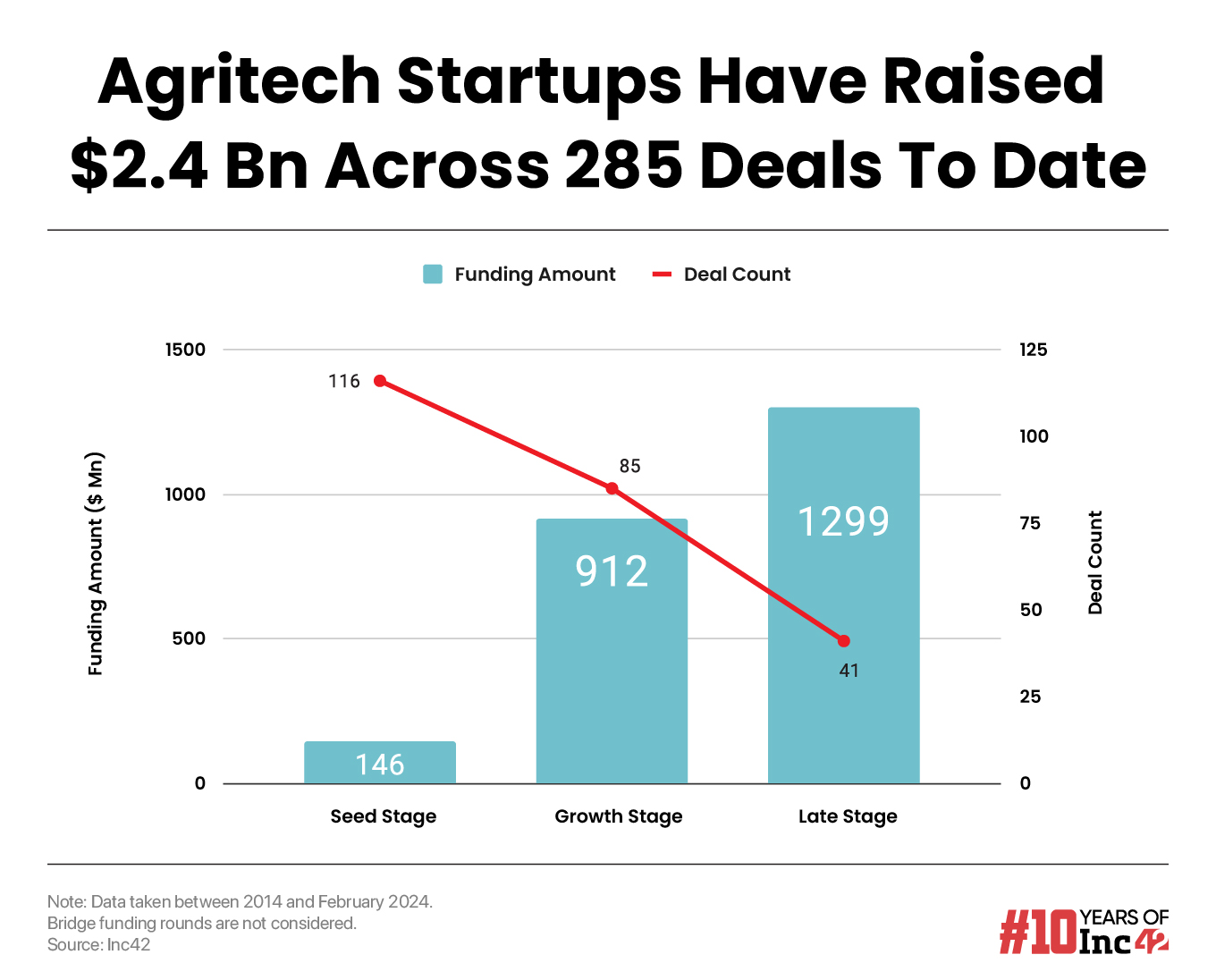

According to Inc42, the Indian agritech sector secured more than $2.4 Bn in funding in 285 deals between 2014 and February 2024.

Notably, the year 2022 marked a significant milestone for the industry, as agritech startups secured a record $817 Mn across 60+ deals.Although the numbers declined in 2023, totalling $208 Mn across 28+ deals, industry experts have said that this downturn was the result of the overall decline in funding levels. According to Inc42’s Indian Tech Startup Funding Report 2023, startup funding hit a 7-year low of $10 Bn as investor appetite waned in 2023

On a positive note, however, 2023 witnessed the announcement of 10 funds that have agritech as a focus segment, and prominent investors such as Aeravati Ventures, Omnivore (Fund III) and Unicorn India Ventures (Fund III) actively participated in funding rounds across various deals.

The infographic above highlights that investors predominantly exhibit bullish sentiments towards early stage agritech startups, with 116 deals recorded to date. This stands in contrast with growth and late stage startups, which collectively secured 126 deals.

The agritech sector is now transitioning into a new phase of maturity, marked by a surge in mergers and acquisitions (M&A) activity. According to Inc42 data, high growth startups like WayCool and DeHaat are leading the charge for agritech consolidation since 2019.

A ThinkAg report identifies this trend as a ‘portfolioization’ of solution driven by mature agritech startups’ pursuit of expansion up and down the value chain, across additional value chains or into new geographies.

For instance, DeHaat’s acquisition of agri-input marketplace Helicrofter in 2022 is on the upstream spectrum of the value chain, while the acquisition of food processing startup YCook in the same year lies at the downstream end.

Today, India’s agritech industry stands at the cusp of explosive growth, propelled by a convergence of factors such as increasing demand, heightened internet penetration and rising investor support.

Notably, government initiatives like the Digital Agriculture Mission (DAM), launched in 2021, and the Agriculture Accelerator Fund are crucial steps towards providing vital infrastructure and support for agritech startups and allied sectors.

According to an Inc42 report, the market opportunity for agritech is anticipated to reach $25 Bn by 2025, signifying a transition from its nascent stages to mainstream prominence in the near future.

Despite these positive prospects, the Indian agritech sector confronts challenges that could potentially impede its growth trajectory. A notable obstacle is the digital divide, particularly in rural areas. Bridging this gap is imperative to ensure that the benefits of agritech innovations are accessible to all key stakeholders of this space.

Fostering community building and providing networking opportunities will be critical strategies for increasing stakeholder involvement to counter the industry’s growing pains.

“We organise in-person gatherings, each focussed on specific themes relevant to the ecosystem and spread across various parts of India. The overall objective is to further knowledge about agritech opportunities, technologies and ventures and facilitate connections and potential partnerships among ecosystem stakeholders,” said Srinivasan.

In 2024, ThinkAg is set to host more events, along with its flagship Harvesting Tomorrow Summit, which will be held between September 25 and 26 in Goa. This commitment reflects the organisation’s dedication to nurturing collaboration and steering the agritech industry towards a future of sustainable growth and innovation.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)