SUMMARY

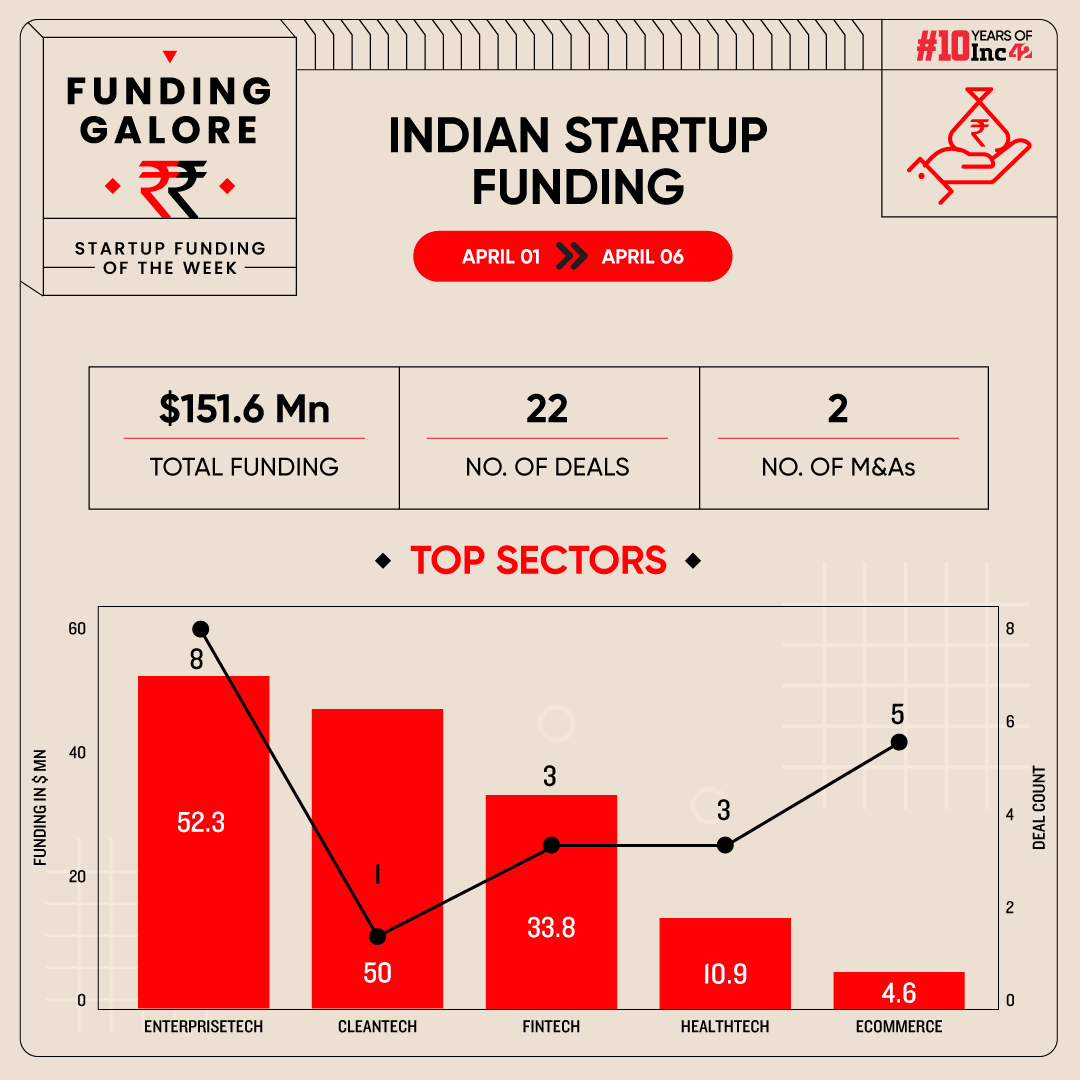

Indian startups cumulatively raised $151.6 Mn from 22 deals between April 1-6

Ola Electric bagged $50 Mn in debt funding, the biggest fundraise this week

Enterprisetech sector bagged the most funding of $52.3 Mn through 8 deals

Funding momentum across the Indian startup ecosystem dropped in the first week of April after a brief uptick. Between April 1 and 6, startups cumulatively raised $151.6 Mn, a 38% decline from last week’s $243 Mn.

However, there was a rise in the number of deals with 22 startups raising funding compared to 17 in the preceding week.

Funding Galore Indian Startup Funding Of The Week [Apr 1 – Apr 6]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 1 Apr 2024 | Ola Electric | Cleantech | Electric Vehicle | B2C | Debt | $50 Mn | EvolutionX Debt Capital | EvolutionX Debt Capital |

| 4 Apr 2024 | SingleInterface | Enterpristech | Horizontal SaaS | B2B | – | $30 Mn | Asia Partners, PayPal Ventures | Asia Partners |

| 2 Apr 2024 | Namdev Finvest | Fintech | Lendingtech | B2C-B2B | Pre-Series C | $19 Mn | Maj Invest, others | Maj Invest |

| 2 Apr 2024 | Scrut Automation | Enterpristech | Horizontal SaaS | B2B | – | $10 Mn | Lightspeed, MassMutual Ventures and Endiya Partners | – |

| 4 Apr 2024 | Nivara Home Finance | Fintech | Lendingtech | B2C | – | $10 Mn | Baring Private Equity India | Baring Private Equity India |

| 2 Apr 2024 | Traya | Healthtech | Fitness & Wellness | B2C | – | $9 Mn | Xponentia Capital | Xponentia Capital |

| 3 Apr 2024 | SiftHub | Enterpristech | Horizontal SaaS | B2B | Seed | $5.5 Mn | Matrix Partners India, Blume Ventures, Neon Fund, Harshil Mathur and Shashank Kumar, Arvind Parthiban, Manish Jindal, Andrew Johnston | Matrix Partners India, Blume Ventures |

| 1 Apr 2024 | Innoviti | Fintech | Payments | B2B-B2C | – | $4.8 Mn | Bessemer Venture Partners, Patni Family Office | Bessemer Venture Partners, Patni Family Office |

| 1 Apr 2024 | Bombay Shaving Company | Ecommerce | D2C | B2C | Debt | $3 Mn | Alteria Capital | Alteria Capital. |

| 2 Apr 2024 | Assembly | Enterpristech | Horizontal SaaS | B2B | – | $2.1 Mn | Prath Ventures, Anicut Capital, Blume Founders Fund, others | Prath Ventures |

| 3 Apr 2024 | Vodex | Enterpristech | Horizontal SaaS | B2B | Seed | $2 Mn | Unicorn India Ventures, Pentathlon Ventures | |

| 3 Apr 2024 | Arch0 | Enterpristech | Horizontal SaaS | B2B | Pre-Seed | $1.25 Mn | Leo Capital, Village Global, Indian Silicon Valley Capital, Appreciate Capital, SuperMorpheus | Leo Capital |

| 4 Apr 2024 | Curelo | Healthtech | Healthcare Services | B2C | – | $1.2 Mn | IIMA Ventures, Tarun Katial, Shreyas Iyer | – |

| 4 Apr 2024 | Limelight Lab Grown Diamonds | Ecommerce | D2C | B2C | – | $1 Mn | – | – |

| 4 Apr 2024 | Hudle | Enterpristech | Vertical SaaS | B2B | Pre-Series A | $838K | Inflection Point Ventures, Sky Impact Capital, Survam Partners, Anay Ventures | Inflection Point Ventures, Sky Impact Capital |

| 3 Apr 2024 | Mave Health | Healthtech | Telemedicine | B2C | Pre-Seed | $718K | All-In Capital, iSeed Fund, Bharat Founders Fund, Deepinder Goyal, Kunal Shah, Mohit Kumar, Vatsal Singhal, Gaurav Agarwal, Nandan Reddy, Rohan Verma, Nikhil Kant, Harsh Shah, Neel Mehta, Nitin Mehrotra, Himanshu Aggarwal, Vikrampati Singhania, Gaurang Patel, Pradeep Patel, Rajan Dube, Ganesh Prasad, Parsh Kothari, Shlok Srivastava, Neel Gogia, Naim Siddiqu | All-In Capital, iSeed Fund |

| 4 Apr 2024 | Cloudworx Technologies | Enterpristech | Horizontal SaaS | B2B | Seed | $600K | Venture Catalysts | Venture Catalysts |

| 4 Apr 2024 | Troovy | Ecommerce | D2C | B2C | Pre-Seed | $599K | Veltis Capital, SSV, Rebalance, others | – |

| 2 Apr 2024 | The Fresh Press | Ecommerce | D2C | B2C | Pre-Series A | – | Gruhas Collective Consumer Fund | Gruhas Collective Consumer Fund |

| 2 Apr 2024 | SatSure | Deeptech | Spacetech | B2B | Series A | – | Baring Private Equity Partners (BPEP), India Promus Ventures, TransUnion | Baring Private Equity Partners (BPEP), India Promus Ventures |

| 2 Apr 2024 | Hitwicket | Media & Entertainment | Gaming | B2C | – | – | Harsha Bhogle | Harsha Bhogle |

| 2 Apr 2024 | A47.in | Ecommerce | D2C | B2C | – | – | Aditya Pittie | Aditya Pittie |

| Source: Inc42 *Part of a larger round Note: Only disclosed funding rounds have been included |

||||||||

Key Startup Funding Highlights Of The Week

- IPO-bound Ola Electric bagged the biggest cheque this week, securing $50 Mn in debt funding from EvolutionX Debt Capital via non-convertible debentures (NCDs).

- Maintaining its lead from last week, enterprisetech sector bagged the most funding of $52.3 Mn through 8 deals.

- Seed-stage startup funding picked up steam this week with startups netting $8.1 Mn, up 270% from last week’s $3 Mn.

Updates On Indian Startup IPOs

- SaaS cybersecurity startup TAC Infosec shares opened at INR 290 on the NSE’s small and medium enterprises platform (NSE SME), a 173.6% premium on the issue price of INR 106.

- Fintech SaaS company Trust Fintech shares opened at INR 143.25 on NSE SME, a 42% premium on its issue price of INR 101 per share.

Startup Acquisitions This Week

- In an acquisition within Amazon India’s sellers space, Clicktech acquired Appario, one of the largest seller entities on the e-commerce marketplace.

- Business services provider Quess Corp Limited has fully acquired gig economy platform Taskmo for an undisclosed amount. Both Taskmo founders – Prashant Janadri and Naveen Ram – will exit once the acquisition by Quess is completed.

Startup Fund Launches Of This Week

- VC firm Centre Court Capital announced its maiden INR 350 Cr fund ($42 Mn) focussed on early stage startups in the sports and gaming space. It has already received commitments to the tune of INR 200 Cr from investors and top athletes.

- Indian Navy Veteran Navneet Kaushik has rolled out Jamwant Venture Fund, an angel fund backed by SKI Capital, a SEBI-registered AIF, RTA & Category1 Merchant Bank. It will primarily look into investing in early-stage tech startups in the defence space

Other Major Developments From This Week

- Quick commerce unicorn Zepto has initiated discussions with a clutch of global investors to raise $300 Mn at a valuation range of $2.5-$3 Bn. It was last valued at $1.4 Bn in 2023.

- Fintech unicorn Navi is in talks with investors to raise $200-$400 Mn in funding at a valuation of $2 Bn. This will be the Flipkart cofounder Sachin Bansal-led startup’s maiden external fundraise.

- Ride-hailing startup Rapido is eyeing a mega $100 Mn fundraise from existing investor WestBridge Capital and others at a valuation to $900 Mn. It has reportedly received commitments of around $70 Mn and is currently approaching Indian family offices for the rest.

- Beauty ecommerce marketplace Purplle is currently in initial discussions with Abu Dhabi Investment Authority (ADIA) for a $100 Mn investment. The investment is expected to come through secondary transactions, allowing some early investors to exit.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)