India’s EV story is about to change in a major way this year. Tesla is finally coming to India.

After teasing the Indian automobile enthusiasts for years, it looks like the company is closer than ever. Reports this past week showed the US EV giant is preparing for its first major shipment into the country and also has plans for a major manufacturing push.

Tesla’s entry is undoubtedly massive for the country and signals a new phase of maturity in the India EV story. This Sunday, we will look to dig under the hood of Tesla’s India entry and see whether it will accelerate the Indian electric car market, which has been sorely lacking momentum.

That’s after these top stories from our newsroom this week:

- Into The Soonicorn Club: India’s future unicorn startups together boast a combined valuation of over $40 Bn and have netted more than $15 Bn since 2014. Here’s what the data shows about India’s soonicorns

- What’s Next For Bengaluru? Bengaluru was the top startup hub for funding and deals in 2023, but now the Karnataka government is looking beyond — at plug-and-play infrastructure, global linkages and more, according to IT & BT minister Priyank Kharge

- Edtech’s GenAI Phase: After several disruptions in the past year, edtech startups are now turning to GenAI for customer support, hyper personalisation, content creation and of course, operational efficiency

Clear Road For Tesla

Reports around Tesla this past week have put the Indian automobile industry under a big spotlight in the global market.

The EV giant is said to have begun production of right-hand drive cars at its plant in Germany, as it moves ahead with a possible entry later this year into India, the world’s third-largest car market. Further, a team from Tesla is expected to visit India later this month to look at sites for a car manufacturing plant in Telangana, Gujarat or Tamil Nadu with a potential investment of $2 Bn.

Fans have waited for Tesla in India for a number of years, and when the Indian government updated its electric vehicle policy in March, many thought it was specifically meant for the Elon Musk-led car maker.

In March, the central government approved a new EV policy which opened the door for the entry of global EV manufacturers. The policy involves lowering the import duty on EVs — this has been a long-standing demand for EV majors such as Tesla — for companies setting up a manufacturing plant in India with a minimum investment of INR 4,150 Cr or roughly $500 Mn.

Companies wishing to enter the Indian market through this route have also been set clear localisation targets by the government. They need to have 25% localised components by the third year and 50% by the fifth, which is in line with previous manufacturing incentives such as for smartphones and laptops.

Why India Matters For Elon Musk

India is a critical market for Tesla, especially in the current China+One movement, and as the US market slows down. Tesla CEO Elon Musk even met Prime Minister Narendra Modi in New York in June 2023 to open up dialogues with the Indian government.

Even though India is a two-wheeler and three-wheeler country when it comes to EVs, by 2030, the country is expected to have significantly more electric cars on the road, especially as most manufacturers look to compete on pricing. The scope for growth in various EV segments is massive, especially considering the Indian government’s push to have 30% EVs on the road by 2030.

While the current EV four-wheeler or car market in India is small, the overall momentum is with EVs. Sales of electric vehicles crossed 1.5 Mn in 2023, dominated by two-wheelers and three-wheelers, as reported by Inc42. The EV four-wheeler space is dominated by Tata Motors, but electric cars made up just 2% of total car sales in 2023.

Tesla’s push into India comes at a time when slowing EV demand in the US and China, its two largest markets. In China, the company is facing intense competition from Chinese OEMs, while some quality and manufacturing issues have damaged Tesla’s reputation and market share in the US. The company reported a decline in its first-quarter deliveries and missed analyst estimates on shipments.

India’s Electric Car Race

Tesla’s India entry plan also includes investment in a charging network, which will come on top of the $2 Bn earmarked for the plant. But competition is also heating up.

Besides Tesla, Vietnamese OEM VinFast said it would invest $2 Bn in India and started building an EV factory in Tamil Nadu. Further, a number of ride-hailing players are also looking to increase the share of EVs in their fleet and are signing deals with OEMs and fleet operators for the transition.

Interestingly, Ola Electric also has plans for an electric car by 2025 or 2026, and Tesla’s entry is likely to accelerate those plans for the Bhavish Aggarwal-led company, which is also eyeing a public listing this year. Ola Electric plans to construct what it calls the largest automobile factory in the world, with an annual production capacity of 1 Mn electric cars.

Besides the number of players, Tesla will also be tested by the price-sensitive Indian market. Even though India has a growing base of affluent population, Tesla will likely attract quite a bit of premium in the Indian market, even compared to the higher-end EVs by the likes of Hyundai or Volvo. Will the brand’s prestige be enough to sway Indian car buyers?

In the recent past, the US-based giant is speculated to be working on a smaller and more affordable car for the Indian market, which is said to be priced at less than $30,000 (roughly INR 25 Lakh), which would put it directly in competition with some of the existing models.

However, the OEMs focussed on EVs are looking to compete in the affordable category as seen with the launch of MG Comet and Tata Punch EV.

Make In India, Like Apple

For Tesla, the Apple experience is likely to be a big inspiration. Apple reportedly manufactured iPhones worth INR 1 Lakh Cr in India in 2023 or roughly 7% of its global production at the end of December 2023. Of the total output, ‘Made in India’ iPhones worth INR 65,000 Cr were reportedly exported between January and December 2023.

A host of Apple vendors have made a beeline for India, including names such as Foxconn, Pegatron, Wistron India, and the same recipe could be followed by Tesla for its India plans.

Apple has also shown that made-in-India products can be sold globally, with 65% of the iPhones made in the country being exported to the US, Europe, West Asia, among other regions. Apple plans to manufacture more than 50 Mn iPhones in India annually.

Tesla would do well to take a page out of Apple’s playbook, but the electronic giant’s success has not come overnight. Apple has invested billions of dollars and several years in ensuring that India becomes a key piece of its global empire.

Given the growing competition in the EV cars space, Tesla would do well to set low targets for itself in the first few years as it sets up its India base. Companies such as Tesla which enter India are also likely to focus heavily on charging infrastructure especially if they have long-term ambitions.

Is Tesla Ready For India?

This will be a critical piece of their growth story in India, and there are some signs that Tesla is preparing for this experience already.

For one, charging interoperability with other EVs will be key for Tesla and other car makers as the Indian government is likely to bring in standardisation in the near future.

Tesla Supercharger stations in the US, for instance, now have a ‘Magic Dock’ that allows non-Tesla cars to charge up. Besides this, the company is also looking at charging for EV two-wheelers, which will be a huge factor in India and other Southeast Asian markets.

For Indian consumers, the entry of Tesla and other potential global manufacturers will signal the beginning of the electric car era. If we take Apple’s success as an example, the likes of Samsung, Google, Oneplus and others followed suit and expanded their India manufacturing bases.

Tesla’s entry could similarly spark off the golden phase of EVs in India, but a lot would depend on how robust India’s EV infrastructure gets alongside these new players. And perhaps this is where the next phase for EV startups also begins.

Looking Back At The GenAI Summit

The first ever edition of The GenAI Summit saw the most influential leaders, builders and investors in AI delve into the future of AI in India. From founders talking about how GenAI has disrupted business models to investors eyeing next-gen innovations:

Sunday Roundup: Tech Stocks, Startup Funding & More

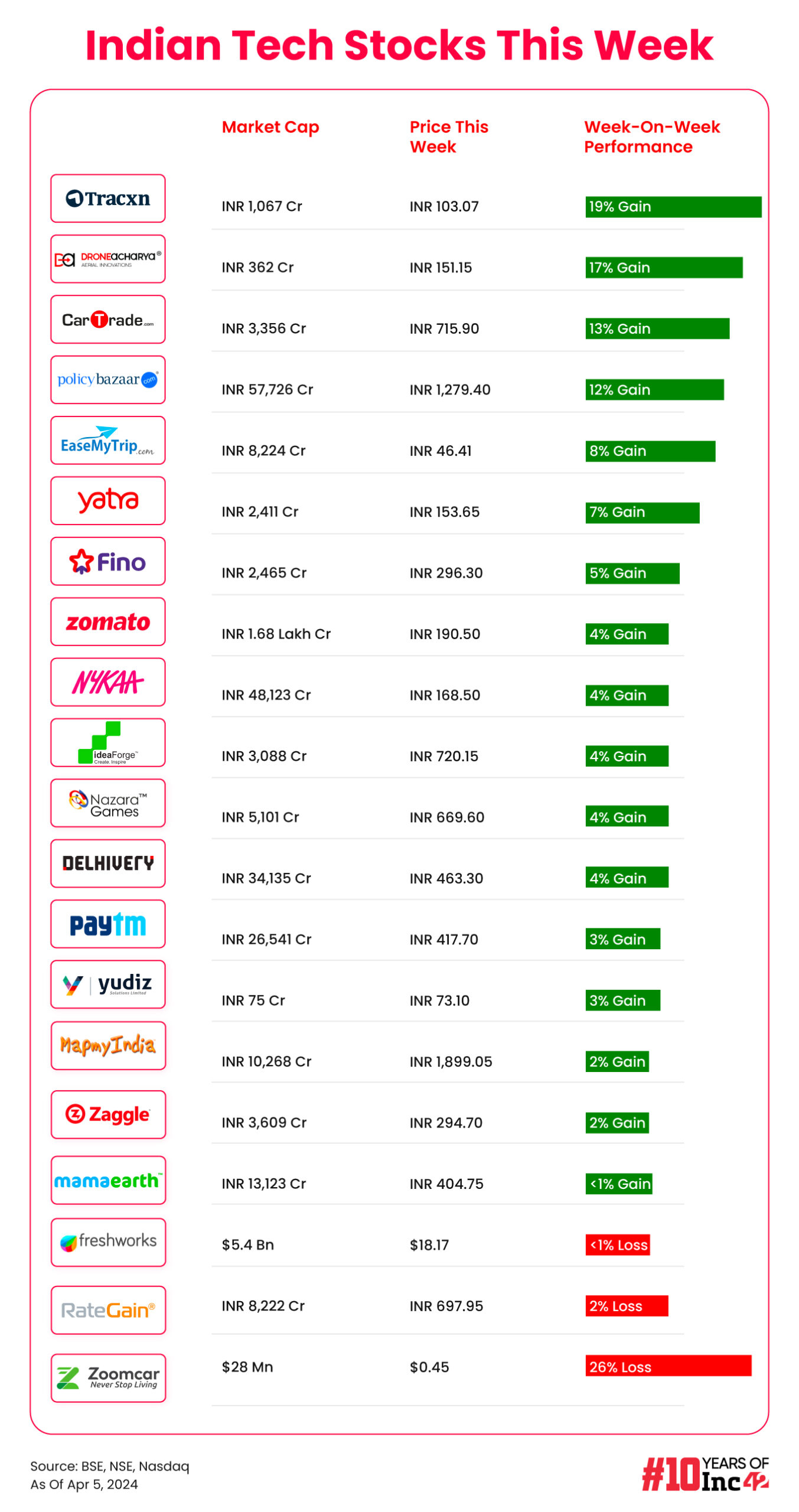

- Zomato’s High: The foodtech major started off the new fiscal year in style as its stock soared to an all-time high this past week, ending Friday just over INR 190

- Rejig At Inshorts: In a major reshuffle, Inshorts’ incumbent CEO and cofounder Azhar Iqubal has moved to the role of chairman, while cofounder Deepit Purkayastha is now the new CEO

- TAC’s Listing Pop: SaaS cybersecurity startup TAC Infosec made a blockbuster debut on NSE Emerge, with its shares listing at a 173.6% premium on the issue price of INR 106

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)