Meesho, Udaan, Sharechat, Pharmeasy, BYJU’S — all unicorns in their own way, but staring at deep valuation cuts when raising funds. In some cases, even the unicorn tag is slipping away thanks to the season of down rounds for Indian startups.

Indeed, it’s not just the large unicorns that are facing the reality. Even growth and early-stage Indian startups are struggling to show the right numbers to earn an uptick in valuation when raising funds.

There are exceptions, of course — the likes of Zepto are said to have resisted deals due to lower valuations. But the reality is that raising funds in 2024 means settling for a lower valuation, which is more aligned with the company’s revenue picture, as well as accepting the dilution that may come as a result.

So this Sunday we are taking a closer look at this trend, and where this season of down rounds fits into the larger scheme of things for Indian startups. That’s after a look at these stories from our newsroom:

- Bitcoin’s Big Moment: Crypto watchers are calling the Bitcoin halving an inflection point for cryptocurrencies at large, thanks to the recent influx in Bitcoin’s price and its evolving role in the global economy

- Inshorts’ New Tune: From a news aggregator, Inshorts is becoming a social media platform of sorts similar to X, Youtube or LinkedIn as it pushes for growth and higher engagement from its user base

- Koo’s Fall: Koo, once hailed as a potential X rival, faces a stark reality as its user base has plummeted by 62% in the past nine months, amid failed revenue models

Choosing Runway Over Valuation

Data doesn’t lie. In private, investors are talking about several deals being cracked at the early stage, but the fact is that funding is still not easy to come by for startups.

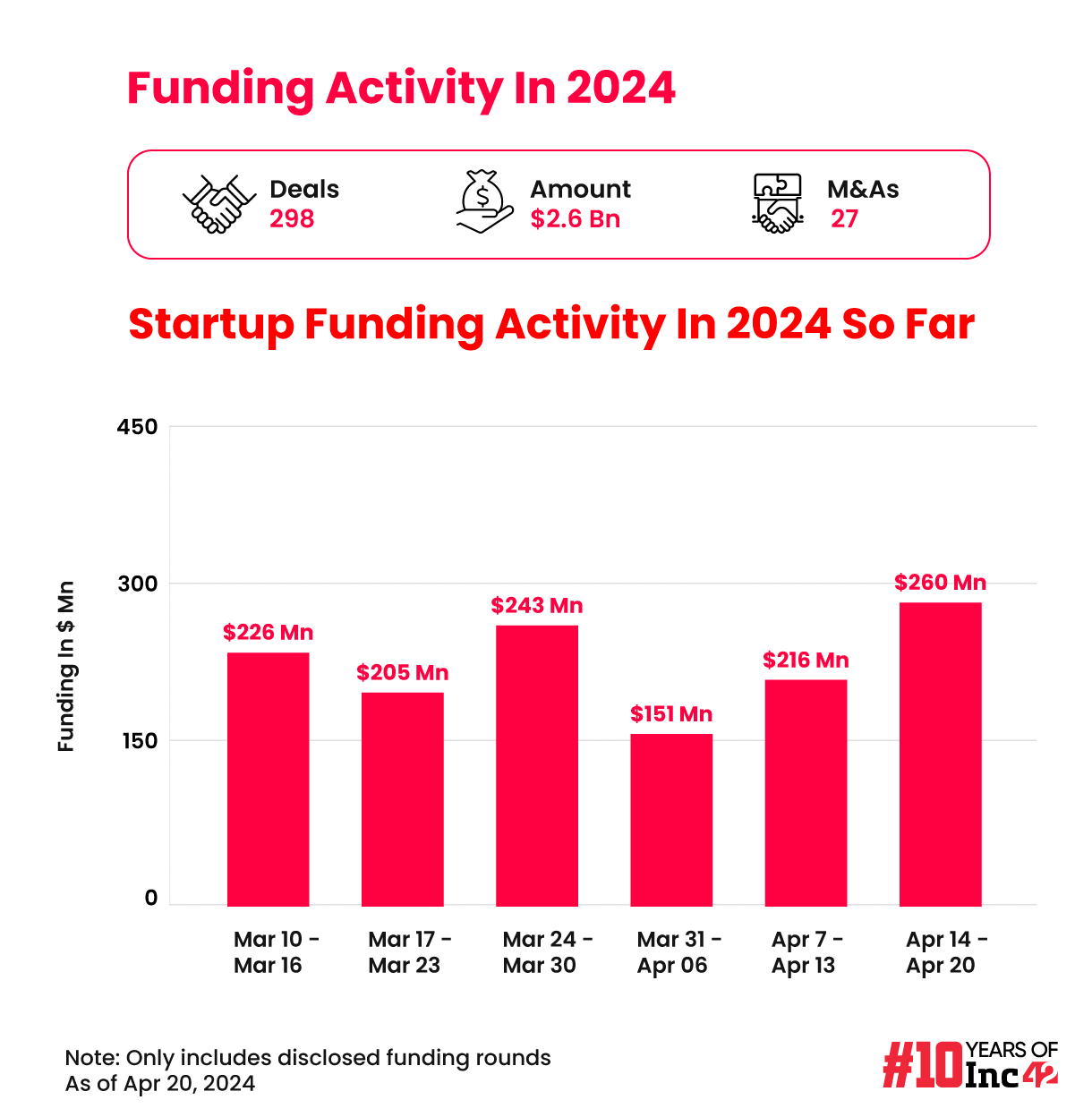

According to Inc42’s Q1 2024 report, the overall funding in India dropped by 33% YoY to $2 Bn, registering a seven-year low. Despite bullishness about emerging areas such as AI, semiconductors and manufacturing, funding for the established sectors has remained slow, which reflects in the overall numbers.

And naturally, this means investors have the leverage over founders. VCs seem to be adopting a more cautious approach, prioritising revenue generation and solid cash flow, especially in consumer brands.

A large portion of the Indian startup ecosystem is banking on the Indian consumer story, where profitability has been especially elusive.

According to some VCs we spoke to, down rounds may not necessarily have a significant impact on the overall view of Indian startups as an investment class. Fluctuations in valuation are a common occurrence, even in the public market where prices fluctuate regularly, pointed out Rohit Krishna, general partner at WEH Ventures.

“The trend of inflated valuations in 2021 was notable, but some startups may still see their valuations rise again in the future. However, the crucial factor remains securing capital rather than solely maintaining a high valuation,” he added.

lockquote>

Survival seems to be the keyword. Startups are looking to extend their runways to a time when the markets improve, and most are looking to reserve some of the capital raised for the long term.

“The lessons learnt from the bear market of the last two years are still fresh. Those who are generating revenue are reserving it for future expenses, and those who are raising are investing most of it for use in the next two or three years,” said a Delhi-based partner at a growth-stage VC firm.

lockquote>

Indian Startups Hit By Down Rounds

Of the unicorns that are looking at a valuation cut, Meesho has seen the lowest decline at 20%, while BYJU’S has seen a massive 99% cut similar to Pharmeasy’s 90% drop.

One could say that the edtech and healthtech unicorns are outliers in this situation, given that they raised funds through a rights issue to pay off overrunning debt. In BYJU’S case, the rights issue may have been approved by the board, but the company cannot use the proceeds due to a pending hearing with the Karnataka High Court.

Investors believe that a 50% to 60% dip, as in Sharechat’s case, is roughly what most startups can expect in 2024.

Down rounds may seem like an isolated incident, but the reality is that they have an impact on equity held by employees and founders, impacts the company’s image as an employer and also is a signal to the market that the company is not on a growth trajectory.

“Founders have also adjusted their expectations, realising that valuations from a year or so ago may not align with present market realities. The impact of downrounds may primarily affect employees with ESOPs, as the value of their holdings decreases,” Ashwin Raguraman, founder of Bharat Innovation Fund, told Inc42.

lockquote>

According to him, if the valuation is cut in the range of 15% to 20%, the impact is likely limited to marginal effects such as decreased employee motivation and potential talent attrition.

On the other hand, more significant corrections like the ones seen by BYJU’S or Pharmeasy indicate fundamental structural issues within the business, which is in line with what’s happening in those companies.

“Rather than waiting for higher valuations, founders may opt to raise capital sooner to ensure sufficient runway for growth. The critical decision for founders revolves around balancing the need for immediate capital infusion with the desire for long-term value creation,” Raguraman added.

Waiting For The Tide To Turn

Investors believe that down rounds and valuation corrections will continue to occur for most of the year. But there is some optimism for ‘normalcy’ returning to deal flows from the second half of 2024.

Flat rounds or even higher valuations could also materialise, as many startups take this time to fix their unit economics and profitability. Many of those we spoke to pointed to the public markets as a reference point to see what startups can expect in terms of valuation.

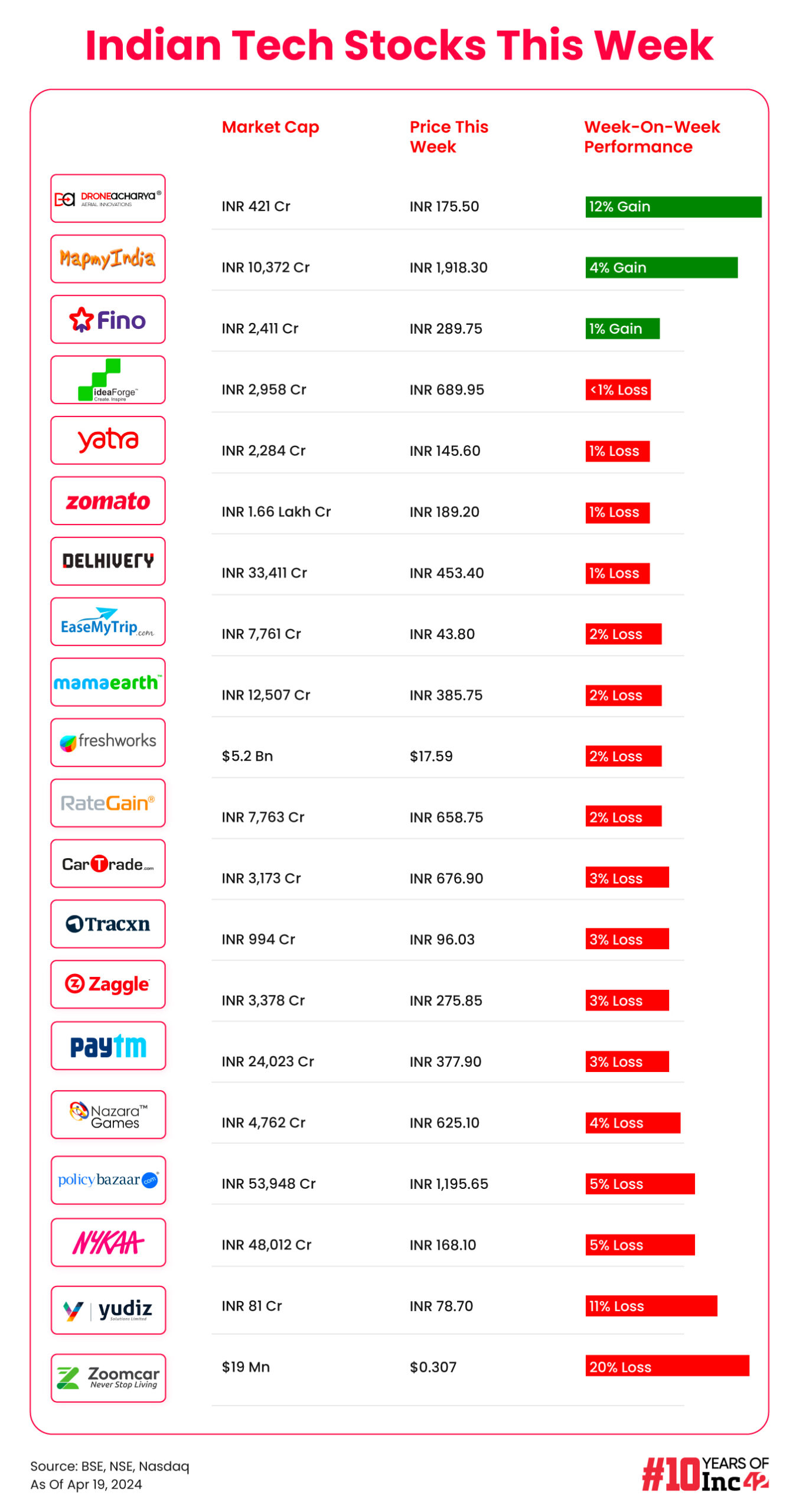

Profitability is being rewarded by investor faith — as seen in the case of Zomato, Mamaearth, Zaggle and others this year.

Growing losses and corporate governance issues are being punished, with Paytm being the biggest example, or even Nasdaq-listed Zoomcar.

The situation is much the same with private market investments. “Take a look at Zepto or Perfios which turned unicorn this year. Perfios raised funds at a unicorn valuation because it turned profitable in FY23. Zepto is said to be close to profitability and has grown massively. These are the cases that will beget high valuations,” the Delhi-based partner quoted above said, adding that most other companies have to settle for either a flat round or down round.

lockquote>

But these are still rare cases in the startup ecosystem. Profitability is still elusive for India’s unicorns and soonicorns. A recent analysis of soonicorns revealed that a mere 8% of such startups were profitable, from a total of 41 soonicorns that disclosed their financials in FY23.

Many of them have laid off employees and cut costs in FY24, but investors want to see a path to profitability at scale and which can be continued for more than just one year.

In this situation, most Indian startups need to accept that down rounds are the only way out for them. Unicorns or not.

Sunday Roundup: Tech Stocks, Startup Funding & More

- Funding Stays Flat: The weekly startup funding in India is settling into something of a groove. This week’s tally of $260 Mn is more or less the same as the week-on-week numbers for the past two months.

- Musk’s U-Turn: SpaceX and Tesla CEO Elon Musk has postponed his trip to India where he was scheduled to announce Tesla’s entry into India and meet spacetech startups

- Reprieve For Paytm: Regulations-hit Paytm began the process of migrating its UPI users to third-party bank handles from Paytm Payments Bank after getting the nod from the NPCI

- Flipkart’s UPI Bet: In its first month of full-fledged UPI launch, Walmart-backed ecommerce major Flipkart recorded 5 Mn UPI transactions worth INR 197.24 Cr in March

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)