It’s a payment aggregator (PA) feeding frenzy out there as dozens of startups and big tech companies have bagged the licence in recent months.

Since December last year, the RBI has approved the PA applications or has given in-principle approval to Zoho, Juspay, Decentro, CRED, PayU, Enkash, Pine Labs, Amazon Pay, Innoviti, Razorpay, CC Avenue, Cashfree, Tata Pay, Google Pay, Infibeam Avenues, Mswipe, among others.

Just this week, Groww and Worldline Global also joined this list. Overall, more than 20 companies have received the green light from the central bank in 2024 alone.

So what explains this sudden rush to become a payment aggregator and why exactly are companies queuing up?

The payment aggregator rush in India is particularly curious because becoming a PA could soon come with increased regulatory scrutiny on startups, and higher burden of compliance as well as increased cost of due diligence.

The RBI is looking to bring in a new set of guidelines for this space over the next month. In draft directions released on April 16, 2024, the central bank has sought comments and feedback from the fintech and payments industry. Stakeholders have till May 31, 2024 to submit their views to the RBI, post which the final guidelines are likely to be finalised before the next quarter.

In the present state, the draft directions bring in some much-needed clarity on the entry requirements for companies looking for a PA licence, but along with this, the central bank has looked to ensure a higher degree of customer monitoring by existing and future payment aggregators.

As one Gurugram-based fintech startup founder put it, “The KYC and due diligence requirements are pretty much similar to what the RBI expects of universal banks. It may seem like a challenge, but it’s a welcome change since it creates a level playing field.”

The primary attraction for a payment aggregator licence is that entities can enable ecommerce sellers and other merchants in India to accept various payment instruments from customers, pool these collections and get settlements through PAs, without the need to create a separate payment integration system of their own.

Essentially, PAs act as intermediaries between the merchant and the customer, ensuring that funds are transferred in a timely manner to the former.

The Cost Of Being A PA

Many of the players that we spoke to are either in the process of replying to the central bank or are awaiting approvals for their payment aggregator licence bids and in this case, not many are willing to publicly comment on how the new guidelines might complicate matters.

“This is definitely going to increase the cost of compliance for some startups, but more importantly it hurts those merchants that want to start selling online. They have to ensure full compliance with the rules so that they can be onboarded by PAs, but this is not always possible,” said a Bengaluru-based founder of a payment aggregator startup.

While these are not the final guidelines, industry sources we spoke to believe that the Reserve Bank is unlikely to budge from its position on many of the points.

In particular, the RBI’s stipulation for customer verification is likely to remain unchanged, but there could be further clarity on points such as maintaining common escrow accounts for online and offline operations.

Customer verification is going to be a sore point for many PAs as many independent sellers operate out of informal workspaces or may not have the adequate documentation required by the RBI.

The RBI’s diligence requirements are rather stringent on the time allowed for payment aggregator to comply.

The central bank has stipulated that those with an existing PA licence or those who have applied for one and are awaiting approval need to process 100% of their gross processing value (GPV) through customers and merchants whose diligence has been completed.

Meanwhile, companies that apply after the guidelines have been notified will need to have 100% compliance on the customer due diligence front within the first year of operations.

The RBI has allowed for a phase-wise implementation of diligence but PAs have to increase the base of verified customers by 25% every three months from December 2024.

Diligence Burden On Payment Aggregators, Merchants

With higher due diligence requirements, startups fear that it will take them longer to onboard new customers. Plus, it also adds to the cost of compliance both on the PA side as well as merchant side.

For instance, some PAs might have to increase the strength of their in-house teams for customer verification purposes. While several are banking on automation to accelerate onboarding, the RBI has called for physical verification of merchant and business documentation.

However, given the mandate for physical verification, those PAs who do not want to hire additional employees could be compelled to empanel agencies and outsource the verification.

“This might be cheaper than hiring staff to conduct the verification in-house, but also opens up risks of inadequate checks by agencies that are dealing with large volumes. At the end of the day, the burden to ensure that the verification is done in the right manner still falls on the PA,” said another industry insider and cofounder of a digital KYC solutions company that works with a number of such payments companies.

With the new guidelines, the RBI has for the first time also brought physical digital payments under the same ambit as the rules for online digital payments. This means that companies offering point-of-sale systems or quick response (QR) codes or soundboxes among other devices to small and medium retail merchants would also need to get a PA licence for operations.

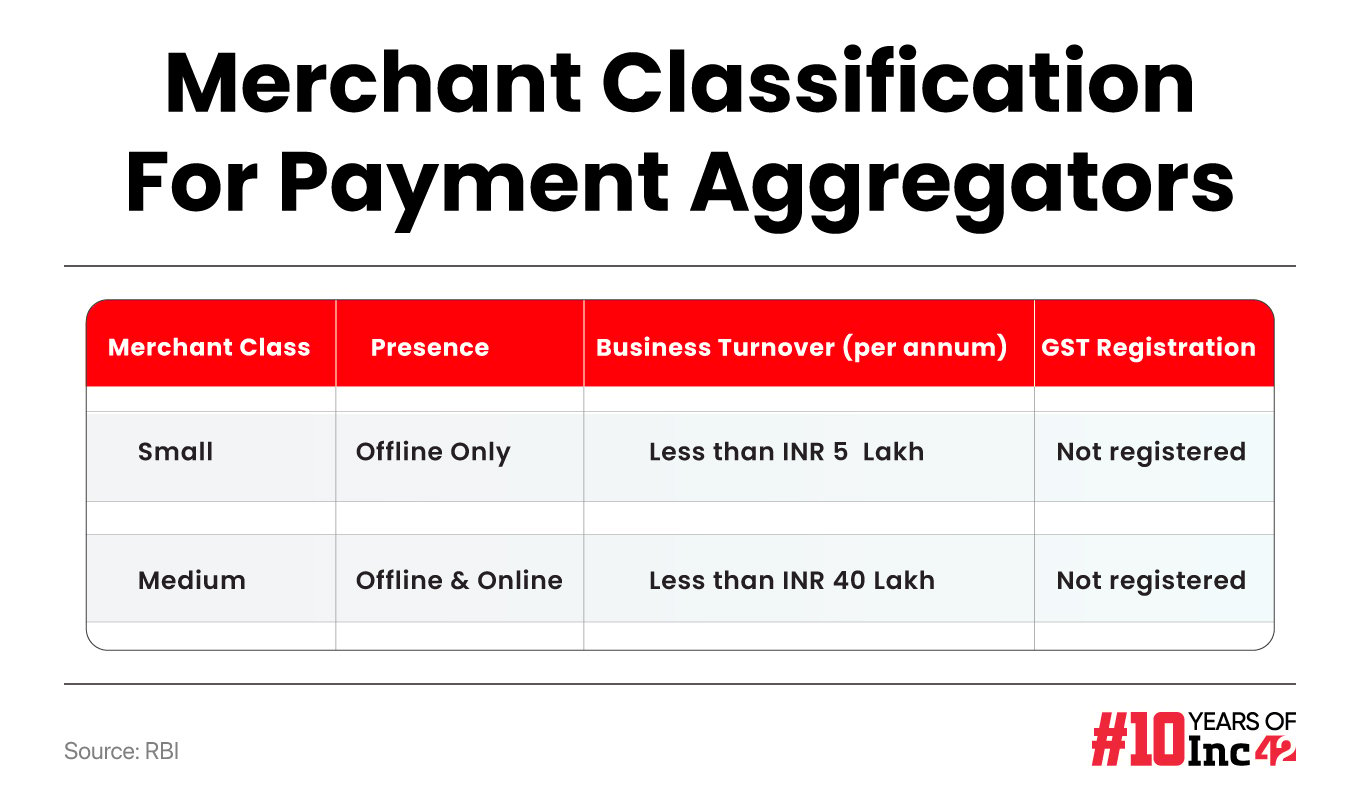

While the RBI has separated these two licences, it allows players to apply for both or either with different thresholds for due diligence of its customers i.e merchants.

“Essentially, it’s making it harder for smaller merchants to sell online or to implement PA services such as QR codes or soundboxes. Many of these merchants do not have data related to contactability or proper addresses in the places they operate. Many have permanent addresses in other states, so this complicates how quickly they can be onboarded,” added the Delhi NCR-based founder quoted above.

What Explains The Payment Aggregator Rush

Given these potential compliance challenges, one wonders why there is a glut of companies lining up at the RBI for a PA licence.

Besides the obvious economic upside, there is also a feeling that the RBI wants to encourage a large base of PA entities to ensure that no single PA can gain an advantage over the others in terms of onboarding merchants.

For instance, given the PA licence for Amazon Pay or Google Pay or Tata, there is always a danger of big tech companies and conglomerates monopolising the PA space and leveraging affinities between their various businesses to dominate the market.

Having multiple payment aggregators also means that merchant onboarding does not slow down due to friction with any particular player’s verification operations.

“When it comes to UPI, two or three platforms have a large market share and now the regulator is looking to tackle this with caps on the transaction shares for each platform. Instead of concentrating payment aggregation with one or two companies, it’s better for the system to have multiple players who all have to follow the same rules,” according to the founder of a Mumbai-based fintech-focussed fund.

This would also help arrest any potential slowdown in the number of online sellers or verified retail merchants. With many PAs targeting the merchant and seller base, there is a greater chance of covering the depth of the market faster. “India has millions of merchants and online sellers who need better KYC. It’s better to have 20 players operating and growing this penetration rather than one or two players enjoying the access which is not suited for such a large market,” the investor added.

And this is not an overnight development either. Many of these startups have waited for nearly a year for RBI’s nod and perhaps the recent spate of approvals is a sign that the central bank was waiting to make up its mind on the regulations needed to govern online payment aggregation, which is seen as a critical pillar of the digital economy.

So why are more and more startups going for a PA licence even as compliance seems to be getting harder? The answer ironically is because compliance is getting harder, and everyone sees a chance of grabbing a chunk of the market in these circumstances.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)