swiggy

According to industry sources keeping a close eye on the foodtech giant in the run-up to the company’s public listing, the Swiggy management and investors engaged in several discourses in the last few months to reach a consensus over the company’s valuation.

Unlike the company’s largest shareholder, Prosus, which as per our sources wants to pound the IPO table with a higher valuation, the management and investment bankers are looking at a discount from Swiggy’s last valuation of $10.7 Bn. But then, it is only natural for Prosus to ask for a sky-high valuation as it holds 33% of the company and plans to offload a majority of its stake in the firm.

lockquote>

According to multiple media reports, Swiggy is looking at a pre-IPO round and offering various high-net-worth individuals (HNIs) shares at a 20% discount to the last valuation or even steeper. This is despite Baron Capital’s and Invesco’s optimism in the business and their subsequent valuation markups for Swiggy.

Last month, US-based fund manager Invesco marked up Swiggy’s valuation to $12.7 Bn, a 19% increase from its last markup in October 2023.

Nevertheless, what has turned up the heat for the Bengaluru-based foodtech major before its stock market debut is its Gurugram-based rival Zomato’s impressive run on the bourses, its back-to-back profitable quarters and a positive outlook by brokerages.

At a time when Swiggy has taken a confidential route to file its IPO papers, let’s understand the key factors that will bolster Swiggy in making its $1.2 Bn IPO a grand success.

Swiggy To Say No To A Saucy Valuation

Instead of shooting for the moon in terms of valuation, the foodtech giant could target a modest valuation, something similar to its last funding round.

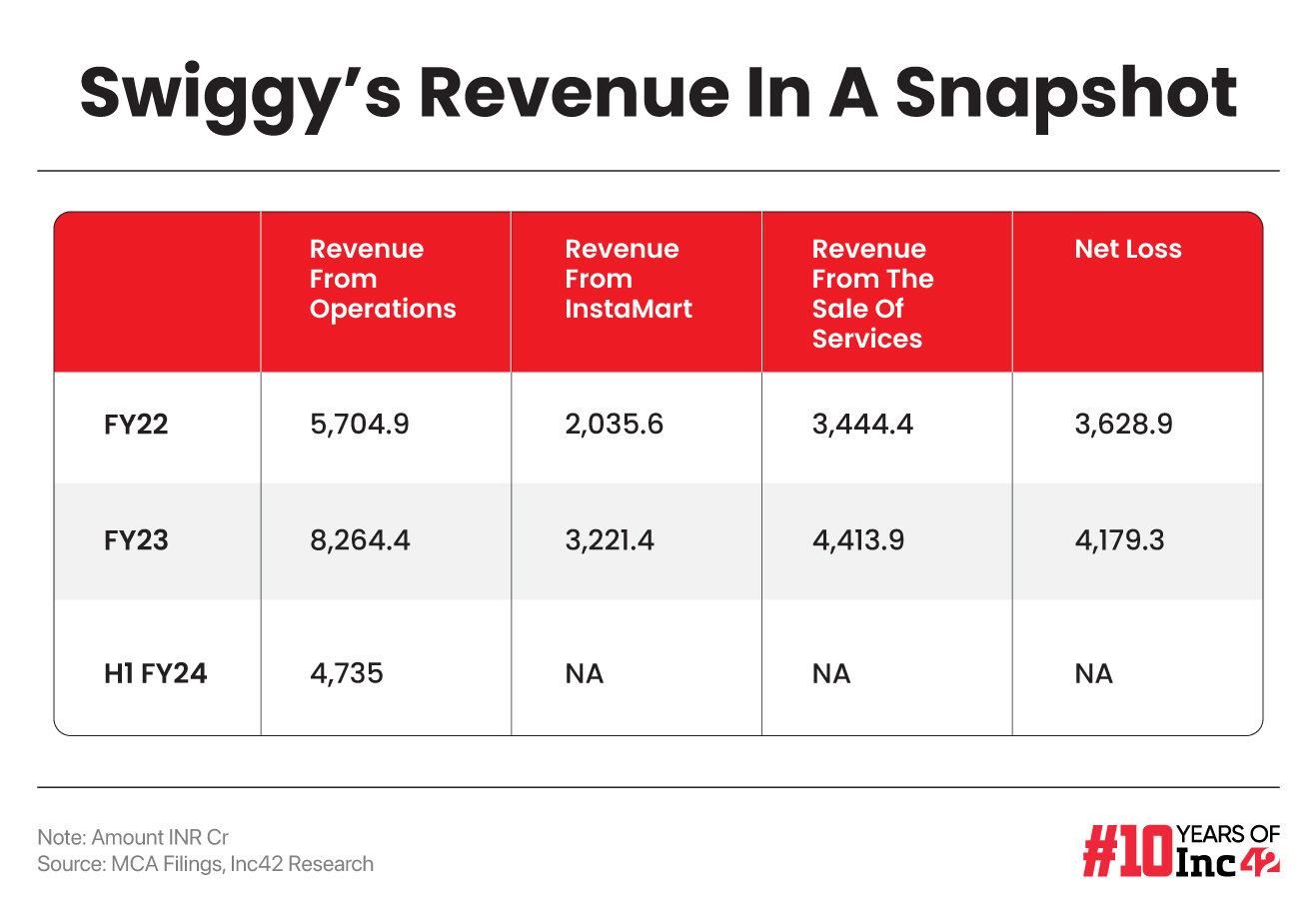

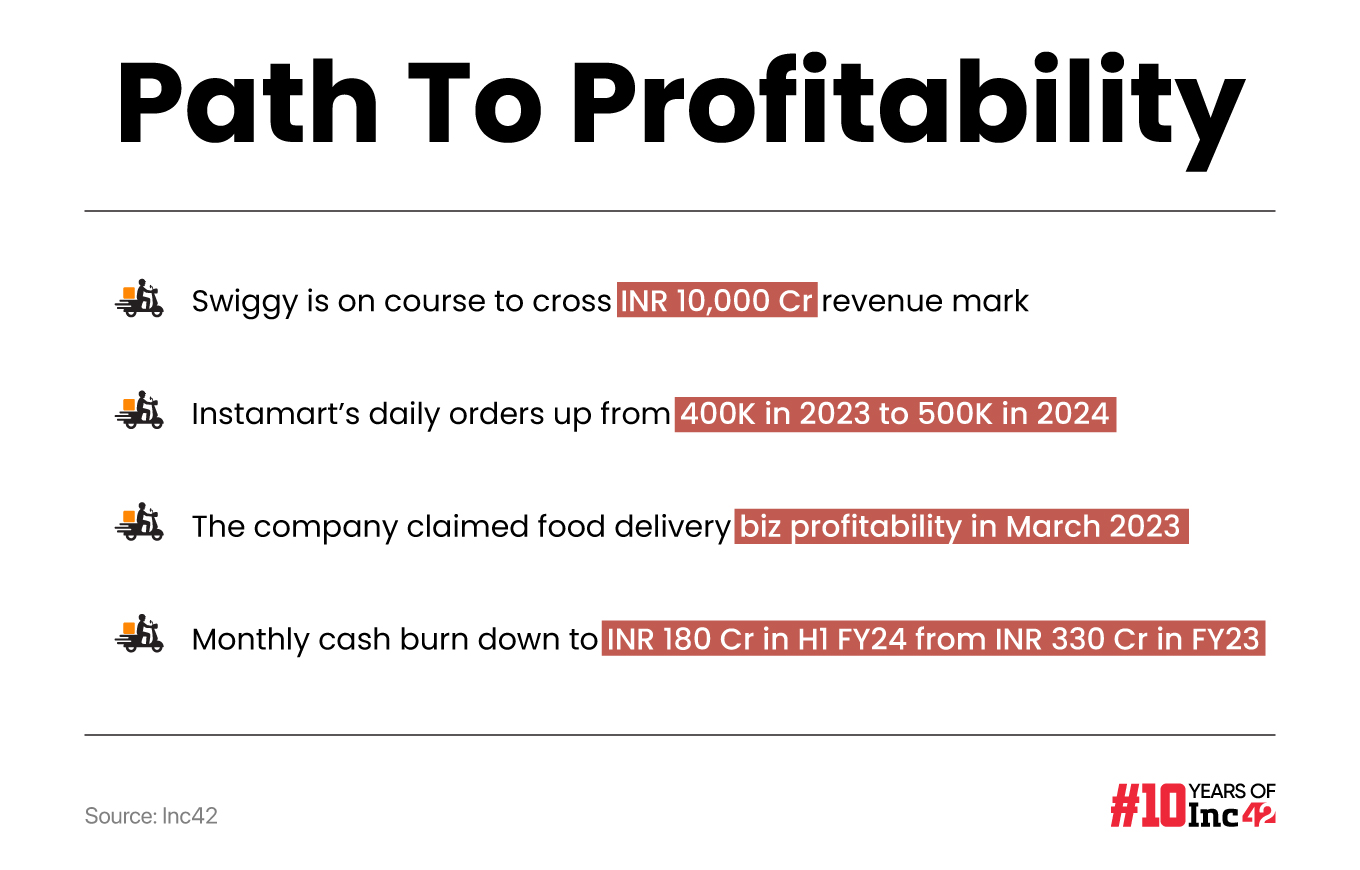

This projection by industry experts is despite the company’s claims that its food delivery business is already profitable and it has been able to cut losses in the quick commerce business, Instamart.

Over the course of the financial year 2023-24 (FY24), Swiggy was able to reduce its marketing expenses and employee costs. Further, in a bid to reduce its operational costs, the company integrated Swiggy Mall and InsanelyGood with Instamart this year.

The company could also consider maintaining a realistic valuation, especially since it has ceded the first-mover advantage in the quick-commerce sector to Zomato’s Blinkit and Zepto.

Zomato listed on the bourses at a $8.6 Bn valuation in 2021 and currently has a market capitalisation of nearly $20 Bn.

Notably, Swiggy’s CEO Sriharsha Majety targeted an annualised $1 Bn in gross merchandise value (GMV) for Instamart in 2022, but the vertical continues to be Swiggy’s Achilles heel.

For the first three quarters of FY24, Swiggy’s Instamart vertical posted a total loss of $207 Mn.

The investment management firm Wright Research cofounder, Sonam Srivastava, sees a realistic valuation of new-age companies paving the way for a successful public market debut.

“Markets are already aware of the overvalued tech startup IPOs of 2021 and 2022. Hence, it would be folly for the likes of Swiggy, Ola and others to price their IPOs higher. I am sure the investment bankers will look at the previous trends. This is a better year for the IPOs, but Swiggy will have to get the timings right too,” she added.

lockquote>

Further, as per market analysts, the April to June quarter of FY25 will prove to be crucial for Swiggy to turnaround the market sentiments and show that the company is near to becoming contribution margin positive on a consolidated basis.

Institutional Investors To Save The Day

A significant trend noted in the 2023 IPOs across different sectors was the oversubscription of offerings by institutional investors, resulting in strong responses from the public.

Towards the end of 2023, we saw the institutional investor portion of several companies get oversubscribed. However, the retail portions were either fully subscribed or near to it.

For instance, the institutional investors portion of Mamaearth was subscribed 11.5X whereas its retail portion got subscribed by a mere 1.35X. Some other notable names are SAMHI Hotels (1.7X), HMA Agro Industries (0.96X), Mankind Pharma (0.92X), and Avalon Technologies (0.88X).

Nikhil Kishore, a Mumbai-based market analyst said that the IPO-bound Swiggy should tap into the foreign institutional investors’ (FII) capital, which will negate any aberrant response from retail investors.

lockquote>

It’s worth noting that with robust economic growth and favourable quarterly performance by companies, FIIs are anticipated to bolster their investments in India’s equity markets in FY25, extending the trend observed in FY24.

Moreover, a noticeable trend of FIIs strengthening their positions in new-age companies has occurred over the past two years. Notably, as of December 2023, FIIs held more than 63.7% stake in Paytm, 62.7% in Delhivery, and over 50% stake in Zomato.

On the domestic front, Kishore said that IPOs have been receiving significant interest from asset management companies (AMCs) on the back of a sudden uptick in the appetite of mutual funds investors in India.

Overall, this paves the way for Swiggy’s healthy stock market debut.

Swiggy To Cash In On Zomato’s Success

Despite Swiggy trailing behind in market share (46%), experts suggest that this shouldn’t necessarily raise alarm bells for the Bengaluru-based firm.

A public markets analyst, who specialises in advising startups on IPOs, told Inc42 that Swiggy stands to benefit as investors see it aping Zomato on the Street.

“With few players in this market, especially retail investors will closely monitor how Zomato achieved profitability over a year after its listing, focussing on operational execution and improving unit economics. There’s no reason why Swiggy can’t replicate its rival’s success,” the analyst said.

lockquote>

He added that Zomato’s recent 260% surge in stock price last month (April 2024) has prompted analysts to reconsider their perspectives on the instant delivery model, which could work in Swiggy’s favour.

Zomato’s current market capitalisation of INR 1.7 Lakh Cr is also expected to significantly influence investors considering Swiggy’s IPO.

Quick Commerce Vertical To Emerge As The Dark Horse

A recent report from Goldman Sachs, estimating Zomato’s quick commerce valuation to be $13 Bn higher than its core food delivery business, has sparked enthusiasm in the markets.

Consequently, several investment banks and brokerages, including HSBC and Citibank, have raised their price targets for Zomato.

In its report, Goldman Sachs highlighted India’s rapid progress toward adopting the quick commerce industry, citing factors such as a sizable unorganised grocery sector, high population density in urban areas, and favourable delivery cost-to-average order value ratios.

The target addressable market for the quick commerce industry was $150 Bn as of 2023, with Blinkit, Swiggy Instamart and Zepto being the biggest players.

lockquote>

Blinkit as per a report from Elara Capital captured a 45% market share in the vertical followed by Instamart with a 27% share and Zepto at 21%.

According to Kishore, quick commerce has succeeded in turning into a convenience-led habit-inducing vertical in Tier 1 towns and metros of India.

“As against food delivery, improving operational efficiencies and enhancing both average order value and order volumes are crucial factors for the growth of the quick commerce industry. While a significant portion of Swiggy Instamart’s deliveries have focussed on groceries, which typically yield lower margins, players like Blinkit have expanded into electronics and non-food item deliveries within the quick commerce vertical for higher margins. This strategy will be adopted by other players too,” Kishore said.

Strengthening Revenue Streams To Boost Investor Sentiment

At a time when industry experts attribute Zomato’s faster revenue growth and profits to its B2B vertical, Hyperpure, Swiggy is in early discussions to enter the space with its eye on boosting its revenue streams.

Notably, Zomato’s Hyperpure contributes over INR 2,000 Cr to Zomato’s annual revenue. According to Kishore, Hyperpure has provided Zomato with an advantage, increasing revenues from restaurants by supplying raw materials and serving as inventory and infrastructure for Blinkit.

lockquote>

“This has been a crucial aspect missing in the Zomato-Swiggy competition so far. Swiggy can capitalise on this opportunity and focus on improving execution,” the analyst said.

Swiggy’s acquisition of restaurant booking platform Dineout in May 2022 for $120 Mn has started to bear fruits. The vertical contributed INR 77 Cr to the company’s total FY23 revenue of INR 8,625 Cr.

Meanwhile, it has ventured into the events business through Dineout and recently launched the Swiggy Dineout Great Indian Restaurant Festival, attracting participation from 7,000 eateries.

With this, Swiggy aims to lock horns with Zomato’s on-ground food events business, Zomaland, which offers a combination of dining and entertainment experiences across multiple Indian cities.

While anticipations run galore, analysts see Bengaluru-headquartered Swiggy to make a significant impression on the bourses, despite its struggle to turn a profit.

[Edited by Shishir Parasher]

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)