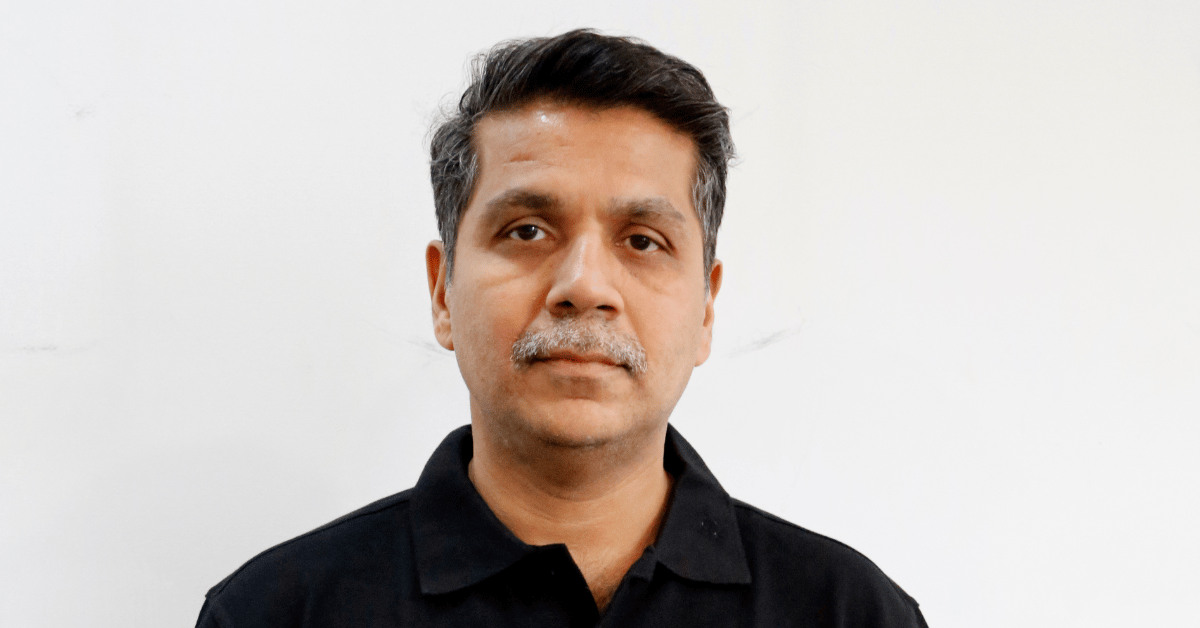

Talathi, a former CFO at Pepperfry, Mensa Brands and Vedanta Group, will lead the company’s financial function ahead of its planned IPO

Talathi replaces Mayank Gupta, who was the group CFO since September 2021

Recently, the company entered the tractor segment with TractorsDekho, targeting India’s farming communities, while fintech arm Rupyy entered into the personal lending space beyond automobile loans

Jaipur-based cardekho

Talathi, a former CFO at Pepperfry, Mensa Brands and Vedanta Group, will be responsible for financial planning and analysis, optimising capital allocation, driving mergers and acquisitions (M&A) activities and bringing new growth opportunities at the group level.

Founded in 2008 by Amit Jain and Anurag Jain, CarDekho Group includes brands such as automobile marketplace CarDekho, insurance platform InsuranceDekho, lending platform Rupyy and car rental platform Revv.

Talathi replaces Mayank Gupta, who was the group CFO since September 2021.

The group said it has roped in Talathi to strengthen its position in the national and international market through his expertise in navigating capital market volatilities, regulatory landscapes, and compliance requirements across geographies.

“It is impressive to witness how the [CarDekho] Group has sustained continued growth since its inception and changed the outlook of the auto and finance industry with its deep-rooted commitment to innovation and customer-centric solutions. Joining them on their journey, I am excited to further strengthen our financial foundation, enhance customer value, and foster sustainable growth,” Talathi said in a statement.

CarDekho last raised funds at a valuation of $1.2 Bn and is backed by investors such as Peak XV Partners, Hillhouse Investment, CapitalG, Ratan Tata Trust, LeapFrog (ESG-focused investment fund), HDFC Bank, ICICI Bank, and Axis Bank amongst others.

Recently, the company entered the tractor segment with TractorsDekho, targeting India’s farming communities, while fintech arm Rupyy entered into the personal lending space beyond automobile loans.

In FY23, Cardekho Group’s consolidated revenue grew by 1.5X to INR 2,331 Cr, even though net loss rose marginally to INR 562 Cr from INR 535 Cr in FY22.

In a statement, CarDekho credited the increase to the growth seen by InsuranceDekho, Ruppy, its marketplace and financing business in Southeast Asia.

Cofounder and CEO Amit Jain earlier told Inc42 that the company aims to achieve more than 60% revenue growth YoY in FY24.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)