The fund will look to invest in early-stage tech startups from seed to pre-Series A across sectors

Launched in 2015, ThinKuvate was started by a group of close professionals with having interest in angel investing with a pool of $1.5 Mn

The average investment size from the new fund is likely to be up to INR 3 Cr. They plan to invest in 12 -15 startups in a year

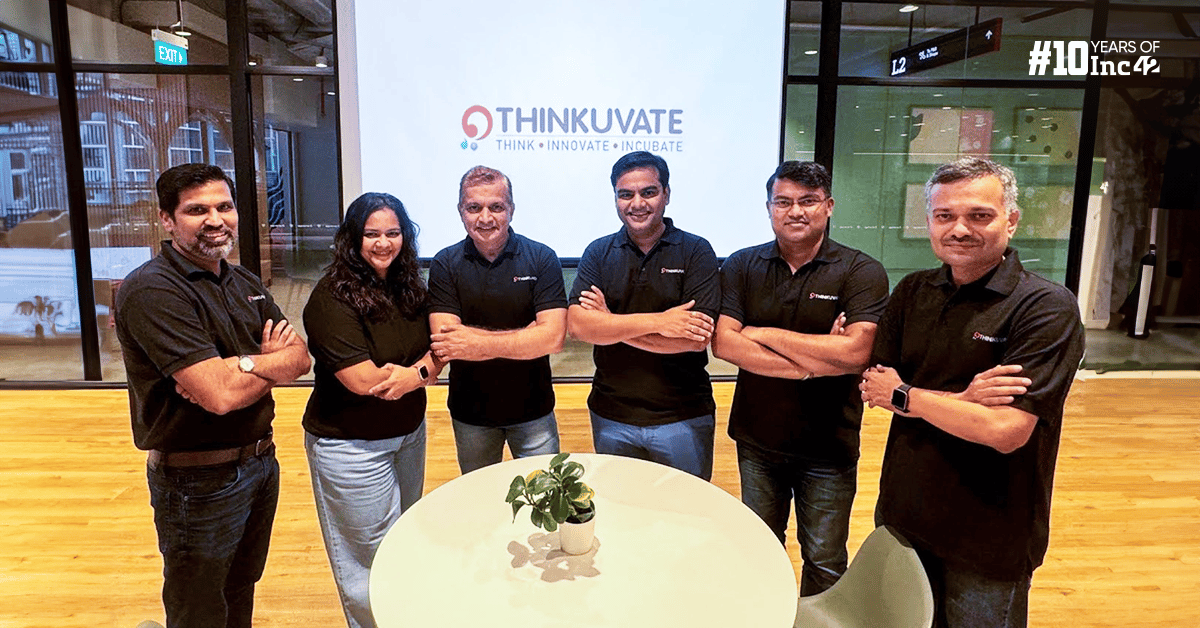

Singapore-based angel investment network ThinKuvate has obtained a SEBI license to launch their first India-focussed fund with a corpus of INR 100 Cr. The fund will look to invest in early-stage tech startups from seed to pre-Series A across sectors.

ThinKuvate will be kicking off its fundraising activities with a series of investor-centric roadshows in Nagpur, Raipur, Bengaluru and Chennai. The first close of the fund is expected to be within this quarter.

The fund is founded by Nagpur University alumni Ghanshyam Ahuja, Ritesh Toshniwal and Vikas Saxena. The fund has also expanded its core team with Mayank Jain joining ThinKuvate as

CEO of the fund.

Launched in 2015, ThinKuvate was started by a group of close friends with an interest in angel investing with a pooled corpus of $1.5 Mn. It has been an active investor in India and SEA for the last seven years. Today, the angel network has grown to 150+ mid to senior professional NRIs.

This network will help the fund to bring in added capabilities for its portfolio companies such as mentorship, help with technology and restructuring, go-to-market discovery, business development and more.

“Thanks to the entrepreneurial spirit of India, even if we [NRIs] have been living away from India for 10 or 20 years, we still have that connection back to India. We still understand the market well, which brings in a natural affinity for our network to invest in the Indian market,” ThinKuvate founding partner Ritesh Toshniwal told Inc42.

lockquote>

The fund is counting on this network and is looking for India-based HNIs and family offices to come onboard as LPs. “In my view, we can look up to 60% overseas and 40% local capital availability,” he added.

They currently have a portfolio of 22 startups, of which 40% have gone on to raise Series B rounds while one of them is getting listed on Australian exchanges. Sixteen of these startups are from India which includes the likes of CureSkin, Vidyacool and Cube Wealth.

The fund has already made a partial exit from Cureskin. The average investment size from the new fund is likely to be up to INR 3 Cr. The fund plans to invest in 12 -15 startups in a year.

Thinkuvate’s Investment Thesis

ThinKuvate stands for Think, Innovate, Incubate. According to Toshiwal, Thinkuvate primarily invests in B2B2C startups that are solving real-life problems with technology and can scale up fast, not only in India but also across Southeast Asia.

Although sector agnostic, Toshiwal believes that the fund can find high-potential startups to invest in sectors such as healthtech, edtech and consumer tech.

From an investment perspective, the fund does one to two weeks of 360-degree due diligence before investing in any startup. The team looks at startups showcasing continuous month-on-month revenue growth in the last six months with strong financials and unit economics. The team also prefers to invest in startups with two or more founders.

Toshniwal also believes that this is the right time for the fund to launch in India.

As he explains, compared to seven years before, India today has a lot of repeat founders who know how to go to market faster and scale sustainably, thereby giving an option for faster exits. Also, now more professionals with 10 or 15 years of experience are entering into entrepreneurship as there is a whole ecosystem of investment and mentorship available to them.

“Gone are the days when the entrepreneurs had to completely bootstrap or even sell their properties to build a startup. At the same time with the advent of increased technology adoption, both enterprises and customers have evolved, opening up a plethora of opportunities,” he added.

lockquote>

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)