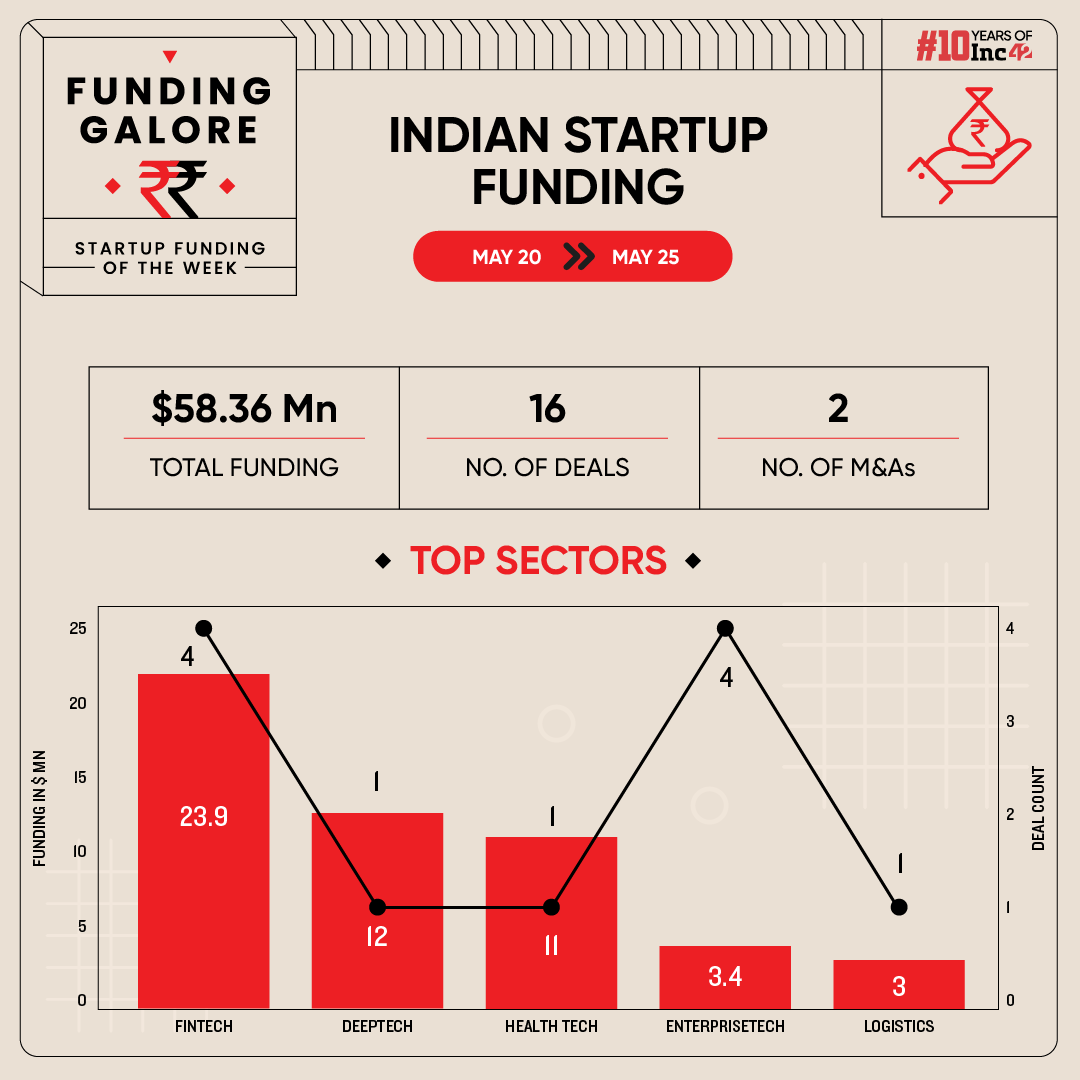

Indian startups were able to net a $58.36 Mn across 16 deals, a 52% decline from last week’s $121.8 Mn raised across 21 deals

The Fintech sector emerged as an investor favourite this week, with startups in the sector securing $23.9 Mn across 4 deals

Seed funding jumped up more than 4X this week to $13.12 Mn from last week’s $3.5 Mn

Investment activity across the Indian startup ecosystem saw a significant decline throughout May. While funding momentum started slipping right from the get-go of the month, it fell to the lowest in the week between May 20 and 25. During the week, startups bagged $58.36 Mn across 16 deals, a 52% drop from $121.8 Mn raised across 21 deals in the preceding week.

Funding Galore: Indian Startup Funding Of The Week [May 20 – May 25]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 23 May 2024 | Navi Finserv | Fintech | Lendingtech | B2C | $18 Mn | Debt | Kairus Shavak Dadachanji, Pervin Kairus Dadachanji, Rishad Kairus Dadachanji, Rohit Kapadia, Sandhya Kapadia, Yash Kapadia | – |

| 20 May 2024 | Stanza Living | Real Estate Tech | Shared Spaces | B2C | $12 Mn | – | Alpha Wave, Matrix Partners, Accel India, Peak XV Partners | – |

| 23 May 2024 | UnifyApps | Enterprisetech | Horizontal Saas | B2B | $11 Mn | Seed | Elevation Capital | Elevation Capital |

| 20 May 2024 | Varthana | Fintech | Lendingtech | B2B-B2C | $3.2 Mn | – | Triodos Investment Management | Triodos Investment Management |

| 23 May 2024 | Portl | Healthtech | Fitness & Wellness | B2C | $3 Mn | – | Bharat Innovation Fund, Kalaari Capital, T-HUb foundation | Bharat Innovation Fund |

| 22 May 2024 | NoPo Nanotechnologies | Deeptech | IoT & Hardware | B2B | $3 Mn | Pre-Series A | Axilor Ventures, Inflexor Ventures, Spectrum Impact, Aureolis | Axilor Ventures, Inflexor Ventures |

| 23 May 2024 | EkAnek | Ecommerce | Social Commerce | B2B-B2C | $2.5 Mn | – | Lightspeed India | – |

| 22 May 2024 | SuperKalam | Edtech | Test Preparation | B2C | $2 Mn | Seed | Y Combinator, Fundersclub, GoodWater Capital, Nurture Ventures, SuperCapital, Pareto Ventures, Puneet Kumar | Y Combinator, Fundersclub |

| 23 May 2024 | ProsParity | Fintech | Lendingtech | B2B-B2C | $2 Mn | Pre-seed | BEENEXT, Sparrow Capital, All In Capital, DeVC, Huddle Ventures, Ashish Gupta, Dhyanesh Shah, Abhishek Goyal, Nitin Kaushal | – |

| 23 May 2024 | Superfoods Valley | Ecommerce | D2C | B2C | $842K | Pre-Series A | Sharrp Ventures, Thinkuvate, Multiply Ventures | – |

| 20 May 2024 | KonProz | Fintech | Fintech SaaS | B2B | $700K | – | Dr. Ruchi Parekh, RDB Group | Dr. Ruchi Parekh |

| 23 May 2024 | Freshleaf | Ecommerce | D2C | B2C | $120K | Seed | Inflection Point Ventures | Inflection Point Ventures |

| 23 May 2024 | Collective Artists Network | Media & Entertainment | – | B2B | – | – | Nikhil Kamath | – |

| 23 May 2024 | Fix My Curls | Ecommerce | D2C | B2C | – | Seed | Smbhav Venture Fund, India Quotient and DSG Consumer Partners | Smbhav Venture Fund |

| 21 May 2024 | Infinx | Healthtech | Healthcare SaaS | B2B | – | – | KKR, Norwest Venture Partners | – |

| 23 May 2024 | Agrilectric | Agritech | Farm Input | B2C | – | – | ah! Ventures | – |

| Source: Inc42 *Part of a larger round Note: Only disclosed funding rounds have been included |

||||||||

Key Startup Funding Highlights Of The Week

- Buoyed by the $18 Mn funding secured by lendingtech startup Navi Finserv, the biggest paycheck of the week, the fintech sector emerged as the sweet spot for investors this week. Startups in the sector secured $23.9 Mn across 4 deals, the highest number of deals secured at a sectoral level.

- Startups in the ecommerce space also secured a similar number of deals, raising $3.5 Mn across 4 transactions.

- Seed funding jumped more than 4X this week to $13.12 Mn from last week’s $3.5 Mn.

Updates On Indian Startup IPOs

- With eyes on raising $450 Mn through the sale of dollar bonds, hospitality unicorn OYO officially deferred its plans to make a debut in the public markets. According to documents from the market regulator SEBI, the company officially withdrew its IPO papers on May 17.

- Coworking startup Awfis’ public issue received 9.84 Cr bids as against the 86.29 Lakh shares on offer, resulting in an oversubscription of 11.4X. Retail investors led the pack as the quota was subscribed 21.1X.

- Online travel aggregator (OTA) ixigo public listing plans are now in high gear as it received a go-ahead from SEBI for its over INR 120 Cr IPO. The offer will comprise a fresh issue of shares worth INR 120 Cr and an OFS component of 6.66 Cr shares.

- Insurtech unicorn Go Digit General Insurance’s (Digit) Go Digit made an underwhelming public market debut this week. Its shares were listed at INR 286 per share on NSE, a 5.1% premium of than the issue price of INR 272.

Startup Acquisitions This Week

Other Major Developments Of The Week

- Home furnishing startup Vaaree is looking to raise $2.5 Mn as part of a Pre-Series A funding round from Capier Investments and Peak XV’s Surge. The company’s board passed a resolution to allot 3,063 CCPS to the new backers.

- Fashion brand Rare Rabbit is close to securing over $60 Mn in its maiden funding round. The round will be led by A91 Partners, which will invest $42 Mn and will see participation from Manyavar’s family office and Zerodha’s cofounder Nikhil Kamath

- Venture capital (VC) firm Caret Capital has launched Caret360 Accelerator, a 100-day outcome-focussed programme for early-stage startups. Under this programme, selected startups will receive up to INR 3 Cr in investment as well as an opportunity to secure further follow-on capital from the VC.

- IVY Growth Associates launched Arigato Capital fund with a target corpus of around $29 Mn. With the Category I AIF fund, it will invest in startups across agritech, cleantech, GenAI, fintech, consumer brands and software-as-a-service (SaaS) sectors.

- EV cab-hailing startup BluSmart is looking to raise $25 Mn in its Pre-Series B round in equity preference. The fundraise will see participation from major new and existing investors.

- D2C skincare brand WOW Skin Science is in talks with existing and new investors to raise $65 Mn-$75 Mn in primary capital at a valuation of $400 Mn. Besides existing investors like GIC and ChrysCapital, it is also in Japanese and Middle East-based funds for the round.

- Google has picked up a minority stake in Flipkart in a funding round led by the platform’s parent Walmart. The investment is likely a part of the ecommerce major’s larger $1 Bn fundraise.

- VC fund YourNest Venture Capital has partnered with deeptech enablement platform SanchiConnect to launch an accelerator for deeptech startups, Velocity Fast Track Startup Funding Program. It will invest INR 30 Cr in eight startups.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)