The fintech repository will facilitate access to all information related to the Indian fintech sector as well as data related to various fintech startups

The central bank also announced the creation of a related repository, EmTech repository, for RBI regulated entities such as banks and NBFCs

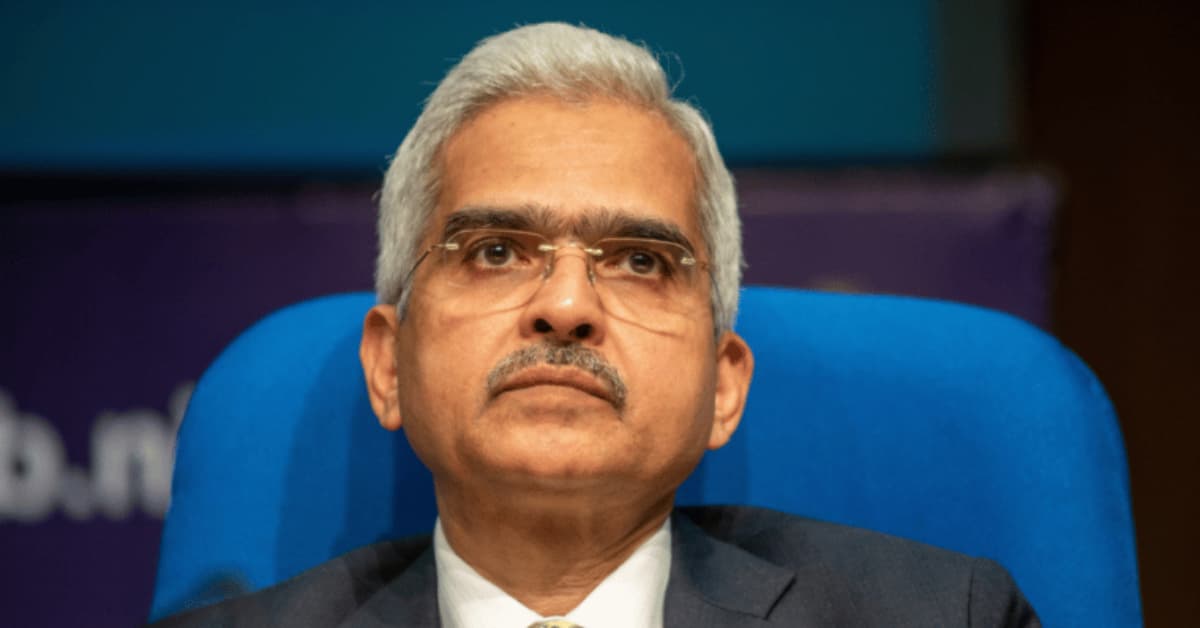

During the event, governor Shaktikanta Das also launched two other offerings – the PRAVAAH portal and the Retail Direct Mobile App

Five months after it was first announced, Reserve Bank of India (RBI) governor Shaktikanta Das on Tuesday (May 28) launched the fintech repository.

The repository will facilitate access to all information related to the Indian fintech sector, including data related to various fintech startups as well as their activities, operations and technology use cases.

“The FinTech Repository will contain information on (the) Indian fintech sector for a better understanding of the sector from a regulatory perspective and facilitate in designing appropriate policy approaches,” the RBI said in a statement.

The repository will enable the availability of data at the sectoral level, trends, analytics, among others. This, the RBI said, would be “useful” for both policymakers and industry stakeholders.

Additionally, the RBI governor also announced the creation of a related repository for RBI regulated entities such as banks and NBFCs. Called the EmTech repository, the platform will track the adoption of emerging technologies, such as AI, ML and blockchain, by these stakeholders.

The RBI said that the fintech and “EmTech” repositories are secure web-based apps and are managed by the central bank’s wholly-owned subsidiary called Reserve Bank Innovation Hub (RBIH).

“(The) Reserve Bank of India encourages the fintechs and regulated entities to actively contribute to the repositories,” added the central bank.

The new offering was launched during an event which was also attended by other senior officials of the central bank as well as representatives of fintech startups and other industry bodies.

During the event, the governor also launched two other offerings – the PRAVAAH portal and the Retail Direct Mobile App. While the PRAVAAH portal will make it convenient for individuals and entities to apply online for various regulatory approvals, the Retail Direct Mobile App will enable users to seamlessly invest in government securities.

It is pertinent to note that the fintech repository was announced earlier as part of the RBI’s bimonthly statement in December 2023. The new repository will offer concerned stakeholders a one-stop platform for understanding developments in the fintech ecosystem and gain deeper knowledge about players in the space.

The latest development comes at a time when the RBI has cracked its whip on the fintech ecosystem as cases of lax corporate governance make headlines. Earlier this year, it directed an unnamed card network to halt all card-based business payments made via payment intermediaries to entities that do not accept card payments with immediate effect.

Earlier this month, the central bank also expressed concerns about the evaluation process used by banks and fintechs, especially while sourcing gold. It also cautioned banks on gold loan disbursals made through fintech startups.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)