Founded by Shakeef Khan and Ajay Vaish in 2021, Naksh is a D2C brand that sells specially designed bed and bath linens for younger audiences across ecommerce platforms and its website

The startup has a customer base of 5,000 per month and an average order value of INR 1,200

It has netted a total funding of INR 1.5 Cr from Haptik’s founder Aakrit Vaish

The direct-to-consumer wave has changed the consumption patterns across categories. Shakeef Khan had seen it up close as the head of commerce at Bewakoof, which disrupted the casual wear category before being acquired by TMRW.

But the depth of the Indian market means there are still gaps where new brands can be built.

And in 2021, when Khan was looking to set up a new home in Mumbai, he realised that bed and bath linen is a category that’s still largely dominated by small manufacturers and legacy brands and as a result there hasn’t been much innovation in terms of design.

“It seemed like a genuine problem that many other new-age buyers like myself would have been facing and I decided to dig deeper. After a research of about six months, I realised that while limited options is a problem, people are also duped into buying polyester bed linen on the pretext of it being rich cotton. These discoveries triggered me to start Naksh,” Khan told Inc42.

Khan wanted Naksh to bridge the gap in the category by providing high quality bed and bath linen, with a “minimalist” bent in design and consistency in quality. The company has chosen bright colours such as blue, aqua, turquoise which are in line with the target audience of new-age homemakers.

lockquote>

But how did it manage to disrupt an industry which has been set in its ways for so long?

The Story Behind Naksh

Even before Bewakoof, Khan had plenty of experience when it came to ecommerce. He started a D2C footwear brand called Yute in 2014, which was able to expand from an online business to omnichannel retail in three years before winding down. He then set up a fashion and lifestyle D2C brand Disrupt, which was in the limelight briefly thanks to associations with celebrities such as Ranveer Singh. However, the startup was unable to sustain itself during the pandemic.

The experience of building these brands has served Khan well, and it was during his time at Bewakoof that he conceptualised Naksh and tapped his network to make it happen.

One of the key people in the journey is Haptik founder Aakrit Vaish and his father Ajay Vaish. The Vaish family came from a textile industry background and manufactured bed and bath linen brand “MARK HOME”.

“Ajay, who was also instrumental in the launch of Welspun in India, brought in a lot of credibility in the textile space. We knew he was the right person to work with right from the get go. Fortunately for us, he was also thinking of foraying into the D2C space and targeting new-age customers at that time. My research as well as experience in the space combined with his experience and business acumen is what’s behind Naksh,” Khan exclaimed.

With Aakrit Vaish pouring in INR 1.5 Cr as seed capital, Naksh was ready for launch by June 2022.

Khan acknowledges that the key challenge was changing the relationships Indians have with their bedroom decor. He feels that the modernisation of the bedroom tends to take a Western inspiration, but when it comes to linen designs and patterns, the options are limited.

Naksh claims to source high-quality fabric from suppliers across India and the final products are manufactured in Mumbai, where the brand can monitor quality and consistency.

Besides capital, the Vaish family connected Naksh to large manufacturers for raw material procurement. The company also outsourced some production for certain styles in addition to manufacturing in-house. Naksh’s flagship product today is a range of bedsheets and covers with minimal designs — solid colours and stripes.

Beating The Competition

As of now, it sells bed linen across marketplaces such as Amazon, Flipkart, Ajio, Meesho, Pepperfry, and its native online store, to about 5,000 consumers on a monthly basis. Khan claims that the average order value (AOV) is about INR 1,200, while it sells products in the range of INR 500 to INR 2,800.

He says that the company has a net margin of 10%. He attributes the profit margin to the company’s limited marketing expenses.

The company only runs its ads on ecommerce platforms Amazon and Flipkart, with a brand messaging meticulously designed by Khan himself, who also moonlights as an influencer. The company’s brand messaging revolves around the premium look and feel of its sheets.

“We target a very underserved segment in the niche bedsheet market, the mass premium segment. While players like D’Decor or The Home Style cater to the premium segment, the under INR 500 category primarily buys their bedsheets offline. Given a dearth of players in the space, we are able to reduce our customer acquisition costs to only 12-13%,” he said.

lockquote>

While the company could be counted as one of the early movers in the online bedsheet business, the space has gotten more cluttered over the past few years. A simple search on Amazon can lead you to interact with tons of other players, old and new, looking to touch base with consumers.

Inc42 first discovered Naksh during its 2024 edition of FAST42.

Khan counts on the brand’s positioning as bedsheets specially designed for younger audiences to strike a chord with its potential user base digitally.

However, multiple new-age startups with a similar line of brand messaging have also been able to connect the dots and realise the market opportunity in the space. Hence, startups like Wakefit, Haus & Kinder, Blocks Of India, among a few others have also forayed into the space and are looking to build a connection with the audience.

However, Khan is confident of taking on these players. Given the intensifying competition in the space, what differentiates Naksh in the blossoming bedsheet space?

Naksh Eyes Offline Expansion

In his decade-long career in building ecommerce brands, Khan believes he has gained a key insight in nurturing a D2C brand to success. He believes the key to success for a brand in D2C is supply chain. Product market fit (PMF) is only good enough when the business is able to meet the demand with supply. This is especially critical because right now Naksh is not an omnichannel brand.

“The holy grail is inventory and supply chain management. We distribute fabric manufacturing on the basis of colour to different suppliers. A supplier then churns out sheets in five different sizes in batches based on consumer demand per month. As of now, our inventory is running with a 30-day cover and we focus on one metric: how quickly the inventory can be turned up and sent out,” the founder claimed.

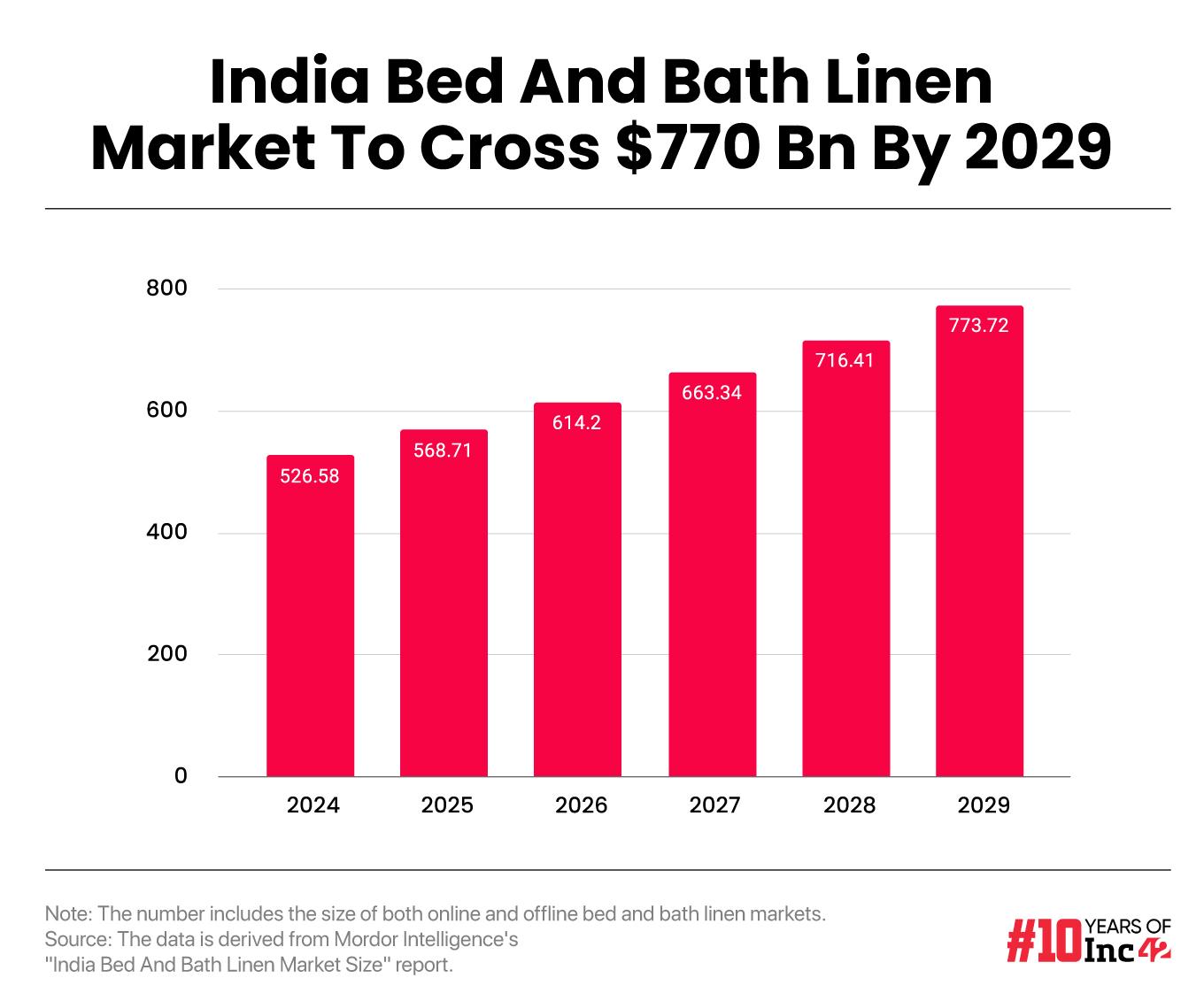

The company’s next phase of growth depends on how it can smoothen its supply chain. A large part of the market is still offline, Khan said, estimating ecommerce is just about 5% of the bed linen category in India.

In FY24, the company claims to have reached total revenue of INR 4.8 Cr. Its losses for the fiscal stood at INR 50 Lakh. Inc42 has not seen Naksh’s audited financials for FY24.

lockquote>

In FY23, the startup reported an operating revenue of INR 95.9 Lakh. The founder claims that the company is close to achieving its target of INR 1 Cr sales per month and is inching closer towards profitability.

Khan also said that the company achieved EBITDA breakeven in December 2023. Touching a monthly sales run rate of INR 1 Cr consistently will require a big push on the offline front.

Its offline plans include identifying top players in regional markets and bringing them onboard as distributors as well as retail chains. He believes that the company’s online brand positioning will row its boat offline as well. Besides, Naksh will also identify consumer hotspots across the country to set up its own stores.

But those plans are in the slightly distant future for Naksh. The reason behind this is the fact that offline expansion is extremely capital intensive, and identifying the right retail channels will require adequate time for market testing.

For this the company will need to bag additional funds. Khan, however, thinks that the right time to raise will only be after the company is able to stabilise its operations and reach breakeven or profitability. Doubling its revenue in FY25 will be a key step in reaching that milestone.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)