Founded in 2023 by Dhruv Kohli, Boba Bhai sells bubble tea in 45 flavours and K-Pop burgers with an Indian twist

With 27 outlets across seven cities, including Delhi, Gurugram, Udaipur, Bengaluru, Mumbai, Hyderabad, and Chennai, the company currently boasts an annual revenue run rate of INR 24 Cr and a monthly revenue run rate of INR 2 Cr

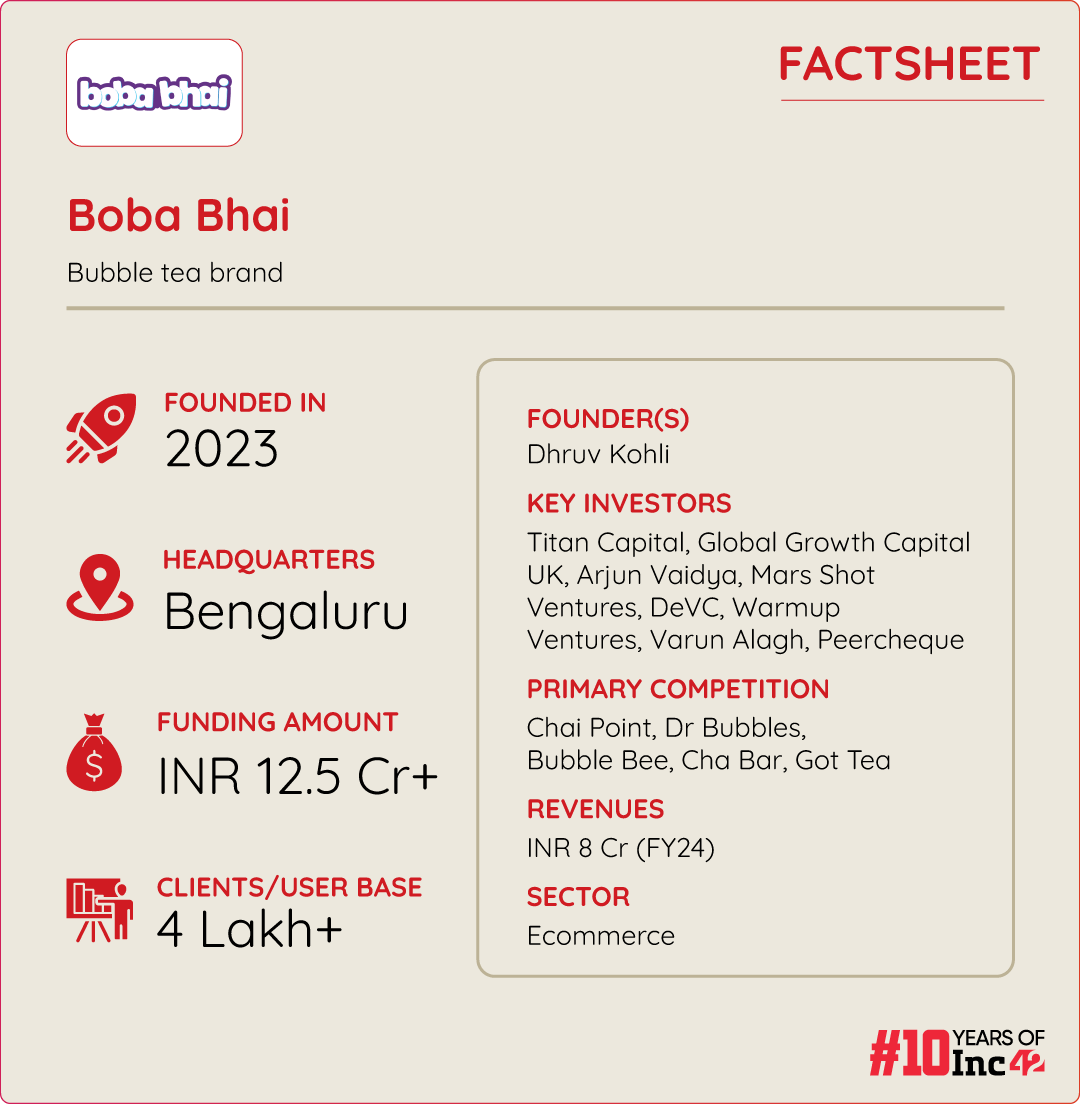

So far, the startup has raised INR 12.5 Cr ($1.4 Mn) from investors such as Titan Capital, Global Growth Capital UK, Arjun Vaidya, Peercheque among others

Bubble tea, a Taiwanese tea-based beverage, has dominated Asia Pacific and North America for quite some time, so much so that the global bubble tea market is anticipated to grow at a CAGR of 9% to become a $6.17 Bn opportunity by 2033.

This global drink has now found a fervent following in India. Social media platforms, particularly Instagram, reflect this trend, with hashtags like ‘bubble tea’ and ‘boba tea’ accumulating millions of posts.

Over the past two years, bubble tea has captured the interest of Gen Z in India, much like other global trends such as Turkish ice cream, Neapolitan pizza, K-Pop burgers, and ramen.

“In India, the bubble tea market is still in its early stages. But it’s growing rapidly. In the next 10 years, I see it becoming a $3 to $4 Bn market opportunity in India,” said Dhruv Kohli founder and CEO Boba Bhai.

While global brands like Chatime, Coco Fresh Tea & Juice, and Lollicup US dominate the bubble tea landscape globally, India is witnessing a rise in small players and even small cafes entering this new category. Among these emerging players are Dr Bubbles, The Bubble Tea Junction, Bubble Bee, Cha Bar, and Got Tea.

Following this trend, recently, Chai Point has also launched its own bubble tea. Among these, a new startup named Boba Bhai has emerged to tap into this emerging market.

“I am glad that players like Chai Point are selling bubble tea because it sends a signal to the market that India is evolving. This serves as market validation, indicating that players recognise India’s shift towards bubble tea,” Kohli said.

lockquote>

Founded in 2023 by Dhruv Kohli, Boba Bhai sells bubble tea in 45 flavours and K-Pop burgers with an Indian twist. With 27 outlets across seven cities, including Delhi, Gurugram, Udaipur, Bengaluru, Mumbai, Hyderabad, and Chennai, the company currently boasts an annual revenue run rate (ARR) of INR 24 Cr and a monthly revenue run rate (MRR) of INR 2 Cr.

Kohli claims that the startup achieved revenues of INR 8 Cr in the first six months of operations. By December 2024, he aims to reach INR 60-65 Cr in revenue and capture 75-80% of India’s bubble tea market share.

So far, the startup has raised INR 12.5 Cr ($1.4 Mn) from investors such as Titan Capital, Global Growth Capital UK, Arjun Vaidya, Mars Shot Ventures, DeVC, Warmup Ventures, Varun Alagh, and Peercheque. Additionally, with a monthly repeat rate of 45%, it serves over 60K customers a month and has an overall user base exceeding 4 Lakh customers.

The Boba Bhai Inception Story

The genesis of Boba Bhai stems from Kohli’s craving for bubble tea when he returned to India from Australia in April 2022. Kohli was surprised to find that the beverage that he had been cherishing for a long time living abroad was a scarce product in India. The three-time founder, Kohli, then decided to take things into his own hands to introduce this exotic beverage to the Indian pallets.

After spending three months with his R&D team, Kohli realised that the Indian market lacked affordable options, with the then-existing products being vastly different and overpriced than the original ones.

Recognising the opportunity to cater to the Indian palette and create a new market segment, Kohli observed consumer preferences. Understanding that India’s young generation is the fastest-growing market segment, Kohli targetted Gen Z and millennials.

What initially began as a hobby project for Kohli soon started attracting customers in droves, 40,000 to 60,000 customers monthly.

lockquote>

“Our vision isn’t just about building another F&B brand, it’s about integrating bubble tea into people’s lifestyles,” Kohli said.

While ambitious goals drove him to launch the brand, the first few months proved challenging for the founder.

“We understood that creating a category from scratch wouldn’t be simple, especially with established giants like Cafe Coffee Day dominating the tea & coffee market. Despite lacking resources and capital, we remained determined to leave our mark. Our objective wasn’t merely to introduce another pizza or biryani but to pioneer a new category,” Kohli said.

Kohli faced significant hurdles when launching his startup, particularly in educating customers about bubble tea, as it was unfamiliar to many.

Another hurdle for Kohli was setting up the supply chain from scratch in India. Kohli added that sourcing vendors to adapt to the requirements of bubble tea, such as straw size and packaging, posed a major challenge.

“Additionally, aligning production processes with those used in China, where bubble tea is typically served cold and primarily through delivery, required strategic partnerships with vendors. To address this, we partnered with vendors from different states,” the founder said.

lockquote>

To overcome these challenges, he focussed on crafting clear messaging strategies to communicate the benefits of bubble tea and diligently sourced reliable vendors within India.

Boba Bhai’s Go-To-Market Strategy

Launched as a D2C delivery model, the startup currently serves its customers through Swiggy, Zomato, and its own website. It has 27 offline stores across India in cities like Delhi, Gurugram, Udaipur, Bengaluru, Mumbai, Hyderabad, and Chennai. These stores are situated in malls, high streets, and standalone locations, with a majority of them located in Bengaluru and Udaipur.

While currently serving its customers via these four channels, the startup aims to expand to include quick commerce and modern retail in the near future.

Currently, the sales split between its channels is 80% from online platforms like Swiggy, Zomato, and its own website, while the remaining 20% comes from its offline stores.

lockquote>

The QSR brand, which initially started with six products, now offers 20-25 items along with a range of 45 bubble teas. Its bestsellers include Taro Lava, Mocha, Jamun Kala Khatta, and Chili Alphonso Mango iced tea. Apart from selling bubble teas, the startup offers K-Pop burgers. The product range starts from INR 99 and goes up to INR 219.

As per Kohli, Boba Bhai sets itself apart from competitors by emphasising the uniqueness of its product range, offering a diverse range of bubble teas. Moreover, the brand positions itself as a lifestyle brand rather than an F&B one, as it aims to integrate bubble tea into people’s daily routines.

To ensure uniqueness, the startup communicates personally with customers, maintaining consistency from packaging to store ambience. Additionally, it prioritises sustainability, using biodegradable materials and offering eco-friendly options like paper straws.

What’s Ahead Boba Bhai?

The startup’s expansion plans for FY25 include targeting top cities in India and tripling its offline footprint to reach 80-100 stores. Additionally, its goal is to expand to 300 stores within three years and 500 stores within five years, aiming for an annual recurring revenue of INR 100 Cr.

“For our offline channel expansion plans, we’re currently in discussions with malls and real estate partners for store locations. However, a major challenge we encounter is finding suitable physical locations at competitive prices. Our strategy entails initially targeting top cities and gradually expanding into Tier II cities to broaden our presence,” Kohli said.

lockquote>

Eventually, Boba Bhai plans to explore international markets such as Saudi Arabia and Dubai, where there is a significant Indian population.

Furthermore, the brand aims to diversify its product portfolio beyond bubble tea by introducing Bingsu Korean ice cream in its physical stores. Additionally, it plans to launch more bubble tea flavours in the coming months to offer customers a wider range of choices.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)