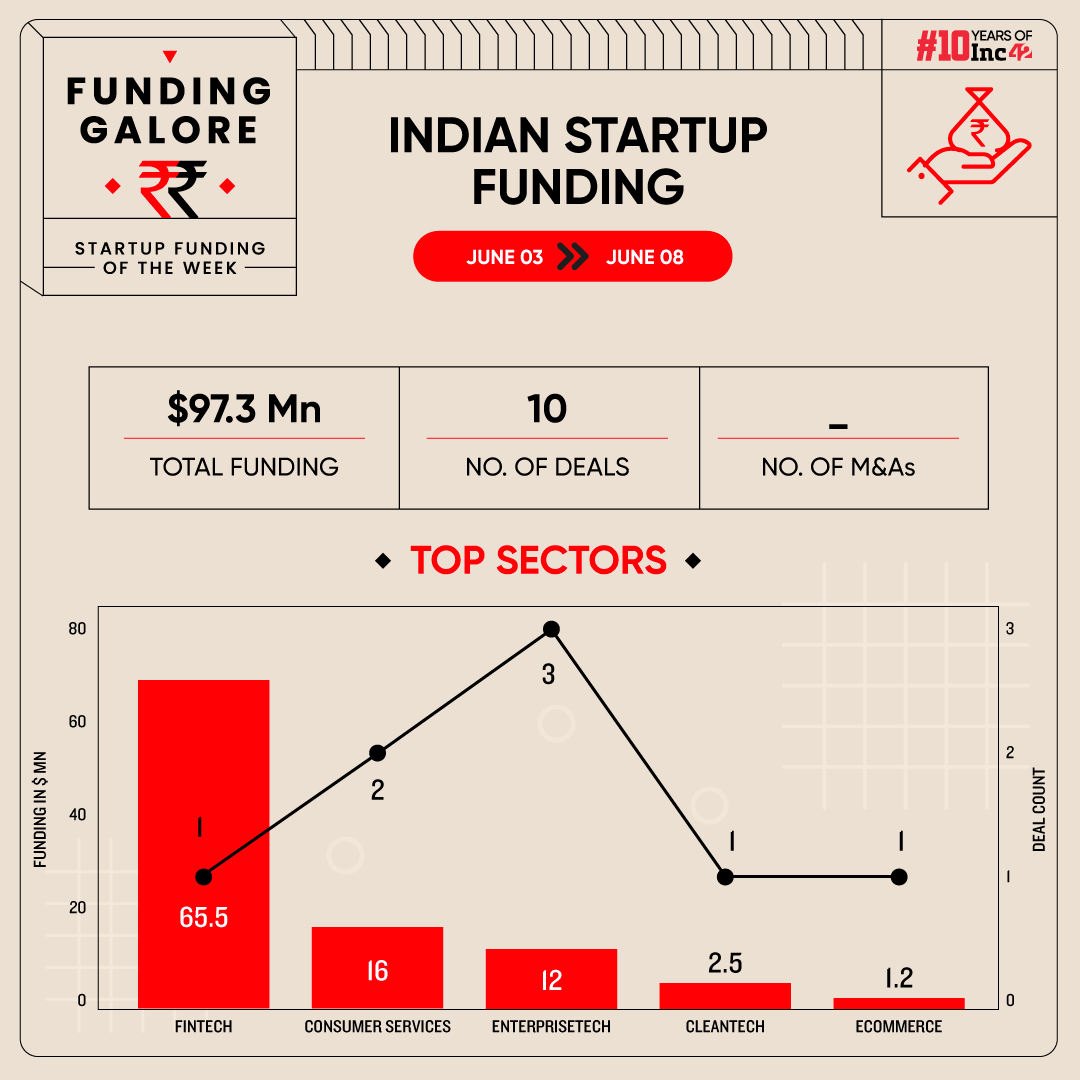

Indian startups cumulatively raised a total of $97.3 Mn across 10 deals, an over 55% decline from previous week’s $217.84 Mn raised across 31 deals

Despite the lagging primary funding infusion of the week, the week was rich in terms of secondary transactions

Continuing on its downward trajectory of the past few weeks, seed funding went down by 67% week-on-week to $3 Mn

During the week of the Indian elections, funding momentum in the world’s third largest startup ecosystem saw a significant decline. Between June 3 and 8 startups raised a total of $97.3 Mn across 10 deals. This represents a nearly 55% decrease from the previous week, when startups secured $217.84 Mn across 31 deals.

Funding Galore: Indian Startup Funding Of The Week [ June 3 – June 8 ]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 5 Jun 2024 | Fibe | Fintech | Lendingtech | B2C | $65.5 Mn* | Series E | TR Capital, Trifecta Capital, Amara Partner, TPG Rise Fund, Norwest Venture Partners, Eight Roads Ventures, Chiratae Ventures | PV Sindhu |

| 4 Jun 2024 | Astrotalk | Consumer Services | Hyperlocal Services | B2C | $14 Mn | Series A | Elev8 Venture Partner, Left Lane Capital | Elev8 Venture Partner, Left Lane Capital |

| 5 Jun 2024 | Testsigma | Enterprisetech | Horizontal SaaS | B2B | $8.2 Mn | Series A | MassMutual Ventures, Accel, STRIVE, BoldCap | MassMutual Ventures |

| 4 Jun 2024 | LogicLadder | Cleantech | Climate Tech | B2B | $2.5 Mn | – | Big Bang Capital, Rainmatter | – |

| 5 Jun 2024 | BIGGUYS | Consumer Services | Hyperlocal Delivery | B2C-B2B | $2 Mn | – | Surya Kalai, Vinod Achutan, Nagaraja Kalia | TR Capital, Trifecta Capital, Amara Partner |

| 6 Jun 2024 | Clodura.AI | Enterprisetech | Horizontal SaaS | B2B | $2 Mn | Pre-Series A | Bharat Innovation Fund, Malpani Ventures | Big Bang Capital, Rainmatter |

| 6 Jun 2024 | Maino.AI | Enterprisetech | Horizontal SaaS | B2B | $1.8 Mn | Seed | India Quotient Advisers LLP, Karan Bedi, Janhavi Parikh | Bharat Innovation Fund |

| 6 Jun 2024 | CHOSEN by Dermatology | Ecommerce | D2C | B2C | $1.2 Mn | Seed | – | India Quotient Advisers LLP |

| 6 Jun 2024 | Docplix | Healthtech | Fitness & Wellness | B2C | $144K | – | Inflection Point Ventures | – |

| 3 Jun 2024 | Greenday | Agritech | Market Linkage | B2B | – | – | PV Sindhu | Inflection Point Ventures |

| Source: Inc42 *Part of a larger round Note: Only disclosed funding rounds have been included |

||||||||

Key Startup Funding Highlights Of The Week

- The week’s largest funding round saw lending tech startup Fibe (erstwhile EarlySalary) raise $90 Mn in its Series E funding round led by TR Capital, Trifecta Capital and Amara Partner. In this, the startup bagged only $65.5 Mn in primary capital and the rest came through secondary transactions.

- Buoyed by Fibe’s funding, the fintech sector topped the funding charts in terms of amount raised. The lending tech startup’s funding was the lone deal in the sector this week.

- Enterprisetech saw the highest three deals materialise this week. Startups in the segment bagged $12 Mn via three deals.

- Continuing on its downward trajectory of the past few weeks, seed funding went down by 67% this week to $3 Mn.

Other Major Developments Of The Week

- Despite the lagging primary funding infusion of the week, the period was rich in terms of secondary transactions. Peyush Bansal-led Lenskart saw Temasek and Fidelity buy $200 Mn worth stakes from undisclosed stakeholders. With the investment, Temasek effectively doubled down its investment in the startup. On the other hand, Fidelity now joins the startup’s cap table.

- The week saw Flipkart cofounder Sachin Bansal completely exit two-wheeler electric vehicle maker Ather Energy. He sold his 2.2% of his shareholding in the EV major to Hero MotoCorp for $14.8 Mn, while Zerodha cofounder Nikhil Kamath lapped up his remaining 5.3% stake for $33.7 Mn.

- CarDekho’s insurance arm InsuranceDekho is looking to acquire a majority stake in the wealthtech startup BankSathi in a share swap deal. The move will help the insurtech platform build its credit products portfolio.

- In a bid to become one of the leading sports and entertainment focus publishers in the US market, Nazara Technologies’ subsidiary Absolute Sports (parent of Sportskeeda) will be acquiring all the assets of Pennsylvania-based entertainment news site Soap Central for $1.4 Mn in an all-cash deal.

- Amazon’s acquisition of MX Player from Times Internet is in its final stages, Inc42 has learnt. The ecommerce giant has confirmed that it has signed an agreement to purchase some assets of the video streaming platform.

- Adding on to the string of initial public offerings (IPOs) coming out of the Indian startup ecosystem this year, online travel aggregator ixigo is set to make its public debut on June 10. At a price band of INR 88-93 per equity share for its public issue, it is expected to raise a total of INR 740 Cr at the upper end. Ahead of its IPO, it raised over INR 333 Cr from 23 anchor investors at INR 93 per equity share.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)