Sunil Barthwal emphasised that the digital economy, along with emerging technologies such as AI, is key to India’s future growth

Multiple overseas-headquartered homegrown startups are mulling shifting their base to India as they eye their IPO on Indian bourses

While Groww completed its reverse flip to India from the US in March, the likes of Flipkart, Zepto, and Razorpay are also mulling similar plans

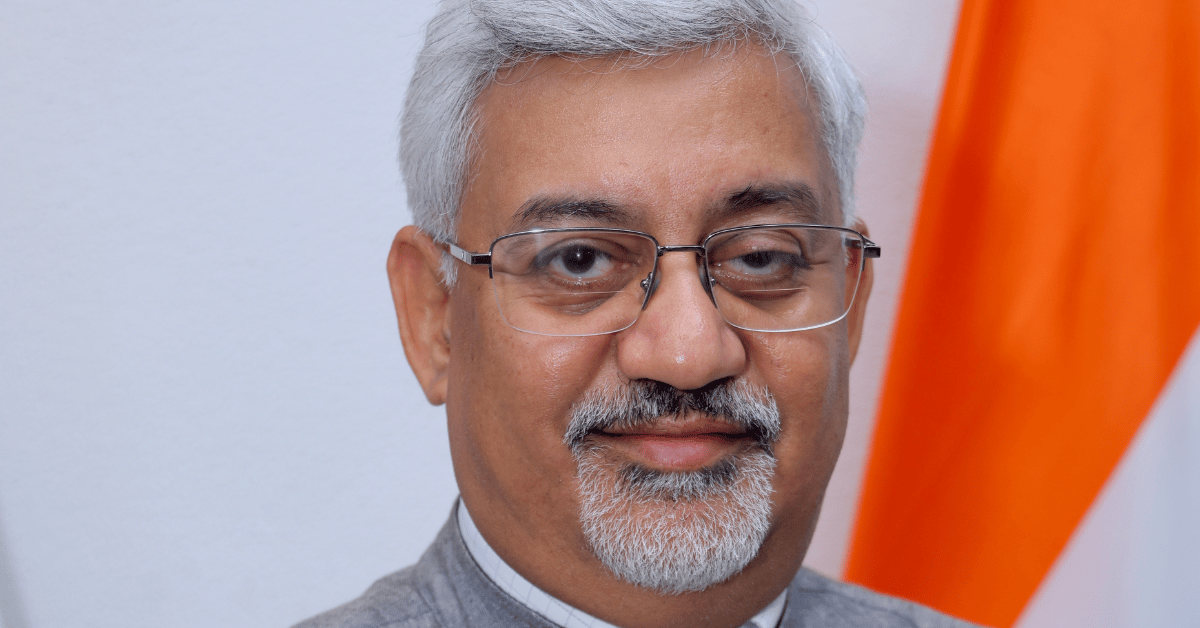

Commerce secretary Sunil Barthwal said that the strong growth of the Indian economy is stirring up the trend of reverse flipping in startups.

Addressing the Indo-Pacific Economic Framework for Prosperity (IPEF) Clean Economy Investor Forum, Barthwal said that “Desh Wapsi” is fast emerging as a major trend on the back of the country’s economy, which is currently growing at double the rate compared to other emerging economies.

As per a government statement, he also emphasised that the digital economy, along with emerging technologies such as AI, is the key to India’s future growth.

The event brought together 60 attendees, including investors and government officials from multiple countries. Established in May 2022, the IPEF, which currently includes 14 member countries, aims to foster cooperation in areas such as trade, supply chain, clean economy and fair economy.

Barthwal’s comments come at a time when a growing number of overseas-headquartered Indian startups are mulling shifting their base to India. This trend has largely been attributed to big-ticket startups eyeing their initial public offering (IPO) on Indian bourses.

In late-2022, Walmart-backed digital payments juggernaut PhonePe moved back to India. More recently, fintech unicorn Groww also completed its reverse flip to India from the US in March. Last month, Walmart-owned Flipkart reportedly initiated talks to redomicile its parent entity to India from Singapore.

Besides, the likes of Zepto and Razorpay are also looking to shift back to India. Another fintech unicorn Pine Labs is said to have received approval from a Singapore court to merge its Singapore-based entity with the India entity last month.

However, reverse flipping has been fraught with its own set of challenges. For instance, PhonePe’s India move cost the digital payments giant a tax bill of $800 Mn. Additionally, its founders also flagged issues such as lengthy paperwork, redtape and regulatory issues for not moving back to the country.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)