Investors placed total bids for 8.55 Cr shares on the first day as against 4.38 Cr shares on offer

The retail investors’ portion was oversubscribed 6.21X, as they placed bids for 4.95 Cr shares of ixigo as against 79.58 Lakh shares on offer for them

ixigo’s IPO comprises a fresh issue of shares worth INR 120 Cr and OFS component of 6.67 Cr shares worth up to INR 620 Cr

The public issue of online travel aggregator Ixigo

Investors placed bids for 8.55 Cr shares on the first day as against 4.38 Cr shares on offer.

The retail investors’ portion was oversubscribed 6.21X, as they placed bids for 4.95 Cr shares as against 79.58 Lakh shares on offer for them.

The non-institutional investors’ (NIIs) portion was also oversubscribed 2.78X by the day’s end, as these investors placed bids for 3.32 Cr shares versus 1.19 Cr shares on offer for them.

However, the qualified institutional buyers’ (QIBs) portion remained undersubscribed. The QIBs placed bids for 28.83 Lakh shares at the end of the first day as against 2.39 Cr shares on offer.

Among the sub-segments of QIBs, mutual funds placed the highest number of bids for 26.88 Lakh shares.

ixigo’s IPO comprises a fresh issue of shares worth INR 120 Cr and an offer for sale (OFS) component of 6.67 Cr shares worth up to INR 620 Cr.

The startup has set a price band of INR 88-93 per equity share for its public issue. Investors can place bids for a minimum of 161 equity shares and in multiples of that thereafter.

At the upper end of the price band, the OTA major is looking to raise INR 740 from its IPO.

On Friday, a day before its IPO opening, ixigo raised INR 333 Cr from 23 anchor investors, including SBI Magnum Children’s Benefit Fund, the Government of Singapore, Tata Investment Corporation Limited, Bajaj Allianz Life Insurance Company, among others.

Prior to this, ixigo also closed a pre-IPO secondary sale at INR 176.2 Cr.

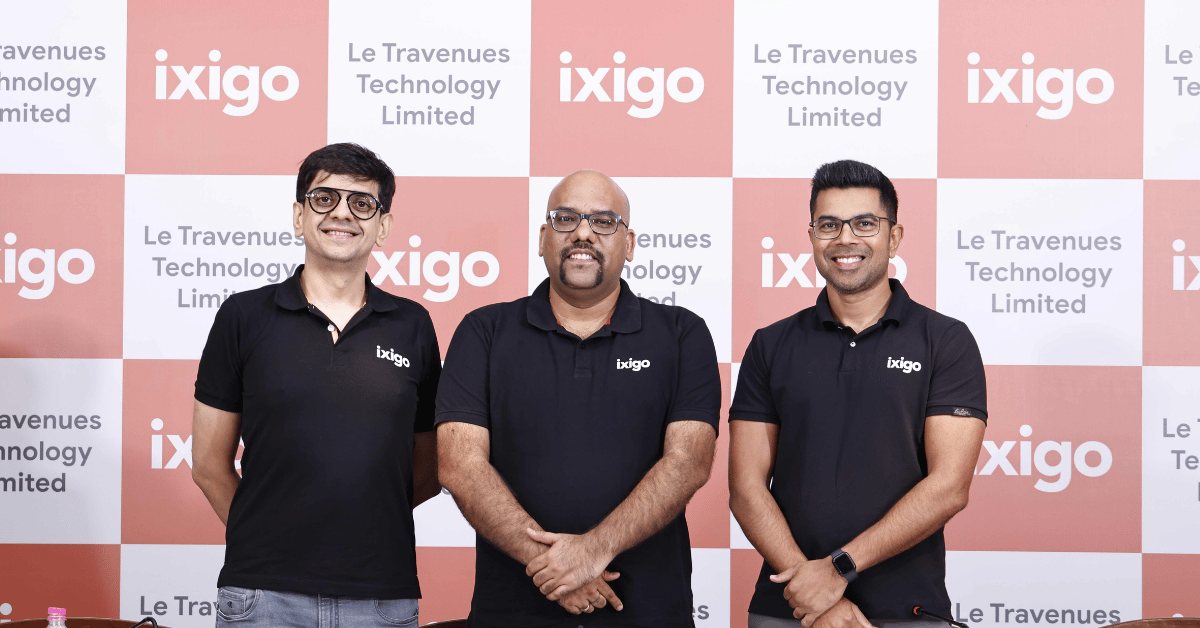

Founded by Aloke Bajpai and Rajnish Kumar, ixigo started in 2007 as a travel search website to help users compare flight deals. In FY20, it became an OTA and started earning revenue from selling various travel services like flights, trains, bus tickets, hotel bookings and holiday packages.

The investors Inc42 spoke to ahead of ixigo’s IPO emphasised that the biggest value propositions of the startup in the crowded OTA market were its focus on the railways and deep penetration into Tier-2 and beyond cities, which would also lead to a successful market debut for the company.

The IPO will close on June 12.

ixigo reported a consolidated net profit of INR 65.7 Cr in the first nine months of FY24, up 3X YoY, on an operating revenue of INR 491 Cr.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)