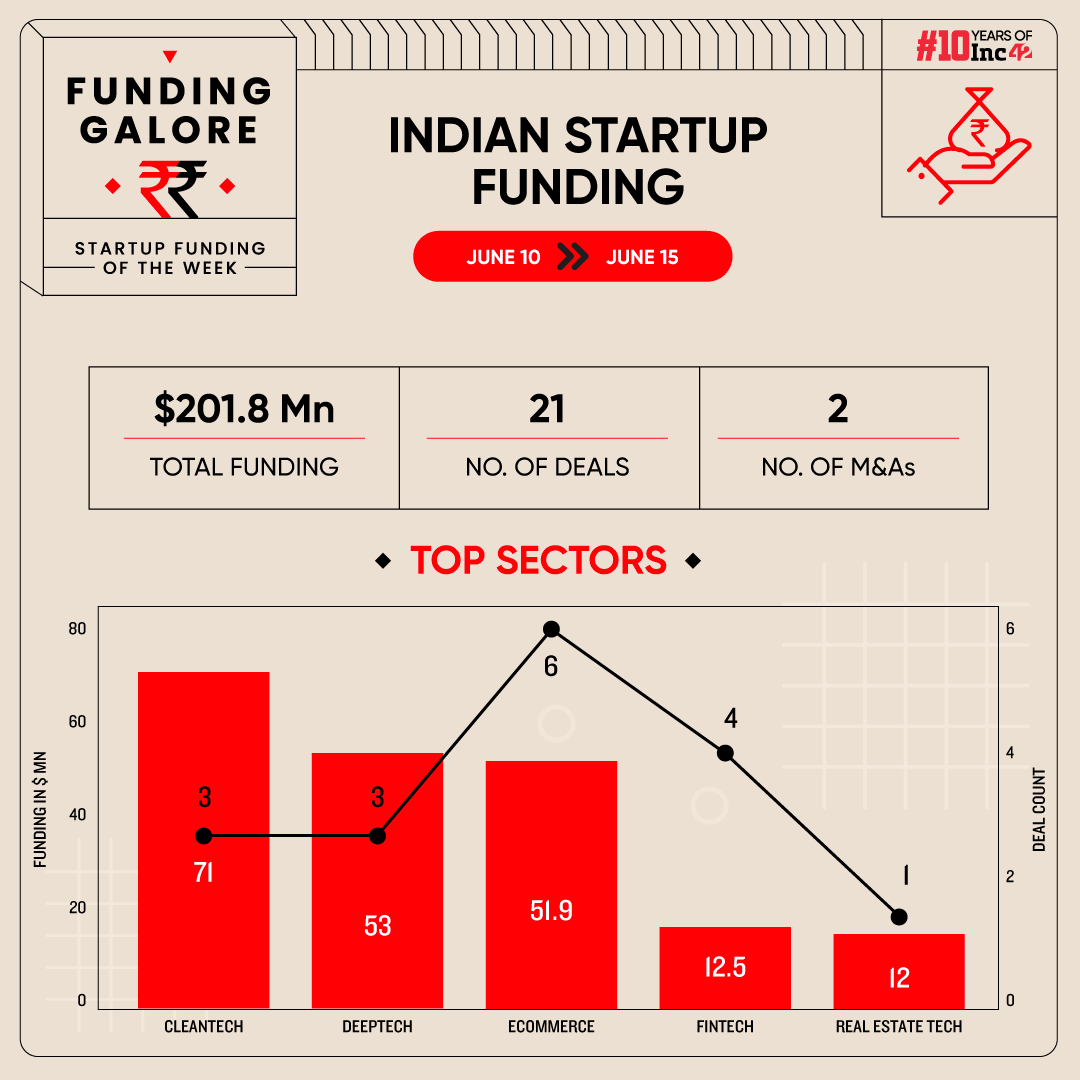

Indian startups cumulatively raised $201.8 Mn via 21 deals, a 107% increase from last week’s $97.3 Mn raised across 10 deals

Cleantech sector topped the funding charts at a sectoral level. The sector saw startups net $71 Mn via three deals.

Seed funding picked up this week, with the startups at this stage bagging $9.4 Mn this week

Shortly after a lacklustre investment activity across the Indian startup ecosystem, funding started picking up momentum in the middle of the ongoing month. Between June 10 and 15, startups cumulatively bagged funding of $201.8 Mn across 21 deals, which marks over 2X jump or 107% uptick from $97.3 Mn raised across 10 deals in the preceding week.

Funding Galore: Indian Startup Funding Of The Week [ June 10 – June 15 ]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 11 Jun 2024 | Battery Smart | Cleantech | Electric Vehicle | B2B-B2C | $65 Mn | Series B | MUFG Bank, Panasonic, Ecosystem Integrity Fund, Blume Ventures, British International Investment | – |

| 13 Jun 2024 | Indkal | Deeptech | IoT & Hardware | B2B | $36 Mn | Series A | Aries Opportunities Fund | Aries Opportunities Fund |

| 12 Jun 2024 | Foxtale | Ecommerce | D2C | B2C | $18 Mn | Series B | Panthera Growth Partners, Matrix Partners India, Kae Capital | Panthera Growth Partners |

| 13 Jun 2024 | Ethereal Machines | Deeptech | IoT & Hardware | B2B | $13 Mn | Series A | Peak XV Partners, Steadview Capital, Blume Ventures, Enam Investments, Sandeep Singhal | Peak XV Partners, Steadview Capital |

| 10 Jun 2024 | Hocco | Ecommerce | D2C | B2C | $12 Mn | – | Chona family, Sauce.vc, Ritesh Sidhwani, Farhan Akhtar | Chona family, class=”in-cell-link” href=”http://sauce.vc/” target=”_blank” rel=”noopener”>Sauce.vc |

| 11 Jun 2024 | Smartworks | Real Estate Tech | Shared Spaces | B2B | $12 Mn | – | Ananta Capital, Plutus Capital, Kili Ventures LLP, Dhawan Family Trust | Ananta Capital |

| 13 Jun 2024 | RENEE | Ecommerce | D2C | B2C | $11.9 Mn | Series B1 | Evolvence India, Edelweiss Group | Evolvence India, Edelweiss Group |

| 13 Jun 2024 | Trampoline | Ecommerce | B2B Ecommerce | B2B | $7 Mn | Seed | Matrix Partners India, WaterBridge Ventures, Alteria Capital | Matrix Partners India, WaterBridge Ventures |

| 10 Jun 2024 | Arthan Finance | Fintech | Lendingtech | B2B | $6 Mn | Series B | Incofin India Progress Fund, Michael & Susan Dell Foundation | Incofin India Progress Fund |

| 13 Jun 2024 | Indigrid | Cleantech | Electric Vehicle | B2B-B2C | $5 Mn | Series A | Cactus Partners | Cactus Partners |

| 11 Jun 2024 | Skye Air | Deeptech | Dronetech | B2B | $4 Mn | Series A | Mount Judi Ventures, Chiratae Ventures, Venture Catalyst, Windrose Capital, Tremis Capital, Faad Capital, Misfits Capital, Hyderabad Angels, Soonicorn Ventures | Mount Judi Ventures |

| 12 Jun 2024 | CredAble | Fintech | Lendingtech | B2B | $3.6 Mn | Debt | Small Industries Development Bank of India | Small Industries Development Bank of India |

| 12 Jun 2024 | Palette Brands | Ecommerce | D2C | B2C | $2 Mn | Pre-Series A | Rockstud Capital, Inflection Point Ventures, Dholakia Ventures | Rockstud Capital |

| 12 Jun 2024 | Finsall | Fintech | Insurtech | B2B-B2C | $1.7 Mn | – | Unicorn India Ventures, Seafund | Unicorn India Ventures, Seafund |

| 11 Jun 2024 | Qiro Finance | Fintech | Lendingtech | B2B | $1.2 Mn | Pre-Seed | Alliance, Druid Ventures, Escape Velocity, Trident Digital, CMT Digital | Alliance |

| 10 Jun 2024 | Clean Mobility Solution India | Cleantech | Electric Vehicle | B2B | $1 Mn | Seed | India Accelerator | India Accelerator |

| 11 Jun 2024 | Sova Health | Ecommerce | D2C | B2C | $1 Mn | Seed | VC Antler, Accelerating Asia, Practical VC, VC Grid, Venture Catalysts, Quadrant Consumer Products, Midas Capital | VC Antler, Accelerating Asia, Practical VC, VC Grid, Venture Catalysts |

| 13 Jun 2024 | Hour4u | Enterprisetech | Horizontal SaaS | B2B-B2C | $420K | Seed | Apptad Technologies | Apptad Technologies |

| 11 Jun 2024 | Clapingo | Edtech | Skill Development | B2C | $263K | Pre-Series A | Sandeep Aggarwal, Biswa Kalyan Rath, Appurv Gupta | – |

| 11 Jun 2024 | NeuraSim | Healthtech | IoT & Hardware | B2C-B2B | – | Pre-Seed | Research and Innovation Circle of Hyderabad | Research and Innovation Circle of Hyderabad |

| 11 Jun 2024 | C3 Med-Tech | Healthtech | Medtech | B2C-B2B | – | – | Industrial Metal Powders | Industrial Metal Powders |

| Source: Inc42 *Part of a larger round Note: Only disclosed funding rounds have been included |

||||||||

Key Startup Funding Highlights Of The Week

- Battery-swapping startup Battery Smart’s $65 Mn Series B funding round was the week’s biggest funding round. The equity round is a mix of primary and secondary investments and saw participation from a mix of new and existing investors, including MUFG Bank, Panasonic, Ecosystem Integrity Fund (EIF), Blume Ventures and British International Investment (BII). The round also saw its initial backer Orios Venture Partners making a partial exit with 29X returns.

- Battery Smart’s funding round propelled the cleantech sector to top funding chart at a sectoral level. The sector saw startups raking in $71 Mn via three deals.

- Interestingly, deeptech tied cleantech in terms of the secured number of deals. Startups in the space netted $53 Mn via three deals. However, the ecommerce sector witnessed the highest number of deals materialising this week, with startups bagging $51.9 Mn through six deals.

- Blume Ventures, Matrix Partners India and Venture Catalysts emerged to be the most active investors this week, backing two startups each.

- Seed funding levels also improved significantly this week, going up 214% from last week’s $3 Mn to $9.4 Mn this week.

Updates On Indian Startup IPOs

- About six months after filing its DRHP, two-wheeler electric vehicle manufacturer Ola Electric got the approval from the Securities and Exchange Board of India (SEBI) for its initial public offering (IPO). The company will be looking to make its public market debut within a month.

- Online travel aggregator ixigo’s public issue received bids for 430.40 Cr shares against the 4.37 Cr on offer, implying a 98.34X oversubscription rate. QIBs led the charts as they oversubscribed their quota by 106.73X.

Startup Acquisitions This Week

- 360 One has signed an agreement to buy ET Money from Times Internet for INR 365.8 Cr in a cash and stock deal. Of this, the wealth and asset company will pay INR 85.8 Cr in cash to the company.

- Continuing its acquisition streak, listed gaming Nazara Technologies’ subsidiary NODWIN Gaming International Pte Ltd, bought middle eastern esports and gaming production company Ninja Global FZCO (Ninja) for $3.57 Mn in a cash and stock deal.

Other Major Developments Of The Week

- Beauty ecommerce marketplace Purplle reportedly raised $100 Mn in a mix of primary and secondary investments led by Abu Dhabi’s sovereign fund ADIA. The fundraise valued the startup at $1.2-1.3 Bn, a 15% increase from its erstwhile fundraise.

- Fintech startup KreditBee’s NBFC arm bagged a $32 Mn Debt from Yubi, Dzerv, Neo Group, and OfBusiness, among others between April and June. The debt is likely to fuel its working capital needs and business expansion plans.

- Ola Electric is eyeing a $12 Mn debt raise from venture debt fund Alteria Capital. Its board has approved the issuance of 10,000 non-convertible debentures (NCDs) with face value of INR 1 Lakh each to the investor.

- D2C personal care startup 82°E will see a $6 Mn infusion as part of its extended seed funding round by its founder Deepika Padukone and her father Prakash Padukone’s investment entity, Ka Enterprises. The infusion is expected to be completed by June 20.

- Amid ongoing speculations about Zepto’s upcoming funding round, reports now found out that the round could be the tune of $650 Mn. The round will see the quick commerce unicorn’s valuation soar to $3.5 Bn, 2.5X its erstwhile valuation of $1.4 Bn.

- D2C wearables major boAt’s parent Imagine Marketing India is in talks with three investors to raise an undisclosed amount. Its cofounder and CEO Sameer Mehta said the fundraise will be “strategic” in nature instead of just raising capital.

- Pavestone VC’s maiden fund Pavestone Technology Fund raised $1.8 Mn from Colruyt Group India, the engineering arm of Belgian food and grocery retailer Colruyt Group. The VC has set a target corpus of $107.7 Mn for the fund.

- Early-stage VC firm Huddle Ventures’ Fund II has been oversubscribed by 20% ahead of its final close. The VC firm has activated the green shoe option following the oversubscription and is aiming for a final close at INR 150 Cr in the next four to eight weeks.

- Fintech Neo group’s asset management arm Neo Asset Management has marked the final close of its maiden special credit opportunities fund at $308 Mn. Neo claims to have backed 12 companies and made two exits within a time span of 15 months via the fund

- VC firm Unifi Capital has floated two new funds in GIFT City, Gujarat. While the first fund will focus on Indian growth businesses benefiting from demographic shifts and sectoral reforms, the second will aim to assist Indian HNIs in diversifying their portfolios.

- Silicon Valley-based early-stage venture fund South Park Commons (SPC) has entered India in collaboration with Flipkart cofounder Binny Bansal and has opened its first international outpost in Bengaluru.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)