Fifteen out of the 23 new-age tech stocks under Inc42’s coverage gained this week in a range of 0.05% to about 29%, with MapmyIndia emerging as the biggest gainer

DroneAcharya Aerial Innovations was the biggest loser this week. Paytm, PB Fintech, and Delhivery were among the other losers

Online travel aggregator ixigo became the latest new-age tech startup to go public this week. After its stellar listing, the stock gained over 25% in four sessions

Riding on the back of the rally in the broader market following the return of the NDA government to power, Indian new-age tech stocks witnessed yet another week of gains.

Fifteen of the 23 new-age tech stocks under Inc42’s coverage gained in a range of 0.05% to about 29% this week. MapmyIndia emerged as the biggest gainer this week, with its shares surging 28.89%.

Fino Payments Bank (16.68%), Tracxn (10.47%), Yudiz (5.76%), Zomato (4.24%), and Nykaa (1.52%) were among the other winners this week.

Coworking space provider Awfis reported its first financial results this week since its listing on the exchanges. The startup turned profitable in the fourth quarter of the financial year 2023-24 (FY24), posting a consolidated profit of INR 1.4 Cr. Following this, the stock jumped 9% to INR 543.70 during the intraday trading on Thursday. Eventually, Awfis ended the week 0.92% higher.

On the other hand, DroneAcharya Aerial Innovations emerged as the biggest loser this week. Its shares ended 3.79% lower at INR 149.60 on Friday.

Among the other losers this week were Paytm (3.20%), PB Fintech (2.81%), and Delhivery (1.91%).

Meanwhile, this week, online travel aggregator ixigo became the latest new-age tech startup to go public, becoming the 24th stock under Inc42’s coverage.

The startup’s shares were listed at INR 138.10 per share on the NSE, a premium of 48.5% from the issue price of INR 93. Similarly on the BSE, the shares opened at INR 135 apiece, up 45.16% from the issue price.

Following the listing, shares of ixigo continued to gain and ended the week over 25% higher from the listing price at INR 169.18 on the BSE.

lockquote>

In the broader market, benchmark indices Sensex and Nifty50 gained 0.28% and 0.15%, respectively. While Sensex ended the week at 77,209.90, Nifty 50 closed at 23,501.10.

It is pertinent to note that the stock exchanges were closed on Monday (June 17) on the occasion of Bakri Id.

Commenting on the market performance, Geojit Financial Services’ research head Vinod Nair said, “With a coalition government in place, there is optimism that the upcoming Budget will strike a balance between growth initiatives and populist measures. Additionally, expectations are high for government actions aimed at stimulating consumption, a critical area to focus on.”

lockquote>

Now, let’s take a deeper look at the performance of some of the new-age tech stocks this week.

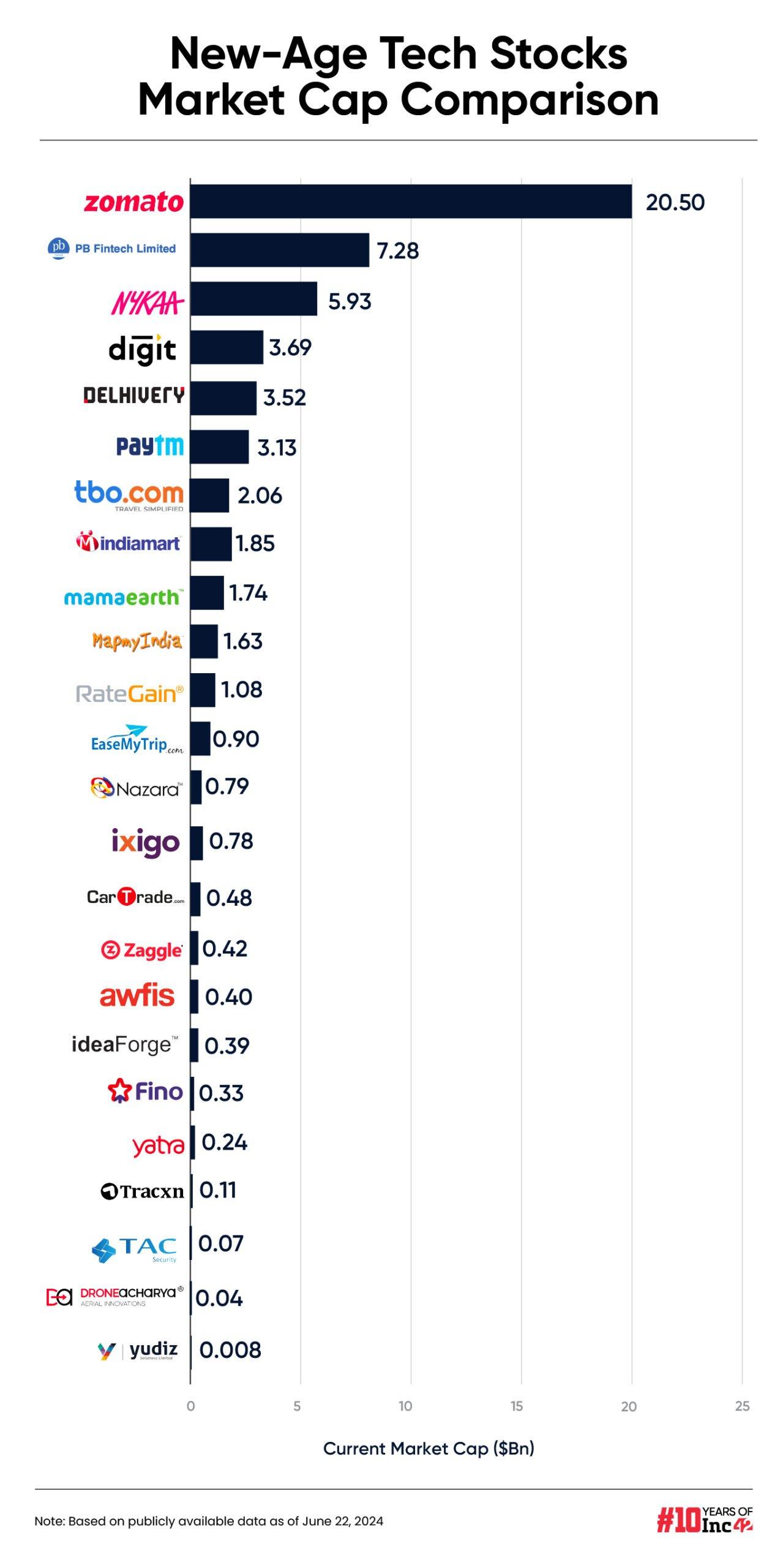

Overall, the 24 new-age tech stocks under Inc42’s coverage ended the week with a total market capitalisation of $54.95 Bn as against 23 stocks ending the last week with a valuation of around $54.94 Bn.

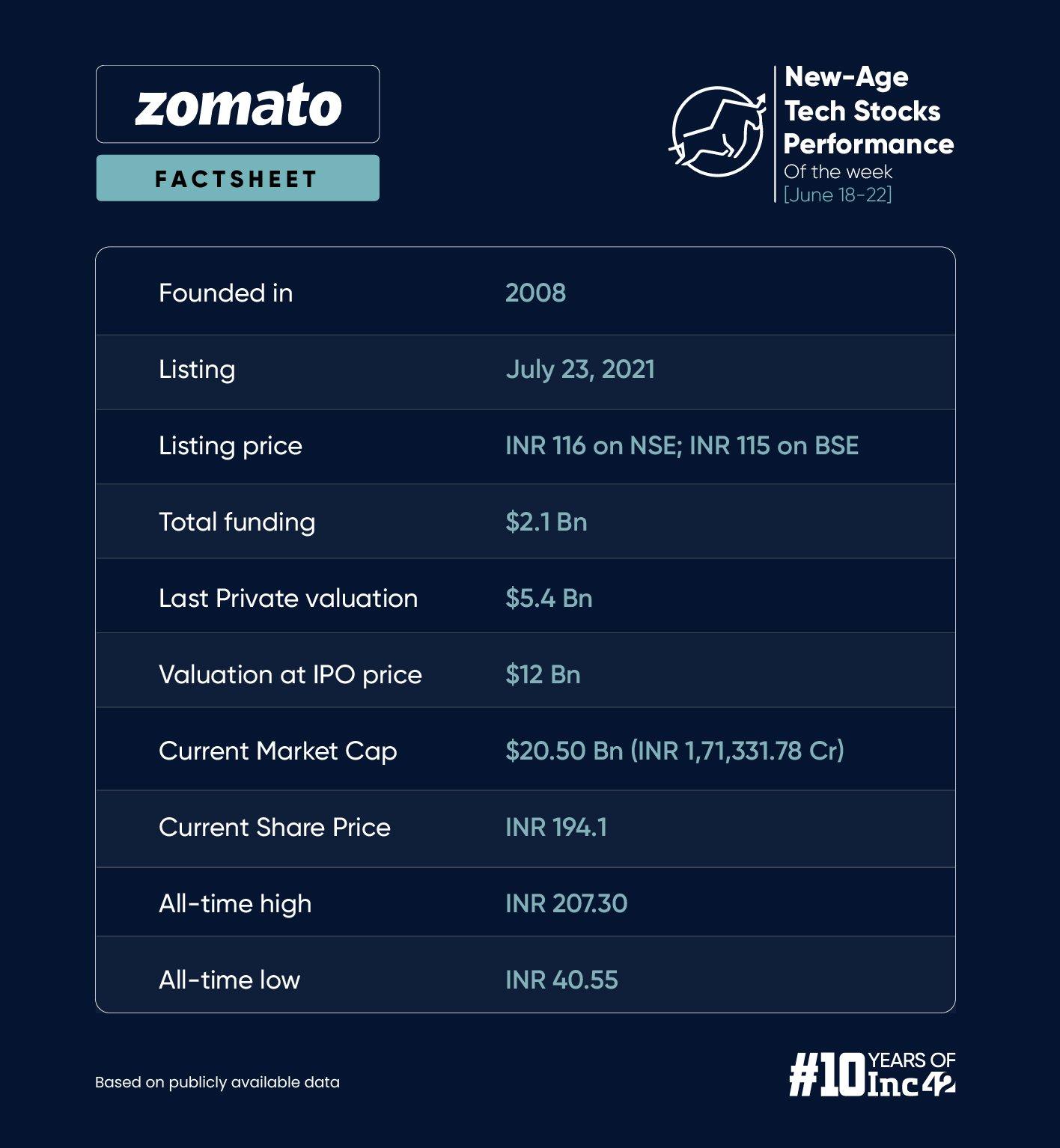

Zomato Gains On Paytm Insider Acquisition Bid

On Sunday (June 16), foodtech major Zomato and fintech Paytm intimated the bourses that they were in discussions for the former to acquire the latter’s events and movie ticketing business, Paytm Insider.

While the companies only said that the discussions were at a preliminary stage, reports pegged the deal size at around INR 1,500 Cr.

If it materialises, the deal can shore up Zomato’s revenue by bolstering its ticketing and entertainment segment revenue. It will also position the foodtech company as a challenger to BookMyShow.

Buoyed by the acquisition talks, shares of Zomato jumped 4.24% to end the week at INR 194.10 on the BSE.

Meanwhile, brokerages continue to be bullish on the stock. In a research report this week, JM Financial retained its ‘Buy’ rating for the stock but reduced its price target (PT) for the stock to INR 250, from April’s INR 260. It said that acquisition of Paytm’s ticketing business will strengthen Zomato’s ‘Going-out’ business,

“The deal could catapult Zomato to second position in the events & movie ticketing space, behind only BookMyShow,” the brokerage added.

lockquote>

Meanwhile, Bernstein also maintained its ‘Buy’ rating on the stock, along with a PT of INR 230.

“Zomato is a market leader in key segments it operates in, driven by its solid execution in selected under-penetrated end markets. Going forward, we believe quick commerce which has shown exponential growth — growing over 100% YoY in 2023, will be the most attractive segment from a growth and margin perspective,” Bernstein said in a report.

Paytm Loses Steam

The fintech giant ended its three-week winning streak, with the stock falling 3.2% this week. The company was in the news for a number of different reasons this week.

- Amidst ongoing layoffs, several ex-Paytm employees have complained to the Ministry of Labour and Employment, alleging “unlawful termination” without compensation. The ex-employees have sought the reinstatement of their employment, alleging unfair and unethical termination by the Paytm management.

- Adding to the top level churn at the company, Paytm’s non-executive independent director Neeraj Arora resigned this week. The company replaced him with former Securities and Exchange Board of India’s (SEBI) whole time member Rajeev Krishnamuralilal Agarwal.

- The series of block deals continued at Paytm this week, with Goldman Sachs (Singapore) PTE selling shares worth INR 183 Cr and Marshall Wace Investment Strategies – Eureka Fund offloading shares worth INR 25 Cr.

While JM Financial remains bullish on Zomato, it gave a ‘Sell’ rating and a price target of INR 300 for Paytm.

On the potential deal with Zomato, JM Financial’s BFSI analyst Sameer Bhise said that it is in line with Paytm’s stated strategy of focussing on the payments and financial services business.

“Incrementally, cash realisation from this sale should aid Paytm as it reenergises its marketing spends,” he said.

lockquote>

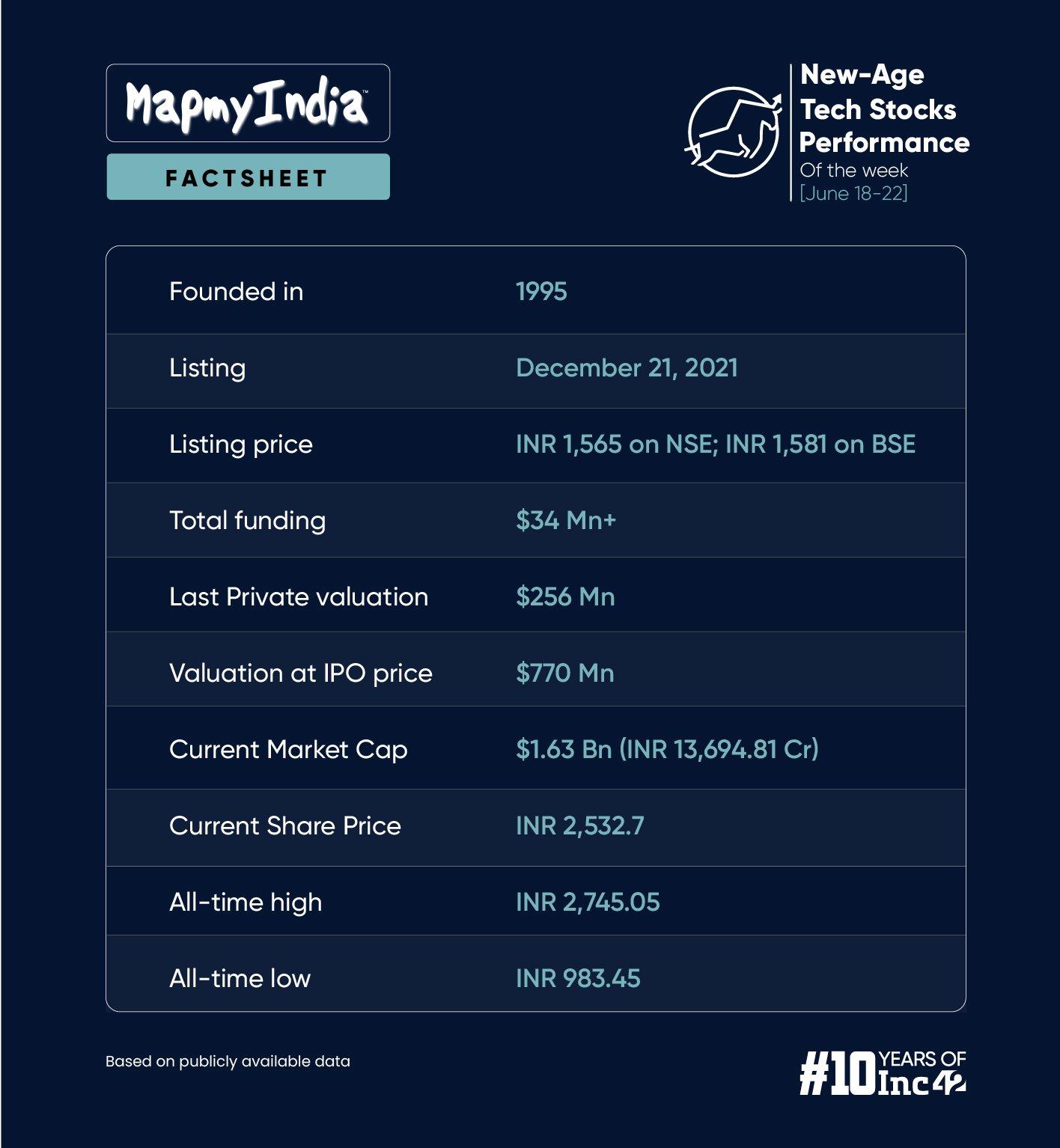

MapmyIndia Soars To All-Time High

The geotech company’s shares soared to an all-time high of INR 2,745.05 on June 21. Eventually, the stock ended the week nearly 29% higher at INR 2,532.7 on the BSE.

The sharp rise came on the back of Goldman Sachs initiating its coverage on the stock with a ‘buy’ rating and a price tag of INR 2,800.

The brokerage highlighted MapmyIndia’s advantageous early market position in high-growth sectors such as automotive navigation, mapping devices, connected vehicles, telematics, and government digitisation. It also forecasted a CAGR of 38% in the FY24-FY27 period, with a steady EBITDA margin in the 38% to 41% range.

The company reported a 35% increase in its consolidated profit after tax (PAT) in the March quarter of FY24 to INR 38.2 C from INR 28.3 Cr in the same quarter a year ago. Operating revenue grew 47.5% to INR 106.9 Cr from INR 72.4 Cr in Q4 FY23.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)