Indian startups raised $196.47 Mn via 17 deals, a 75% decline from last week’s $800.5 Mn raised across 21 deals

The week’s largest funding round saw NBFC Northern Arc bag a debt of $75 Mn from FMO

Seed funding dipped this week by 69% to $6.9 from last week’s $22.7 Mn

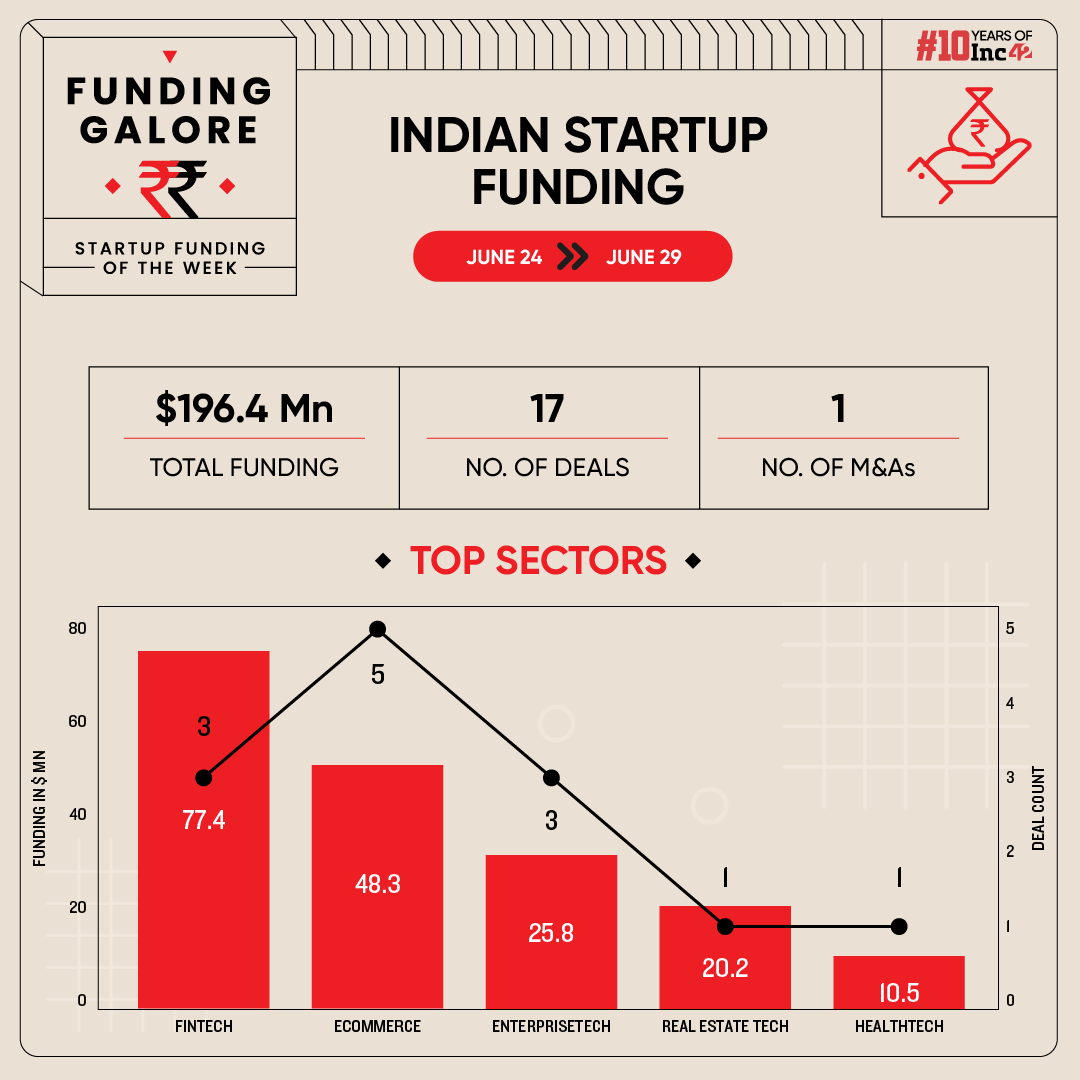

After a big funding week, investment activity across the Indian startup ecosystem has entered into the slow lane again. Between June 24 and 29, startups cumulatively bagged $196.47 Mn across 17 deals, a 75% decline from $800.5 Mn raised across 21 deals in the preceding week.

However, it would be unfair to say that funding trends plunged drastically this week. Of the $800.5 Mn secured last week, around $665 Mn was raised by quick commerce unicorn Zepto alone. Hence, the rest of the startup ecosystem only saw $135.5 Mn capital infusion in the week.

Funding Galore: Indian Startup Funding Of The Week [ June 24 – June 29 ]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 25 Jun 2024 | Northern Arc | Fintech | Lendingtech | B2B | $75 Mn | Debt | FMO | FMO |

| 25 Jun 2024 | Rocketlane | Enterprisetech | Horizontal SaaS | B2B | $24 Mn | Series B | 8VC, Matrix Partners India, Nexus Venture Partners | 8VC, Matrix Partners India, Nexus Venture Partners |

| 27 Jun 2024 | Smartworks | Real Estate Tech | Shared Spaces | B2B | $20.2 Mn | – | Keppel Ltd, Ananta Capital Ventures Fund I, Plutus Capital LLC | – |

| 25 Jun 2024 | Zyod | Ecommerce | B2B Ecommerce | B2B | $18 Mn | Series A | RTP Global, Stride Ventures, Stride One, Trifecta Capital, Lightspeed, Alteria Capital | RTP Global |

| 24 Jun 2024 | Bluestone | Ecommerce | D2C | B2C | $12 Mn | Debt | Neo Markets | Neo Markets |

| 25 Jun 2024 | Cloudphysician | Healthtech | Healthcare SaaS | B2B | $10.5 Mn | Series A | Peak XV Partners, Elevar Equity, Panthera Peak | Peak XV Partners |

| 28 Jun 2024 | Matter | Clean Tech | Electric Vehicles | B2C | $10 Mn | – | Japan Airlines & Translink Fund, Capital 2B Fund, Helena Special Investments Fund, Abhay Shah | – |

| 25 Jun 2024 | Sid’s Farm | Ecommerce | D2C | B2C | $10 Mn | Series A | Omnivore, Narotam Sekhsaria’s family office | Omnivore, Narotam Sekhsaria’s family office |

| 26 Jun 2024 | Two Brothers | Ecommerce | D2C | B2C | $7 Mn | Series A | Rainmatter Capital, Raju Chekuri | Rainmatter Capital |

| 27 Jun 2024 | Morphing Machines | Deeptech | IoT & Hardware | B2B | $2.7 Mn | Seed | Speciale Invest, IvyCap Ventures, Golden Sparrow, Navam Capital, CIIE Initiatives, DeVC | Speciale Invest |

| 25 Jun 2024 | Nitro Commerce | Enterprisetech | Vertical SaaS | B2B | $1.8 Mn | Seed | Cornerstone Venture Partners, Warmup Ventures, Lead Angels, Dholakia Ventures, India Accelerator, Arjun Vaidya, Kunal Khattar | Cornerstone Venture Partners |

| 25 Jun 2024 | LetsDressUp | Ecommerce | D2C | B2C | $1.3 Mn | pre-Series A | GVFL Limited, Indian Angel Network, The Chennai Angels, Titan Capital | – |

| 25 Jun 2024 | LXME | Fintech | Investment Tech | B2C | $1.2 Mn | Seed | Kalaari Capital, Yash Kela, Amaya Ventures, Capri Holdings, Aditi Kothari, Vivek Vig, Sumit Jalan, Avinash Pahuja | Kalaari Capital |

| 25 Jun 2024 | Plus Gold | Fintech | Investment Tech | B2C | $1.2 Mn | Seed | JITO Incubation, Innovation Foundation, Venture Catalysts, Signal Ventures, Sonakshi Sinha, Sachin Shetty, Varun Dua | JITO Incubation, Innovation Foundation |

| 26 Jun 2024 | O Hi | Media & Entertainment | Social Media & Chat | B2C | $1 Mn | pre-Series A | JIIF | JIIF |

| 27 Jun 2024 | Machaxi | Consumer Services | Hyperlocal Services | B2C | $575K | pre-Series A | Inflection Point Ventures, Ankit Nagori | Inflection Point Ventures |

| 27 Jun 2024 | Celebal Technologies | Enterprisetech | Horizontal SaaS | B2B | – | – | BlackSoil | BlackSoil |

| Source: Inc42 *Part of a larger round Note: Only disclosed funding rounds have been included |

||||||||

Key Startup Funding Highlights Of The Week

- The week’s largest funding round saw NBFC Northern Arc bagging a debt funding of $75 Mn from FMO. On the back of this, fintech emerged as the investors’ favourite this week. Startup’s in the space cumulatively raised $77.4 Mn across three deals.

- The highest number of deals materialised for ecommerce startups this week as players in the space raised $48.3 Mn via five deals.

- However, seed funding dipped this week by 69% to $6.9 from last week’s $22.7 Mn.

Other Major Developments Of The Week

- Moving towards a public market debut, electric two-wheeler manufacturer Ather Energy’s board passed a resolution to convert the startup into a public company from private. The startup’s name has changed to Ather EnergyAther Energy from Ather Energy Pvt Ltd earlier, its regulatory filings revealed.

- Within a week of raising big bucks, quick commerce major Zepto has initiated conversations with multiple investors to raise $400 Mn at a likely valuation of $4.6 Bn. This will be 25% higher than the $3.6 Bn at which it raised $665 Mn last week.

- UK-based private equity (PE) firm Finnest has invested $160 Mn to acquire a majority stake in cloud kitchen startup Kitchens@. The fresh capital will be utilised to fuel the startup’s business operations and expand its footprint.

- Gold loan provider Rupeek is close to bagging $24 Mn in another down round. The funding is expected to be a mix of primary and secondary transactions and will be raised at a valuation of $250 Mn, a 60% cut.

- US-based ecommerce giant Amazon has infused $72 Mn in its Indian fintech arm Amazon Pay India. Amazon Pay allotted 59.99 Cr shares to Amazon Corporate Holdings and 59,952 Cr shares to Amazon.com for INR 10 apiece.

- Nazara-owned gaming company NODWIN has completed the acquisition of marketing services company Freaks 4U Gaming GmbH through a share swap valued at up to INR 271 Cr.

- Edtech unicorn upGrad is planning to allot 25 Lakh NCDs and 3.75 Lakh OCDs to EvolutionX Debt Capital to raise a debt of $34.4 Mn. The capital will be used to fuel growth and fund operating expenses.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)